In today's economic landscape, an intriguing trend has emerged: millionaires are increasingly investing in life insurance. This might seem counterintuitive, as one might assume that the wealthy have little need for such coverage. However, the decision to purchase life insurance among high-net-worth individuals is driven by a multitude of strategic and financial considerations. Millionaires often view life insurance as a powerful tool for wealth preservation, estate planning, and ensuring the financial security of their loved ones. This paragraph will explore the reasons behind this trend, shedding light on the unique perspectives and benefits that life insurance offers to those with substantial financial resources.

What You'll Learn

- Wealth Preservation: Millionaires use life insurance to protect and preserve their assets for future generations

- Legacy Planning: It helps create a lasting legacy by ensuring financial security for beneficiaries

- Tax Efficiency: Life insurance policies offer tax advantages, allowing millionaires to optimize their financial strategies

- Business Continuity: Millionaires often rely on insurance to ensure business continuity in the event of their passing

- Risk Management: Life insurance provides a safety net, mitigating risks associated with unexpected deaths

Wealth Preservation: Millionaires use life insurance to protect and preserve their assets for future generations

Wealth preservation is a critical aspect of financial planning for millionaires, and life insurance plays a pivotal role in safeguarding their assets for the benefit of future generations. While it might seem counterintuitive for the wealthy to purchase life insurance, it is a strategic move that can ensure the longevity and growth of their financial legacy. Here's how millionaires can utilize life insurance as a powerful tool for wealth preservation:

Asset Protection and Transfer: Life insurance provides a mechanism to protect and transfer wealth. Millionaires often have substantial assets, including businesses, real estate, and valuable holdings. By taking out a life insurance policy, they can create a financial safety net. The death benefit from the insurance policy can be designated to pay off any outstanding debts or taxes, ensuring that the majority of the proceeds go directly to the intended beneficiaries. This strategic use of life insurance allows millionaires to protect their assets from potential creditors and ensures that their wealth is transferred intact to their heirs.

Wealth Generation and Growth: Life insurance can also be a powerful tool for wealth generation. Millionaires can utilize various types of policies, such as whole life or universal life insurance, which offer investment components. These policies allow them to build cash value over time, which can be invested and grow tax-deferred. By regularly contributing to these policies, millionaires can create a substantial investment portfolio that can be passed on to their beneficiaries. This approach not only preserves wealth but also provides an opportunity for it to grow significantly over the long term.

Long-Term Financial Security: For millionaires, life insurance offers long-term financial security. It provides a guaranteed income stream for beneficiaries, ensuring a steady flow of funds for their education, living expenses, or other financial needs. This is particularly important for families who want to maintain a certain standard of living even if the primary breadwinner passes away. By having a life insurance policy in place, millionaires can provide peace of mind, knowing that their loved ones will be financially protected for years to come.

Flexibility and Customization: One of the advantages of life insurance for millionaires is the flexibility it offers. They can customize their policies to fit their specific needs and goals. Millionaires can choose the death benefit amount, policy term, and beneficiaries, ensuring that the insurance plan aligns perfectly with their wealth preservation strategy. Additionally, they can opt for various riders and add-ons to enhance the policy's benefits, such as critical illness coverage or accidental death benefits, further tailoring the insurance to their unique circumstances.

In summary, life insurance is a valuable tool for millionaires to protect and preserve their assets, ensuring a secure future for their families. By utilizing life insurance strategically, they can create a robust financial plan that safeguards their wealth and provides for future generations. It is a testament to the versatility and effectiveness of life insurance as a wealth management tool.

DUI's Impact: Getting a Life Insurance License

You may want to see also

Legacy Planning: It helps create a lasting legacy by ensuring financial security for beneficiaries

Legacy planning is a crucial aspect of financial strategy, especially for those with substantial wealth, as it enables individuals to create a lasting impact and provide for their loved ones even after their passing. This process involves a thoughtful approach to wealth distribution, ensuring that the financial security of beneficiaries is prioritized. By implementing effective legacy planning, millionaires can achieve their goals of leaving a meaningful and secure legacy.

