Losing your job is stressful enough, but it's made worse by losing your employer-sponsored health insurance. In the US, the Consolidated Omnibus Budget Reconciliation Act (COBRA) allows you to continue your employer's group health plan at your own expense. However, COBRA is not insurance itself but a law. Private health insurance, on the other hand, is any health insurance policy plan that is not government-run. So, is private insurance a cheaper option than COBRA?

What You'll Learn

COBRA vs. Private Health Insurance Costs

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a law that was passed in 1985. It is not insurance itself but allows employees to continue on their existing health insurance plan if they are reduced to working less than 30 hours a week, or leave their job voluntarily or involuntarily.

Private health insurance is any health insurance policy plan that is not run by a government-run insurance plan (e.g. Medicare, Medicaid, Obamacare). This type of coverage must comply with state and federal insurance regulations.

COBRA Costs

COBRA is not cheap. On average, it costs between $400 to $700 per month per person. This is because you are now responsible for paying your portion of your health insurance, plus the cost your employer contributed to your premium, in addition to a 2% service fee on the cost of your insurance.

Private Health Insurance Costs

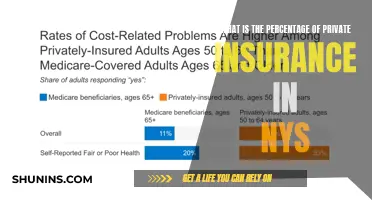

Private health insurance is even more expensive than COBRA. Some policies may only cover up to 80% of the cost of care. The national monthly average of insurance costs in 2022 was $541.

So, which is cheaper?

Private health insurance is more expensive than COBRA. However, with government subsidies available, the average cost of a similar Obamacare plan can be less than $10 per month.

Other Options

If you are looking for more affordable healthcare coverage, Healthcare.gov (The Marketplace) offers subsidies to qualifying individuals to help pay their monthly premiums. If you are 65 or older, or are permanently disabled, you may qualify for Medicare. If you are on a very low income, you may qualify for assistance through your state's Medicaid program.

Obamacare's Impact on Private Insurance: Measuring the Metrics

You may want to see also

Pros and Cons of COBRA

Pros of COBRA

COBRA is an acronym for the Consolidated Omnibus Budget Reconciliation Act, a law passed in 1985 that allows employees to continue on their existing health insurance plan if they are reduced to working less than 30 hours a week, or leave their job voluntarily or involuntarily. Here are some pros of COBRA:

- It allows you to keep your same health insurance policy in the event you lose your job voluntarily, involuntarily, or through a reduction of work hours.

- It offers added security in case an unexpected life event occurs while you are unemployed.

- Beneficiaries can continue the same coverage for pre-existing conditions and prescription drugs.

- You can use COBRA coverage for 18 to 36 months depending on why you need it, and it can be extended depending on qualifying events.

Cons of COBRA

- COBRA coverage is not cheap. You are now responsible for paying your portion of your health insurance, plus the cost your employer contributed to your premium, in addition to a 2% service fee on the cost of your insurance. A COBRA premium can cost on average $400 to $700 a month per person.

- It is a short-term fix, lasting only up to 18 months.

- It can be expensive, especially if you are also covering your family.

- You have to use your COBRA coverage without interruption. So if you choose to terminate your COBRA coverage during that period, you cannot start it up again.

The Impact of Public Insurance on Private Insurance Markets

You may want to see also

Pros and Cons of Private Health Insurance

Private health insurance is typically more expensive than COBRA. However, it offers greater coverage options, shorter wait times, and better facilities. Private health insurance also allows you to build your own policy and, sometimes, choose your own physician.

On the other hand, COBRA allows you to keep your existing health insurance policy if you lose your job, either voluntarily or involuntarily, or if your hours are reduced. It also covers your spouse and any dependent children on your health plan. However, COBRA is only available to employees who worked at a public or private company with 20 or more employees. Additionally, COBRA can be costly as you are now responsible for paying the full premium amount, plus a 2% service fee.

