If you're looking to get liability auto insurance without broker fees, you have a few options. Firstly, it's important to understand the difference between an insurance broker and an insurance agent. While brokers can help you find a policy that suits your needs and budget, they are not employees of the insurance company and typically charge a fee for their services. On the other hand, insurance agents work for a specific insurance company and can issue policies directly to drivers, usually without any additional fees.

To avoid broker fees, you can purchase insurance directly from an insurance agent or the insurance company itself, either online or over the phone. Some insurance companies, such as Farmers, offer policies without broker fees. Additionally, if you live with the owner of the vehicle, you may be covered under their policy and won't need to purchase separate insurance. It's important to review the insurance policy and understand your coverage before getting behind the wheel.

| Characteristics | Values |

|---|---|

| How to get liability auto insurance without broker fees | Buy directly from the insurance company, online or over the phone |

| Buy through a captive agent (who works for one insurer) | |

| Buy through an independent agent | |

| Use an insurance comparison tool to find the cheapest price | |

| Broker fees | Are added to the actual auto insurance premium |

| Are taken upfront, increasing the amount of the down payment necessary to start a policy | |

| Do not contribute to the actual auto insurance policy | |

| Are non-refundable | |

| Are not charged when buying insurance through an agent | |

| May be charged for making changes to your policy or for making payments | |

| Are usually paid by the insurance company, not the buyer | |

| Are typically a percentage of the policy premium | |

| Can be combined with a commission structure | |

| Should be disclosed upfront |

What You'll Learn

Understand the difference between an insurance broker and an insurance agent

When it comes to purchasing liability auto insurance, you may choose to consult either an insurance broker or an insurance agent. While both are licensed professionals who can help you get insured, there are some key differences between the two that you should understand before making your decision.

An insurance agent represents one or more insurance companies and sells their policies for a commission. They can work full-time for an insurance agency or as independent contractors. Agents have contracts with specific insurers that outline the policies they are allowed to sell and the commission they will make on each policy. They can bind coverage, meaning they have the authority to issue insurance policies and complete insurance sales transactions. There are two types of insurance agents: captive agents, who represent only one specific insurance company, and independent insurance agents, who represent multiple insurers.

On the other hand, an insurance broker represents the consumer in their search for insurance coverage. Unlike agents, brokers are not tied to specific insurance providers and can sell policies from several different companies. They typically charge a broker fee on top of the insurance premium, which is paid by the buyer. Brokers work with their clients to understand their specific coverage needs and then shop around to find the best policies at the best prices to meet those needs. There are also two types of brokers: independent brokers, who offer a wide range of insurance products from various companies, and captive brokers, who work exclusively for a specific insurance company or group of companies.

In summary, the main difference between insurance brokers and agents is who they represent. Agents represent insurance companies, while brokers represent the client. This affects how they conduct their work, as brokers have a fiduciary duty to their clients, whereas agents do not. Brokers play more of an advisory role, while agents can bind coverage and facilitate the insurance sales transaction.

Whether you choose to work with an insurance broker or agent will depend on your specific needs. If your business has complex insurance needs, a broker may be a better option as they can advise you on risk management processes and help ensure your insurance program provides full coverage without gaps. On the other hand, if you already know exactly what coverage you need, an agent might be the best choice as they have in-depth knowledge of the policies they sell and can explain the details to help you decide.

Comprehensive Auto Insurance: Necessary Protection or Unnecessary Expense?

You may want to see also

Know the pros and cons of using a broker

Insurance brokers can be a valuable resource when you're shopping for liability auto insurance, but they might not be necessary for everyone. Here are some pros and cons to consider when deciding whether to use a broker:

Pros of using a broker:

- Unbiased advice: Brokers don't work for a specific insurance company, so they can offer unbiased advice and work in your best interests.

- Insider knowledge: Brokers often have extensive knowledge of the local insurance market, including smaller, regional companies that may offer great deals.

- Expertise: They can help you understand your insurance needs, coverage options, exclusions, and limits.

- Time-saving: Brokers can save you time by collecting and comparing quotes from multiple insurers, especially those that don't offer online quotes.

- Post-purchase support: After purchasing a policy, a broker can be your contact point, assist with claims, and recommend local repair shops or rental car services.

Cons of using a broker:

- Fees: You may have to pay a broker fee, which is an additional cost on top of your insurance premium. These fees can vary and are often non-refundable.

- Can't issue policies: Brokers can direct you to the right insurance company, but you'll still need to connect with an agent to finalise the purchase.

- Online alternatives: With the availability of online quote comparison tools, some people might prefer to manage the process themselves from the comfort of their homes.

- Potential conflict of interest: While brokers are meant to be unbiased, they receive commissions or fees from insurance companies, which could influence their recommendations.

- Limited to certain companies: Brokers typically don't have contracts with all insurance companies, so their recommendations may be limited.

Mazda Loans: Gap Insurance Included?

