Comparing car insurance quotes is essential to finding the best policy for your needs and budget. Prices can vary significantly from company to company, so it's worth shopping around to get the most competitive rate. When comparing quotes, it's crucial to consider factors such as your age, driving record, location, and the type of car you drive, as these can significantly impact your premium. Additionally, it's important to decide on the level of coverage you need, including liability, collision, and comprehensive insurance. By gathering quotes from multiple insurers and comparing them apples-to-apples, you can find the best value for your car insurance.

| Characteristics | Values |

|---|---|

| Compare car insurance quotes from multiple companies | It is important to compare car insurance quotes from multiple companies to find the best deal. |

| Personal information | Date of birth, address, gender, marital status, driver's license number, vehicle information, insurance history, driving history, etc. |

| Coverage options | Liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, personal injury protection, gap insurance, etc. |

| Discounts | Multi-policy, multi-car, safe driver, student, anti-theft device, paperless, bundling, military, automatic payments, etc. |

| Customer service | Reviews, ratings, customer satisfaction, claims handling, customer loyalty, ease of contact, etc. |

| Financial strength | AM Best ratings, National Association of Insurance Commissioners (NAIC) data, J.D. Power ratings, etc. |

What You'll Learn

How to compare car insurance rates without getting spammed

Comparing car insurance rates can help you find the best price for your policy. However, many people are concerned about getting spammed when they start comparing rates. Here are some tips to help you compare car insurance rates without getting spammed:

- Use a trusted insurance comparison site: Some sites, like The Zebra, Nerdwallet, Compare.com, Insurify, and Gabi, offer free car insurance quotes without selling your information. They provide quotes from multiple insurance companies, allowing you to compare rates easily.

- Local insurance broker: Consider visiting a local insurance broker in your city, who can provide you with better coverage options and potentially save you money.

- Create a separate email and phone number: If you are hesitant to provide your personal contact information, create a separate email address and phone number specifically for getting insurance quotes. This way, you can control the amount of spam you receive and protect your personal information.

- Contact insurance companies directly: Most insurance companies offer free quotes on their websites or through their agents. By contacting them directly, you can avoid providing your information to third-party sites.

- Be cautious of lead-generation sites: Some insurance quote sites make money by selling your information as leads, which can result in increased spam. Look for sites that generate real insurance quotes without selling your information.

- Review company reviews: Before providing your information, take the time to read reviews of the insurance company or comparison site. This can give you an idea of how they handle customer data and whether they respect your privacy.

Remember, when comparing car insurance rates, it's important to provide accurate and detailed information about yourself, your vehicle, and your driving history to get the most precise quotes. Additionally, compare the same types and levels of coverage across different companies to ensure an accurate comparison.

The Impact of Claims: Navigating the Auto Insurance Landscape

You may want to see also

How to choose an insurance company

Choosing an insurance company is a balancing act between your needs and preferences, and the costs. Here are some steps to help you choose the right insurance company:

Understand your needs and preferences

First, determine your needs and financial situation. For example, if you are a defensive driver, you may want to look for a company with a telematics program that rewards safe driving habits with personalized discounts. If you have teen drivers in your household, look for providers with discounts or programs geared towards young adults.

Research insurance providers that match your priorities

Once you know your needs, you can start researching companies that align with your circumstances. You can choose between large and small insurers. Smaller companies may offer more personalized and localized service, while larger companies may have more policy options, 24/7 customer service, and more self-service options.

Check third-party ratings

Use third-party ratings to find companies with strong customer service and financial strength. Customer satisfaction rankings from J.D. Power, for example, provide unbiased ratings about popular car insurance providers. You can also refer to AM Best for an analysis of a carrier's historical financial health and strength.

Consider digital tools and customer resources

Think about how you will interact with the company as a policyholder. If you prefer digital tools, choose a company with a robust app that allows you to manage your policy online. If you prefer speaking to representatives, choose a company with easily accessible phone or in-person support.

