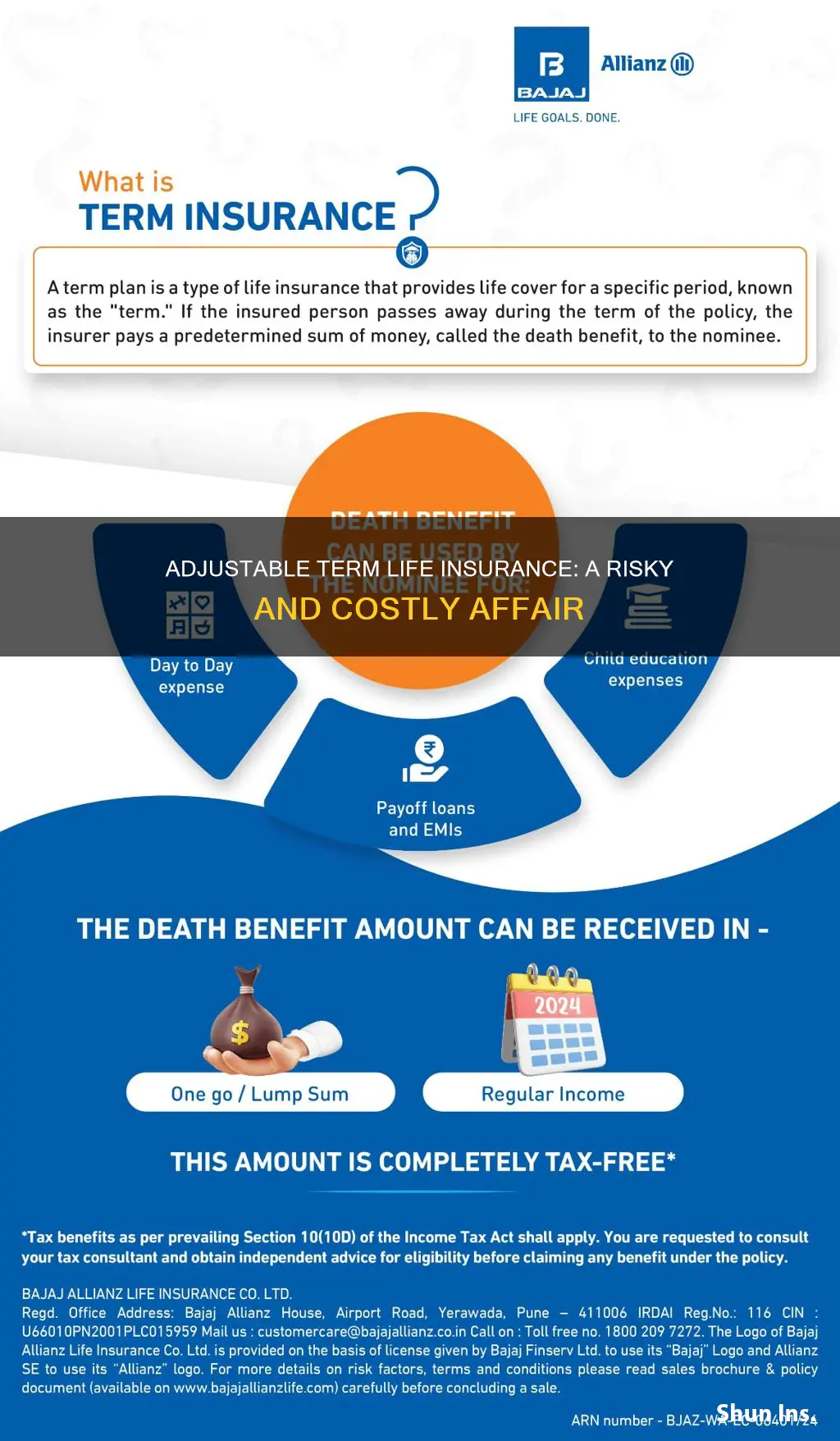

Adjustable life insurance is a type of permanent life insurance that offers flexibility to change the policy terms after signing up. While this flexibility is beneficial for those who expect their financial situation to change, there are several reasons why adjustable term life insurance may not be the best option for everyone. Firstly, it is more expensive than term life insurance, with higher premiums. Secondly, the interest rates on the cash value account may not be as competitive as other investment opportunities. Thirdly, the policy may be influenced by the performance of its associated investment portfolio, which could lead to significantly lower interest rates if the portfolio underperforms.

