When a homeowner files an insurance claim, an insurance adjuster is sent to the property to assess the damage and determine the appropriate compensation. The adjuster's role is to evaluate the damage, calculate the cost of repairs or replacements, and decide on the next steps for processing the claim. This often includes taking photos and making notes about the damage, as well as inspecting the entire property, including the exterior, roof, and any other buildings or items on the property that may have been affected. While the adjuster works for the insurance company and aims to keep costs low, homeowners can also hire a public adjuster to ensure they receive a fair settlement.

| Characteristics | Values |

|---|---|

| Role | Assess and determine the extent of damage or loss covered by a home insurance policy |

| Who hires them | Employed or contracted by insurers; homeowners can hire public adjusters |

| Inspection | Inspect the property, evaluate the damage, and calculate compensation |

| Documents | Damage report, witness statements, photos or videos of the damage, receipts or estimates for repairs |

| Time taken | 1-2 hours |

| Payment | Public adjusters take a percentage of the claim (10-15%) |

What You'll Learn

They assess the damage to your property

When an insurance adjuster visits your house, they will assess the damage to your property. They will want to see what damage your property has sustained and calculate an estimate for the insurance company to restore your property to its pre-loss condition. They will check the entire exterior of your house and any other buildings on the property, including the roofs, and will make notes and take photos of all damaged surfaces. They will also check items known as "collateral" property, such as fences, decks, windows, and gutters. The goal is to create a comprehensive list of things that were damaged.

The adjuster will also ask you some questions about the damage, especially where you believe the damage exists. They may also ask if you've had it inspected by a contractor and what recommendations the contractor suggested. They might also inquire if you have already selected a contractor for the repairs. Remember that as the insured, you are free to hire the contractor of your choice.

The whole inspection process could take between one to two hours, depending on the scope of the damage and the size of your property. Some adjusters then spend another 45-60 minutes in their vehicle writing up their report. If you're home, the adjuster will likely explain their findings and recommendations. Some adjusters have the authority to approve a claim on the spot, while others have to submit everything to the insurance company for review and a claim representative or desk adjuster will make the final decision.

Roofing Contractor and Insurance Adjuster: A Collaborative Presence for Claims

You may want to see also

They calculate an estimate for the insurance company

When an insurance adjuster visits your house, they are there to see what damage your property has and calculate an estimate for the insurance company to restore your property to its pre-loss condition. They are not there to advocate for you; they calculate the lowest possible compensation on your insurer's behalf.

The adjuster's goal is to create a comprehensive list of things that were damaged. They will check the entire exterior of your house and any other buildings on the property, including the roofs, and will make notes and take photos of all damaged surfaces. They will also check "collateral" property, such as fences, decks, windows, and gutters. The whole inspection process could take between one to two hours, depending on the scope of the damage and the size of the property.

After the inspection, the adjuster will file a report containing their findings and recommendations. Some adjusters can authorise a claim on the spot, but it is more common that you will have to review the report and communicate with the insurance company to finalise the claim. The report will include the adjuster's estimate, which will determine the compensation you'll receive.

It's important to remember that almost every insurance claim estimate is too low. The claim document is just an estimate, and it is not set in stone. You might receive a lower estimate than a roofing contractor would give, but this is normal.

Navigating Roof Repair Conversations with Insurance Adjusters: A Homeowner's Guide

You may want to see also

They determine the compensation you'll receive

An insurance adjuster is a person who investigates an insurance claim to determine if the insurer should pay for damage or injuries, and if so, how much they should pay. They are responsible for assessing and determining the extent of damage or loss covered by a home insurance policy.

When a homeowner files a home insurance claim, the insurance company assigns an adjuster to investigate the situation. The adjuster may be employed by the insurance provider or may be contracted by the company. The adjuster's role includes inspecting the property, evaluating the damage, and calculating the appropriate compensation or settlement that the insurance company should provide.

- They evaluate your property and collect evidence on the extent of the damage. This includes inspecting the property, taking photographs, reviewing documents, and assessing any collateral damage.

- They determine whether the insurance policy covers the type and extent of the claimed loss. This involves reviewing the insurance policy and comparing it to the details of the incident and damage.

