Navigating the intricacies of insurance claims can be challenging, and it's natural to wonder if your insurance has processed your claim successfully. Understanding how to verify that your insurance has paid out is essential for ensuring you receive the coverage you're entitled to. This guide will provide valuable insights into the steps you can take to confirm that your insurance has settled your claim, offering peace of mind and clarity during what can be a stressful time.

How to Determine if Your Insurance Paid

| Characteristics | Values |

|---|---|

| Check Your Policy Documents | Review your insurance policy to understand the coverage, claims process, and any specific requirements for notification. |

| Contact Your Insurance Company | Reach out to your insurance provider directly. They can provide information on claim status, payment amounts, and any outstanding actions needed from your end. |

| Review Your Bank or Credit Card Statements | If the payment was made via direct deposit or credit card, check your financial statements for the transaction. Look for the insurance company's name and the claim reference number. |

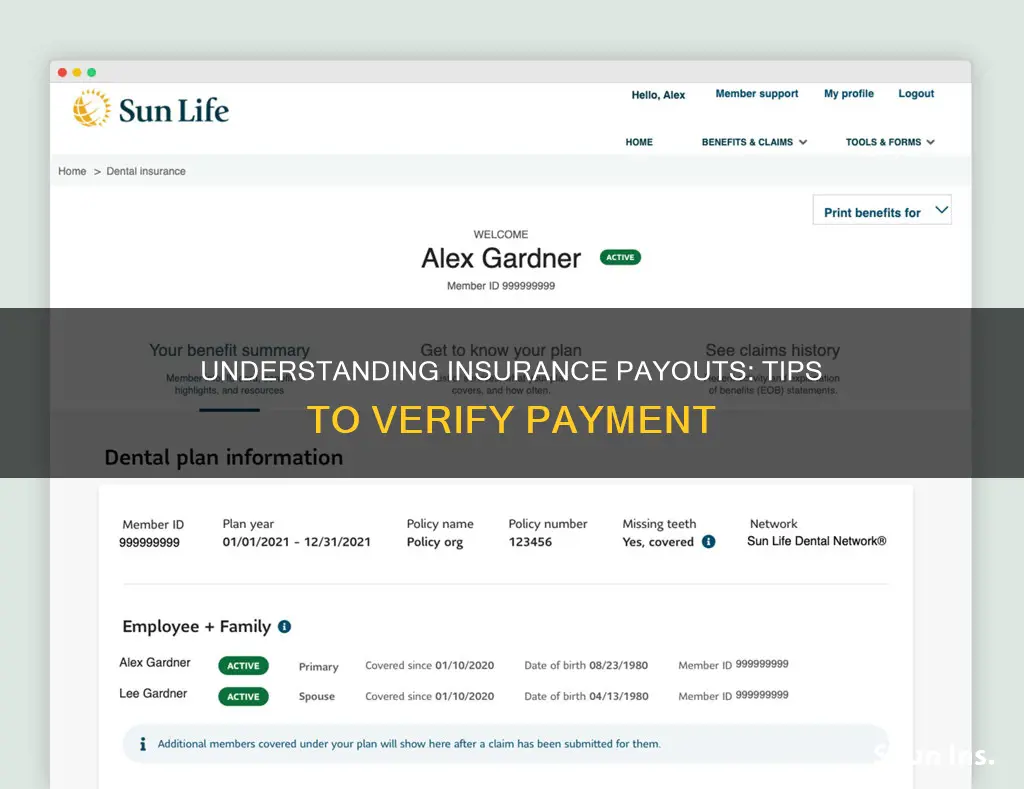

| Online Account Access | Many insurance companies offer online account access. Log in to your account to view claim details, payment history, and any updates. |

| Claim Settlement Letter | If your claim was settled, you may receive a letter outlining the payment amount, deductions (if any), and the reason for any adjustments. |

| Follow Up on Claims | Don't hesitate to follow up with your insurance company if you haven't heard back within a reasonable timeframe. They can provide clarification and ensure your claim is processed correctly. |

| Understand Payment Processing Time | Insurance companies typically have processing times for claims. Be aware of these timelines to manage your expectations. |

| Record Keeping | Keep all relevant documents related to your claim, including receipts, medical bills, and correspondence with the insurance company. This documentation can be useful for future reference. |

