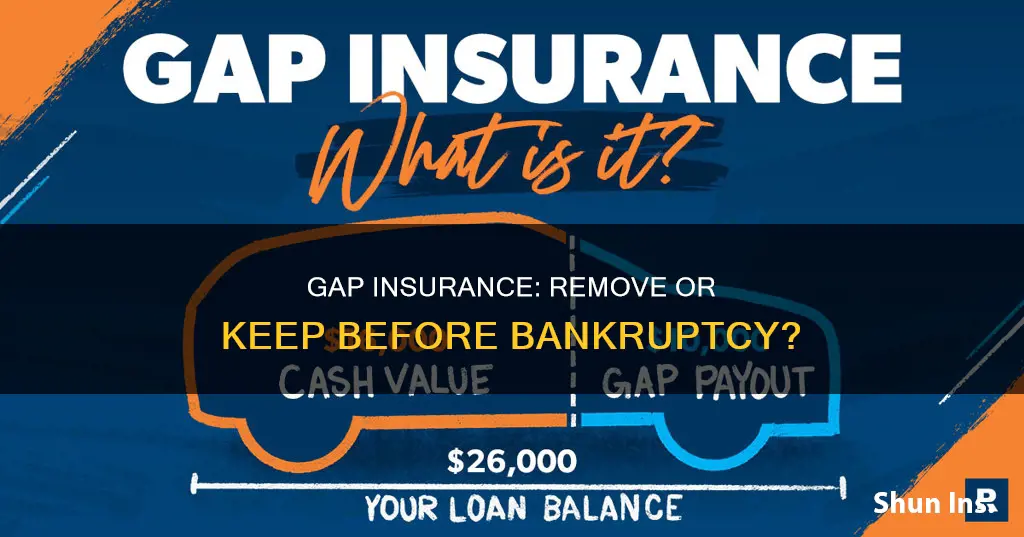

Gap insurance covers the difference between what you owe on a car and what the insurance company will pay out if it’s a total loss. It is not mandatory and can be cancelled at any time, although it is not generally recommended as it is the best way to protect your finances when leasing or financing a new vehicle. It is worth considering if you have problem credit and need an auto loan after completing bankruptcy. If you decide to cancel gap insurance, you may be able to get a refund on the premium you already paid.

| Characteristics | Values |

|---|---|

| Can you remove gap insurance before bankruptcy? | Yes, gap insurance can be cancelled at any point. |

| Should you remove gap insurance before bankruptcy? | It depends on your financial situation. Gap insurance is not mandatory, but it can protect your finances when leasing or financing a new vehicle. |

| How to remove gap insurance | Contact the insurance company and request a cancellation. You may need to provide written notice and your vehicle purchase agreement. |

| Refund | You may be eligible for a refund if you paid upfront or in monthly instalments. |

What You'll Learn

- Gap insurance covers the difference between what you owe and what the insurance company pays out

- Gap insurance isn't mandatory and can be cancelled at any time

- Cancelling gap insurance may result in a refund

- Bankruptcy can lower credit scores, which can affect insurance rates

- Auto insurance is required by lenders for car loans

Gap insurance covers the difference between what you owe and what the insurance company pays out

Gap insurance is an optional type of auto insurance that covers the difference between what you owe on your car loan or lease and the depreciated value of your car if it is totaled due to a problem covered by your policy, like a car accident. It is sometimes called loan/lease coverage.

Gap insurance covers the "gap" between what you owe on your car loan or lease and what the insurance company pays out. This gap can occur because cars depreciate quickly. The average car depreciates by 10% in the first month of ownership, according to data from Carfax. If your car is totaled, your car insurance company will reimburse you based on the current value of the car after depreciation—not the price you paid for it, the cost of a new one, or the amount you still owe on your loan or lease agreement.

For example, say you bought your car two years ago and owe $20,000 on your financing agreement. However, due to depreciation, your car's actual cash value is $15,000. If your car is completely written off as a result of an accident or theft, your car insurance policy will pay out $15,000. You can put that $15,000 toward your car loan, but you'll be short of what you owe, even though you no longer have a car.

If you have gap insurance, it would cover the $5,000 "gap," or the difference between the money you receive from the reimbursement and the amount you still owe on the car.

Gap insurance can be purchased from car insurance companies or dealers. It is typically paid for upfront in a lump sum or through monthly payments. Paying a lump sum means you may get refunded the unused money spent on coverage later. If you pay monthly, you may get a smaller refund if you cancel the policy early in the month.

Recording Insurance Proceeds: Vehicle Loss

You may want to see also

Gap insurance isn't mandatory and can be cancelled at any time

Gap insurance is an optional form of financial protection for car buyers. It covers the difference between what you owe on a car loan and what the insurance company will pay out if the car is a total loss. This type of insurance is particularly relevant if you owe more than your car is worth. For example, if your car is totalled in an accident and the insurance payout doesn't cover the remaining loan amount, gap insurance will pay the difference.

Gap insurance is not mandatory and can be cancelled at any time. Unlike car insurance, it is not a legal requirement. Drivers can cancel their gap insurance policy if they feel it is no longer financially beneficial to them. This may be the case if the remaining balance of their loan is less than the book value of their car. In this scenario, the driver is essentially paying for coverage that they will never use.