Compare insurance quotes and coverage

Compare insurance quotes from multiple companies, ensuring that you are using the same coverage choices, limits, and deductibles across all carriers for an accurate comparison. Working with an insurance agent can be helpful if you are unsure about how much coverage you need.

Check your comfort level

Finally, choose an insurance company that you feel comfortable with. Make sure the company or agent will be easy to reach if you have questions or need to file a claim. Check customer reviews to get an idea of the company's customer service, reliability, and claims processing.

LLC Auto Insurance: Owner Reimbursement?

You may want to see also

How your car insurance rate is calculated

The cost of car insurance is determined by a multitude of factors, which can be broadly categorised into personal factors and vehicle-related factors.

Personal Factors

- Age and Gender: Younger and less experienced drivers are statistically more likely to be involved in accidents and, therefore, tend to pay higher insurance premiums. Generally, drivers over 55 pay lower rates, with premiums rising again at 75 years of age. Additionally, women are statistically less likely to be involved in car accidents and tend to have less severe accidents, resulting in lower insurance rates compared to men.

- Marital Status: Data shows that married people are less likely to file auto insurance claims than single people, leading to lower premiums for married couples.

- Driving History: Insurance companies review an individual's driving record when determining insurance rates. Safe drivers with clean records and no traffic violations tend to pay lower premiums. Conversely, a history of moving violations, such as speeding or reckless driving, can result in higher insurance costs.

- Claims History: Car insurance companies examine an individual's history of filing claims. Multiple claims suggest a higher likelihood of future claims, leading to increased insurance rates.

- Credit Score: In most states, insurance companies consider an individual's credit score when calculating car insurance premiums. A higher credit score typically results in lower insurance rates, as insurers associate lower credit scores with a higher risk of filing claims.

Vehicle-Related Factors

- Vehicle Type and Age: The cost of insuring a vehicle is influenced by its make, model, and age. Luxury vehicles with advanced technology and safety features tend to be more expensive to insure due to higher repair or replacement costs. Older vehicles with more miles tend to have lower insurance rates than newer models.

- Vehicle Cost and Safety Features: The cost of the vehicle and the likelihood of theft are also considered. Vehicles with high-quality safety equipment may qualify for premium discounts, while vehicles with a higher chance of inflicting damage in an accident may result in higher insurance rates.

- Location: Urban drivers often pay higher insurance rates due to increased risks of vandalism, theft, and accidents. The frequency of litigation, medical care costs, car repair costs, insurance fraud, and weather trends can also impact insurance rates in specific locations.

Other Factors

- Insurance Coverage Type and Amount: The type and amount of insurance coverage can significantly impact the cost. Basic auto insurance with lower liability limits tends to be cheaper, while adding comprehensive, collision, or other optional coverages will increase the premium.

- Vehicle Usage: The more an individual drives, the higher the chances of an accident. Therefore, those who drive for work or commute long distances tend to pay higher insurance rates.

- Insurance Company: Different insurance providers may offer varying rates for the same type and amount of coverage. It is essential to compare quotes from multiple companies to find the most competitive rates.

While these are the primary factors influencing car insurance rates, it is worth noting that race and religion are illegal factors in determining insurance rates.

