Insurance is an operating expense for companies. Companies purchase insurance coverage by paying insurance premiums and recording related transactions accordingly. When insurance is prepaid, it is initially recorded as an asset on the company's balance sheet. However, as the insurance expires over time, companies need to make adjusting entries to reflect the reduction in assets and the increase in expenses. The adjusting entry involves debiting the expense account of expired insurance and crediting prepaid insurance to reduce the balance in the asset account. This ensures accurate reporting of the company's financial position and compliance with accounting principles.

| Characteristics | Values |

|---|---|

| Type of adjusting entry | Deferral |

| What it's for | To update a previous transaction |

| When it's made | Before preparing financial statements |

| What it does | Transfers expired insurance from a prepaid insurance account to an expense account |

| Debit | Insurance Expense |

| Credit | Prepaid Insurance |

What You'll Learn

- Companies record expired insurance based on the intersection of their accounting periods and the time structure of the insurance

- Expired insurance is recorded as an expense and reported in the income statement

- Companies use two sets of journal entries to record insurance-related transactions

- The total amount of prepaid insurance is not recorded as an immediate expense at the time of purchase

- Prepaid insurance is moved from the current asset account to the income statement account as it expires

Companies record expired insurance based on the intersection of their accounting periods and the time structure of the insurance

Companies record insurance expenses periodically, depending on the length of the insurance purchased. This means that instead of expensing the total insurance purchase at once in a single period, companies may have to record insurance expenses over multiple accounting periods. This is because insurance is generally prepaid for a period of six months, one year, or multiple years.

The total amount of prepaid insurance is not recorded as an immediate expense at the time of purchase. Companies only exchange cash for the right to insurance coverage in the future. The insurance coverage expires with the passage of time. Thus, the total amount of cash spent on the insurance premium is not an expense in the current period.

Companies record expired insurance periodically based on the intersection of their accounting periods and the time structure of the insurance. Expired insurance during a period is recorded as an insurance expense for the same period. Companies lose their prepaid insurance coverage over time, irrespective of whether they have used it by filing any claims.

At the end of the insurance term, the total insurance expires, and companies would have fully recorded the total prepaid insurance as expenses over multiple periods. Companies use two sets of journal entries to record insurance-related transactions, involving both prepaid insurance and expired insurance.

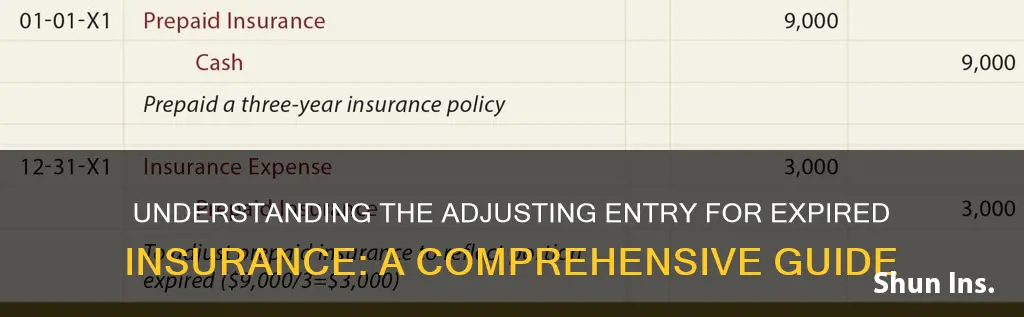

When companies initially pay for the total insurance premium, a debit is entered to the asset account of prepaid insurance, and a credit is entered to the cash account for the cash spent. As the insurance expires over time, companies debit the expense account of expired insurance and credit prepaid insurance to reduce the balance in the asset account. At the end of the insurance term, the account of prepaid insurance should have a zero balance.

Becoming an Insurance Adjuster in Oregon: A Comprehensive Guide

You may want to see also

Expired insurance is recorded as an expense and reported in the income statement

Insurance is an operating expense for companies. Companies purchase insurance coverage by paying insurance premiums and recording related transactions accordingly. Insurance is generally prepaid as companies may purchase it on a six-month, one-year, or multiyear term.

The total amount of prepaid insurance is not recorded as an immediate expense at the time of the purchase when the insurance has not been used. The insurance coverage expires only with the passage of time. Thus, the total amount of cash spent on the insurance premium is not an expense in the current period. Companies simply have exchanged cash for the right to insurance coverage in the future.

Expired insurance during a period is recorded as an insurance expense for the same period. Companies lose, or are said to have consumed, their prepaid insurance coverage over time whether or not they have actually used it by filing any claims.

Companies record expired insurance periodically based on the intersection of their accounting periods and the time structure of the insurance. At the end of the insurance term, the total insurance expires, and companies would have fully recorded the total prepaid insurance as expenses over multiple periods.

While expired insurance in each accounting period is recorded as an expense and reported in the income statement, the total prepaid expense is recorded as an asset at the time of the purchase and reported on the balance sheet. All assets provide certain utilities, and prepaid insurance as an asset affords companies the benefit of insurance coverage. However, as the insurance expires over time, the amount of prepaid expense as an asset decreases.

