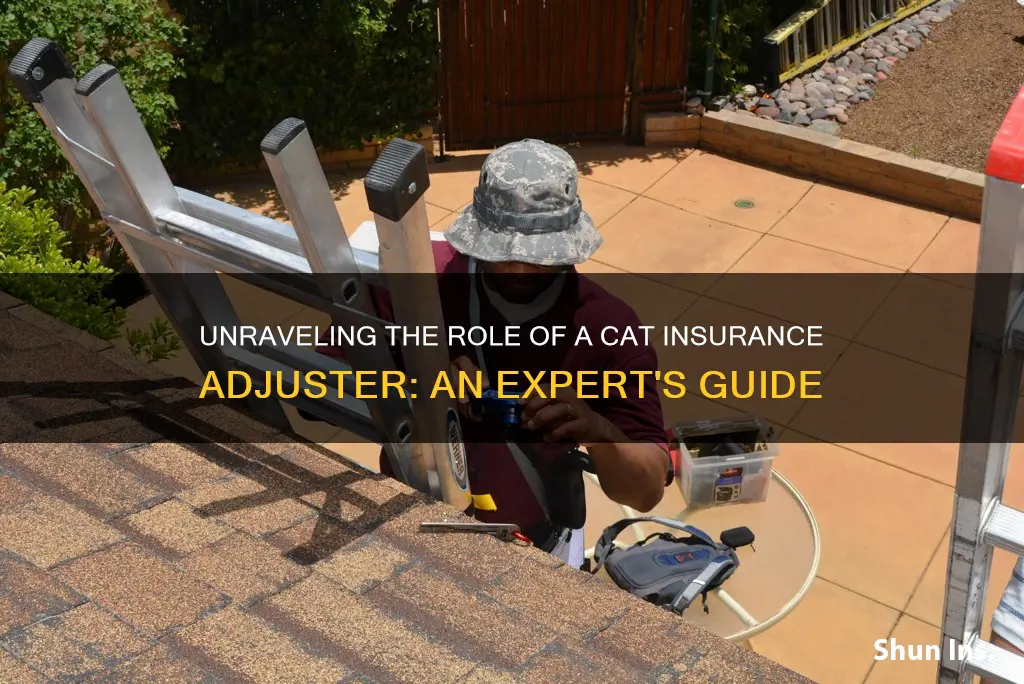

A CAT adjuster, short for catastrophe adjuster, is an insurance professional who visits and assesses areas affected by natural disasters. They are deployed to catastrophic events such as hurricanes, floods, wildfires, or any major storm event that requires insurance companies to send independent contractors to the affected region. These adjusters go from house to house, performing inspections to determine how much compensation the insurance customer is entitled to under their policy. CAT adjusters are paid per claim closed, with their income averaging between $70,000 and $100,000 during the storm season, which typically lasts 6 to 9 months.

| Characteristics | Values |

|---|---|

| Definition | A Cat Adjuster, short for Catastrophe Adjuster, is a specific type of insurance claims adjuster that is deployed to areas affected by natural disasters. |

| Deployment | Cat Adjusters are deployed to areas affected by hurricanes, hailstorms, floods, wildfires, or any major storm event. |

| Role | Cat Adjusters go from house to house performing inspections to determine how much compensation the insurance customer is entitled to under their policy. |

| Income | Cat Adjusters are paid per claim closed, with an income range of $70k - $100k during the storm season. |

| Work Hours | Cat Adjusters work long days, sometimes for weeks to months at a time. |

| Work Difficulty | The work involved can be both physically and mentally taxing. |

| Career Prospects | It can be difficult to get into the field without the proper training and connections. |

| Licensing | Licensing is regulated at the state level, and there is no national Cat Adjuster license. Several states do not require a license to operate as an adjuster. |

| Training | Obtaining a license does not guarantee employment, and further training in areas such as construction, loss analysis, and estimating software may be beneficial. |

| Travel | Cat Adjusters may need to travel extensively, especially if they are covering larger areas or multiple states. |

| Hazards | Cat Adjusters may encounter hazards such as flooded roadways, fallen power lines, debris, and broken glass. |

| Work Season | Cat Adjusters may have the option to take time off during the slower winter season and focus on working during the spring and summer. |

| Licenses in Other States | Obtaining licenses in other states prone to catastrophic weather events can increase job opportunities. |

| Insurance Scams | Cat Adjusters need to be vigilant about insurance scams, where people damage their property or worsen storm damage to get a bigger payout. |

