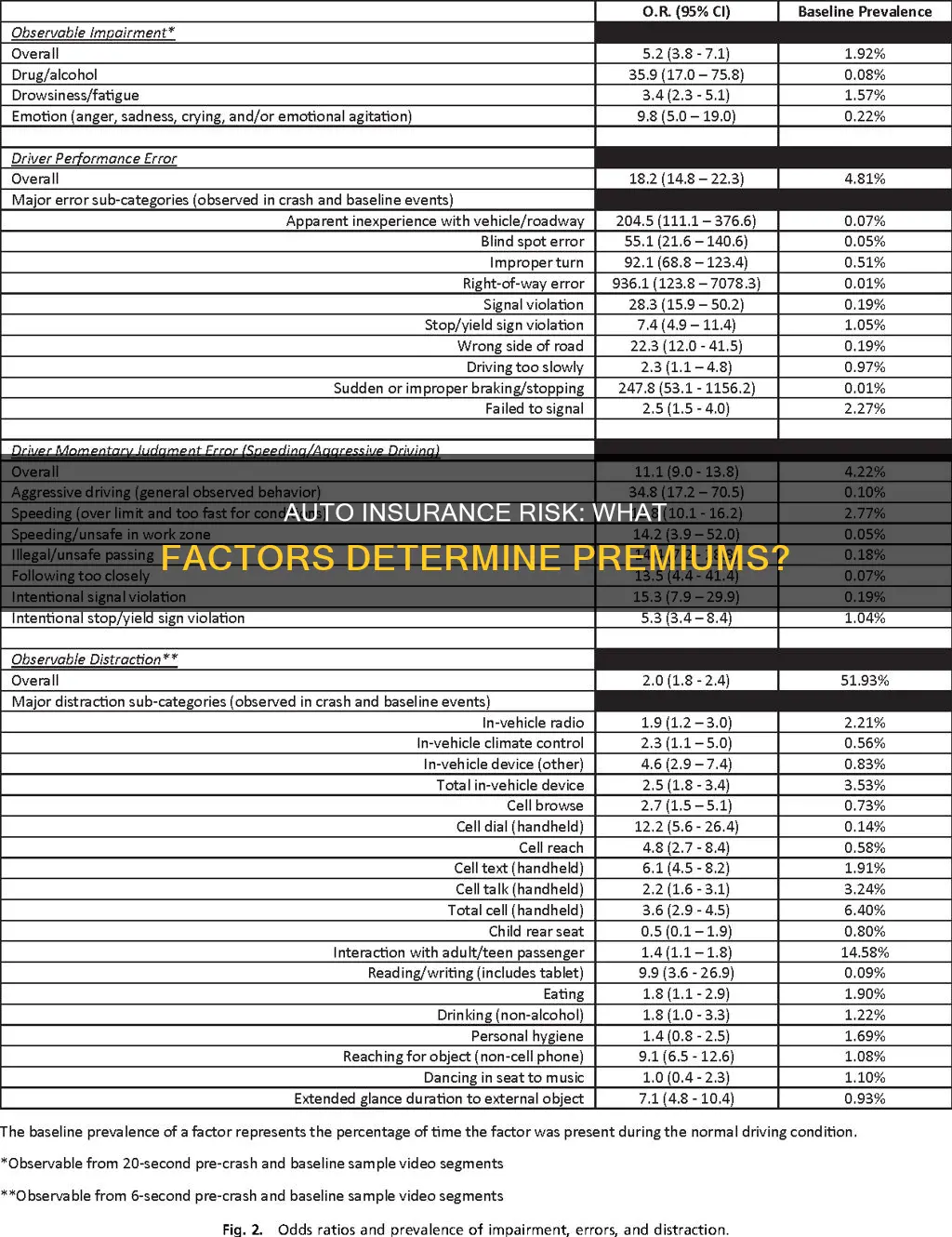

Auto insurance companies use various factors to determine whether a driver is high or low risk. These factors include age, driving experience, driving record, financial and insurance history, and the type of car driven. Young and inexperienced drivers are often considered high risk due to their higher likelihood of being involved in car accidents. Additionally, a history of at-fault accidents, traffic violations, DUI/DWI convictions, or lapses in insurance coverage can also contribute to a driver being classified as high risk. Conversely, low-risk drivers typically have clean driving records with few or no violations and minimal accidents. While the specific criteria may vary across insurers, the overall goal is to assess the probability of a driver filing an insurance claim and adjust premiums accordingly.