Companies use two sets of journal entries to record the insurance-related transactions, involving both prepaid insurance and expired insurance. When companies initially pay for the total insurance premium, a debit is entered to the asset account of prepaid insurance and a credit entered to the cash account for the cash spent. As the insurance expires over time, companies debit the expense account of expired insurance and credit prepaid insurance to reduce the balance in the asset account. At the end of the insurance term, the account of prepaid insurance should have a zero balance.

The adjusting entry to record expired insurance would be to debit the insurance expense and credit prepaid insurance. This is done to match the proper amount of insurance expense to the period indicated on the income statement.

Insurers and Attorneys: When to Bring Legal Counsel into the Conversation

You may want to see also

Companies use two sets of journal entries to record insurance-related transactions

When companies initially pay for the total insurance premium, a debit is entered to the asset account of prepaid insurance and a credit is entered to the cash account for the cash spent. This is because the total amount of prepaid insurance is not recorded as an immediate expense at the time of the purchase. Instead, it is recorded as an asset on the company's balance sheet.

As the insurance expires over time, companies then need to record this as an expense. They do this by debiting the expense account of expired insurance and crediting prepaid insurance to reduce the balance in the asset account. This is done at the end of each accounting cycle or prior to the issuing of financial statements. At the end of the insurance term, the account of prepaid insurance should have a zero balance.

Understanding Prepaid Insurance Adjusting Entries: A Comprehensive Guide

You may want to see also

The total amount of prepaid insurance is not recorded as an immediate expense at the time of purchase

Companies often purchase insurance coverage for six-month, one-year, or multiyear terms. The total amount of prepaid insurance is not recorded as an immediate expense at the time of purchase when the insurance has not been used. Instead, it is recorded as an asset on the company's balance sheet, as it has the potential to bring future benefits to the company.

When companies initially pay for the total insurance premium, a debit is entered to the asset account of prepaid insurance and a credit is entered to the cash account for the cash spent. This is because the company has simply exchanged cash for the right to certain insurance coverage in the future. The insurance coverage expires only with the passage of time.

As the insurance expires over time, companies must record this periodically based on the intersection of their accounting periods and the time structure of the insurance. Companies lose their prepaid insurance coverage over time, whether or not they have actually used it by filing any claims. Expired insurance during a period is recorded as an insurance expense for the same period.

At the end of the insurance term, the total insurance expires, and companies would have fully recorded the total prepaid insurance as expenses over multiple periods. The account of prepaid insurance should have a zero balance.

Unraveling the Path to Becoming an Insurance Adjuster in Arizona

You may want to see also

Prepaid insurance is moved from the current asset account to the income statement account as it expires

Prepaid insurance is an expense that has not yet been recorded as an expense because it has not expired yet. It is initially recorded as an asset on the company's balance sheet. As the insurance gets used up, an adjusting entry is made to account for the reduction in assets and the resultant increase in expenses. This increase in expenses is reflected in the company's income statement within the accounting period when it has been used up.

When a company initially pays for the total insurance premium, a debit is entered to the asset account of prepaid insurance and a credit is entered to the cash account for the cash spent. As the insurance expires over time, companies debit the expense account of expired insurance and credit prepaid insurance to reduce the balance in the asset account. At the end of the insurance term, the account of prepaid insurance should have a zero balance.

The adjusting entry is necessary as it records the amount of insurance that has been used up by the company and also ensures accurate reporting of the company's financial standing in its various financial statements. Adjusting entries are made at the end of each accounting cycle or prior to the issuing of financial statements by a company.

If the prepaid insurance account is not adjusted in tandem with the portion of the insurance that has expired, it will lead to errors in reporting the assets and expenses of the company. This is because prepaid insurance before its expiration is considered a current asset, whereas, upon the expiration of the prepaid insurance, it is considered part of the company's expenses and is reflected in the income statement.

The Comprehensive Guide to Becoming a Roofing Insurance Adjuster

You may want to see also

Frequently asked questions

The adjusting entry for expired insurance is made to record the expired portion of the prepaid insurance as an expense and reduce the balance in the asset account. This involves debiting the expense account for expired insurance and crediting the prepaid insurance account.

Adjusting entries for expired insurance are necessary to accurately reflect the financial position of a company. As insurance expires over time, the amount of prepaid expense as an asset decreases, while the expired portion becomes an expense. Adjusting entries ensure that financial statements correctly report the portion of prepaid insurance that is still an asset and the part that has expired and become an expense.

Adjusting entries for expired insurance can be made at the end of each accounting cycle, which could be monthly, quarterly, or yearly, depending on the company's preferences and financial reporting frequency.

To calculate the amount to be adjusted for expired insurance, you need to determine the portion of the insurance that has expired. This can be done by dividing the total insurance cost by the number of months or accounting periods it covers. This amount is then recorded as a debit to insurance expense and a credit to prepaid insurance.