Getting a speeding ticket in Massachusetts can be costly, with fines ranging from $100 to $300, plus a $50 surcharge, and the possibility of a license suspension for repeat offenses. But what about the impact on your insurance? Speeding tickets are considered surchargeable events in Massachusetts, which means they will end up on your driving record and be reported to your insurance company. This will likely lead to an increase in your insurance premium, with rates potentially rising by 31% on average. However, the impact on your insurance may depend on various factors, including your driving history, location, and the policies of your insurance company. Some insurers may not raise rates after a single speeding violation, so shopping around for a new policy could be an option to mitigate the financial impact. Additionally, taking a defensive driving course or inquiring about discounts with your insurer might help reduce any potential increase in insurance costs.

| Characteristics | Values |

|---|---|

| Will a speeding ticket increase insurance in Massachusetts | Yes, a speeding ticket will increase insurance rates in Massachusetts, but only after the policy renews. |

| How much will the insurance increase by | A speeding ticket can increase insurance rates by 28-31%. |

| How long does a speeding ticket stay on your record | A speeding ticket will stay on your driving record for 3-5 years in Massachusetts. |

| How to avoid an increase in insurance premiums | Take the case to court, take a defensive driving course, shop for a new policy, or switch to minimum coverage. |

| How long before insurance rates increase | Insurance rates will increase after the policy renews, which could be in a few months. |

| Fines for speeding | $100-$300, plus a $50 surcharge, plus $10 for each mile over the limit. |

What You'll Learn

- A speeding ticket is a surchargeable event in Massachusetts

- The impact of a speeding ticket on insurance depends on the insurer

- A speeding ticket may not affect insurance for a first-time offender

- A speeding ticket can increase insurance rates by hundreds of dollars

- A speeding ticket may add points to your license

A speeding ticket is a surchargeable event in Massachusetts

In Massachusetts, a speeding ticket is a surchargeable event, which means it will go on your driving record and be reported to your insurance company. The Safe Driver Insurance Program (SDIP) in Massachusetts allows insurance companies to issue surcharges on insurance rates based on your driving record. This means that a speeding ticket will likely increase your insurance rate, though how much it increases depends on a variety of factors, including your driving history, location, and insurance company.

The impact of a speeding ticket on your insurance rate can vary. A single speeding ticket could increase your insurance rate by hundreds of dollars, with rates increasing by nearly a third, or 31% on average, according to some sources. However, other sources suggest that a first speeding ticket may not affect your insurance rate at all, depending on your state and insurer. It is worth noting that insurers typically review your Motor Vehicle Record (MVR) at policy renewal, so if you get a speeding ticket with a few months left on your existing policy, you may see a rate increase when your renewal policy is issued.

There are ways to mitigate the impact of a speeding ticket on your insurance rates. You could consider taking the case to court, as officers may not show up, leading to a dismissal. Alternatively, the prosecutor may allow you to plead to a lesser traffic violation, resulting in no or lower points on your record and a reduced rate increase. Taking a defensive driving course may also help, as some insurers offer discounts for this. Additionally, you can shop around for insurance companies with lower rates or those that won't penalize you for a single speeding ticket.

It is important to note that a speeding ticket will stay on your driving record for six years in Massachusetts. During this time, you may lose any safe driving discounts you previously had with your insurer. Speeding tickets may also result in fines, ranging from $100 to $300, a $50 surcharge, and a license revocation for repeat offenses.

Auto Insurance and Relationships: Am I Covered if My Girlfriend Drives My Car?

You may want to see also

The impact of a speeding ticket on insurance depends on the insurer

In Massachusetts, a speeding ticket is a "surchargeable" offence, which means your insurer can add a surcharge to your insurance bill. This will increase your insurance premium. However, the impact of a speeding ticket on your insurance depends on the insurer and how they treat the violation. Some insurers don't raise rates after a single speeding violation, so if your current insurer does, you can shop around for a new policy.

In Massachusetts, a speeding ticket will stay on your driving record for six years, and you can expect your insurance to increase by an average of 31%. For example, if you were paying $1,223 per year in premiums, a speeding ticket could increase that to $1,602. This increase will depend on several factors, including your insurance company, driving record, insurance history, and how fast you were travelling when you were cited.

If you receive a speeding ticket, there are some ways to avoid an increase in your insurance premiums. You can take the case to court, as many officers fail to show up, leading to a dismissal. Or, the prosecutor may allow you to plead to a lesser traffic violation, which may not result in any points on your ticket and could lead to lower rates. Taking a defensive driving course may also help, as some insurers offer discounts for this.

Full Glass Auto Insurance Coverage: What You Need to Know

You may want to see also

A speeding ticket may not affect insurance for a first-time offender

In Massachusetts, a speeding ticket is considered a "surchargeable event" and will go on your driving record, which will be reported to your insurance company. This will inevitably lead to an increase in your insurance premium. However, the impact of a speeding ticket on your insurance rates may vary depending on several factors, including your insurance company, driving record, insurance history, and the state you live in.