| Characteristics | Values |

|---|---|

| Age | Drivers under 25 and over 65 are considered high risk |

| Driving experience | Lack of experience is considered high risk |

| Driving record | At-fault accidents, speeding tickets, DUI/DWI convictions, reckless driving, moving violations |

| Insurance history | Lapses in coverage |

| Credit history | Poor credit history is considered high risk |

| Claims history | Multiple claims in the last three years |

| Vehicle type | Driving a high-value vehicle |

What You'll Learn

Driving history

A driver's history is a key factor in determining whether they are a high or low risk. Insurers will look at a driver's record to assess their risk profile, and how likely they are to make a claim. This will include checking for accidents, speeding tickets, and DUI/DWI convictions.

Insurers will typically look back over the previous three to five years of a driver's history, although this can vary depending on the insurer and the state. Some states may allow insurers to look back as far as ten years. Any incidents during this period will be considered an active part of a driver's history and will impact their insurance risk profile and premiums.

Serious moving violations, such as speeding tickets and DUI/DWI offenses, are red flags for insurers. These violations signal to insurers that a driver is more likely to be involved in an accident or incident and will result in higher premiums. The more tickets a driver accumulates, the higher their rates will be. For example, one source states that each speeding ticket can increase a driver's insurance rates by $45 per month.

Additionally, the severity of a speeding violation will also impact insurance rates. The faster a driver was going over the speed limit, the greater the chance of an increase in premiums. At-fault accidents will also result in higher premiums, with one source stating that one accident can increase rates by an average of $80 per month.

It is important to note that not all driving incidents will impact insurance rates. Non-moving violations, such as parking tickets, typically do not affect insurance premiums. Furthermore, many insurers will not increase premiums following a driver's first moving violation. Some states even prohibit insurers from increasing rates after a first-time speeding offense.

In summary, a driver's history is a critical factor in determining their insurance risk profile and premiums. Insurers will consider the number and severity of any incidents over the previous three to five years, with more serious violations and accidents resulting in higher premiums. Maintaining a clean driving record is essential for obtaining the best insurance rates.

Golf Cart Conundrum: Navigating Insurance Coverage for Your Ride

You may want to see also

Age and experience

Statistically, drivers aged 16 to 19 have a 300% higher risk of being involved in an accident than other age groups. This increases the likelihood of insurance claims, which is reflected in higher insurance rates for this age group. The Insurance Institute for Highway Safety reports that drivers aged 16 to 19 are four times more likely to be in a car accident than older drivers, and drivers between 15 and 20 years old account for 7% of all fatal accidents while only representing 4% of overall drivers.

The cost of auto insurance generally decreases as drivers gain more experience and enter their early 20s. By the age of 25, drivers typically see a significant reduction in their insurance premiums. This trend continues throughout adulthood, provided the driver maintains a clean driving record and safe driving habits.

However, as drivers reach their senior years, insurance rates may start to increase again. Aging-related factors such as vision or hearing loss and slowed response time can contribute to a higher risk of accidents among older adults. While seniors may not pay the same high rates as teenage drivers, their insurance costs can still be higher than those in their middle-aged years.

It is important to note that age is not the only factor influencing insurance rates. Other considerations include driving history, credit score, marital status, vehicle type, geographic location, and miles driven annually. Additionally, gender can also impact insurance rates, with men generally paying higher premiums due to a greater propensity for risky driving behaviours.

Becoming an Independent Auto Insurance Agent in India

You may want to see also

Credit history

Insurance scores are calculated using a variety of factors, including credit history, credit mix, and payment history. A good insurance score is usually 770 or higher, while a score below this indicates that a customer is a potential high-risk insurance client and may be subject to higher premiums.

