Form 1095-A is a form sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. It is a record of key information about your health insurance coverage, including the effective date of the coverage, the premium amounts paid monthly, and any advance payments of the premium tax credit or subsidy. It is not necessary to send the form in with your tax return, but if you are eligible for a subsidy or tax credit, you need to transfer that information to Form 8962 and include it with your tax return.

| Characteristics | Values |

|---|---|

| Who gets Form 1095-A? | Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier |

| When should you receive Form 1095-A? | By mid-January of the year following the coverage year |

| How do you receive Form 1095-A? | By mail or in your HealthCare.gov account |

| What to do if you don't receive Form 1095-A? | Contact HealthCare.gov directly |

| What is Form 1095-A used for? | To fill out Form 8962: Premium Tax Credit |

| Do you need to send Form 1095-A to the government? | No, but you need to transfer the information to Form 8962 and include it with your tax return |

| What information does Form 1095-A include? | Effective date of coverage, premium amounts paid monthly, advance payments of the premium tax credit or subsidy, personal information, policy number, insurance company name |

What You'll Learn

Who needs to file Form 1095-A?

Form 1095-A is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. This includes those who bought health insurance through a Health Care Exchange or Marketplace, also known as Obamacare.

If you enrolled in a qualified health plan via the federal Health Insurance Marketplace or a state's exchange, you will receive Form 1095-A. The exchanges use the form to provide participants in different markets with information on their coverage.

Form 1095-A is absolutely required for taxpayers who received advance payments of the Premium Tax Credit (APTC) to help pay for health insurance coverage during the year. You will also need to file Form 1095-A if you want to claim the Premium Tax Credit.

The form includes information such as the effective date of the coverage, the premium amounts paid monthly, and any advance payments of the premium tax credit or subsidy.

You don't have to send the form in with your tax return. However, if you are eligible for a subsidy or tax credit, you need to transfer that information to Form 8962 and include it with your tax return.

Blue Cross Blue Shield Massachusetts: Private Insurance Explained

You may want to see also

What to do with Form 1095-A?

Form 1095-A is a form sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. It is not mandatory to submit Form 1095-A to the government with your tax return. However, if you are eligible for a subsidy or tax credit, you must transfer that information to Form 8962 and include it with your tax return.

