The issuance of life and health insurance licenses is a critical process in the financial services industry, ensuring that insurance companies operate with integrity and adhere to strict regulatory standards. Various regulatory bodies and organizations are responsible for granting these licenses, each with its own set of criteria and requirements. These issuing organizations play a vital role in safeguarding consumers and maintaining the stability of the insurance market. Understanding the specific entities that oversee the licensing process is essential for insurance companies, agents, and consumers alike, as it directly impacts the legitimacy and reliability of insurance providers.

What You'll Learn

- Regulatory Bodies: Government agencies oversee insurance licensing and regulation

- Insurance Companies: They apply for licenses to operate legally

- State Insurance Departments: Issue licenses, regulate, and enforce compliance

- Licensing Criteria: Specific standards and requirements for insurance professionals

- Application Process: Steps to apply, fees, and documentation needed

Regulatory Bodies: Government agencies oversee insurance licensing and regulation

In the realm of insurance, the issuance of licenses to operate and sell life and health insurance policies is a critical process that ensures the protection of consumers and the stability of the financial market. This process is primarily governed and regulated by government agencies, which act as the watchful eyes and guardians of the insurance industry. These regulatory bodies play a pivotal role in maintaining the integrity and trustworthiness of insurance companies, ultimately safeguarding the interests of policyholders.

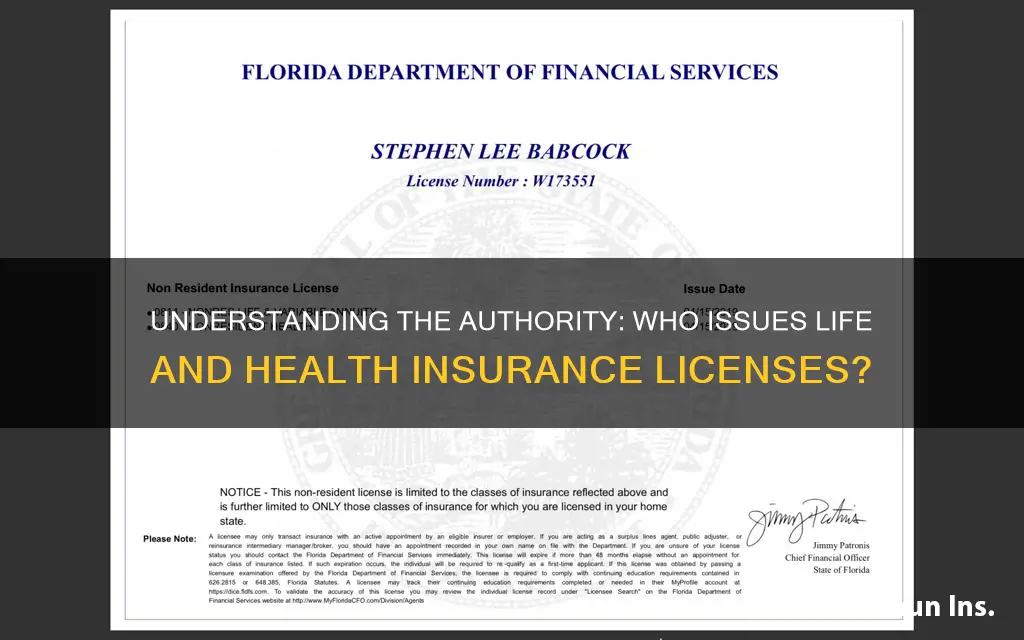

The specific issuing organization that grants life and health insurance licenses can vary depending on the country and its regulatory framework. For instance, in the United States, the insurance regulatory authority is typically the state insurance department or commissioner. Each state has its own insurance regulatory body, which is responsible for licensing and regulating insurance companies, agents, and brokers operating within its jurisdiction. These state-level agencies ensure that insurance providers adhere to the relevant laws and regulations, offering protection to consumers and maintaining a fair and transparent market.

Government agencies overseeing insurance licensing and regulation have a comprehensive set of responsibilities. They are tasked with examining and approving insurance company applications, assessing their financial stability, and verifying the accuracy of their operations. These regulatory bodies also set and enforce standards for insurance practices, including underwriting, policy administration, and customer service. By doing so, they ensure that insurance companies maintain a certain level of quality and integrity, providing policyholders with the expected benefits and protections.

The regulatory process often involves rigorous scrutiny of insurance companies' business plans, financial statements, and risk management strategies. Government agencies may conduct on-site inspections, review compliance reports, and even impose penalties or revoke licenses if companies fail to meet the required standards. This oversight is crucial in preventing fraudulent activities, ensuring fair competition, and protecting consumers from potential financial losses or unethical business practices.

Furthermore, these regulatory bodies often provide resources and guidance to insurance professionals and the public. They offer educational materials, licensing requirements, and industry updates to help individuals and businesses navigate the complex world of insurance. By doing so, they empower consumers to make informed decisions and promote transparency in the insurance sector. Ultimately, the presence of these government agencies is essential for maintaining a well-regulated insurance industry, fostering trust, and ensuring the long-term sustainability of the market.

