Insurance adjusters are the people who are sent to assess the damage to your home, car, or property after you file an insurance claim. They are either salaried employees or independent contractors working on behalf of insurance companies. They are directed by and represent the insurance company, and their main objective is to resolve your claim as quickly and cheaply as possible.

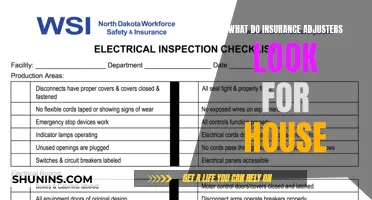

Adjusters are on call to review what happened and estimate the claims payment. They may inspect the damages, look at police reports, talk to witnesses, or ask for more information when reviewing your claim. They are also on call to negotiate with claimants, who are advised to retain a lawyer to advocate for them and handle all interactions and negotiations with the adjuster.

| Characteristics | Values |

|---|---|

| Role | Evaluate insurance claims to determine the insurance company's liability under the terms of an owner's policy |

| Types | Insurer adjusters, public adjusters, independent adjusters |

| Qualifications | High school diploma, associate's or bachelor's degree |

| Skills | Analytical, communication, detail-oriented, interpersonal |

| Work Environment | Offices, outdoors |

| Work Schedule | Full-time, irregular |

| Salary | $61,465 per year (average in the U.S.) |

What You'll Learn

- Insurance adjusters are usually the main point of contact for claimants

- They work for the insurance company, not the claimant

- Their goal is to resolve claims quickly and cheaply

- Adjusters will try to contact claimants within the first few weeks

- Claimants should be cautious and consider seeking legal advice

Insurance adjusters are usually the main point of contact for claimants

After an accident or incident that triggers insurance coverage, the adjuster will be the one to handle the resulting claim. They will gather basic information such as the date of the incident, the claimant's name, contact information, and other relevant details. The adjuster will also investigate the incident by examining any police reports, medical records, and other evidence related to the claim. This may include speaking with the claimant, interviewing witnesses, and inspecting any property damage.

It is important for claimants to remember that insurance adjusters are not on their side and may employ certain tactics to try to reduce the payout. For example, adjusters may try to delay communication or use a lack of communication to their advantage, hoping that the claimant will become frustrated and accept a lower settlement offer. Adjusters may also try to get the claimant to admit fault or share liability for the accident, which can reduce the amount of money the claimant can recover.

To protect themselves, claimants should be cautious when communicating with insurance adjusters. It is recommended to document all communication, create a paper trail, and be proactive in providing proof of losses and requesting specific dollar amounts. Claimants should also be aware of their rights and not feel pressured to give recorded statements or accept early settlement offers without fully understanding the extent of their injuries or damages.

Overall, while insurance adjusters are the main point of contact for claimants, it is crucial for claimants to remember that adjusters represent the insurance company and to take steps to protect their own interests during the claims process.

The Distinct Roles of Insurance Adjusters and Lawyers: Unraveling the Similarities and Differences

You may want to see also

They work for the insurance company, not the claimant

When an insurance adjuster reaches out to you, it is important to remember that they work for the insurance company, not the claimant. Their primary objective is to minimise the payout on the claim. They are not on your side and are not looking out for your best interests.

Adjusters are trained to look for evidence that can be used against you and will try to get you to say something that could hurt your claim. They may subtly try to get you to tell them about the accident or your injuries, or they may ask unusual questions that seem unrelated to the incident but are designed to draw you out and get you to answer in a way that can be used to force you into a settlement or against you if the claim goes to trial. They will also try to get you to settle quickly, before you fully understand what your injuries are and how much your claim is worth.

If an adjuster calls you, be polite and professional, but give only limited personal information. You can tell them your full name, address, phone number, what type of work you do, and where you are employed, but avoid discussing anything else about your work, your schedule, your income, your medical/injury history, or anything else. Do not give details of the accident or your injuries, and do not admit fault or say that you are not hurt. You should also refuse to give recorded statements.