One of the primary benefits of legacy planning is the ability to provide financial security for future generations. Millionaires often have significant assets, and through careful planning, they can ensure that their wealth is utilized to support their families, charities, or other chosen causes. This involves creating a structured plan that may include setting up trusts, establishing charitable foundations, or contributing to family-owned businesses. By doing so, individuals can guarantee that their money is used according to their wishes, providing long-term financial stability for beneficiaries.

Life insurance plays a pivotal role in legacy planning. Millionaires can utilize life insurance policies to secure their assets and ensure that their beneficiaries receive the intended financial support. The death benefit from a life insurance policy can be designated to pay off debts, cover funeral expenses, or provide a lump sum or regular income to beneficiaries. This financial safety net allows individuals to pass on their wealth without incurring unnecessary taxes or leaving beneficiaries with a complex estate to manage.

Furthermore, legacy planning offers the advantage of flexibility and customization. Millionaires can tailor their plans to align with their unique goals and values. This may include setting specific inheritance amounts, choosing beneficiaries, and deciding on the distribution of assets. For instance, an individual might opt to leave a substantial portion of their estate to a spouse for a certain period, ensuring their immediate financial needs are met, while also providing for children or other dependents.

In summary, legacy planning is an essential strategy for millionaires to create a lasting impact and ensure financial security for their beneficiaries. By incorporating life insurance into their plans, they can effectively manage their wealth, provide for their loved ones, and leave a meaningful legacy. This approach empowers individuals to take control of their financial future and that of their family, offering peace of mind and a sense of fulfillment.

Canceling Genworth Life Insurance: A Step-by-Step Guide

You may want to see also

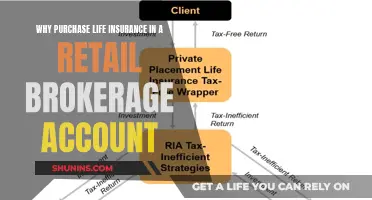

Tax Efficiency: Life insurance policies offer tax advantages, allowing millionaires to optimize their financial strategies

Life insurance policies have become an essential tool for millionaires to enhance their financial strategies and optimize their wealth management. One of the key advantages is the tax efficiency that these policies offer. When it comes to tax planning, millionaires often seek ways to minimize their taxable income and maximize the growth of their assets. Here's how life insurance can be a valuable asset in this regard:

Tax-Free Proceeds: Life insurance policies provide a unique benefit in the form of tax-free proceeds. Upon the insured individual's death, the death benefit is typically paid out to the designated beneficiaries. This amount is generally not subject to income tax, allowing the wealth to be passed on to heirs without triggering a significant tax liability. For millionaires, this can be a strategic way to transfer assets while ensuring that the beneficiaries receive the full value of the policy.

Tax Deductions: In many jurisdictions, life insurance premiums can be a deductible expense for individuals. Millionaires can take advantage of this by allocating a portion of their income to pay for life insurance premiums, thus reducing their taxable income. This strategy not only provides immediate tax benefits but also contributes to long-term wealth preservation by keeping more of their income after taxes.

Asset Protection: Life insurance can also serve as a powerful asset protection tool. Millionaires often have diverse investment portfolios, and life insurance can be used to protect these assets. By funding a life insurance policy, individuals can ensure that their wealth is preserved and accessible to their beneficiaries, even in the event of their passing. This is particularly useful for those with complex financial structures, as it provides a layer of security and control over the distribution of their assets.

Long-Term Wealth Planning: Tax efficiency in life insurance policies extends beyond the immediate tax benefits. Millionaires can utilize these policies as part of a comprehensive wealth management strategy. By regularly reviewing and adjusting their policies, they can optimize the tax implications and ensure that their financial plans remain aligned with their long-term goals. This may include taking advantage of policy loans or surrenders, which can provide tax-free cash values that can be reinvested or utilized for other financial objectives.

