Private health insurance is an optional form of coverage in Australia that allows individuals to be treated in hospital as private patients and covers healthcare costs that Medicare does not, such as physiotherapy, dental, and optical. It is important to understand the differences between the various types of private health insurance to choose the right cover for your needs. To determine whether you have private insurance, you can review your policy to see what is covered, including hospital stays, general treatment services, and ambulance services. Additionally, you can request a private health insurance statement from your registered health insurer, which provides information about your premiums and private patient hospital cover.

| Characteristics | Values |

|---|---|

| How to know if you have private insurance | You can use online services to log in and check your policy details. |

| You can request a private health insurance statement from your registered health insurer. | |

| You can check your tax return form. | |

| Types of private insurance | Hospital cover |

| Extras cover | |

| Combined health insurance | |

| Benefits of private insurance | Faster treatment |

| Choice of doctor or specialist | |

| Choice of hospital | |

| Dental and orthodontics | |

| Glasses and contact lenses | |

| Greater choice about treatment | |

| Lower tax bill | |

| No waiting period |

What You'll Learn

Private insurance and Medicare

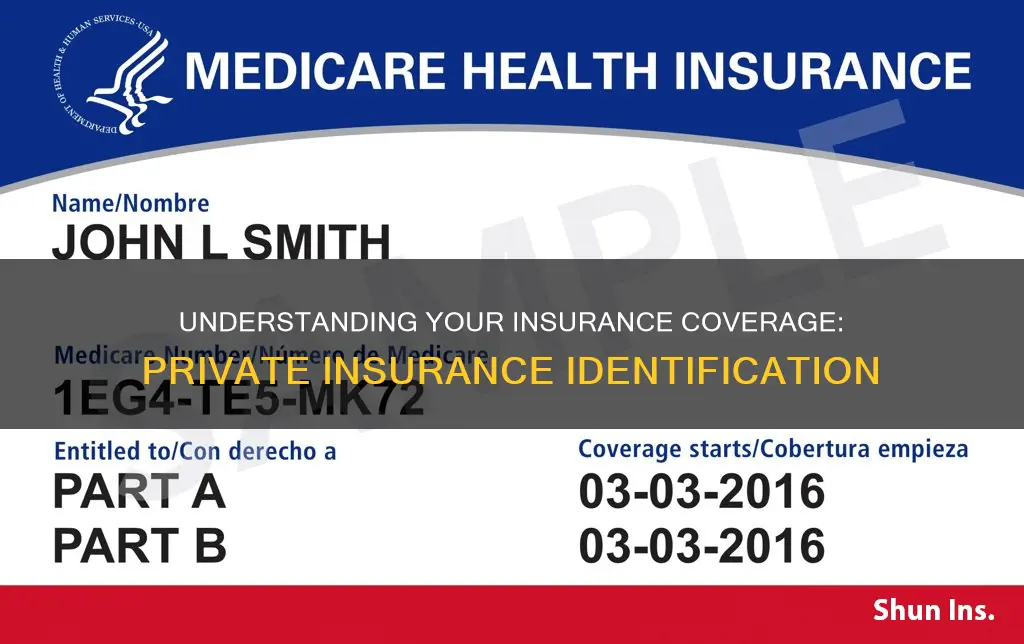

Private insurance plans are generally provided by employers or purchased individually. However, you may have private insurance even if you are covered by a government insurance program like Medicare or Medicaid. Many people have government insurance that is administered by a private company, such as a Medicare Advantage plan. Medicare Advantage plans are offered by private companies that contract with Medicare and must follow the rules set by Medicare. These plans typically include Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

Medicare Advantage plans are sometimes called "Part C" or "MA plans". Most of these plans include drug coverage (Part D). Before joining a Medicare Advantage plan, it is important to understand the rules and potential impacts on any existing coverage you have through your employer, union, or other benefits administrator. In some cases, enrolling in a Medicare Advantage Plan could result in the loss of your existing coverage, including that of your spouse and dependents, which may be difficult to regain. Insurance companies can decide on the availability of a plan based on specific states or counties, and they may offer multiple plans in an area with varying benefits and costs. It is also important to note that insurance companies can choose to join or leave Medicare annually. If a plan decides to stop participating in Medicare, you will need to join another Medicare health plan or return to Original Medicare.

If you have both Medicare and private insurance, each type of coverage is called a "payer". The "primary payer" pays up to their coverage limit and then sends the remaining balance to the "secondary payer". If the secondary payer doesn't cover the remaining balance, you may be responsible for the remaining costs. This order of payment is called "coordination of benefits". In some cases, if the insurance company doesn't pay the claim promptly (usually within 120 days), Medicare may make a conditional payment to cover the bill and then recover any payments that the primary payer should have made.

To understand your specific insurance coverage, it is recommended to review your insurance statement, which provides information about your premiums and coverage. If you have private health insurance, you can request a statement from your registered health insurer. This statement will help you understand the details of your coverage, including any out-of-pocket expenses you may be responsible for. Additionally, if you have Medicare, understanding the different types of Medicare health plans available and how they work with other insurance options can help you make informed decisions about your healthcare coverage.

California Private Residents: Fire Insurance Coverage Queries

You may want to see also

Private insurance statement

Private health insurance is an optional cover that can help you pay for hospital and medical costs not covered by government insurance. It is important to note that private health insurance is not the same as government insurance such as Medicare or Medicaid. Private insurance plans generally include health plans provided by employers and policies purchased by individuals.