- They calculate the appropriate compensation amount. This involves considering factors such as the cost of repairs or replacements, actual cash value, replacement cost, and any policy limits.

- They may use specialised software to analyse the damage and calculate the settlement amount. This software can help in estimating repair or replacement costs and ensuring that the compensation is fair and accurate.

- They negotiate with the policyholder to finalise the settlement. Adjusters typically aim to keep the payout as low as possible, so homeowners may need to negotiate to receive a fair settlement. Having documentation, such as itemised lists of belongings and damage, can help support your claim.

- They may provide an initial settlement offer that is lower than what they expect to pay. This is a common tactic used by insurance adjusters, and homeowners should not feel pressured to accept the first offer. Countering with a higher amount or providing additional evidence to support a higher settlement may be necessary.

- They consider the strength of the claimant's case. If the claimant has a strong case and can prove negligence or fault, the adjuster may offer a higher settlement to avoid a costly lawsuit.

- They take into account the policy limits. The insurance company will never pay more than the maximum amount of the insurance policy. If the claimed damages exceed the policy limits, the claimant will need to pursue additional compensation directly from the at-fault party.

The Driver's Right to Remain Silent: Navigating Conversations with Insurance Adjusters

You may want to see also

They may ask about any prior inspections

When an insurance adjuster visits your home, they will ask about any prior inspections. This is because insurance companies will often inspect a property before issuing a policy or while processing a claim. This is to ensure that the property is maintained and that there are no major liability hazards or maintenance concerns.

If your home is relatively new, you may not need to worry about prior inspections. However, if there have been any previous issues with the property, it is important to be prepared to discuss these with the adjuster. They will likely ask about any previous damage or maintenance concerns that have been addressed. This could include things like missing handrails on steps, missing steps off sliding glass or exterior doors, excess debris in the yard, a deteriorated roof, boarded windows, or missing siding.

If there have been any prior inspections, the adjuster will also want to know if any recommendations or repairs were made as a result. It is important to provide as much detail as possible about any prior inspections and any actions that were taken afterward. This will help the adjuster to understand the current state of the property and any potential risks or concerns.

In addition to asking about prior inspections, the adjuster will also want to know about any updates or renovations that have been made to the property. This includes things like updates to the electrical system, plumbing, heating, windows, and roof. They will also want to know about any security or safety features that have been added, such as alarm systems or water damage prevention devices. Providing this information will help the adjuster to assess the current condition of the property and determine if there are any potential risks or hazards.

Overall, it is important to be prepared to discuss any prior inspections and provide detailed information about any actions that were taken as a result. This will help the adjuster to accurately evaluate the property and determine the appropriate coverage and premiums for your insurance policy.