| Characteristics | Values |

|---|---|

| Cost | More expensive than a temporary term life insurance policy |

| Interest rates | Modest interest rates |

| Flexibility | Allows changes to the premium, cash value, and death benefit |

| Risk | May be affected by the investment portfolio it is part of |

What You'll Learn

Adjustable life insurance is more expensive than term life insurance

Adjustable life insurance is a type of permanent life insurance that can last your entire life, provided you keep paying the premiums. It is more expensive than term life insurance, which only offers coverage for a set period, usually 10-30 years. Term life insurance is much more affordable, but it does not offer lifelong coverage like adjustable life insurance.

Adjustable life insurance allows policyholders to change key features such as premiums and the death benefit. It provides greater flexibility than most life insurance policies but comes with a higher price tag. The premiums for adjustable life insurance can be six to 15 times more expensive than term life insurance premiums for the same amount of coverage.

The higher cost of adjustable life insurance is due to its permanent nature and the inclusion of a cash value account. This account grows tax-deferred over time, and the funds can be borrowed against, withdrawn, or used to pay premiums. While the cash value account offers benefits, it may not be as lucrative as other investment opportunities in terms of returns.

The flexibility of adjustable life insurance makes it appealing to those with changing financial circumstances, such as business owners with fluctuating revenue or individuals who anticipate significant life changes. It allows them to adjust their coverage and premium payments accordingly. However, it is important to carefully plan and manage these changes to avoid problems with the policy, such as ensuring ongoing insurance costs are covered to maintain coverage.

While adjustable life insurance offers the advantage of flexibility, it may not be the best option for everyone due to its higher cost. Term life insurance, with its lower premiums, can be a more financially viable option for those seeking basic coverage without the need for lifelong protection.

Life Insurance in the Philippines: A Step-by-Step Guide

You may want to see also

The interest rates on cash value are modest

Adjustable life insurance is a type of permanent life insurance that can last an entire lifetime, provided the policyholder consistently makes payments. It is a hybrid policy between term life and whole life insurance. Term life insurance offers a death benefit for a specific number of years, while whole life insurance provides a death benefit for the entirety of the policyholder's life.

Adjustable life insurance policies have a cash value savings component that earns interest. This cash value accrues tax-deferred and can be borrowed against or used to pay premiums. The interest rates on this cash value are modest, and there is typically a minimum interest rate that the money can earn. While this may sound appealing, it is important to note that better rates can likely be found elsewhere in the market. The modest interest rates on the cash value of adjustable life insurance policies may not be as lucrative as other investment opportunities.

The interest rates on the cash value of adjustable life insurance policies are variable and dependent on market interest rates. As a result, the returns can fluctuate from year to year. While the cash value does grow over time, the modest interest rates may not provide significant returns compared to other investment options.

It is worth noting that the primary benefit of adjustable life insurance is the flexibility it offers. Policyholders can adjust the death benefit, premium payments, and cash value to suit their current financial situation. However, the modest interest rates on the cash value may be a factor to consider when deciding whether to choose an adjustable life insurance policy over other investment or insurance opportunities.

In summary, while adjustable life insurance provides flexibility and the ability to adjust various components of the policy, the modest interest rates on the cash value may be a potential drawback. Individuals considering adjustable life insurance should carefully weigh this factor and compare it to other available options to make an informed decision.

