Deciding on a settlement is a complex process that involves many factors. If you've been in an accident, you might be preparing to file a claim with an insurance company. This is where a claims adjuster comes in. A claims adjuster is someone who works for the insurance company to determine liability. They investigate damages resulting from accidents to people and property and, based on what they find, they determine the extent of the company's liability.

The process of settling a claim can be lengthy and complex, and it's important to be prepared. Here are some key steps to keep in mind:

1. File an insurance claim: Determine where to file your claim, whether it's with your own insurance company or the at-fault party's insurer.

2. Organize your records: Gather and organize all relevant documents and evidence related to your accident, such as police reports, medical records, property damage quotes, photographs, and more.

3. Calculate your minimum settlement amount: Estimate the value of your claim by considering the financial implications of expenses related to the accident and any losses or damages incurred.

4. Negotiate the settlement: The adjuster will likely make an initial settlement offer that is lower than what you expect. It is common for insurance companies to start with a low offer to test your negotiation skills. Don't be afraid to counter with a higher amount and provide justification for your valuation.

5. Emphasize your strongest points: Focus on the severity of the accident, your injuries, and any long-term impacts. Provide evidence and records to support your arguments.

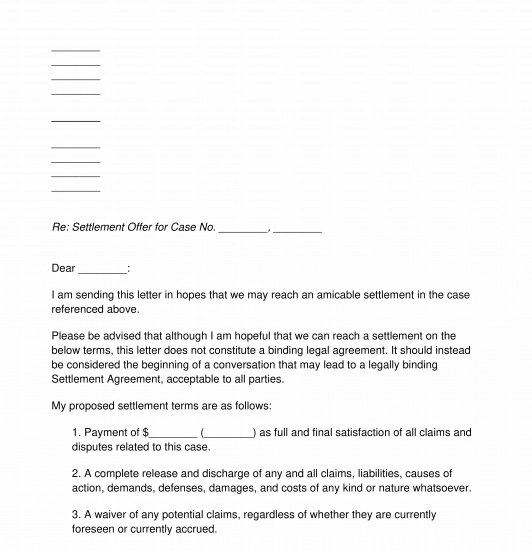

6. Get the settlement in writing: Once you and the adjuster reach an agreement, get the terms in writing to ensure both parties are clear on the settlement amount and what it covers.

Remember, you don't have to accept the adjuster's first offer. You have the option to counter with a different value, seek legal advice, or even refuse the offer and consider other options. It's important to be well-informed and prepared throughout the process to ensure you receive a fair settlement.

What You'll Learn

- Insurance adjusters investigate claims, reviewing evidence and determining liability

- They assess the validity of claims, interviewing witnesses and claimants

- Adjusters calculate settlement values based on damages, medical bills, and lost earnings

- They consider chances of winning at trial and potential jury awards to the claimant

- The first settlement offer is often a low percentage of the case value, which can be negotiated

Insurance adjusters investigate claims, reviewing evidence and determining liability

Insurance adjusters play a crucial role in investigating claims, reviewing evidence, and determining liability. They work on behalf of insurance companies to assess damages and establish the company's liability. Here's an overview of how insurance adjusters investigate claims and reach settlement decisions:

Claim Investigation:

- Interviewing Parties and Witnesses: Insurance adjusters conduct interviews with the involved parties, including the policyholder and the claimant, to gather their firsthand accounts of the incident.

- Reviewing Reports and Records: They examine relevant reports, such as police reports, accident reports, and medical records, to understand the circumstances and impact of the incident.

- Evaluating Property Damage: Adjusters inspect and assess any property damage associated with the claim, which helps in determining the extent of financial losses.

- Analysing Medical Records: In cases involving injuries, adjusters review medical records to evaluate the severity of the injuries, the treatment required, and any associated costs.

- Witness Interviews: They also interview witnesses to gather additional information and perspectives about the incident, which can help corroborate or contradict the involved parties' statements.