What You'll Learn

- Catastrophe adjusters are deployed to hurricanes, floods, wildfires, and more

- They determine how much compensation the insurance customer is entitled to

- CAT adjusters can earn between $70k and $100k during storm season

- The job is demanding and can be both physically and mentally taxing

- To become a CAT adjuster, you'll need to obtain an adjuster license and get critical adjuster training

Catastrophe adjusters are deployed to hurricanes, floods, wildfires, and more

Catastrophe adjusters are deployed to areas affected by hurricanes, floods, wildfires, and other natural disasters. They assess property damage and report their findings to insurance companies, helping to determine how much compensation policyholders are entitled to. This can be a lucrative career, with catastrophe adjusters earning an average of $64,690 per year, but it can also be demanding. Adjusters may be deployed for weeks or months at a time, working long days in challenging conditions.

Catastrophe adjusters are often deployed to areas affected by hurricanes. For example, in the wake of Hurricanes Katrina, Rita, and Wilma in 2005 and 2006, there was a high demand for cat adjusters. Similarly, in 2017, after Hurricanes Harvey, Irma, and Maria, many cat adjusters were needed to help with the recovery efforts.

Floods are another common type of natural disaster that catastrophe adjusters are deployed to. For example, in Texas, flooding is common in Houston and coastal areas. Cat adjusters are also needed after wildfires. Wildfires can crop up in rural areas of Texas, and in 2021, there were also major wildfires in Colorado.

Catastrophe adjusters may also be deployed to areas affected by hailstorms, tornadoes, tsunamis, and earthquakes. For example, North Fort Worth and San Antonio in Texas are prone to hail damage, and Northern Texas is in "tornado alley".

Navigating the Claims Process: Strategies for Responding to Insurance Adjuster Questions

You may want to see also

They determine how much compensation the insurance customer is entitled to

Catastrophe insurance adjusters, or CAT adjusters, are insurance professionals who assess property damage and determine how much compensation an insurance customer is entitled to following a natural disaster. They are deployed to areas affected by catastrophes, including hurricanes, floods, wildfires, and hailstorms. CAT adjusters are paid per claim closed, so their income depends on their ability to close claims.

CAT adjusters follow a process to determine how much compensation an insurance customer should receive. First, they review the insurance policy to understand the coverages and determine if the damage is covered. They also investigate the claim by interviewing those involved, such as the claimant, witnesses, and experts, and reviewing evidence such as police reports, video footage, and photographs.

During the investigation, CAT adjusters may work with the customer to get their vehicle or property inspected and set up repairs. They may also consult with other professionals, such as accountants, architects, construction workers, engineers, and lawyers, to obtain a more expert evaluation of the claim.

Once the investigation is complete, CAT adjusters compare the damage to the customer's insurance policy to ensure it is covered. They then determine the appropriate amount of compensation based on factors such as actual expenses (e.g., medical bills, property damage), lost income, and pain and suffering. CAT adjusters may use specialised software, such as Xactimate, to help them analyse and estimate the damages and the cost of repairs.

It is important to note that CAT adjusters work for the insurance company and aim to keep payouts as low as possible while also avoiding costly personal injury lawsuits. As a result, insurance customers may consider hiring a public adjuster or a lawyer to help them negotiate a fair settlement and ensure they receive the compensation they are rightfully owed.

Navigating Fire Damage Claims: The Benefits of Engaging a Public Insurance Adjuster

You may want to see also

CAT adjusters can earn between $70k and $100k during storm season

A CAT adjuster, or catastrophe adjuster, is a type of insurance claims adjuster that is deployed to areas affected by natural disasters. This could include hurricanes, hailstorms, floods, wildfires, or any major storm event that requires insurance companies to send adjusters to the affected region. These adjusters will go from house to house performing inspections to determine how much compensation the insurance customer is entitled to under their policy.

CAT adjusters are typically paid per claim closed, and their income can vary depending on their ability to close claims. During the storm season, which typically lasts 6-9 months, CAT adjusters can earn between $70,000 and $100,000. This high earning potential is reflected in the common phrase among adjusters: "make 6 figures in 6 months."

The process of becoming a CAT adjuster can vary by state, but typically involves obtaining an adjuster license and receiving adjuster training. CAT adjusters are often required to travel to different locations and work long days, making it a demanding career. However, it offers the opportunity to help those affected by natural disasters and provides a high salary.

While it can be challenging to break into the field without the proper training and connections, CAT adjusting offers a lucrative and exciting career path for those willing to put in the work.