If you decide to cancel your gap insurance, you can follow these steps:

- Review your policy: Check for any cancellation fees or information on how the provider will compensate you.

- Get your mileage: Obtain an odometer disclosure statement to verify your car's mileage.

- Request cancellation forms: Ask your gap insurance company for the necessary forms to cancel your policy and request a refund.

- Submit the required documents: Fill out and submit the paperwork, including the odometer disclosure statement, to your agent or insurance company.

- Receive your refund: Once your policy is cancelled, you should receive a refund for the unused portion of your coverage, minus any fees.

It's important to note that gap insurance can offer peace of mind and financial protection in certain situations. Before cancelling, carefully consider your circumstances and whether the coverage is still beneficial to you.

Gap Insurance vs. Conditional Gap Waivers

You may want to see also

Cancelling gap insurance may result in a refund

Gap insurance covers the difference between what you owe on your car loan and the depreciated value of your car if it is totaled. It is not legally required, and you can cancel it at any time. However, it is important to have a new policy in place before cancelling your current policy to ensure there is no lapse in coverage.

To cancel your gap insurance and request a refund, follow these steps:

- Review your policy to understand the cancellation process and any associated fees.

- Get an odometer disclosure statement to verify your car's mileage.

- Request cancellation forms from your gap insurance company.

- Submit the required documents, including the cancellation forms and odometer disclosure statement, to your agent or insurance company.

- Provide your current contact information to ensure you receive any refund cheque.

By cancelling gap insurance and obtaining a refund, you can save money on coverage that you may no longer need. However, it is important to carefully consider your needs and ensure you have alternative coverage in place before cancelling your policy.

Renew Vehicle Insurance: A Quick Guide

You may want to see also

Bankruptcy can lower credit scores, which can affect insurance rates

Bankruptcy can have a significantly negative impact on your credit score, which in turn can affect your insurance rates. When you file for bankruptcy, your credit score can drop by 100-200 points, and this negative mark will stay on your credit report for up to 10 years. This will make it difficult to obtain new credit or loans, and any credit you do obtain will likely come with punitive interest rates.

The impact of bankruptcy on your credit score depends on your credit profile prior to filing. If you already have a low credit score and negative marks on your credit report, the impact of bankruptcy may not be as severe. However, if you have a high credit score and minimal negative marks, declaring bankruptcy could have a much greater impact on your score.

Insurance companies use your credit score to determine your insurance rates. With a lower credit score after bankruptcy, you may face higher insurance rates. Additionally, insurance companies may view you as a high-risk client and be less willing to offer you coverage.

It is important to note that the impact of bankruptcy on your insurance rates may vary depending on the type of insurance. For example, gap insurance, which covers the difference between what you owe on a car loan and its depreciated value, is not mandatory and can be cancelled at any time. However, other types of insurance, such as health or life insurance, may be more heavily influenced by your credit score and could become more expensive or difficult to obtain after bankruptcy.

Overall, while bankruptcy can provide much-needed financial relief, it is important to consider the potential long-term consequences on your credit score and insurance rates.

Gap Insurance: Claiming and Collecting

You may want to see also

Auto insurance is required by lenders for car loans

Lenders require auto insurance for car loans to protect their investment. This is known as "full coverage" and typically includes comprehensive, collision, and liability insurance. Comprehensive coverage insures against non-collision damage, such as theft, vandalism, or weather-related damage. Collision coverage, on the other hand, pays for damage to your vehicle in an accident, regardless of fault. Liability insurance covers damage to another person's property or medical expenses for other individuals if you cause an accident.

While liability insurance is mandatory in most states, comprehensive and collision coverage are not legally required. However, lenders usually mandate these additional coverages to safeguard their investment in the vehicle. This requirement ensures that their investment is protected in the event of an accident or damage to the vehicle.

Some lenders may also require other types of coverage, such as uninsured motorist coverage or gap insurance. Uninsured motorist coverage protects you in the event of an accident with an uninsured driver. Gap insurance, or Guaranteed Auto Protection, is particularly relevant when you owe more on your car loan than the car's current value. It covers the difference between the insurance payout and what you still owe on the loan if your vehicle is totalled or stolen.

It's important to note that auto insurance requirements may vary slightly between lenders, so it's always a good idea to review your loan agreement carefully and consult with your lender about their specific insurance requirements.

MOT and Insurance: Are You Legal to Drive?

You may want to see also

Frequently asked questions

Yes, gap insurance can be cancelled at any point. It is not mandatory and is not legally required.

First, review your policy. Then, get an odometer disclosure statement to verify your car's mileage. Request cancellation forms from your gap insurance company and submit the necessary documents.

You may get a refund for your gap insurance, depending on the terms of your contract. If you paid upfront, you will likely get a refund for the difference.

It makes sense to cancel gap insurance when it no longer makes financial sense to keep paying for it. This is usually when the remaining balance of your loan is less than the book value of your car.

Bankruptcy can lower your credit score, which can make it harder to secure a policy with a new insurance company. However, gap insurance is not a requirement for a high-risk car loan, and it may be cancelled at any time. It is up to you to decide whether to remove gap insurance before bankruptcy.