Challenging Life Insurance Beneficiaries: Your Rights and Options

You may want to see also

The policy may be affected by the investment portfolio

Adjustable life insurance is a type of permanent life insurance that can last the policyholder's entire life, provided they keep paying the premiums. It is a "hybrid" between a term life policy and whole life insurance. Term life insurance offers a death benefit for a specific number of years, while whole life insurance can last the policyholder's entire life, with no term limit.

Adjustable life insurance policies have an investment component, which means that the interest earned on the cash value is impacted by the investment portfolio it is a part of. If the investment portfolio does not perform well, the interest rate on the cash value will be significantly lower, and the cash value may fail to grow or keep up with inflation. This is a significant risk, as the policyholder's money could be better invested elsewhere, earning a higher return.

The investment portfolio is chosen by the insurance company, and policyholders usually have options for more aggressive or conservative portfolios within these offerings. These portfolios are typically low-risk and well-hedged, but the performance of the portfolio can impact the interest rate on the cash value. Over time, a policyholder's financial goals and risk tolerance may change, requiring a different investment strategy.

While the cash value in an adjustable life insurance policy can grow over time, the interest rates are modest, and the money may be better invested outside of a life insurance policy. The policyholder's money will likely do more for them in the market over their life, and they should aim to self-insure.

Therefore, the main downside of adjustable life insurance is the risk that the policy may be affected by the investment portfolio it is tied to. If the portfolio does not perform well, the policyholder may earn a lower return on their investment, and their money could have been better invested elsewhere.

Life and Health Insurance: Who Issues Licenses?

You may want to see also

Adjustable life insurance has an expiration date

Adjustable life insurance is a type of permanent life insurance that can last the entire life of the policyholder, provided they keep up with the premium payments. It is a "hybrid" between term life and whole life insurance.

Term life insurance offers a death benefit for a specific number of years, typically between five and 30, and the policy remains in effect until the end of the term. Whole life insurance, on the other hand, can last the policyholder's entire life, with no term limit, as long as premiums are paid as agreed.

Adjustable life insurance, like whole life insurance, does not have an expiration date per se. As long as the premiums are paid, the policy remains active. However, it is important to note that there are certain conditions that can affect the policy's longevity. For example, if the policyholder fails to meet the minimum cost for the life insurance, the policy may lapse. Additionally, the policy may be influenced by the performance of the investment portfolio it is tied to, which could impact the interest rate on the cash value.

While adjustable life insurance does not have a set expiration date, it is important for policyholders to be mindful of the factors that can impact the longevity of their coverage. Regular reviews of the policy and consultation with a licensed insurance agent can help ensure that the policy remains in good standing and provide peace of mind for the policyholder.

Involuntary Life Insurance: What You Need to Know

You may want to see also

The death benefit and premium payments can be modified

Adjustable life insurance, also known as universal life insurance, is a type of permanent life insurance that can last your entire life, provided you keep paying the premiums. It differs from other products like whole life insurance because it offers a lot more flexibility to change the policy terms after signing up.

The premium payments can also be adjusted to fit the current needs of the policyholder. You can pay the minimum premium due or choose to pay more. However, if you don't pay enough to cover the insurance costs, your future premiums will go up. You can also borrow against the cash value of your universal life insurance policy, which is typically at a lower interest rate than bank loans. However, if you fail to pay back the loan, the amount and interest will be subtracted from your death benefit.

The flexibility of adjustable life insurance means that it takes more work to plan and manage than a policy with fixed premiums. It is also more expensive than term life insurance.

Max Life Insurance: Understanding Client ID Significance

You may want to see also

Frequently asked questions

Adjustable life insurance is a type of permanent life insurance that can last your entire life, provided you keep paying the premiums. It differs from other products like whole life insurance because you have a lot more flexibility to change the policy terms after signing up.

Adjustable term life insurance is more expensive than a temporary term life insurance policy. The cash value does grow over time, but the interest rates are modest, and you might earn a higher return by investing outside of a life insurance policy.

The policy may be affected by the investment portfolio that it is a part of. If the investment portfolio doesn't perform well, the interest rate on the cash value will be significantly lower.