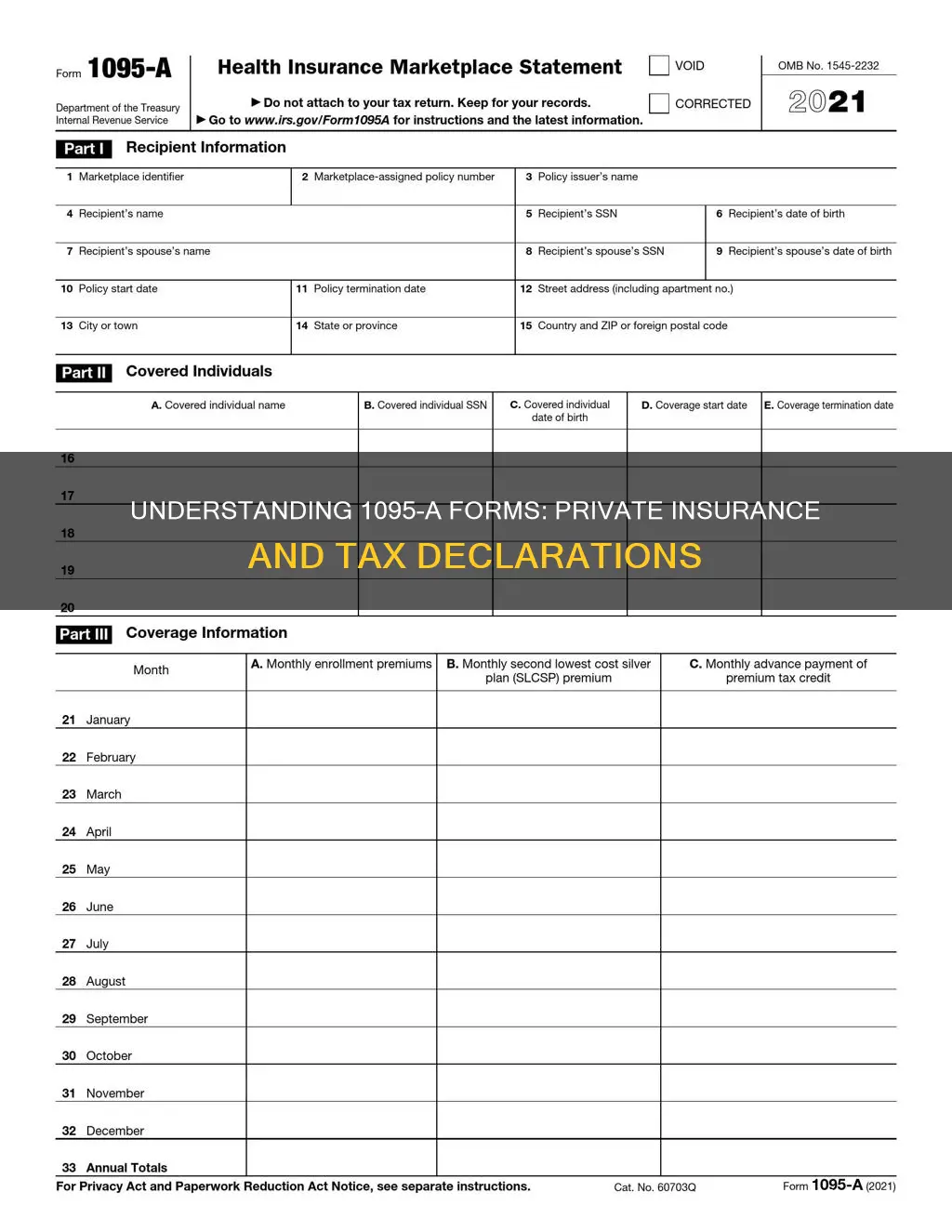

Form 1095-A contains three parts. The first part contains basic household information, the name of the insurance company that provided you with coverage, the health insurance policy start and termination date, and the marketplace policy number. The second part provides a list of individuals in your household who are covered under a health insurance marketplace plan, including their names, Social Security numbers, and coverage termination dates. The third part provides more details about your coverage during the year, including monthly premiums, dates of insurance coverage, and advance payments of premium tax credit.

You will receive Form 1095-A by mid-January or mid-February of the year following the coverage year, either by mail or in your HealthCare.gov account. If you don't receive your form or notice any inaccuracies, you can contact HealthCare.gov directly.

It is important to review your Form 1095-A for accuracy before submitting your tax returns. If you filed your taxes before reviewing Form 1095-A, you may need to submit an amended tax return. While you do not need to submit Form 1095-A with your tax return, it is recommended to keep it with your tax records for at least three years in case the IRS decides to audit your return.

Private Insurance: Over 160 Million Americans Covered

You may want to see also

When to expect Form 1095-A?

Form 1095-A is a form sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. It is a record of key information about your health insurance coverage, and you should receive it by mid-January of the year following your coverage year. The form does not have to be returned to the government but serves as a record of the individual's coverage. It includes information such as the effective date of the coverage, the premium amounts paid monthly, and any advance payments of the premium tax credit or subsidy.

The Health Insurance Marketplace (or "Marketplace") is required to send Form 1095-A to individuals by January 31 of each year. The form is sent to those who enrolled in coverage through the Marketplace, providing information about the coverage, who was covered, and when. The form is typically sent by mail or made available electronically through the individual's HealthCare.gov account.

If you do not receive your Form 1095-A by mid-January, you can contact HealthCare.gov directly to request the form or inquire about any inaccuracies. It is recommended that you wait to file your income tax return until you receive Form 1095-A, as it is crucial for claiming or reporting tax credits, which can affect the amount of income tax you owe or any refunds you are due.

