Insurance fraud is a widespread issue that costs Americans billions of dollars annually. It involves deliberate deception by or against an insurance company or agent for financial gain. This can include padding or inflating claims, misrepresenting facts on insurance applications, submitting claims for non-existent injuries or damage, and staging accidents. Fraudulent activities may be committed by organised criminals, professionals, or individuals. While individuals may create counterfeit documents or purchase coverage from fraudulent companies, insurance agents can also commit fraud by embezzling premiums or stealing customers' insurance payments. The cost of insurance fraud is significant, with estimates ranging from $40 billion to $308.6 billion per year in the United States.

| Characteristics | Values |

|---|---|

| Type of Fraud | Premium Diversion, Asset Diversion, Workers' Compensation Fraud, Disaster-Related Fraud, Auto Insurance Fraud, Healthcare Fraud, Workers' Compensation Fraud, Catastrophe-Related Property Fraud |

| Fraudster | Organized Criminals, Professionals and Technicians, Ordinary People |

| Fraudulent Activities | False or Exaggerated Claims, Misclassification of Damage, Misrepresenting Facts on an Insurance Application, Submitting Claims for Injuries or Damages that Never Occurred, Staging Accidents, Embezzlement of Insurance Premiums, Theft of Insurance Company Assets, Inflating Service Costs, Charging for Services Not Rendered, Counterfeit Vehicle Titles or Registration, Unbundling, Performing Excessive or Unnecessary Services, Kickbacks, Abuse and Resale of Legal Narcotics and Other Prescription Drugs, Medical Identity Theft, Unrecognized Drivers, Underestimated Mileage, False Garaging to Lower Premiums |