What You'll Learn

- Policy Details: Review your policy documents to understand coverage and payment methods

- Payment Status: Check online portals or contact customer service for payment confirmation

- Claims Process: Understand the claims process and expected timelines for payment

- Documentation: Keep records of submitted claims and received payments for reference

- Dispute Resolution: Know how to dispute payments if necessary and the steps to resolve issues

Policy Details: Review your policy documents to understand coverage and payment methods

When it comes to understanding whether your insurance has paid out, a thorough review of your policy documents is the first step. These documents are the foundation of your insurance coverage and provide essential details about what is covered and how payments are processed. Here's a breakdown of how to navigate through your policy to gain clarity:

Understanding the Policy Language: Begin by carefully reading through the entire policy. Insurance policies can be complex, so it's crucial to comprehend the terms and conditions. Pay close attention to the sections outlining coverage types, such as property, liability, or health insurance. These sections will specify what events or situations are covered and the associated benefits. For instance, in a health insurance policy, you'll find details about covered medical procedures, prescription drugs, and hospitalization expenses. Understanding these specifics is vital to knowing what your insurance will and won't cover.

Identifying Payment Methods: Policy documents also outline the payment process. This includes information on premiums, deductibles, co-pays, and coinsurance. For instance, in health insurance, you might have a deductible that you need to meet before the insurance starts covering expenses. Understanding these payment methods ensures you know your financial responsibilities and how the insurance company processes payments. Look for sections like 'Payment Structure,' 'Deductibles and Co-pays,' or 'Claims Payment Process' to gain a comprehensive understanding.

Reviewing Coverage Limits and Exclusions: Another critical aspect is understanding the coverage limits and any exclusions. Coverage limits set the maximum amount the insurance will pay for a specific claim. Exclusions, on the other hand, are situations or events that are not covered. For example, in a home insurance policy, natural disasters like earthquakes or floods might be excluded. Knowing these details ensures you're aware of any potential gaps in your coverage.

Checking for Additional Benefits: Insurance policies often include additional benefits or riders that provide extra coverage. These can be add-ons for specific risks or enhanced protection. Reviewing these sections can help you discover any additional perks you may have. For instance, in a life insurance policy, you might find options for accidental death coverage or critical illness riders.

Contacting the Insurance Provider: If you still have doubts or require further clarification, don't hesitate to contact your insurance provider. Their customer service team can guide you through the policy and answer any questions. They can also provide examples of how claims are processed and paid, ensuring you have a clear understanding of the entire process.

Regosa Engineering Services: Unveiling Insurance Coverage and Peace of Mind

You may want to see also

Payment Status: Check online portals or contact customer service for payment confirmation

To determine if your insurance has been processed and paid, the most straightforward approach is to check the online portals provided by your insurance company. These portals are typically secure and user-friendly, allowing you to access your account information at any time. Here's a step-by-step guide on how to do this:

- Visit the Insurance Company's Website: Start by opening your preferred web browser and navigating to the official website of your insurance provider. Look for a 'Customer Login' or 'Account Access' section, often found in the top menu bar or on the homepage.

- Log In to Your Account: Enter your unique username or email address, along with the password you created during account registration. Ensure you have the correct login credentials to access your personal information.

- Navigate to Payment History: Once logged in, locate the 'Payment' or 'Billing' section. This area will display a record of your insurance premiums and any associated fees. Look for a search or filter option to find specific payments. You might be able to view payments made within the last few months or even a full year.

- Verify Payment Status: Check the payment details for the specific insurance claim or premium you are concerned about. Look for indicators such as 'Paid in Full,' 'Processing,' or 'Payment Received.' Some portals may provide a status update, showing when the payment was processed and the amount received. If you don't see the payment, it might be in the processing stage or pending further verification.

If you encounter any issues or cannot find the required information online, the next step is to contact customer service. Insurance companies typically offer multiple ways to reach their support team, including phone, email, or live chat. Here's how you can proceed:

- Contact Customer Service: Dial the insurance company's customer service number or use the provided email address. You can also access live chat support on their website if available. Be prepared to provide your policy number, personal details, and any relevant information about the payment in question.