Pros of Private Health Insurance:

- You have the flexibility to choose a policy that works best for you.

- You may also be able to choose your own physician.

- Private health insurance offers greater coverage options and flexibility, shorter wait times, and better facilities.

Cons of Private Health Insurance:

- Private health insurance is more expensive than COBRA.

- Some policies may only cover up to 80% of the cost of care.

- Insurance premium costs are on the rise and are expected to continue increasing.

Private Insurance: A Popular Choice or Necessary Evil?

You may want to see also

Qualifying for COBRA

To qualify for COBRA, you must meet certain eligibility criteria. Firstly, COBRA only applies to employers with 20 or more employees, so if you work for a smaller company, you won't be eligible. Secondly, qualifying events for COBRA include the death of the covered employee, termination or reduction of employment hours, the covered employee becoming entitled to Medicare, divorce or legal separation, or a dependent child ceasing to be a dependent. These events would cause an individual to lose health coverage under a group health plan.

Once a qualifying event occurs, you typically have at least 60 days to decide whether to enrol in COBRA. It's important to note that COBRA is not insurance itself but a law that allows employees to continue their existing health insurance plan under certain circumstances. As such, it is more expensive than regular insurance as you are now responsible for paying the full monthly premium plus an administration fee.

COBRA can provide added security and allow you to keep your same health insurance policy and coverage for pre-existing conditions and prescription drugs. It can be especially useful if you unexpectedly lose your job and need to maintain health coverage. However, it is not a cheap option, and private health insurance may offer more flexibility in terms of coverage options and choice of physicians.

Bernie Sanders' Plan: Private Insurance Ban and Medicare

You may want to see also

Private Health Insurance Alternatives

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a law that allows employees to continue their health insurance coverage after leaving their place of employment. However, COBRA is often expensive, as the employee is now responsible for the entire cost of the premium, plus a 2% service fee.

The Health Insurance Marketplace (HIM)

The Health Insurance Marketplace offers plans that are typically less expensive than COBRA. 80% of people qualify for financial help from the government (called a subsidy) to help pay their premium. Marketplace insurance refers to health plans that meet the "minimum essential coverage" requirements of the Affordable Care Act (ACA). Nearly all Americans can enrol in Marketplace insurance, and it is possible to explore and enrol in plans by putting in your zip code.

Short-Term Health Insurance

Short-term health insurance plans offer cost-saving benefits, with premiums only half of those of the Marketplace. They offer superior flexibility and features, allowing customisation of coverage to fit the needs of your family. They can be a good option for those facing a need for immediate care or tight finances. However, coverage only lasts three months, and applications can be rejected due to pre-existing health conditions.

Health Benefit Insurance (HBI)

HBI is a limited benefit medical indemnity insurance that has been around for over 60 years. HBI plans pay a fixed cash benefit to members for doctors' visits and hospital stays.

High-Deductible Private Insurance

You can opt for a high-deductible private insurance plan to lower your premiums.

Wealth Management Funds: Are Your Investments Insured?

You may want to see also

Frequently asked questions

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a law that was passed in 1985. It allows employees to continue their existing health insurance plan if they are reduced to working less than 30 hours a week, or leave their job voluntarily or involuntarily.

Private health insurance is any health insurance policy plan that is not run by a government-run insurance plan (e.g. Medicare, Medicaid, Obamacare). This type of coverage must comply with state and federal insurance regulations.

No, COBRA is more expensive than private insurance. COBRA costs an average of $400 to $700 per month per person, whereas private insurance costs vary but are typically more affordable.

COBRA allows you to keep your existing health insurance policy and group rate, which can provide peace of mind during a period of transition. However, it is costly and only available for a limited time (18-36 months). Private health insurance offers more flexibility in terms of coverage options and can be renewed, but it is also expensive and may offer limited coverage depending on the disease and condition.