What You'll Learn

Fake car insurance cards

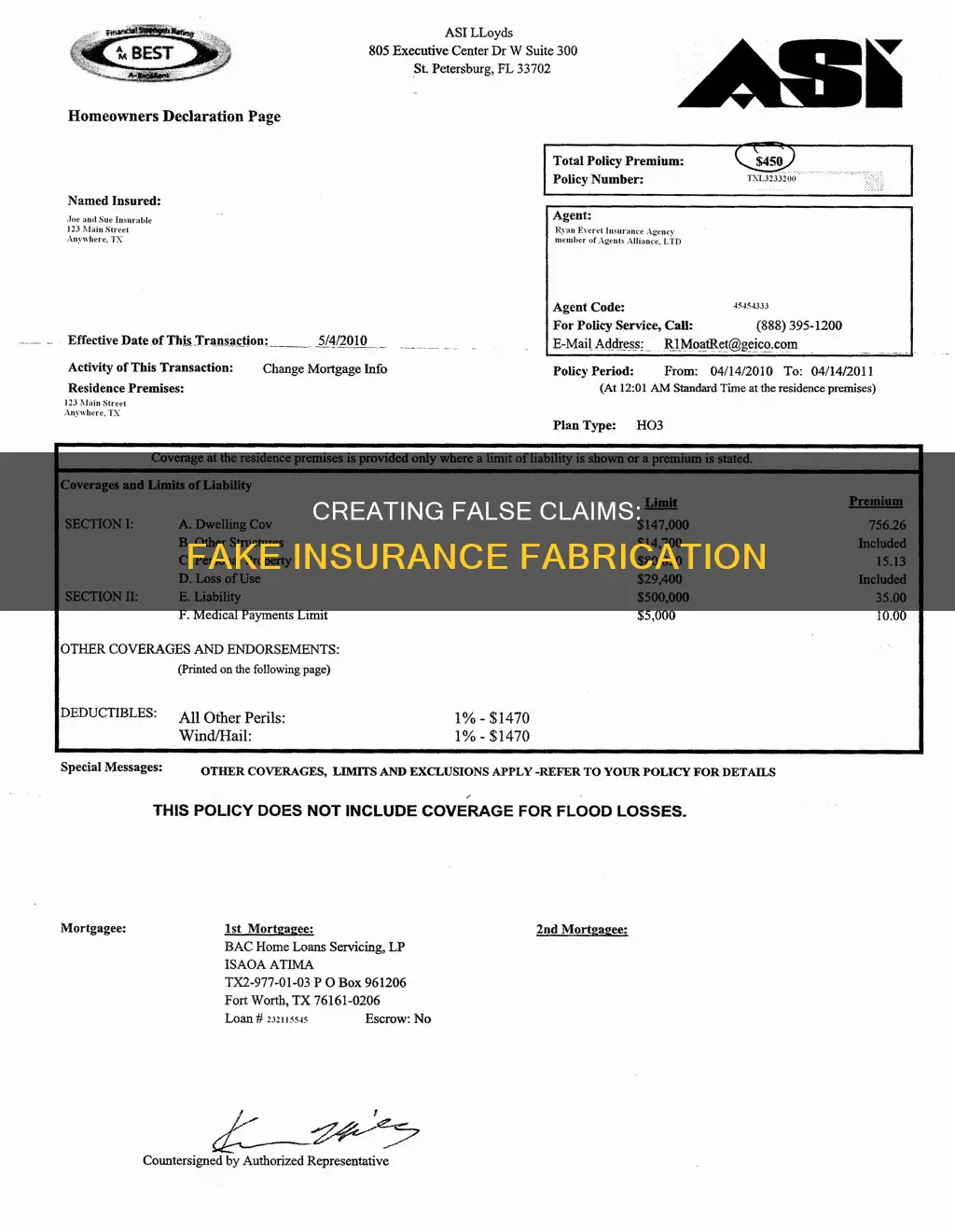

People who intentionally fake car insurance often take a DIY approach to create a false auto insurance card. This can seem like a quick solution for vehicle owners who need proof of insurance in a hurry or are looking to cut costs on auto coverage.

Unintentionally buying fake car insurance is also a common issue. Insurance fraud ranks as the second most expensive form of white-collar crime in the United States. Scammers can trick people into buying coverage by presenting themselves as legitimate insurance agents or companies, offering policies that appear valid.

How to Make a Fake Car Insurance Card

There are various websites that offer free insurance card templates. These can be edited and filled out online, and then printed or saved as a PDF. However, it is important to note that using a fake insurance card is illegal and can lead to serious legal consequences and fines.

The Intricacies of COIs: Navigating Insurance Terminology

You may want to see also

Premium diversion

In premium diversion, an insurance agent collects premiums from customers but fails to forward the money to the insurance company that underwrites the policy. Instead, the agent misappropriates the funds for their personal use. This fraud can be lucrative for unscrupulous agents, as evidenced by a case in Kansas, where an agent was convicted of insurance fraud and related charges, netting her over $100,000. The agent collected premiums but never obtained coverage for the customers or submitted premium payments to insurers.

Another common scheme involves selling insurance without a license, collecting premiums, and then failing to pay claims. This type of premium diversion occurs when an individual poses as an insurance agent and collects premium payments without providing any legitimate insurance coverage.

To carry out this fraud, an insurance agent might issue fake documents to make it appear that a customer has a valid policy when, in reality, no policy exists. Alternatively, the agent might accept premium payments for a legitimate policy but deposit them into their personal account instead of a business account. Customers typically make payments to the agent directly, rather than to the insurance company, and the money never reaches the insurer.

Policyholders may not realize they are victims of premium diversion until they attempt to file a claim. At this point, they discover that their policy was cancelled due to non-payment of premiums or that they never had coverage in the first place. Repeated stalling or excuses from the agent when asked for copies of the policy or other insurance documents can be a warning sign of potential premium fraud.

To avoid becoming a victim of premium diversion, customers should deal only with licensed insurance agents, keep detailed records of all discussions and promises made, and obtain all official documents associated with their coverage. Payments should be made directly to the insurance company, not to an individual agent, and customers should always request a receipt for their records. By staying vigilant and informed, policyholders can help protect themselves from the detrimental effects of premium diversion.

The Fluctuating Nature of Insurance Quotes: A Daily Change

You may want to see also

Asset diversion

The Federal Bureau of Investigation (FBI) identifies asset diversion as one of three fraudulent schemes that occur on the seller side of insurance fraud. The other two are premium diversion and fee churning. Asset diversion results in significant costs, with insurance fraud costing the average U.S. family between $400 and $700 per year in increased premiums.

Understanding Reinstatement in Insurance: A Comprehensive Guide

You may want to see also

False or exaggerated claims

False or exaggerated insurance claims are a deliberate attempt to deceive insurance providers with misleading or fabricated information to receive undeserved benefits. This can take the form of inflating the value of lost or stolen items, staging accidents, or submitting claims for incidents that never occurred.

Examples of False or Exaggerated Claims

- Exaggerated Loss or Damage: This involves inflating the value of lost or stolen items or the extent of damage to property to receive a higher claim payout. This deceptive practice increases the financial burden on insurance providers and contributes to rising premiums for all policyholders.

- Staged Accidents: Some scammers deliberately cause damage to vehicles or property or orchestrate accidents to make a claim. Such incidents, like arson, not only put innocent lives at risk but also result in higher insurance premiums for everyone due to increased payouts.