In summary, life insurance policies offer millionaires a strategic approach to tax efficiency and financial optimization. Through tax-free proceeds, deductible premiums, asset protection, and long-term wealth planning, these policies provide a comprehensive solution for managing and preserving wealth. By understanding and utilizing these tax advantages, millionaires can make informed decisions to secure their financial future and that of their beneficiaries.

Maximizing Your Cash Value Life Insurance: Strategies for Success

You may want to see also

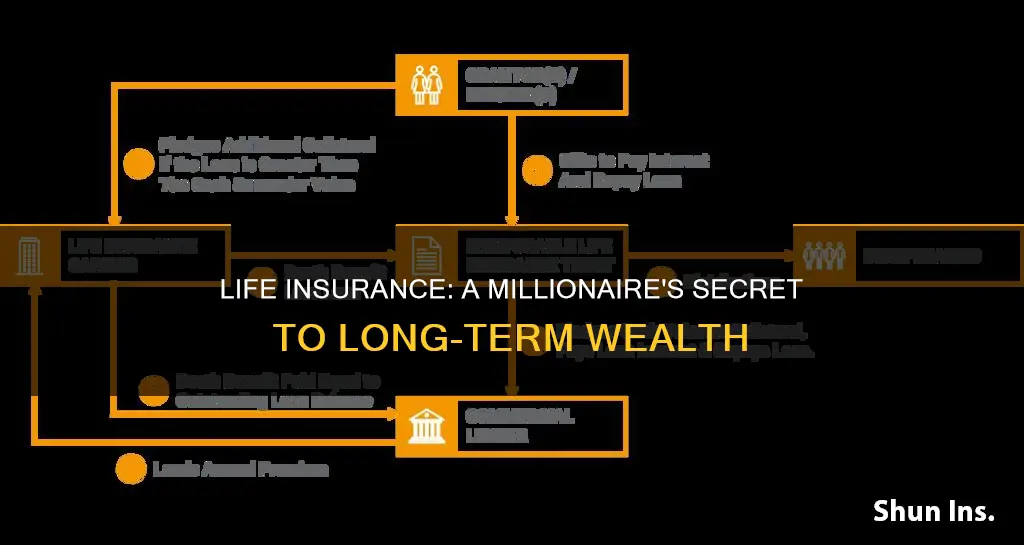

Business Continuity: Millionaires often rely on insurance to ensure business continuity in the event of their passing

Business continuity is a critical aspect of wealth management, and millionaires understand the importance of safeguarding their assets and ensuring the smooth operation of their businesses even in the face of adversity. One of the key tools millionaires employ to achieve this is life insurance. Here's how it works and why it's essential for business continuity:

Preserving Wealth and Business Interests: When a millionaire passes away, the impact on their business can be significant. The loss of a key decision-maker, founder, or owner can disrupt operations and potentially lead to financial strain. Life insurance provides a financial safety net by offering a substantial payout upon the insured's death. This payout can be strategically utilized to cover various business-related expenses, such as outstanding debts, loans, or even the purchase of a buy-sell agreement, which ensures the business remains within the family or with trusted partners. By doing so, the insurance proceeds act as a bridge, allowing the business to continue functioning and preventing potential financial crises.

Key Person Insurance: Millionaires often have specific roles or individuals whose expertise and contributions are invaluable to the company's success. These individuals are referred to as "key persons." Key person insurance is tailored to protect the business from the financial consequences of losing such a critical employee. The policy pays out a lump sum to the business upon the insured's death, enabling the company to cover recruitment costs, train replacements, or even purchase the shares of the deceased individual to maintain ownership within the family. This type of insurance ensures that the business can continue its operations without the immediate financial burden of replacing a vital team member.

Strategic Planning and Legacy: Life insurance also plays a role in strategic planning and legacy management. Millionaires can use insurance policies to provide financial security for their families and beneficiaries while also ensuring the long-term sustainability of their businesses. By structuring the insurance proceeds appropriately, they can fund trust distributions, charitable foundations, or even future business ventures. This approach allows millionaires to leave a lasting legacy, support their loved ones, and potentially secure the future of their business through well-planned insurance strategies.