If you have been injured, it is a good idea to hire a personal injury lawyer to handle all adjuster interactions and negotiations and manage the claims process to maximise the payout you receive.

Navigating the Path to Becoming an Insurance Adjuster in Florida: A Comprehensive Guide

You may want to see also

Their goal is to resolve claims quickly and cheaply

Insurance companies aim to resolve claims quickly and cheaply, but this can be a challenging process with many variables. The time taken to resolve a claim depends on the type of claim, the complexity of the case, and the number of parties involved. For example, personal injury claims can take longer to process than property damage claims, and more complex cases can take several months or even years to settle.

In general, insurance companies will have a goal of settling and paying out a claim within 30 days of filing. However, this is not a strict requirement, and the process can be delayed if any party involved does not cooperate. To speed up the process, claimants can provide as much information as possible, including photographs and videos of the damage, and respond promptly to any requests from the insurance company.

In some cases, insurance companies may try to delay or deny claims to minimise their costs. Claimants should be aware of their rights and the timeframes within which the insurance company is required to respond. If there are unreasonable delays, claimants can complain to the insurance company's complaints department or seek help from external organisations, such as the Australian Financial Complaints Authority (AFCA) in Australia or a lawyer in the US.

To avoid delays in the claims process, it is important for individuals to choose a reputable insurance provider with good ratings for claim processing and customer satisfaction. Additionally, being proactive and staying in communication with the insurance company can help speed up the process.

Unraveling the Path to Becoming an Insurance Adjuster in North Carolina

You may want to see also

Adjusters will try to contact claimants within the first few weeks

Adjusters prefer phone calls as a live call can give them a sense of how comfortable the claimant is with the injury claim process. They can also use the call to try to get the claimant to say something that could hurt their claim or be difficult to walk back later on.

It is important to remember that an adjuster's allegiance is to the insurance company, not the claimant. Their primary objective is to minimise the payout on the claim. They will try to contact claimants soon after the incident, and it is advisable to respond promptly to their messages and phone calls for the efficient processing of the claim. However, claimants should be cautious when speaking to adjusters and avoid giving too much information or agreeing to a settlement before they are ready.

The Complex Relationship Between Insurance Adjusters, Contractors, and Carriers

You may want to see also

Claimants should be cautious and consider seeking legal advice

In the case of a claim against the NHS, for example, it is important to understand that the court cannot discipline healthcare practitioners, force a hospital or healthcare practitioner to change how they work, or make a healthcare practitioner apologise. Claimants should also be aware that they will need to show both a breach of duty of care and causation to be entitled to receive compensation.

Additionally, claimants should be aware that litigation is a complex area of law, and even if they believe their case is strong, they could still lose on a technicality. A solicitor can help claimants navigate this complex process and achieve the best possible outcome for them. They can also help claimants resolve the issue without going to court, which is a less costly and stressful option.

If claimants are unsure about whether to proceed with a claim, they should consider seeking legal advice to help them make an informed decision. This will also ensure that they are aware of their rights and obligations and do not inadvertently do or say something that could affect their case.

The Trust Factor: Examining the Reliability of AAA Insurance Adjusters

You may want to see also

Frequently asked questions

Yes, insurance adjusters are on call and will likely contact you shortly after an accident.

An insurance adjuster is a person who is dispatched by your insurance company to assess the property and cause of loss, calculate damage, and help decide on the next steps for processing your claim.

It is important to remain calm and polite. Get the name of the company and the person's name and title. Give them only the basic information, such as your name, address, and phone number.

Avoid admitting fault, speculating on injury severity, negotiating without legal advice, providing recorded statements, volunteering detailed descriptions of the accident, and signing any documents without a lawyer's review.

If you are having trouble getting the adjuster to return your calls, you can try calling frequently to put your name at the top of their list or ask for a supervisor to intervene and help push your claim forward.