Prepaid insurance is a fee paid in advance for an insurance contract. It is treated as an asset in accounting records and is gradually charged to expense over the period covered by the insurance contract. Prepaid insurance is typically classified as a current asset on a company's balance sheet, as it usually covers a period of one year or less. When a company pays for insurance in advance, this is recorded in the balance sheet as a prepaid insurance expense. As the insurance expense accrues, the prepaid insurance amount is deducted accordingly, and the company must make appropriate journal entries to apportion the prepaid insurance expense according to the time period during which the expense accrues.

| Characteristics | Values |

|---|---|

| Definition | Prepaid insurance is the fee associated with an insurance contract that has been paid in advance of the coverage period. |

| Accounting Treatment | Prepaid insurance is treated as an asset in the accounting records. |

| Recording | Prepaid insurance is recorded as a prepaid expense account (an asset). |

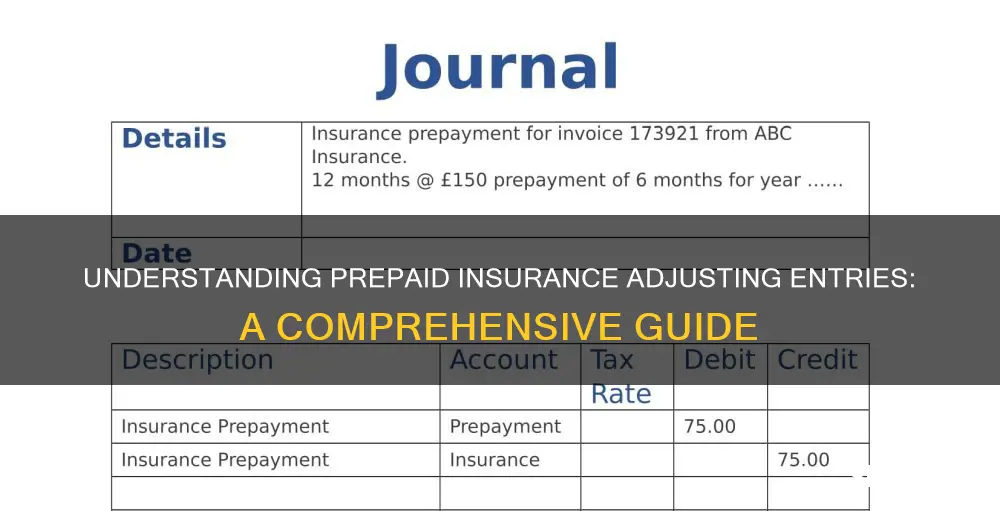

| Journal Entry | Debit the prepaid expense account and credit the corresponding account used to make the payment (e.g. Cash or Checking account). |

| Adjusting Entries | As the prepaid insurance is used, decrease the prepaid expense account and increase the actual expense account. |

| Time Period | Prepaid insurance is usually for a period of up to 1 year. |

| Classification | Prepaid insurance is typically classified as a current asset. If the prepayment covers a longer period, the portion beyond 1 year is classified as a long-term asset. |

| Journal Entry for Adjustment | Debit the insurance expense account and credit the prepaid insurance account. |

| Example | A business pays $1,800 upfront for a one-year insurance policy. Each month, adjust the accounts by $150 ($1,800/12 months). |

What You'll Learn

Prepaid insurance is an expense paid in advance

When a company pays for insurance in advance, this is recorded in the balance sheet as prepaid insurance. Since the amount paid for insurance will either come from a bank or cash, which is also a balance sheet item, prepaid insurance does affect the income statement. The journal entry that must be made to account for the purchase of prepaid insurance is:

> Paid in advance for the insurance cover for next year.

Here, the prepaid insurance account is debited as it increases and there is a counter decrease in cash or bank account.

As the insurance expense accrues, and the prepaid insurance amount begins to expire, part of the prepaid insurance expense will be gradually moved from the current asset account under the balance to the income statement under the expenses as insurance expense.

The company must continue to make appropriate journal entries to apportion the prepaid insurance expense according to the time period during which the expense will continue to accrue. This is usually done by the accounting department at the end of each financial year by using an adjusting journal entry.

The journal entry reflecting the actual expense should look like this:

> Insurance expense account

> Prepaid Insurance account

To account for the insurance expense for the current financial year.

Prepaid insurance is commonly recorded because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would risk having its insurance coverage terminated. In particular, the providers of medical insurance usually insist upon being paid in advance, so a company must record an insurance payment at the end of one month as prepaid insurance, and then charge it to expense in the next month, which is the month to which the payment relates.

Unraveling the Path to Becoming an Insurance Adjuster in New Mexico

You may want to see also

It is treated as an asset and gradually charged to expense

Prepaid insurance is treated as an asset on a company's balance sheet and is gradually charged to expense. This is because the insurance has been paid for in advance and has not yet expired as of the date of the balance sheet. It is considered a current asset because it will be used within a year of payment.

When a company pays for insurance in advance, this is initially recorded in the balance sheet as a prepaid insurance asset. This is done by debiting the prepaid insurance account and crediting the cash or bank account. As the insurance period begins and the company starts to use the insurance, the prepaid insurance asset is gradually reduced and charged to expense. This is done by making adjusting entries at the end of each month or accounting period. The amount of the prepaid insurance that has expired is moved from the prepaid insurance asset account to the insurance expense account. This is done by debiting the insurance expense account and crediting the prepaid insurance account.

