Are AAA insurance adjusters trustworthy?

AAA, also known as Triple A or the American Automobile Association, is a well-known insurance company that offers a wide range of insurance options, including auto, home, and life insurance. With any insurance company, it is important to remember that their goal is to make a profit, which may sometimes result in them being reluctant to pay out settlements. This can make it challenging for customers to receive fair compensation for their claims.

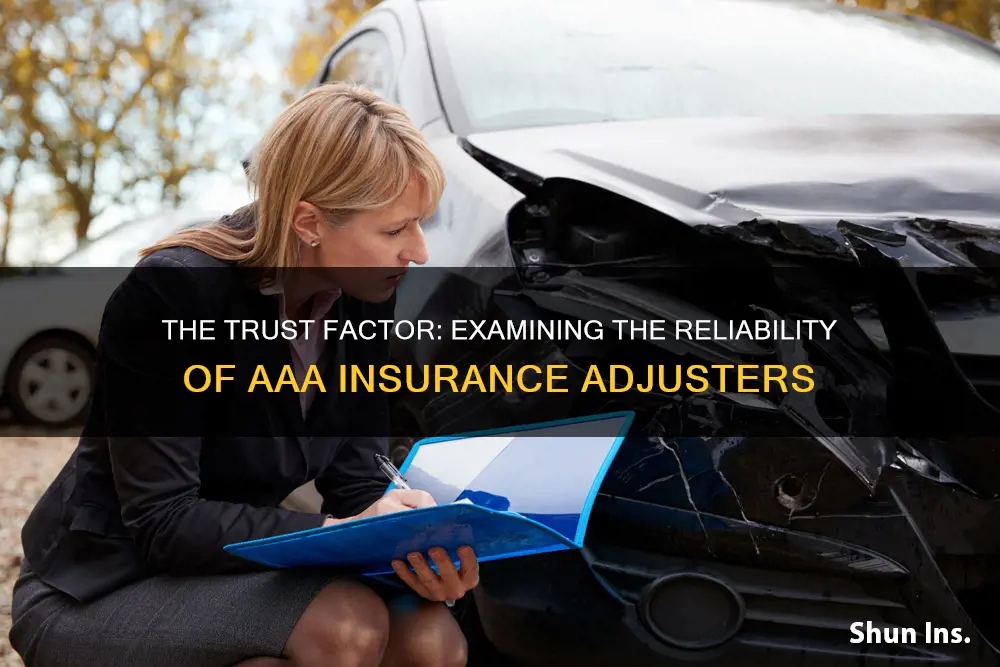

When it comes to AAA insurance adjusters specifically, there seem to be mixed reviews. On one hand, AAA has received complaints about poor customer service and delayed claims payments. Some customers have also shared negative experiences with adjusters, citing issues such as unresponsiveness, lack of support, and unfair claim denials.

On the other hand, there are also positive testimonials from customers who have had satisfactory experiences with AAA insurance adjusters. These customers praise the company for its affordable rates, efficient claims process, and transparency. Additionally, former employees of AAA have shared insights into the company's culture, with some highlighting a stressful and negative work environment, while others appreciate the company's member-centric approach and the empowerment it offers to its employees.

In conclusion, while there are varying opinions on the trustworthiness of AAA insurance adjusters, it is essential to remember that individual experiences may differ. Seeking legal advice or hiring an independent adjuster to advocate on your behalf can be considered if you feel you are not being treated fairly by AAA or any other insurance company.

| Characteristics | Values |

|---|---|

| Customer Service | Poor |

| Claims Handling | Poor |

| Coverage | Poor |

| Timeliness | Poor |

| Transparency | Poor |

| Affordability | Good |

| Work-Life Balance | Poor |

| Management | Poor |

| Company Culture | Poor |

| Training | Poor |

What You'll Learn

- AAA insurance adjusters are not keen on cutting customers any breaks

- They are content with not paying customers at all if they can help it

- This may be a breach of contract and an action of bad faith

- AAA has a rating of 3.2 out of 5 from WalletHub's editors

- AAA has received more complaints than the average car insurance provider of its size

AAA insurance adjusters are not keen on cutting customers any breaks

AAA insurance adjusters are not known for cutting their customers any breaks. Their primary goal is to make a profit and avoid paying out excessive settlements. This means that they are content not to pay out at all if they can help it. While this may constitute a breach of contract and an action of bad faith, it is challenging to receive compensation from AAA without a court order.