How Pharmacy Gag Clauses Profit Private Insurers

You may want to see also

What to do if you don't receive Form 1095-A?

If you haven't received your Form 1095-A by early February, there are a few steps you can take to obtain it. Firstly, check your online account to see if the form is available in your enrollment dashboard inbox or account notifications. If the form is not there, or if you would prefer to receive a physical copy, contact the relevant authority, such as the MNsure Contact Center, to confirm your mailing address. It is important to ensure that your address is correct, as forms are not always forwarded by the postal service if there is no forwarding order in place.

If you were enrolled in a minimum coverage or catastrophic plan, the Medi-Cal program, or employer health coverage through Covered California for Small Business (CCSB), you may not receive Form 1095-A. In such cases, you can sign in to your secure mailbox on CoveredCA.com to check if your tax forms are available for download. If you still cannot find your form, you should contact the relevant service center.

It is important to wait for your Form 1095-A before filing your tax return, as it contains crucial information for claiming or reporting tax credits, which can affect the amount of income tax you owe or any refunds you are due.

Understanding HMO and PPO: Private Insurance Options

You may want to see also

How to fill out Form 1095-A?

Form 1095-A, also known as the Health Insurance Marketplace Statement, is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. It is important to note that this form does not need to be sent to the government along with your tax return. However, specific details from the form will need to be transferred to Form 8962, which should then be included in your tax return.

Part I: Recipient Information

This section requires the following details:

- Marketplace state name or abbreviation.

- The number the Marketplace assigned to the policy. If the policy number exceeds 15 characters, only the last 15 characters need to be entered.

- Name of the policy issuer.

- Name of the recipient of the statement. This should be the person identified at enrollment as the tax filer. If the tax filer cannot be identified, enter the name of the primary applicant for coverage.

- Social Security Number (SSN) for the recipient.

- Recipient's date of birth (optional).

- Information about the recipient's spouse, if applicable, including date of birth (optional).

- Date that coverage under the policy started. If the policy was in effect at the start of the year, enter 1/1/2023.

- Date of termination if the policy was terminated during the year. If the policy was in effect at the end of the year, enter 12/31/2023.

- Recipient's address.

Part II: Covered Individuals

This section requires the following details:

- Information for each individual covered under the policy, including the recipient and their spouse, if covered. This includes their full name, date of birth, the date their coverage started, and the date of termination if their coverage was terminated during the year. If the coverage was in effect at the end of the year, enter 12/31/2023.

- If there are more than five covered individuals, complete one or more additional Forms 1095-A, Part II.

Part III: Coverage Information

This section requires the following details:

- Total monthly enrollment premiums for the policy in which the covered individuals enrolled. Include only the premiums allocable to essential health benefits.

- Premiums for the applicable second lowest cost silver plan (SLCSP) that was used to compute monthly advance credit payments.

- Amount of advance credit payments for the month.

- If a Form 1095-A was sent for a policy that should not be reported on a Form 1095-A, send a duplicate of that Form 1095-A and check the VOID box at the top of the form.

- If you discover any incorrect information on the form, report the corrected information to the IRS and the recipient as soon as possible. Check the CORRECTED box at the top of the form.

Private Insurance: A Canadian's Perspective on Coverage

You may want to see also

Frequently asked questions

Form 1095-A is a form sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. It includes information such as the effective date of the coverage, the premium amounts paid monthly, and any advance payments of the premium tax credit or subsidy.

You should receive Form 1095-A by mid-January of the year following the coverage year, either by mail or in your HealthCare.gov account.

If you haven't received your Form 1095-A by early February, first check your online account to see if the form is in your enrollment dashboard inbox or account notifications. You can print the form from your account. If the form is not available in your account, or you would like a form mailed to you, call the Health Insurance Marketplace to confirm your mailing address.

You don't need to send Form 1095-A to the government with your tax return. However, if you are eligible for a subsidy or tax credit, you need to transfer that information to Form 8962 and include it with your tax return.