- Inquire About Payment: Clearly communicate your concern regarding the payment status. Ask the customer service representative to confirm if the payment has been received and processed. They might need to verify your identity and account details to ensure they provide accurate information.

- Follow Up: If you don't receive a response or confirmation within a reasonable time frame, don't hesitate to follow up. Insurance companies often have strict timelines for processing payments and addressing customer inquiries. Re-contacting them can help ensure your concern is addressed promptly.

Becoming a Preferred UPC Insurance Vendor: A Guide

You may want to see also

Claims Process: Understand the claims process and expected timelines for payment

The claims process can vary depending on the type of insurance and the specific circumstances of your claim, but understanding the general steps and timeline can help you navigate the process more effectively. Here's a breakdown of what to expect:

- Filing a Claim: The first step is to notify your insurance company about the incident that triggered the claim. This is typically done by submitting a claim form, which can be provided by the insurance company or accessed online. Be sure to provide all the necessary details, including the date, location, and a description of the event. If you have any supporting documents or evidence, such as police reports, medical records, or repair estimates, include them as well.

- Initial Assessment: Once the insurance company receives your claim, they will review the information and assess the validity of the claim. This step may involve contacting you for additional details or clarifying certain aspects of the incident. The insurance adjuster will evaluate the damage, verify the facts, and determine if the claim is eligible for coverage.

- Estimation of Benefits: If the claim is approved, the insurance company will estimate the amount of coverage you are entitled to. This process involves calculating the costs associated with the claim, such as medical expenses, property damage repairs, or replacement costs. The adjuster will consider the policy terms and conditions to determine the settlement amount.

- Payment Processing: After the benefits are estimated, the insurance company will process the payment. The timeline for payment can vary, but it typically follows these steps: First, the insurance company will send a payment offer, outlining the amount they are willing to pay and the terms of the settlement. You may have the option to accept the offer or request an appeal if you disagree with the amount. If you accept, the payment will be disbursed according to the agreed-upon terms. If you disagree, you can provide additional evidence or negotiate further.

- Timelines: The entire claims process can take several weeks to a few months, depending on the complexity of the claim and the insurance company's procedures. Here's a general timeline:

- Initial claim submission: 1-3 days

- Initial assessment and investigation: 3-14 days

- Estimation of benefits: 5-21 days

- Payment processing and disbursement: 7-30 days after acceptance of the offer.

It's important to stay in communication with your insurance company throughout the process. They should provide regular updates and be available to answer any questions you may have. If you feel that the process is taking too long or if there are delays, don't hesitate to follow up and inquire about the status of your claim.

Adjusting Your Insurance Coverage: Navigating Enrollment Date Changes

You may want to see also

Documentation: Keep records of submitted claims and received payments for reference

When it comes to ensuring that your insurance provider has processed your claim and made the necessary payments, documentation is key. Keeping records of your submitted claims and received payments is an essential step to verify the status of your insurance coverage. Here's a breakdown of why and how to maintain these records:

Claim Submission Records: Start by creating a file or digital folder specifically for each insurance claim you've filed. Include the following details: the date of the incident or loss, a brief description of the event, and the amount you claimed. Also, note the claim number assigned by the insurance company, as this will be crucial for tracking. Keep all relevant documents, such as police reports, medical bills, repair estimates, or any other evidence supporting your claim. These documents provide a comprehensive overview of the claim, ensuring that you have a clear record of what was submitted.

Payment Receipts: After your claim is processed, you should receive payment from the insurance company. Obtain payment receipts or proof of payment for each claim. These receipts should include the claim number, the date of payment, the amount paid, and any relevant reference numbers. Keep these receipts in the same organized manner as your claim submission records. It is important to note the date and amount of payment to ensure that you have a clear record of when and how much the insurance company disbursed.

Online Portals and Communication: Many insurance companies now offer online portals or customer portals where you can view the status of your claims and payments. Familiarize yourself with these portals and regularly check for updates. You may also receive notifications or emails regarding the progress of your claim. Keep a record of these communications, including dates, subject lines, and any relevant details discussed. This digital trail can provide valuable insights into the insurance company's actions and responses.