Evidence Review and Liability Determination:

- Evidence Analysis: Insurance adjusters carefully review and analyse the evidence gathered during the investigation phase, including documents, reports, and witness statements.

- Liability Assessment: Based on the evidence, adjusters determine the liability of the insurance company. They assess whether the company is responsible for paying out damages and to what extent.

- Claimant Background Check: In some cases, adjusters may conduct background checks on claimants to verify the legitimacy of their claims. This may involve checking claims databases or performing online searches.

- Damage Valuation: Adjusters evaluate the financial impact of the incident, including medical bills, lost earnings, property damage, and other relevant costs. They may use specialised software to assign values to certain types of damages.

- Settlement Offer Calculation: After analysing the evidence and determining liability, adjusters calculate an initial settlement offer. This offer is typically a percentage of what they believe is the final value of the case, and it may be lower than what the claimant expects.

It's important to note that insurance adjusters work on behalf of the insurance company, and their goal is often to minimise the company's financial liability. Claimants are advised to be prepared and well-informed when dealing with adjusters, and seeking legal assistance can help ensure a fair settlement.

Unraveling the Education Mystery: Degree Requirements for Insurance Adjusters

You may want to see also

They assess the validity of claims, interviewing witnesses and claimants

Insurance adjusters play a critical role in the claims investigation process, which involves verifying the validity of insurance claims to protect the interests of both the insurance company and the policyholder. They assess the validity of claims by gathering evidence, interviewing witnesses and claimants, and conducting research.

When assessing the validity of a claim, insurance adjusters follow a thorough process to ensure a fair and accurate assessment. They start by reviewing the claim and conducting an initial investigation and assessment, which includes reviewing policy coverage, analysing damages, and verifying the claimant's identity. This is followed by gathering evidence and documentation, such as physical evidence, photographs, video footage, medical records, and financial records. The evidence-gathering process also involves interviewing witnesses and involved parties to obtain firsthand accounts and relevant details about the incident.

During witness interviews, insurance adjusters aim to record the witness's evidence and statements, focusing on what the witness saw, heard, or felt. It is essential to obtain voluntary statements whenever possible, ensuring that witnesses are treated with courtesy and put at ease. Witness statements are signed to confirm the accuracy of the information provided. In some cases, compelled statements may be necessary, but these have limitations on how they can be used in legal proceedings.

Insurance adjusters also interview claimants to get their perspective and details about the incident. They ask specific questions to understand the circumstances, such as the location, how the incident occurred, the presence of other individuals, vehicles involved, and any injuries sustained. By comparing the claimant's statements with documentary evidence and witness testimonies, adjusters can verify the authenticity of the claim.

Additionally, insurance adjusters may survey the accident scene, take photos and videos, and monitor the claimant's activities to further assess the legitimacy of the claim. They also consider the claimant's social media presence and past claims history to identify any discrepancies or patterns of fraudulent behaviour.

Throughout the process, insurance adjusters must adhere to legal and ethical guidelines, respecting the privacy and rights of individuals involved. They work collaboratively with investigators, law enforcement officials, and legal professionals to thoroughly investigate claims and make informed decisions about their validity.

The Ever-Ready Nature of Insurance Adjusters: On-Call Responsibilities

You may want to see also

Adjusters calculate settlement values based on damages, medical bills, and lost earnings

When it comes to insurance claims, adjusters play a crucial role in determining the settlement value based on damages, medical bills, and lost earnings. This process involves a thorough investigation of the claim, including reviewing documentation, assessing damages, and considering the claimant's chances of winning at trial.

Firstly, adjusters investigate the claim by gathering evidence and reviewing reports, witness statements, and surveillance footage. They also assess the claimant's background and previous claims history. Then, they request documentation from the claimant, including medical bills, proof of earnings, tax returns, and property damage evidence.

When determining the settlement value, adjusters consider two main categories of damages: damages capable of exact calculation (economic damages) and damages that are not precisely calculable (non-economic damages). Economic damages include medical bills and lost earnings, which are calculated by adding up all the related expenses. Non-economic damages, such as pain and suffering, are more challenging to quantify and are often determined using a multiplier method or by investigating comparable cases.