Who Can Insure Whom? Understanding Life Insurance Policies

You may want to see also

Insurance Companies: They apply for licenses to operate legally

Insurance companies are essential components of the financial services industry, providing a safety net for individuals and businesses in the event of unforeseen circumstances. To operate legally and offer life and health insurance products, these companies must navigate a complex regulatory landscape, which includes obtaining the necessary licenses. The process of licensing is a critical step for insurance firms to ensure they meet the standards set by the relevant authorities and to protect the interests of their policyholders.

The issuing organization for life and health insurance licenses varies by jurisdiction, but it is typically a government agency or a financial regulatory body. In the United States, for example, the federal government, through the National Association of Insurance Commissioners (NAIC), sets standards and guidelines for insurance regulation. State insurance departments then issue licenses based on these federal standards. Each state has its own insurance department, which acts as the primary regulator for insurance companies operating within its borders. These departments are responsible for reviewing applications, conducting background checks, and ensuring that the company meets the required capital and surplus requirements.

The licensing process involves a thorough examination of the insurance company's proposed business plan, financial projections, and risk management strategies. Insurance regulators aim to protect consumers by ensuring that companies have the necessary resources to fulfill their financial obligations and maintain a certain level of expertise and integrity. This includes verifying the company's ability to pay out claims, manage risks, and adhere to legal and ethical standards. The license application often requires detailed information about the company's management team, board of directors, and any previous regulatory actions or penalties.

Obtaining a license is a lengthy and rigorous process, involving multiple stages of review and potential negotiations with regulators. Insurance companies must demonstrate their commitment to compliance and provide comprehensive documentation to support their application. This includes evidence of the company's financial stability, a clear understanding of the insurance products they intend to offer, and a robust compliance program to ensure ongoing adherence to regulations. Once licensed, insurance firms are required to report regularly to the regulatory body, providing updates on their financial performance, policyholder data, and any changes to their business operations.

In summary, insurance companies must navigate a rigorous licensing process to operate legally in the life and health insurance sector. This process is designed to protect consumers and ensure the stability of the insurance market. By obtaining the necessary licenses, insurance firms demonstrate their commitment to meeting regulatory standards and providing a reliable service to their policyholders. Understanding the specific requirements and issuing organizations in each jurisdiction is crucial for insurance companies to successfully navigate this complex regulatory environment.

Coronavirus: Life Insurance Impact and Your Coverage

You may want to see also

State Insurance Departments: Issue licenses, regulate, and enforce compliance

State insurance departments play a crucial role in the insurance industry, acting as the primary regulatory body for insurance companies and agents operating within their respective states. These departments are responsible for issuing licenses, regulating the insurance market, and ensuring compliance with state and federal insurance laws. Their primary objective is to protect consumers and maintain the integrity of the insurance sector.

One of the key functions of state insurance departments is to issue licenses to insurance companies and agents. This process involves a thorough examination of the applicant's financial stability, business plan, and compliance with state regulations. The department assesses the company's ability to meet the financial requirements and standards set by the state, ensuring that they have the necessary resources to honor their policy obligations. For insurance agents, the licensing process includes verifying their education, training, and criminal background, ensuring they are fit to interact with consumers.

Regulation is another vital aspect of their work. State insurance departments establish and enforce rules and guidelines to maintain a fair and stable insurance market. They set standards for policy offerings, pricing, and customer service, ensuring that insurance companies provide adequate coverage and treat policyholders fairly. These departments also monitor the market for potential risks, such as fraudulent activities or unfair business practices, and take appropriate action to mitigate these risks.

Enforcing compliance is a critical task for state insurance regulators. They regularly audit and inspect insurance companies and agents to ensure adherence to the established regulations. This includes reviewing financial statements, policy documents, and customer interactions. When non-compliance is identified, the departments have the authority to impose penalties, revoke licenses, or take legal action. This enforcement role is essential to maintain public trust in the insurance system and protect consumers from potential harm.

Additionally, state insurance departments provide resources and guidance to consumers. They offer educational materials and tools to help individuals understand their insurance rights and make informed decisions. These departments also facilitate the resolution of consumer complaints and disputes, acting as mediators between policyholders and insurance companies. By combining regulatory oversight with consumer protection, state insurance departments contribute to a transparent and reliable insurance environment.

CMFG Life Insurance: Is It Worth the Hype?

You may want to see also

Licensing Criteria: Specific standards and requirements for insurance professionals

The process of obtaining a life and health insurance license involves meeting specific standards and requirements set by the issuing organization, which is typically a regulatory body or a state insurance department. These criteria are designed to ensure that insurance professionals are competent, ethical, and capable of providing adequate protection to policyholders. Here are some key licensing criteria for insurance professionals in the life and health insurance sector:

Education and Training: Prospective insurance agents and brokers must possess a certain level of education and undergo comprehensive training. This often includes completing a designated course of study in insurance, finance, or a related field. Many regulatory bodies require a minimum number of hours of continuing education annually to maintain the license. The curriculum should cover various topics, including insurance laws, regulations, ethics, risk assessment, and customer service.