AAA insurance adjusters are similar to those at other companies in that they are incentivized to minimize payouts. However, their customers often face additional challenges when dealing with this large company. AAA has the resources to hire an army of lawyers to fight claims in court, and most ordinary citizens will lose their cases even before going to court. The burden of proof, evidence gathering, and negotiation can be overwhelming for individuals, especially if they are injured and unable to work.

It is advisable to seek legal counsel when dealing with AAA insurance adjusters, as they are skilled at navigating the complex claims process and can help level the playing field. While it is possible to negotiate with AAA without an attorney, it is crucial to be well-prepared with extensive evidence, including photographs, videos, eyewitness reports, police reports, and medical records.

In conclusion, AAA insurance adjusters are not known for being customer-friendly, and their customers often face an uphill battle when seeking compensation. While it is possible to negotiate with them, the process can be challenging and time-consuming, and seeking legal assistance may be in the customer's best interest.

Unraveling the Path to Becoming an Insurance Adjuster in Georgia

You may want to see also

They are content with not paying customers at all if they can help it

It's important to remember that insurance companies are businesses, and their primary goal is to make a profit. This means that they are often reluctant to pay out settlements, and it can be challenging for customers to receive fair compensation.

AAA insurance adjusters are no exception to this. While AAA is a well-known and respected company with a long history, there are numerous customer reviews complaining about issues with receiving payouts. Many customers have shared stories of adjusters delaying, ignoring, or denying their claims, even in cases where the customer had been with the company for many years and had never filed a claim before. Some customers have also reported feeling mistreated or disrespected by AAA employees.

On the other hand, there are also positive reviews from customers who have had smooth and satisfying experiences with AAA insurance. Some customers appreciate the company's affordable rates and the various discounts they offer. Additionally, some former and current employees have shared positive experiences working for the company, praising the work culture and the benefits provided.

So, are AAA insurance adjusters trustworthy? It's difficult to give a definitive answer. While there are certainly some concerning reviews, it's important to remember that people are more likely to share negative experiences than positive ones. Every company will have some dissatisfied customers, and it's possible that some of the issues could be due to misunderstandings or extenuating circumstances.

Ultimately, it's essential to do your research, read a wide range of reviews, and carefully consider your options before choosing any insurance company, including AAA.

The Path to Becoming an Independent Insurance Adjuster: A Comprehensive Guide

You may want to see also

This may be a breach of contract and an action of bad faith

Acting in bad faith is an act of intentional dishonesty that occurs when someone violates the basic principles of honesty in their dealings with others. It is an act of intentional dishonesty that occurs when someone fails to fulfil their legal obligations, deliberately misleads someone, or enters into an agreement with no intention of fulfilling their obligations.

In the context of contracts, all parties are expected to act honestly, fairly, and in good faith. This means they should not interfere with the other party's ability to perform their part of the contract or benefit from it. If a party acts in bad faith, they can be sued for a breach of contract.

Insurance companies owe a duty of good faith and fair dealing to those they insure. This means they must act in a way that does not interfere with the policyholder receiving benefits under the insurance agreement. If an insurance company does not act honestly and fairly in response to a claim, the policyholder may be able to bring a bad faith claim against the insurer.

For example, an insurance company acting in bad faith may intentionally deny a policyholder's claim, mislead the policyholder with false information, dishonestly adjust a claim, or unreasonably delay a payout.

Breach of contract, on the other hand, occurs when a party fails to fulfil a specific requirement of the contract. This could include failing to complete a job, not delivering all the goods or services promised, or failing to pay in full or by the deadline.

While breach of contract and bad faith are distinct concepts, they can sometimes be related. For instance, if an insurance company breaches its implied duty of good faith and fair dealing, it may be considered a breach of contract as well as an act of bad faith.