There are three main types of private health insurance: basic, hospital, and extras cover. Basic cover typically includes emergency ambulance services. Hospital cover helps with the costs of staying in the hospital, and extras cover is for out-of-hospital medical treatments such as physiotherapy, optical, and dental. You can also get a combined policy that includes both hospital and extras cover.

When choosing a private health insurance policy, consider who the cover is for (singles, couples, or families), your budget, the extras you need, and the waiting period for claiming services. It is also important to be honest about your health history when signing up, as misleading your insurer may result in unpaid claims. You can compare private health insurers and their policies on the government's Private Health website.

To know if you have private insurance, you can check your policy details online or contact your insurer directly to request a private health insurance statement. This statement will outline your coverage and provide information about your premiums and private patient hospital cover. Understanding your private health insurance statement will help you comprehend the details of your coverage and make informed decisions about your healthcare and tax obligations.

Student Loan Insurance: Private vs. Federal Loans

You may want to see also

Choosing a health insurance policy

Private health insurance plans generally include health plans provided by employers and policies people buy on their own. If you receive benefits from Medicare, Medicaid, or any other government medical program, you might also have private health insurance liens. Many people have government insurance administered by a private company, and some have supplemental Medicare plans, which are private health insurance plans that cover costs and treatments that Medicare may not.

- Look for the right coverage: Choose a health plan that covers a wide range of medical issues, including pre- and post-hospitalization, daycare expenses, transportation, and illnesses you may be at risk of due to your family's medical history.

- Keep it affordable: While it is important to buy a health plan that meets your needs, it should also be within your budget. Consider the plan benefits first, then the price.

- Family over individual health plans: Individual plans are good for those without a family to support. However, if you are buying health insurance for your family, purchase a family health plan to enjoy maximum benefits at a more affordable price.

- Choose a plan with lifetime renewability: Opt for a health plan that covers you for life, as you will need it the most in your later years.

- Compare quotes online: You can compare health insurance policies online to ensure you buy a health plan that suits your needs.

- Network hospital coverage: Check if your preferred hospitals and doctors are included in the hospital network of your chosen insurance provider.

- High claim settlement ratio: The claim settlement ratio is the number of claims settled by the insurance provider over the total received claims. Always choose an insurer with a high claim settlement ratio.

Tufts Private Insurance: What You Need to Know

You may want to see also

Extras cover

There are different levels of extras cover, typically ranging from basic to top-level ancillary cover. The level of cover you choose will determine the range of services covered and the benefit limits. For example, basic extras cover may include optical, dental, and physiotherapy services with lower annual limits, while top-level ancillary cover will include a wider range of services such as major dental, prescription glasses, chiropractic care, and more, with higher benefit limits.

When choosing an extras cover policy, it's important to consider your budget, healthcare needs, and life stage. Additionally, keep in mind that there are waiting periods for extras cover, which can vary depending on the service and the health fund. These waiting periods typically range from two months to three years or more.

To find out if you have extras cover, review your private health insurance policy or contact your insurance provider. They can provide you with a private health insurance statement that outlines your coverage details, including any extras cover you may have.

Understanding 1095-A Forms: Private Insurance and Tax Declarations

You may want to see also

Government incentives and taxation policies

The Australian government provides the Private Health Insurance Rebate and the Age-based Discount to encourage citizens to take out and maintain private health insurance. Most people are eligible for a rebate on their insurance costs. The Age-based Discount reduces the cost of starting private health insurance for people aged between 18 and 29.

If you purchase hospital cover after 1 July following your 31st birthday, you will have to pay the Lifetime Health Cover (LHC) loading on top of your premium. The loading increases for every year you are aged over 30. The LHC is an Australian government initiative that lets you avoid paying higher premiums for private hospital cover. To be eligible for this, you need to take out hospital cover before turning 31 years old.

If you are not covered by a private hospital insurance policy and your income is above a certain threshold, you may have to pay the Medicare Levy Surcharge when you lodge your tax return. The Medicare Levy Surcharge is a levy of up to 1.5% of taxable income on people who do not have private hospital cover and earn income over a certain level.

The private health insurance rebate is an amount the government contributes toward the cost of your private health insurance premiums. If you meet the eligibility requirements, you can claim your rebate as either a premium reduction, which lowers the policy price charged by your insurer, or a refundable tax offset when you lodge your tax return. The rebate is income-tested, and if you share the policy, your income will be tested on your share. Your rebate entitlement depends on your family status on June 30, and different thresholds apply for single or family incomes. It is also based on the age of the oldest person covered by the policy.

In the United States, multiple tax subsidies are available to many buyers and sellers of health insurance. These subsidies have the potential to create excess demand for health insurance, which can, in turn, create excess demand for health services.

Flood Insurance: Private Options for VA Borrowers

You may want to see also

Frequently asked questions

You can check if you have private insurance by logging into ATO online services and accessing your private health insurance statement. You can also request a statement from your registered health insurer.

Private health insurance allows you to be treated in hospital as a private patient and covers healthcare costs that Medicare doesn't, such as physiotherapy, dental, and optical.

Private health insurance covers healthcare costs that Medicare doesn't, including treatment in public or private hospitals as a private patient, and other medical services such as dental, physiotherapy, and optical.

To get private health insurance, you must buy a policy from a registered health insurer and pay regular premiums to stay covered. You can compare different providers and their policies on the Australian Government's PrivateHealth.gov.au website.