Examinations: Licensing typically involves passing one or more standardized examinations. These exams assess the candidate's knowledge and understanding of insurance principles, regulations, and practices. For instance, the Life and Health Insurance License Examination evaluates an individual's ability to interpret insurance policies, explain complex concepts to clients, and adhere to legal and ethical standards. These tests are rigorous and ensure that licensees can demonstrate their proficiency in the field.

Experience and Background Checks: Issuing organizations often require a certain amount of relevant work experience in the insurance industry. Background checks are conducted to verify the candidate's credentials, employment history, and any previous violations or disciplinary actions. This step ensures that licensees have the necessary practical knowledge and integrity to operate in the insurance sector.

Ethical and Professional Conduct: Insurance professionals must adhere to strict ethical guidelines and professional standards. This includes maintaining confidentiality, avoiding conflicts of interest, and providing honest and accurate information to clients. Regulatory bodies often have codes of conduct that licensees must follow, and any violations can result in license suspension or revocation.

Continuing Education and Renewal: Licensing is not a one-time process; it requires ongoing commitment. Insurance professionals must participate in continuing education programs to stay updated with industry changes and best practices. These programs ensure that licensees can adapt to evolving regulations and maintain their knowledge. Licenses are typically valid for a specific period, after which renewal is required, often involving additional fees and meeting specific criteria.

Biochemists: Life Insurance Options and Availability

You may want to see also

Application Process: Steps to apply, fees, and documentation needed

The process of obtaining a life and health insurance license involves several steps, and it is crucial to understand the requirements set by the issuing organization, which is typically a state insurance department or a similar regulatory body. Here is a detailed breakdown of the application process:

Step 1: Research and Eligibility Check

Start by identifying the specific issuing organization responsible for licensing insurance agents and brokers in your region. This could be a state insurance department or a similar regulatory authority. Research their website or contact them directly to gather information about the licensing requirements. Ensure you meet the basic eligibility criteria, which often include being a legal resident of the state, having a clean criminal record, and meeting minimum age and education standards.

Step 2: Study and Preparation

Obtain the necessary study materials and resources to prepare for the licensing exam. This may include study guides, practice questions, and training manuals provided by the issuing organization or approved training institutions. Some organizations offer preparatory courses or workshops to help applicants succeed. Adequate preparation is essential to ensure you understand the regulatory framework, insurance principles, and ethical standards.

Step 3: Application Submission

Complete the application form provided by the issuing organization. This form typically requires personal, educational, and professional details. You will need to provide information such as your full name, address, date of birth, educational qualifications, previous work experience, and any relevant certifications. Ensure that all the information is accurate and up-to-date. Along with the form, submit the required documentation, which may include:

- Proof of identity (e.g., driver's license, passport)

- Educational transcripts or certificates

- Criminal record check (if required)

- Resume or curriculum vitae

- References (if specified)

Step 4: Examination and Background Check

After submitting your application, the issuing organization will review it and schedule you for the licensing exam. This exam tests your knowledge of insurance regulations, products, and practices. Additionally, a background check will be conducted to verify your credentials and ensure you meet the eligibility criteria. Be prepared to provide any additional documentation or attend an interview if required.

Step 5: Fees and Payment

There are typically associated fees with the application process. These fees cover the administrative costs, exam processing, and background verification. The fee structure may vary depending on the issuing organization and your state of residence. It is essential to check the official website or contact the organization to obtain the most current fee information. Payment methods and instructions will be provided once your application is approved for processing.

Step 6: Licensing and Activation

Upon successful completion of the exam, passing the background check, and meeting all the requirements, the issuing organization will issue your life and health insurance license. This license will be valid for a specified period, after which you may need to renew it. Once licensed, you can start applying for insurance positions and providing coverage to clients.

Remember, the specific steps and requirements may vary slightly depending on the issuing organization and your location. Always refer to the official guidelines and resources provided by the regulatory body for the most accurate and up-to-date information.

Understanding Life Insurance: The Accord Format Explained

You may want to see also

Frequently asked questions

The insurance industry is regulated by various governmental bodies, but in the United States, the primary issuing organization for life and health insurance licenses is typically the state insurance department or the insurance commission. Each state has its own regulatory body that oversees and licenses insurance companies and agents.

You can usually find this information on the official website of your state's insurance department or commission. They often provide a list of licensed insurance companies and the corresponding issuing authority. Alternatively, you can contact your state's insurance department directly to inquire about the licensing process and the specific organization involved.

No, private organizations do not issue insurance licenses. Insurance licensing is a government regulatory function to ensure consumer protection and market stability. The process involves rigorous examination and approval by state or federal authorities.

Both licenses are issued by the same organization, but they cover different areas of insurance. A life insurance license allows individuals to sell policies that provide financial protection for beneficiaries in the event of the insured's death. Health insurance licenses, on the other hand, enable agents to offer coverage for medical expenses, hospitalization, and other healthcare-related costs.

No, the specific issuing organization can vary from state to state. Some states may have a centralized insurance department, while others might have separate agencies for life and health insurance regulation. It's essential to check with your state's regulatory body to understand the licensing process and the relevant issuing organization.