Handling Expunged Records: The Oregon Insurance Adjuster Licensing Conundrum

You may want to see also

The job is demanding and can be both physically and mentally taxing

Being a CAT adjuster is a demanding job that can be both physically and mentally taxing. When disaster strikes, CAT adjusters are deployed to the affected region, where they may be working long days for weeks or even months at a time. The work is challenging and often involves navigating hazardous conditions, such as flooded roadways, fallen power lines, and debris. It requires dedication, hard work, organisation, and self-motivation to succeed in this field.

CAT adjusters, or catastrophe adjusters, are insurance professionals who assess property damage after natural disasters such as hurricanes, floods, wildfires, and earthquakes. They determine the extent of the damage, its cause, and whether it is covered by the customer's insurance policy. This process can be mentally taxing as it involves interacting with claimants who have experienced loss and need rapid financial and personal relief. CAT adjusters need to be able to manage their own time and resources effectively and stay motivated and dedicated to their work, even in challenging circumstances.

The job also involves a significant amount of travel, as CAT adjusters need to be able to reach the affected regions quickly. In the United States, this could mean travelling to different states, and adjusters may average 35,000-40,000 miles per year. This frequent travel can be physically demanding and requires adjusters to be away from home for extended periods.

While the work is demanding, it can also be personally fulfilling and surprisingly profitable. CAT adjusters have the rewarding job of providing much-needed assistance to people in the wake of disasters. The income can be high, with adjusters earning between \$70,000 and \$100,000 during the storm season, which typically lasts 6 to 9 months.

Navigating the Path to Becoming an Insurance Adjuster in Colorado: A Comprehensive Guide

You may want to see also

To become a CAT adjuster, you'll need to obtain an adjuster license and get critical adjuster training

To become a CAT adjuster, you'll need to obtain an adjuster license and undertake critical adjuster training. Here's a detailed breakdown of the steps to achieve this:

Obtaining an Adjuster License

Firstly, it's important to note that insurance adjuster licensing requirements vary across different states. While some states mandate a license for practising adjusters, others do not. Thus, the first step is to ascertain the specific regulations of your home state. Obtaining a license in your home state is generally recommended, as it offers greater flexibility and coverage when seeking reciprocal licenses from other states. This is particularly crucial for CAT adjusters, who frequently travel to different regions.

If your home state does not require adjuster licensing, you can opt for a Designated Home State (DHS) license. This is essential if you intend to work in states that require a license, as it enables you to obtain reciprocal licenses from those states. Florida and Texas are popular choices for DHS licenses due to their reciprocity deals and relatively low costs.

To obtain your license, you will typically need to meet certain basic requirements, such as a minimum age of 18 years, US citizenship or legal work authorization, and residency in the state where you're seeking licensure. Some states may also require pre-licensing education or experience in the insurance adjusting field. After fulfilling these prerequisites, you will need to pass a state licensing exam and submit the necessary application, along with associated fees and documentation.

Critical Adjuster Training

Once licensed, it's essential to pursue critical adjuster training to enhance your employability and effectiveness in the field. Proficiency in industry-standard claims writing software, such as Xactimate, is highly valued by employers. This software proficiency enables adjusters to efficiently close claims and is often a prerequisite for securing a position.

In addition to software training, developing strong people skills and computer proficiency is vital for success in this career. CAT adjusters should also be prepared for the physical and mental demands of the job, which may include long work hours and challenging environments.

The Investigative Nature of Crop Insurance Adjusters: Unraveling the Truth in Agriculture

You may want to see also

Frequently asked questions

A CAT insurance adjuster, or catastrophe adjuster, is a type of insurance claims adjuster that is deployed to areas affected by catastrophic events, such as hurricanes, floods, wildfires, and other major storm events.

CAT adjusters assess property damage from natural disasters and determine how much compensation the insurance customer is entitled to under their policy.

CAT adjusters' income averages between $70,000 and $100,000 during the storm season, which typically lasts 6 to 9 months. They are paid per claim closed, so their income depends on their ability to close claims.

In addition to the high earning potential, CAT adjusters have the flexibility to work independently and create their own schedules. They also have the opportunity to travel and meet new people, as they may be deployed to different regions affected by natural disasters.

The first step to becoming a CAT adjuster is to obtain an adjuster license, which is regulated at the state level. Then, you can consider obtaining additional adjuster training to enhance your skills and knowledge in the field. Finally, you can start applying for jobs and choose a specific career path within the catastrophe insurance field.