You may want to see also

Learn how brokers get paid

Brokers can make money in two ways: through a commission or a broker fee. They may charge both or only a commission. Most states require brokers to disclose commission rates and other fees upfront, but it's always a good idea to ask about any charges you'll have to pay on top of premiums.

Brokers receive a commission from an insurer when they place you with that company. The commission amount varies based on the policy and company and is typically calculated as a percentage of the premium. Brokers often receive a larger commission on the first policy versus renewals. For example, life insurance brokers can earn up to a 100% commission in the first year. This could incentivise them to sell you more life insurance than you need, so it's important to do your own research or consult a fee-only financial advisor.

Although auto insurance brokers and home insurance brokers don't normally have as large an incentive, it's still recommended to do some online research to complement their suggestions.

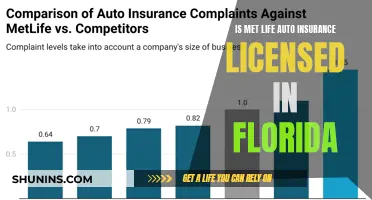

In addition to receiving commissions, some insurance brokers also charge fees. Broker fees must generally be reasonable and disclosed to the buyer, and your state might have fee restrictions. For example, in Florida, broker fees are capped at $35.

Broker fees are often non-refundable, so if you cancel your policy, you won't get your money back unless your insurance broker was dishonest.

The commission is automatically included in the price of the policy. If you shop for coverage on your own, you would still pay the same price—the insurer would just not have to pay a commission.

Because insurance brokers receive a commission from each company they work with, they theoretically shouldn't advocate for one insurer over another. However, some companies offer insurance brokers bonuses or gifts for bringing in clients, with larger incentives for those who bring in more business. Therefore, it's always good to ask upfront about how the commission works.

Expired License: Can You Still Get Car Insurance?

You may want to see also

Compare quotes from multiple insurers

Comparing quotes from multiple insurers is a crucial step in finding the best liability auto insurance policy that suits your needs and budget. Here's a detailed guide to help you navigate this process effectively:

Understand the Importance of Comparing Quotes

Comparing quotes from multiple insurers is beneficial for several reasons. Firstly, it helps you find the most competitive rates. Insurance rates can vary significantly between companies, and by comparing quotes, you can identify the most affordable options. Secondly, it ensures you get the right coverage. Different insurers offer varying coverage options, and by comparing quotes, you can find a policy that best suits your specific needs. Additionally, comparing quotes allows you to assess the insurers themselves. You can evaluate their reputation, customer service, and claims handling process. This helps ensure you partner with a reliable and responsive company.

Identify Reputable Insurance Companies

When comparing quotes, it's essential to focus on reputable insurers with strong financial standings. Look for companies with high financial strength ratings from independent agencies such as AM Best, Moody's, or Standard & Poor's. These ratings indicate the insurer's ability to pay out claims, providing peace of mind that they will be financially stable when you need to file a claim. Additionally, consider customer satisfaction ratings and reviews to gauge the quality of their services and responsiveness to policyholders.

Gather Multiple Quotes

Obtain quotes from at least three to five reputable insurance companies. You can typically request quotes online, over the phone, or through an agent or broker. When requesting quotes, ensure you provide consistent information about your vehicle, driving history, and desired coverage levels to make an accurate comparison.

Compare Coverage Options and Limits

When evaluating quotes, pay close attention to the coverage options and limits offered by each insurer. Standard liability coverage includes bodily injury liability and property damage liability. Ensure that the quotes provide the minimum required coverage amounts as per your state's laws. Additionally, consider any additional coverage options that may be beneficial to you, such as uninsured/underinsured motorist protection or personal injury protection.

Consider Deductibles and Premium Costs

Examine the deductibles and premium costs associated with each quote. The deductible is the amount you'll pay out of pocket before the insurance company covers the remaining expenses in the event of a claim. Typically, a higher deductible results in a lower premium, and vice versa. Consider your financial situation and ability to pay the deductible when weighing this trade-off.

Review Exclusions and Restrictions

Don't forget to scrutinize the fine print of each quote. Look for any exclusions or restrictions that may limit your coverage. For example, certain policies may not cover specific types of incidents or vehicles. Understanding these limitations will help you make an informed decision and avoid unpleasant surprises later.

Evaluate Customer Service and Claims Handling

In addition to the cost and coverage, consider the quality of customer service and claims handling offered by each insurer. You want a company that is responsive, efficient, and easy to reach in case you need to file a claim. Check online reviews, speak to friends and family, or contact the insurers directly to gauge their level of service.

Seek Clarification on Any Uncertainties

If you have any questions or uncertainties about the quotes, don't hesitate to seek clarification. Contact the insurers or their agents directly and ask for explanations regarding coverage, exclusions, premium calculations, or any other concerns you may have. This ensures you fully understand the policies before making a decision.

Make Your Decision

After thoroughly comparing the quotes and considering all the factors, you can now make an informed decision. Choose the liability auto insurance policy that best meets your coverage needs, fits within your budget, and provides you with a comfortable level of customer service and support. Remember to carefully review the final contract before signing up.