In summary, acting in bad faith involves intentional dishonesty and a breach of the duty to act fairly and in good faith. Breach of contract, on the other hand, involves failing to fulfil a specific contractual obligation. Both can have serious consequences and may result in legal action.

The Mystery of Insurance Adjustments Unveiled: Understanding the Process and Its Impact

You may want to see also

AAA has a rating of 3.2 out of 5 from WalletHub's editors

AAA insurance is rated 3.2 out of 5 by WalletHub's editors. This is based on factors such as customer reviews and watchdog-group ratings. AAA has a rating of 3.82 from the National Association of Insurance Commissioners (NAIC), meaning it has more customer complaints than the average insurer of its size. Its average rating among users is 2.3 out of 5.

AAA insurance policies are only available to AAA members. The organisation offers three membership levels (Classic, Plus and Premier), each with special benefits like roadside assistance, vacation planning services, and retail discounts. AAA insurance is pretty affordable, though it's not the cheapest on the market. It ranks in the second quartile in WalletHub's cost comparison.

AAA's overall customer satisfaction scores are among the lowest in The Zebra's Customer Satisfaction Survey, where it ranked 13th out of 15 in the overall auto carrier category. It also earned below-average marks from J.D. Power in their 2021 claims satisfaction study. However, AAA has a relatively high consumer trust ranking, especially among younger drivers.

AAA offers a wide range of coverage options, including home, auto, life, and pet insurance. They also have numerous discount opportunities.

Navigating the Path to Becoming an Insurance Adjuster in Florida: A Comprehensive Guide

You may want to see also

AAA has received more complaints than the average car insurance provider of its size

AAA has a large number of regional branches, and its insurance policies are only available to its members. AAA has received a rating of 3.4/5 by WalletHub's editors, based on customer reviews, sample insurance quotes, and ratings from organizations such as J.D. Power and the Better Business Bureau (BBB). While AAA's customer reviews highlight the company's affordable rates, its NAIC rating is 15.46, indicating that it has received more complaints than the average car insurance provider of its size.

Customer complaints tend to focus on poor customer service and delayed claims payments. WalletHub's research also places AAA in the third quartile among major car insurance companies in terms of price. However, AAA's rates are cheaper than average in certain states, such as California, where a full-coverage policy is 4% cheaper than the state average.

In terms of customer satisfaction, AAA ranked 13th out of 15 in The Zebra's Customer Satisfaction Survey. It received below-average marks from J.D. Power in their 2021 claims satisfaction study and an average customer service satisfaction score in their 2021 study.

Overall, while AAA offers affordable rates and a range of benefits and discounts, its customer service and claims handling have received mixed reviews, with some customers reporting delays and a lack of assistance.

The Art of Damage Assessment: Unraveling the Insurance Adjuster's Process

You may want to see also

Frequently asked questions

Insurance adjusters are employed by insurance companies to protect their interests, not necessarily those of the customer. While AAA insurance adjusters are likely no more or less trustworthy than those of other insurance companies, it is still recommended that you hire your own independent adjuster to ensure your interests are being served.

An insurance adjuster investigates, negotiates, and coordinates on your behalf to resolve a claim. They will take statements, gather evidence, check coverage, secure estimates, and negotiate settlements.

Reviews from former and current AAA insurance adjusters are mixed. While some praise the company culture, benefits, and work-life balance, others criticise the stressful work environment, poor management, inadequate training, and excessive workload.

To file a claim with AAA insurance, you should first file a police report if necessary (for theft or vandalism). Reach out to AAA's support line, fill out the claims form, and provide the required documentation. Make any necessary temporary repairs to prevent further damage and prepare for the adjuster's visit by getting repair or replacement estimates from contractors.

If your claim is denied or insufficiently paid by AAA insurance, you may benefit from seeking legal advice or hiring a public adjuster. A public adjuster is a licensed independent insurance professional who can assist in settling insurance claims and disputes. They can help build a comprehensive claims package, provide evidence-backed data, and guide you through the entire claims process.