When Insurance Adjusters and Police Cross Paths: A Collaborative Investigation

You may want to see also

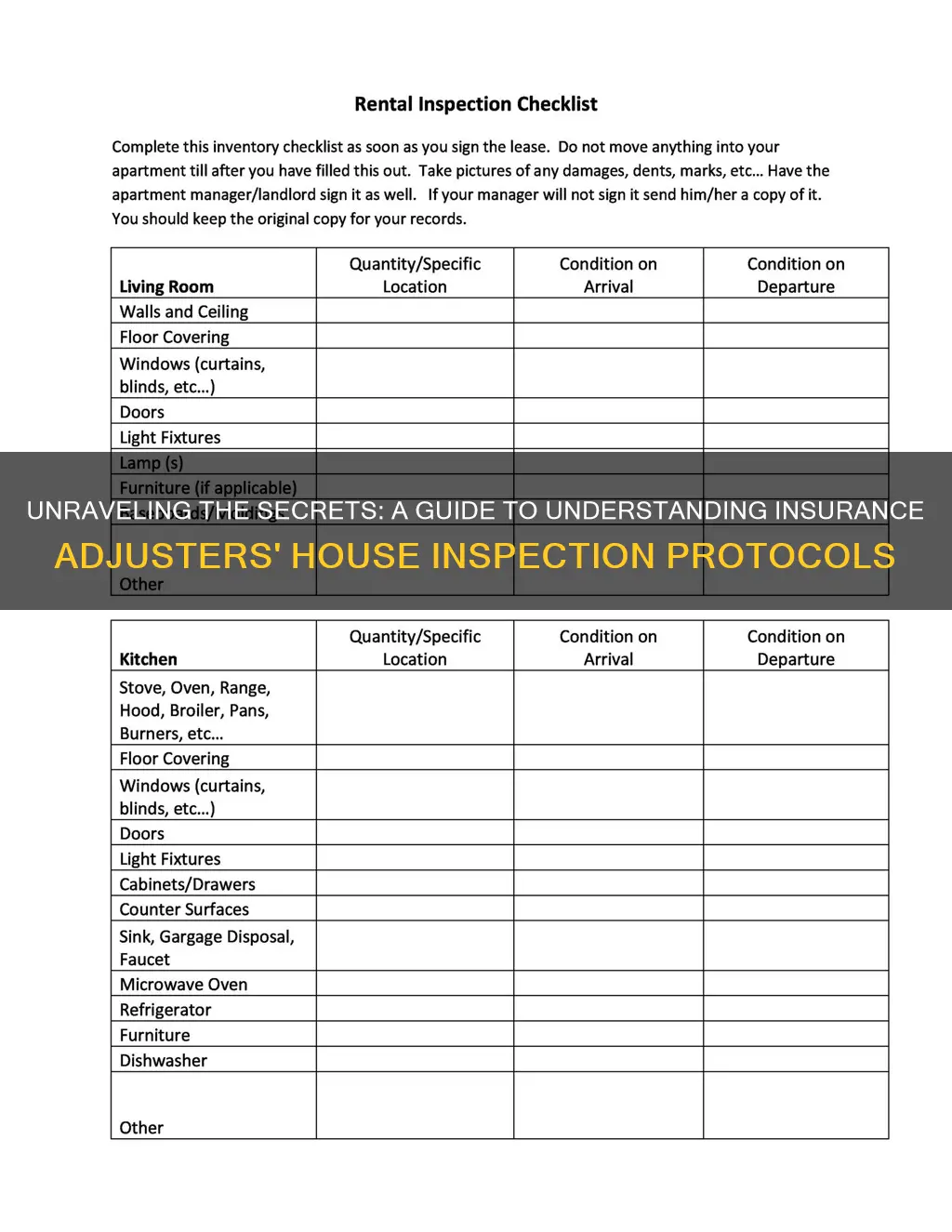

They take photos and make notes of all damaged surfaces

When an insurance adjuster visits your home, they will take photos and make notes of all damaged surfaces. They will inspect the entire exterior of your house and any other buildings on the property, including the roof, and will make notes and take photos of all damaged surfaces. All of this information is put into a report for the insurance company and will probably become part of their estimate if the damage is covered by your policy.

Not only will they check the buildings, but they will also check items known as "collateral" property, such as fences, decks, stamped concrete, windows and window screens, and gutters. The goal is to create a comprehensive list of things that were damaged.

The adjuster will also want to review any claimed losses related to the contents of your home, i.e. your appliances and personal belongings. It is best to have a complete list of lost items for them to review, along with proof of your losses, such as photos or the damaged items themselves.

The whole inspection process could take between 1 hour to 2 hours, depending on the scope of the damage and the size of the property. Some adjusters then spend another 45-60 minutes in their vehicle writing up their report. If you're home, the adjuster will likely explain their findings and recommendations.

Remember that the adjuster doesn't advocate for you. They are paid to calculate the lowest possible compensation on your insurer's behalf.

Crafting a Standout Resume for Aspiring Insurance Adjusters

You may want to see also

Frequently asked questions

It is not critical for you to be present when the insurance adjuster visits your house. However, it is recommended as you can point out any damaged areas that the adjuster might miss, and ask questions about their findings and decisions.

The insurance adjuster will inspect the property, evaluate the damage, and determine the appropriate compensation or settlement. They will check the entire exterior of the house, including the roof, and make notes and take photos of all damaged surfaces. They will also check collateral property such as fences, decks, windows, and gutters.

After the visit, the insurance adjuster will file a report containing their findings and recommendations. They may authorize a claim on the spot, or you may have to review the report and communicate with the insurance company to finalize the claim. You will likely receive your settlement through a check or direct deposit.