The impact of credit history on insurance premiums can vary depending on the state and insurance company. For example, in some states like California, Hawaii, Massachusetts, and Michigan, the use of credit history in determining insurance rates is prohibited or limited. Additionally, each insurance company has its own criteria for evaluating credit scores and their impact on insurance rates.

It's worth noting that having no credit history can be viewed similarly to having poor credit by insurance companies, resulting in higher insurance premiums. However, this is not the case in all states, and some states prohibit insurance companies from charging higher rates due to a lack of credit history.

Improving credit history can be a gradual process, but it is worth the effort to secure lower insurance rates. This can be achieved by paying bills on time, maintaining old lines of credit, keeping credit utilization below 30%, and minimizing hard credit inquiries.

Home and Auto Insurance: Are Your Premiums Taxed?

You may want to see also

Vehicle type

The type of vehicle you drive plays a significant role in determining your auto insurance rates. Insurers will look at past claims from similar models and evaluate repair costs, theft rates, and payments made for comprehensive claims.

The age of your vehicle is a factor in determining insurance rates. Generally, the older the car, the lower the insurance rate. This is because older cars tend to have lower repair costs and are less likely to be stolen. However, very old cars may have higher insurance rates due to their increased risk of breaking down or being involved in an accident.

The manufacturer and model of your vehicle also affect your insurance rates. Some makes and models are more expensive to repair or replace than others, which increases the insurance rate. Additionally, certain models may be more likely to be stolen, which can also drive up the insurance rate.

The value of your vehicle is another factor in determining insurance rates. A more expensive car will typically have a higher insurance rate because the insurer will have to pay out more if the car is damaged or stolen.

In addition to the age, manufacturer, model, and value of your vehicle, other factors that can affect your insurance rates include safety and security features, such as airbags, anti-lock brakes, theft control devices, and alarm systems. These features can help reduce your insurance rates as they make your vehicle safer and less likely to be stolen.

It's important to note that insurance rates can vary significantly between different insurance companies, so it's always a good idea to shop around and compare quotes to find the best rate for your vehicle.

Gap Insurance: Remove or Keep Before Bankruptcy?

You may want to see also

Location

State

Each state has different minimum car insurance requirements, which is the first way that location impacts the cost of auto insurance. For example, 12 states require personal injury protection (PIP) coverage, which can significantly increase the cost of car insurance. In addition, car insurance is regulated at the state level, and each state has its own unique regulations. For instance, Michigan, a no-fault state, requires all drivers to carry unlimited Personal Injury Protection (PIP) coverage by law. This makes car insurance in Michigan over $2,000 per year more expensive than in Ohio.

City

Drivers in metropolitan areas tend to pay more for coverage than those in suburbia or rural areas. This is due to higher rates of theft, vandalism, and car accidents in cities.

Zip Code

Car insurance companies also price by zip code to adjust for external risk factors associated with each area. Insurance costs are higher in locales with more drivers, and areas prone to floods, wildfires, and crimes such as vandalism or theft also face higher rates.

Insuring Husband Too Costly

You may want to see also

Frequently asked questions

A high-risk driver is someone who is considered more likely to file insurance claims than a typical driver. Insurance companies look at your driving record to determine how risky it would be to insure you. Factors that may contribute to a driver being considered high-risk include a history of accidents, traffic violations, and a lack of driving experience.

Insurance companies consider a number of factors when determining if a driver is high-risk. These factors include driving history, such as accidents and violations, as well as age, credit history, and insurance coverage history.

High-risk drivers typically face higher insurance premiums as insurers view them as greater liabilities and more likely to file claims. It may also be more difficult for high-risk drivers to find insurance coverage, as some companies may deny them coverage.

The duration of a high-risk classification varies. Traffic violations typically remain on a driving record for 3-5 years, and more serious violations may be considered for five years or more. However, by maintaining a safe driving record and avoiding incidents, drivers can improve their risk profile over time.

Yes, there are a few strategies that may help. Shopping around for insurance quotes, improving credit scores, taking defensive driving courses, and maintaining a safe driving record can all potentially help reduce the financial burden of being classified as a high-risk driver.