Homelessness and Auto Insurance: Is It Possible?

You may want to see also

Ask about discounts

Discounts are a great way to save money on your auto insurance without sacrificing coverage. There are several types of discounts available that can help offset rising insurance, fuel, and vehicle repair costs. Here are some common discounts to ask about:

Multi-Policy Discount

Also known as a "multi-line discount" or "bundling," this discount is often one of the biggest you can get, typically ranging from 5% to 25% off. This applies when you buy auto insurance and another policy, such as home, condo, renters, motorcycle, boat, RV, or life insurance, from the same company. For example, State Farm offers an average 23% discount for bundling home and auto insurance. Even if you don't own a home, you can still bundle auto insurance with other types of insurance to save money.

Multi-Car Insurance Discount

If you insure more than one car with the same insurance company, you can usually get a discount of up to 8% to 25%.

Vehicle Safety Discounts

If your car has safety features like anti-lock brakes, airbags, and daytime running lights, you may be eligible for a discount. Airbag discounts can be significant, offering up to a 40% discount on medical-related coverage. Cars that are less than three years old may also qualify for a new car discount, typically between 10% to 15%.

Anti-Theft Device Discounts

If your car has anti-theft features, you can usually get a discount of up to 5% to 25% off your comprehensive coverage. This includes both factory-installed and after-market-installed devices. Examples of anti-theft devices include GPS-based systems, stolen vehicle recovery systems, and VIN etching, which permanently engraves the vehicle identification number on the windshield and windows.

Good Driver Discounts

Insurance companies often reward good drivers with savings. To qualify, you typically need to be incident-free for a certain period, such as having no accidents in the last five years. Good driver discounts can range from 10% to 40%.

Defensive Driver Discounts

Some insurance companies offer discounts if you take an approved defensive driving course. This discount may only apply to qualified drivers of a certain age, typically 50 or older. Defensive driver discounts usually range from 5% to 10%, and some states mandate this discount for mature drivers.

Good Student Discount

If you or a student driver on your policy is enrolled full-time in high school or college and maintains good grades (usually a B average or better), you may qualify for a good student discount. This discount can range from 8% to 25% and may last until the student turns 25.

Student Away at School Discount

If your student is away at school and without a car, you may be eligible for this discount. Requirements vary, but typically the student must be under 25 years old, more than 100 miles from home, and only use the insured car while at home during school vacations and holidays.

Payment Discounts

You can often get a discount if you pay your policy in full upfront or set up automatic payments. Additionally, some companies offer a small discount if you use electronic funds transfer (EFT) for installments.

Paperless Discount

If you opt for paperless billing and receive your policy documents electronically, some insurance companies will offer a small discount, typically around 3%.

Online Quote Discount

Some companies offer a discount if you get an online quote and sign up for a policy. This discount can range from 4% to 12%.

Advance Quote Discount

Shopping around and buying a policy in advance of your current one expiring can also bring savings. The discount typically ranges from 2% to 15%, and purchasing about 10 days in advance can result in significant savings.

Occupational Discounts

Your occupation may qualify you for a discount. For example, Liberty Mutual offers special policy features for educators, and Geico offers up to a 15% discount for military personnel.

Alumni Associations and Professional Organizations

Being a member of certain organizations, such as college alumni associations, fraternities, sororities, or professional organizations, may also provide discounts.

Usage-Based Insurance Program Discount

Some insurance companies offer usage-based insurance (UBI), which adjusts rates based on your driving habits. Enrolling in a UBI program can provide a discount of 5% to 10%, and an additional discount based on your driving habits may be applied at policy renewal time.

Remember, not all discounts are automatic. It's a good idea to regularly ask your insurance agent to review the available discounts and determine which ones you may qualify for. Discounts can vary by state and insurance company, so be sure to check with your agent to find out what specific discounts are available to you.

Insurance Tax Penalty Gaps

You may want to see also

Frequently asked questions

An insurance broker is not a representative of an auto insurance company. They shop around for the lowest possible price for you and get paid through fees or commissions that are added to the auto insurance premium. An insurance agent, on the other hand, has entered into a contract with an insurance company to sell insurance to consumers. Thus, when you transact business with an insurance agent, you are purchasing insurance directly from the company they represent.

Insurance brokers get paid through commissions or broker fees, or sometimes a combination of both. Commissions are usually paid by the insurance company and are a percentage of the policy premium. Broker fees are paid by the buyer and can be charged as a flat fee, an hourly rate, or a percentage of the overall coverage package.

Yes, you can buy insurance directly from the insurance company, either online or over the phone. You can also work with a captive agent, who works for a single insurer, or an independent agent.

You do not pay a fee to an agent as they are paid by the insurance company. With a broker, you will usually pay a broker's fee, which is often non-refundable.

Using a car insurance broker can give you access to their insider knowledge of the insurance landscape and help you find the best coverage and prices. However, they usually charge a fee for their services, and they cannot issue policies directly to drivers.