Credit Score Impact on Auto Insurance

You may want to see also

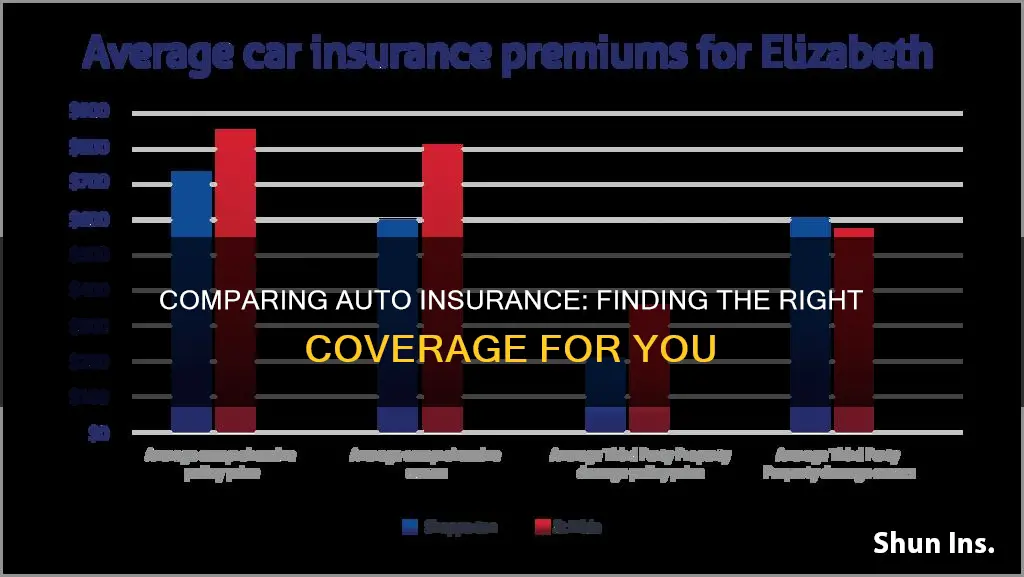

The average annual cost of car insurance

The cost of car insurance also depends on the state in which one lives. For instance, the average annual cost of car insurance in Maine and Idaho is among the lowest in the country, while New York, Louisiana, and Florida have some of the highest average costs. Additionally, the type of coverage also impacts the cost, with full coverage costing more than minimum coverage.

When determining the cost of car insurance, insurance companies consider various factors, including vehicle use, coverage type, deductible, and limit. Minimum coverage is often the cheapest option but may not provide sufficient protection. A higher deductible can lower rates but will result in higher out-of-pocket expenses when making a claim.

Gap Insurance Tax in Texas

You may want to see also

How to get the best value car insurance

There are several factors that determine the cost of car insurance. These include your age, gender, driving history, credit score, vehicle type and location. Here are some tips to help you get the best value for your car insurance:

- Practise safe driving habits: Safe drivers are less likely to get into accidents, and insurers reward them with lower rates. Avoid risky driving behaviours, always use your seat belt and turn signals, and avoid driving under the influence.

- Compare car insurance rates: Shopping around and comparing rates from different companies can help you find the best deal available. The Zebra, for example, compares rates from top companies side-by-side.

- Ask about discounts: Many insurance companies offer an array of discounts that can lower your bill. Ask about potential savings such as multi-policy, multi-car, safe driver and student discounts.

- Maintain a good credit score: Many states allow insurers to consider your credit history when determining rates. Better credit usually leads to lower car insurance rates, while poor credit can result in higher rates. Pay your bills on time and avoid maxing out your credit cards to improve your score.

- Consider the type of coverage you need: There are two main types of coverage: liability-only and full-coverage. Liability-only covers property damage or bodily injury to others in an accident caused by the policyholder, while full-coverage includes liability, collision and comprehensive coverage. Full-coverage is a better option for new or high-value vehicles, or if your vehicle is leased or financed.

- Choose a reputable company: In addition to affordability, consider the insurance company's quality, reputation and financial strength. State Farm, for example, ranks highly for customer service and offers some of the best rates and multiple discounts.

Does Your Car Insurance Cover a Moving Truck Rental?

You may want to see also

Frequently asked questions

Comparing car insurance rates is a simple process. You can use an online insurance comparison site, or you can contact insurance companies directly. You will need to provide some personal information, such as your age, gender, and driving history, as well as information about your vehicle. It is important to compare the same types and levels of coverage across different companies to get an accurate idea of which company offers the best rates for your needs.

It is a good idea to compare car insurance rates every six months, as the marketplace changes quickly. You may also want to compare rates if you experience any life changes, such as getting married or adding a new driver to your policy.

Several factors influence your car insurance rate, including your age, gender, driving record, credit score, and the type of vehicle you drive. Insurance companies weigh these factors differently, so it is important to shop around to find the best rate for your specific situation.