The adjuster will also consider the claimant's chances of winning at trial and the potential jury award. The settlement offer is typically a percentage of the perceived value of the case, and adjusters may have some leeway in adjusting the initial offer. It's important to note that the adjuster's formula is just a starting point, and the final settlement amount can change based on the specific details of the claim.

In summary, insurance adjusters follow a structured process to assess damages, medical bills, and lost earnings, using mathematical formulas and negotiation strategies to determine a fair settlement value. The specific approach may vary depending on the type of claim and the jurisdiction.

Understanding the Flexibility of Insurance Quotes: Are They Set in Stone?

You may want to see also

They consider chances of winning at trial and potential jury awards to the claimant

When determining the settlement value, insurance adjusters have to consider two things: the claimant's chances of winning at trial and the amount a jury might award the plaintiff in damages.

Adjusters will investigate the claim, determining whether the claimant's injuries are eligible for insurance coverage. They will also investigate the claimant, checking for any previous personal injury claims and conducting a background check. They will then request documentation relating to the claim, such as medical bills, proof of earnings, tax returns, and proof of property damage.

Once they have all the necessary documents, they will determine the overall value of the case. If the chances of winning the trial are low, the adjuster will likely make a low settlement offer. On the other hand, if the adjuster is dealing with a high-quality lawyer, the offer may be higher than average.

It is important to note that adjusters often have leeway to adjust the first offer depending on who they are dealing with. If the claimant is unrepresented, the first offer will usually be lower than if they had a lawyer.

When Can I Expect an Insurance Adjuster to Assess My Vehicle Damage?

You may want to see also

The first settlement offer is often a low percentage of the case value, which can be negotiated

When dealing with insurance companies, it's important to remember that you are dealing with experts trained in negotiation tactics. Insurance claims adjusters can be ruthless, and they aren't always honest. They work for the insurance company and are incentivized to minimize the company's financial exposure. As such, the first settlement offer is often a low percentage of the case value, and it is not recommended to accept it.

The first settlement offer is a tactic to see if you know what your claim is worth and to test your negotiation skills. It may be so low that it seems absurd. This is a normal, if frustrating, part of the claims process. Adjusters will employ this tactic to see if you know the worth of your claim and to exploit your lack of legal knowledge. They will also use this tactic to see if you are in a hurry to settle.

The best course of action is to counter with a figure higher than the adjuster's offer but lower than your original demand. You can ask the adjuster to justify their low offer and respond with a letter addressing their points. You can also emphasize the strongest points in your favor, such as the severity of the accident, the pain and suffering from your injury, and the long-term physical effects.

Remember that the insurance adjuster's first offer is just the first step in the settlement process. You can counter their offer with your own or discuss your case with an attorney.

Steep Rooftop Adventures: The Perils of an Insurance Adjuster's Job

You may want to see also

Frequently asked questions

An insurance adjuster investigates claims to determine the insurance company's liability and the settlement amount. They interview involved parties and witnesses, review documents, and evaluate injuries and property damage.

They consider the claimant's chances of winning at trial and the potential jury award. Damages are divided into two categories: those capable of exact calculation (medical bills and lost earnings) and those not capable of exact calculation (pain and suffering).

It is important to be prepared and well-organised. Gather all relevant records and documents, including medical bills, accident reports, property damage quotes, photographs, and salary information. Calculate your minimum settlement amount by considering the financial implications of the accident and any related injuries.

It is common for insurance adjusters to make a low initial offer. Don't be surprised or intimidated by this tactic. Instead, counter with a higher figure and emphasise the strongest points in your favour, such as the severity of the accident, your injuries, and any long-term impacts.

You are not obligated to accept the insurance adjuster's initial offer. You have several options, including accepting the offer if you believe it is fair, making a counteroffer, or consulting with an attorney to discuss your case and explore other options, such as suing the liable party.