While a speeding ticket will typically result in an increase in your insurance premium, there may be instances where a first-time offender's insurance is not affected. Some insurance companies do not raise rates after a single speeding violation. Additionally, non-moving violations, such as parking tickets, typically do not affect your insurance rates, although this can vary by state and insurer.

It is important to note that the impact of a speeding ticket on your insurance may also depend on the number of points added to your license. In Massachusetts, a speeding ticket will result in two points on your record, but more points can be added if your speed was significantly above the limit or if you were involved in an accident. Accumulating a significant number of points due to multiple violations can increase your insurance rates.

To mitigate the impact of a speeding ticket on your insurance, you can consider taking a defensive driving course, which may result in a reduced charge or a discount from your insurer. Additionally, shopping around and comparing quotes from different insurance companies can help you find a policy that does not penalize first-time offenders.

In summary, while a speeding ticket in Massachusetts is likely to impact your insurance rates, there may be instances where a first-time offender's insurance remains unaffected, depending on the specific circumstances and the policies of the insurance company.

Comparing Auto Insurance: Finding the Right Coverage for You

You may want to see also

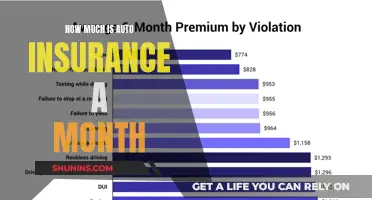

A speeding ticket can increase insurance rates by hundreds of dollars

A speeding ticket can have a significant financial impact on drivers, with insurance rates potentially increasing by hundreds of dollars. In Massachusetts, a speeding ticket is a "surchargeable" offense, allowing insurance companies to add charges to insurance rates based on an individual's driving record. The state uses the Safe Driver Insurance Program (SDIP), which assigns points to a driver's license for each violation. For instance, a speeding ticket in Massachusetts typically results in two points, but this can increase depending on the speed and other factors, such as accidents. These points remain on a driver's record for six years and can lead to a license suspension if they accumulate too many.

The impact of a speeding ticket on insurance rates varies by insurer and state. In Massachusetts, insurance rates can increase by an average of 31% due to a speeding ticket. For example, if the original insurance premium was $1,223 per year, a speeding ticket could increase it to $1,602, a difference of $379. The increase in insurance rates can also depend on the driver's history, location, and other factors.

While a single speeding ticket may not always affect insurance rates, multiple violations within a short period can lead to significant increases. Insurance companies typically review an individual's Motor Vehicle Record (MVR) during policy renewal, and a speeding ticket received shortly before renewal is more likely to result in a rate increase. Additionally, insurers may revoke safe driving discounts after a speeding ticket, further impacting the overall cost.

To mitigate the financial impact of a speeding ticket, drivers can consider several options. One strategy is to shop around for a new insurance policy, as some companies may not penalize a single speeding violation as severely as others. Taking a defensive driving course can also help, as some insurers offer discounts for completing such programs. Additionally, drivers can consider switching to minimum coverage to reduce their overall insurance costs.

Comprehensive Insurance: Does It Cover Auto Theft?

You may want to see also

A speeding ticket may add points to your license

In Massachusetts, a speeding ticket is considered a "surchargeable event" or a civil infraction, which will be noted on your driving record and reported to your insurance company. This means that your insurance company can add charges or surcharges to your insurance bill, and the more surchargeable events you accumulate, the larger your bill will become.

A speeding ticket may add two points to your license, but you could receive more points if your speed was well above the limit. For example, if you were also involved in an accident where claims were between $500 and $2,000, the RMV will impose three points. If the claim exceeds $2,000, you can receive four points.

The impact of a speeding ticket on your insurance rates will depend on your insurance company, driving record, insurance history, and state laws. In Massachusetts, your insurance rates could increase by an average of 31% after a speeding ticket. For instance, if you were paying $1,223 per year in premiums, a speeding ticket could increase that to $1,602. Your premiums may remain higher for one to three years after the violation appears on your record.

It's important to note that some insurers don't raise rates after a single speeding violation. If your current insurer increases your premium after one ticket, you may want to shop around for a new policy or consider switching to minimum coverage to keep your rates as low as possible.

Smart Strategies to Quote Auto Insurance

You may want to see also

Frequently asked questions

Yes, a speeding ticket will increase your insurance in Massachusetts. However, the amount by which your insurance rate increases will vary by insurer.

Your insurance rate may increase by an average of 31% or $485 more than the national average. However, the increase will depend on several factors, including your driving history, location, and insurer.

A speeding ticket will stay on your driving record for six years in Massachusetts.

The more surchargeable offenses you accumulate, the larger your bill will be until your license gets suspended for too many points.

You can take the case to court, take a defensive driving course, or inquire with other insurers who may offer lower rates.