For example, a company pays an insurance premium of $2,400 on November 20 for insurance coverage from December 1 to May 31. On November 20, the payment is recorded with a debit of $2,400 to prepaid insurance and a credit of $2,400 to cash. As of November 30, none of the $2,400 has expired and the entire amount is reported as a prepaid insurance asset. On December 31, an adjusting entry is made to recognise that one month of insurance ($400, or 1/6 of $2,400) has expired. The insurance expense account is debited $400 and the prepaid insurance account is credited $400. This process is repeated each month until the insurance is fully expensed and the prepaid insurance asset account balance is zero.

Prepaid insurance is treated as an asset because it has been paid for by the company and has future value. It is gradually charged to expense as it is used because the expense accrues over time. This process of recording prepaid expenses and adjusting entries is done to ensure accurate record-keeping and to match the payment for expenses with the periods in which they are actually consumed.

Becoming an Insurance Adjuster in Oregon: A Comprehensive Guide

You may want to see also

It is moved from the current asset account to the income statement

Prepaid insurance is a current asset on a company's balance sheet. It is the fee associated with an insurance contract that has been paid in advance of the coverage period. It is treated as an asset in accounting records and is gradually charged to expense over the period covered by the insurance contract.

As the insurance coverage period progresses, the prepaid insurance amount begins to expire. At this point, the expired portion of the prepaid insurance expense is moved from the current asset account to the income statement under expenses as insurance expense. This is done at the end of each accounting period through an adjusting entry.

For example, a company pays an insurance premium of $2,400 for insurance protection during the six-month period of December 1 through May 31. On November 20, the payment is recorded with a debit of $2,400 to Prepaid Insurance and a credit of $2,400 to Cash. On November 30, none of the $2,400 has expired, and the entire amount is reported on the balance sheet as Prepaid Insurance. On December 31, an adjusting entry will debit Insurance Expense for $400 (1/6 of $2,400) and credit Prepaid Insurance for $400. This process is repeated at the end of each month, with an adjusting entry of $400 recorded to debit Insurance Expense and credit Prepaid Insurance.

Another example is a company that buys one year of general liability insurance in advance for $12,000. The initial entry is a debit of $12,000 to the prepaid insurance (asset) account and a credit of $12,000 to the cash (asset) account. Each month, a journal entry is made to debit the insurance expense account and credit the prepaid expenses (asset) account.

The process of recording prepaid expenses is known as accrual accounting. It is important to note that prepaid expenses are not recorded in cash-basis accounting, where transactions are only recorded when money physically changes hands.

Navigating Insurance Adjusters: Recognizing and Avoiding Deception

You may want to see also

Adjusting entries are used to balance the books

Adjusting entries are necessary because, without them, a company's income and expenses won't match up correctly, and financial statements will be inaccurate. For example, a company might pay for six months of insurance coverage, but if the accounting period is only one month, then five months of insurance expense is prepaid and should not be reported as an expense on the current income statement.

Adjusting entries are also needed when revenue has been earned but not yet recorded. For instance, a company might provide a service to a client on the last day of an accounting period but not invoice them until the following week. Adjusting entries ensure that revenue is reported when it is earned, not when it is received.

Adjusting entries typically involve one or more balance sheet accounts and one or more accounts from the profit and loss statement. They are usually made using a journal entry and can be categorised as accruals, deferrals, estimates, or depreciation and amortisation.

Accruals refer to payments or expenses on credit that are still owed. For example, a company might pay rent at the end of the month but occupy the space from the beginning of the month. Accruals also include accrued expenses, such as wages paid to an employee, and accrued revenues, such as revenue generated in one accounting period but not recognised until a later period.

Deferrals refer to revenues or expenses that have been received or paid in advance but have not yet been earned or used. For example, a company might pay for a year's worth of insurance in December, but this would be an expense for the following year. Another example is unearned revenue, where a customer has paid for services that have not yet been rendered.

Estimates are adjusting entries that record non-cash items, such as depreciation expenses, allowance for doubtful accounts, or inventory obsolescence reserves.

Depreciation and amortisation refer to the process of assigning the cost of an asset, such as a building or equipment, over the economic life of that asset. This is typically done for large purchases, and the expense is recorded as a depreciation expense each month.

The Trust Factor: Examining the Reliability of AAA Insurance Adjusters

You may want to see also

Prepaid insurance is usually charged on a straight-line basis

Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract. When the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account. This means that the amount charged to expense in an accounting period is only the amount of the prepaid insurance asset ratably assigned to that period.

For example, a business buys one year of general liability insurance in advance for $12,000. The initial entry is a debit of $12,000 to the prepaid insurance (asset) account and a credit of $12,000 to the cash (asset) account. In each of the next twelve months, there should be a journal entry that debits the insurance expense account and credits the prepaid expenses (asset) account.

Prepaid insurance is the fee associated with an insurance contract that has been paid in advance of the coverage period. It is treated in the accounting records as an asset, which is gradually charged to expense over the period covered by the related insurance contract. Prepaid insurance is commonly recorded because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would risk having its insurance coverage terminated.

Prepaid insurance is usually classified as a current asset on the balance sheet, since the term of the related insurance contract that has been prepaid is usually for a period of one year or less. If the prepayment covers a longer period, then the portion of the prepaid insurance that will not be charged to expense within one year should be classified as a long-term asset.

Becoming an Insurance Adjuster in Ontario: A Comprehensive Guide

You may want to see also