- False Personal Injury Claims: This involves fabricating or exaggerating the severity of injuries to claim compensation for medical expenses, lost wages, or pain and suffering. This type of fraud drains resources from insurance providers and undermines the fairness and trust of the insurance system.

- Identity Theft: Stealing someone's identity to file fraudulent insurance claims on their behalf causes financial harm to the victim and leads to tighter security measures and increased costs for all policyholders.

Detecting False or Exaggerated Claims

Insurance companies employ various methods to detect and prevent false or exaggerated claims:

- Analyzing Claims History: Submitting multiple claims or claiming significant losses can be red flags, triggering closer scrutiny of subsequent claims.

- Suspicious Loss Indicators: The National Insurance Crime Bureau (NICB) has developed a list of "suspicious loss indicators," such as a claimant who is unusually calm after submitting a large claim or one who adds or increases coverage shortly before submitting a claim.

- Private Investigators: Insurance companies may hire private investigators to stake out claimants and uncover fraud by researching their backgrounds, interviewing them and witnesses, and inspecting relevant sites.

- Special Investigation Units (SIUs): Many insurers have SIUs, comprising individuals with law enforcement, medical, or investigative backgrounds. They employ various techniques, such as burn pattern analyses, computer simulations, and vehicle damage assessments, to detect fraudulent claims.

- Social Media Monitoring: Insurance companies may scrutinize social media posts of claimants to identify inconsistencies or evidence of fraudulent behaviour.

- Cross-Checks: Insurers can identify fraud by cross-referencing claims within their database or using anti-fraud information systems like ISO ClaimSearch to detect patterns, such as multiple claims to the same address.

Preventing False or Exaggerated Claims

To prevent falling victim to false or exaggerated insurance claims, individuals should:

- Familiarize themselves with their insurance policy, understanding the coverage limits, exclusions, and legitimate claims filing requirements.

- Maintain diligent documentation of assets, valuable possessions, and policy documents to facilitate reference in case of disagreements or disputes.

- Report any suspicious activities or potential insurance scams immediately to insurance providers or relevant authorities to safeguard their interests and those of other policyholders.

- Stay informed about emerging patterns and trends in insurance fraud by following relevant topics online, such as "insurance fraud trends."

The Consequential Loss Conundrum: Unraveling the Complexities for a Safer Future

You may want to see also

Counterfeit parts

Counterfeit auto parts are a growing concern in the automotive industry. These fake parts are made to look authentic but are not produced by the original manufacturer, often compromising function and safety. They are frequently unreliable, impractical, and dangerous.

Fake auto parts can be found online, in auto parts stores, and even in the back alleys of certain markets. They are usually cheaper than genuine parts, but they will likely not last as long and could be hazardous if used in a vehicle. Counterfeit parts can cause significant damage to vehicles and lead to costly repairs. They can also lead to the failure of important components, such as brake pads and airbags, which can result in serious injury or death.

- Check for imperfections: Authentic auto parts should have a smooth, even finish with no visible imperfections. Cracks, dents, or other deformities indicate a fake part.

- Compare prices: If a seller is offering auto parts at a significantly lower price, it is likely a counterfeit.

- Check the packaging: Fake parts often come in poorly made packaging. Authentic parts typically have well-designed packaging with clear logos, labels, and other identifying marks.

- Research the seller: If buying online, research the seller by checking reviews, complaints, and other information.

- Look for warranty information: Counterfeit parts often do not have any warranty information.

To avoid counterfeit auto parts, it is crucial to only purchase from trusted and reputable sources, such as authorized dealers or authentic online stores. Additionally, verifying the parts with the manufacturer before buying is essential.

Navigating Insurance Options: A Guide to Changing Your Coverage When Turning 26

You may want to see also

Frequently asked questions

Fake insurance is a document, card, or electronic proof of insurance that isn't legitimate. It could be a counterfeit document or a policy purchased from a fraudulent insurance company.

Using fake insurance is illegal and can lead to legal and financial consequences. If caught, one could face penalties such as hefty fines, jail time, and trouble getting legitimate coverage in the future.

Insurance fraud is a significant problem, costing U.S. consumers billions of dollars annually. It affects various sectors, including healthcare, workers' compensation, and auto insurance.

Insurance fraud is committed by various individuals, including organized criminals, professionals who inflate service costs, and ordinary people looking to cover their deductibles or make a quick buck.

It's important to purchase insurance from reputable companies and be vigilant about reviewing bills, claims, and policies. Report any suspected fraud to the relevant authorities and insurance companies.