In summary, millionaires recognize that life insurance is not just about personal protection but also a powerful tool for business continuity. By incorporating insurance into their wealth management strategies, they can safeguard their businesses, ensure financial stability, and provide a secure future for their families and the enterprises they have built. This approach demonstrates a forward-thinking and comprehensive approach to wealth preservation and management.

Dialysis and Life Insurance: What's Covered and What's Not

You may want to see also

Risk Management: Life insurance provides a safety net, mitigating risks associated with unexpected deaths

Life insurance is an essential tool for risk management, especially for high-net-worth individuals who want to ensure their families' financial security and protect their assets. When it comes to risk management, life insurance acts as a safety net, providing a layer of protection against the unforeseen. Here's how it works:

In the event of an unexpected death, life insurance policies offer a financial benefit to the insured's beneficiaries. This benefit can be a lump sum payment or regular income, depending on the policy type. For millionaires, this financial safety net is crucial as it ensures that their loved ones are taken care of financially, even if they are no longer around. By having a life insurance policy, they can provide for their spouse, children, or other dependents, covering essential expenses such as living costs, education, and daily needs. This financial security can prevent the family from facing financial strain and potential debt during an already difficult time.

The risk management aspect comes into play as life insurance helps mitigate the financial risks associated with the loss of a primary income earner. Millionaires often have complex financial portfolios and multiple sources of income. If something happens to the primary breadwinner, the remaining family members might struggle to maintain their current lifestyle and financial goals. Life insurance steps in to fill this gap, providing a steady income stream to cover expenses and maintain the family's standard of living. This is particularly important for those with significant assets, as the loss of a key earner could impact their ability to manage and grow their wealth.

Furthermore, life insurance can also be used as a strategic tool for estate planning. Millionaires can utilize life insurance policies to pass on their wealth to future generations. By naming beneficiaries, they can ensure that their assets are distributed according to their wishes, providing financial security for their heirs. This aspect of risk management allows individuals to plan for the long-term financial well-being of their family, even after their passing.

In summary, life insurance is a powerful risk management tool for millionaires. It provides financial security, ensures the continuity of income, and offers a strategic way to manage wealth transfer. By having a comprehensive life insurance policy, high-net-worth individuals can protect their families from the financial impact of an unexpected death, allowing them to focus on other aspects of their lives with peace of mind.

Strategies to Attract Customers for Life Insurance Policies

You may want to see also

Frequently asked questions

Millionaires are recognizing the value of life insurance as a strategic financial tool. It provides a means to protect and transfer wealth, ensuring financial security for their families and beneficiaries. With the potential to offer substantial death benefits, life insurance can be an effective way to secure assets and provide long-term financial stability.

For high-net-worth individuals, life insurance can serve multiple purposes. Firstly, it can be used to fund charitable giving, allowing them to leave a lasting impact on their communities. Secondly, it can help minimize estate taxes, ensuring that a larger portion of their wealth goes to their intended beneficiaries. Additionally, life insurance can provide liquidity to access funds quickly, which is crucial for managing assets and making strategic financial decisions.

Millionaires often prefer permanent life insurance policies, such as whole life or universal life insurance. These policies offer lifelong coverage and accumulate cash value over time, which can be borrowed against or withdrawn. The cash value can be utilized for various financial goals, providing flexibility and control. Additionally, they may opt for variable life insurance, allowing them to invest a portion of the death benefit in various investment options, potentially offering higher returns.

Yes, life insurance can provide tax benefits. The death benefit of a life insurance policy is generally paid out tax-free to the designated beneficiaries. Additionally, the premiums paid for certain types of life insurance policies may be deductible as a business expense, offering a potential tax advantage. Consulting with financial advisors and tax professionals is essential to understand the specific tax implications and structure the policy to maximize these benefits.