Regular Follow-ups: Insurance claims can sometimes take time, and it's essential to follow up periodically. Keep a log of your follow-up communications, including dates, methods of contact (phone, email), and the purpose of the contact. If you notice a delay in response or have concerns, document these instances. This record-keeping will help you track the insurance company's performance and ensure that your claim is not overlooked.

By maintaining detailed documentation, you create a comprehensive reference for your insurance journey. This process empowers you to verify the insurance company's actions, ensuring that your claim was processed and paid as expected. Regularly reviewing these records can also help identify any discrepancies or issues that may require further attention. Remember, staying organized and proactive in your record-keeping will make it easier to navigate the insurance process and provide valuable documentation for future reference.

Patterson Insurance Services: Your Local Connecticut Experts

You may want to see also

Dispute Resolution: Know how to dispute payments if necessary and the steps to resolve issues

When it comes to insurance claims, understanding the payment process and knowing how to dispute payments if necessary is crucial. Here's a guide on how to navigate this process:

Review Your Policy and Claim Details: Start by thoroughly reviewing your insurance policy and the claim documents. Pay close attention to the coverage limits, exclusions, and any specific requirements mentioned. Ensure you understand the terms and conditions related to payment processing. Look for details such as the estimated settlement amount, any deductibles or co-pays, and the payment timeline. Knowing these specifics will help you identify potential discrepancies.

Check for Payment Confirmation: After submitting your claim, keep an eye on the status updates provided by your insurance company. They should provide a confirmation or acknowledgment of the claim receipt. If you don't receive any communication regarding the payment, it's essential to take action. Contact the insurance company's customer support and inquire about the payment status. Ask for a detailed breakdown of the settlement amount and any applicable fees. This initial step can help you quickly identify any payment-related issues.

Dispute Resolution Process: If you discover that the insurance company hasn't paid the claimed amount or if there are discrepancies, it's time to initiate a dispute resolution process. Here's how:

- Gather Evidence: Collect all relevant documents, receipts, medical records, or any other proof supporting your claim. Ensure you have a comprehensive record of the expenses incurred and the services provided.

- Contact the Insurance Company: Reach out to your insurance provider and inform them of the dispute. Clearly state the issues you've identified and provide the supporting evidence. Be specific about the payment amount you believe is correct.

- Follow the Company's Dispute Procedure: Insurance companies typically have their own dispute resolution protocols. Follow their guidelines, which may include submitting additional documentation, attending a hearing, or providing further clarification. Stay organized and keep records of all communication.

- Mediation or Appeal: If the initial dispute resolution attempt is unsuccessful, you may be offered mediation or the option to appeal. Mediation involves a neutral third party helping to resolve the dispute. If you disagree with the mediator's decision, you can file an appeal, often with a higher-level review board within the insurance company.

Seek External Assistance: If the dispute resolution process feels overwhelming, consider seeking guidance from a legal professional or a consumer protection agency. They can provide valuable advice and ensure your rights are protected throughout the process.

Remember, being proactive and well-informed is key to resolving payment disputes. Stay organized, keep records, and don't hesitate to seek help when needed.

Haven Insurance Phone: Contacting Your Guardian Angel

You may want to see also

Frequently asked questions

You can typically check the status of your insurance claim online through your insurer's website or by logging into your account. Look for a section dedicated to claim management or payments. If you don't have online access, contact their customer support team, who can guide you through the process and provide an update on your claim's status.

Insurance companies usually provide updates or notifications regarding claim settlements. These may include emails, letters, or messages through their online portals. Keep an eye on your communication channels, and if you haven't heard back, reach out to your insurer to inquire about the payment status.

Yes, many insurance providers offer the option to track payments through your online banking portal. You can usually find this information in your insurance policy documents or by contacting their customer service. This method provides real-time updates on any payments made to your account.

If you suspect there might be a delay or an issue with the payment, contact your insurance company promptly. They can investigate the matter and provide a resolution. It's essential to act quickly to ensure you receive the benefits you're entitled to and address any potential discrepancies.