Understanding your insurance deductible is crucial for managing your financial responsibilities effectively. Your insurance deductible is the amount you pay out of pocket before your insurance coverage kicks in. Knowing your deductible is essential because it directly impacts your monthly premiums and the cost of any claims you may file. This knowledge empowers you to make informed decisions about your insurance coverage, ensuring you're prepared for potential expenses and avoiding unexpected financial burdens. Whether you're reviewing your current policy or considering new coverage, knowing your deductible is a key step in managing your insurance effectively.

| Characteristics | Values |

|---|---|

| Direct Communication with Insurer | Contact your insurance company directly. They can provide you with specific details about your policy, including the deductible amount. This is often the most accurate and reliable method. |

| Policy Documents | Review your insurance policy documents, which you should have received upon purchase. Deductibles are typically outlined in the policy's terms and conditions. |

| Online Account Access | Many insurance providers offer online account access, allowing you to view your policy details, including the deductible, from your personal account. |

| Agent or Broker | If you purchased your policy through an agent or broker, they can provide you with the deductible information as they have access to your policy documents. |

| Annual Review | Insurance policies may be reviewed annually, and changes to deductibles are often communicated during this process. |

| Notice of Change | In some cases, insurers might send a notice of change if there are adjustments to your deductible, especially if you've made changes to your policy. |

| Understanding Policy Types | Different types of insurance policies have varying structures. For instance, health insurance deductibles are separate from auto insurance deductibles. |

| Policy Number | Your policy number is unique and can be used to access your policy details, including the deductible, through the insurer's systems. |

| Online Resources | Insurance companies often provide online resources and FAQs that may include information about deductibles and how to find them. |

What You'll Learn

- Understanding Deductibles: Know what a deductible is and how it affects your insurance coverage

- Review Policy Documents: Deductibles are listed in your insurance policy, often in the summary or coverage details

- Contact Insurance Provider: Reach out to your insurance company for specific deductible information

- Understand Coverage Types: Different insurance types (health, auto, etc.) have varying deductible structures

- Estimate Potential Costs: Deductibles impact out-of-pocket expenses; understanding them helps in financial planning

Understanding Deductibles: Know what a deductible is and how it affects your insurance coverage

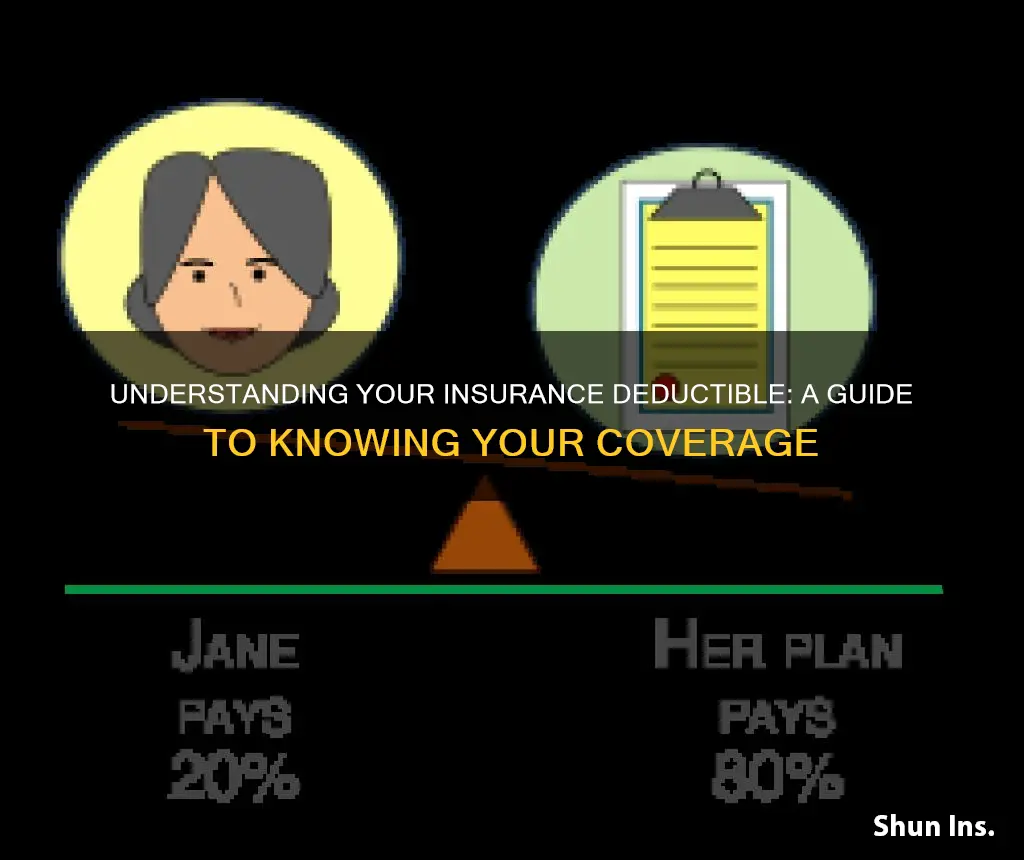

Understanding the concept of a deductible is crucial when it comes to insurance coverage, as it directly impacts the amount you'll pay out of pocket when filing a claim. A deductible is the initial amount you agree to pay when you file an insurance claim, and it is typically set at a specific value when you purchase your policy. This value is a key factor in determining your premium, as insurers often offer lower rates to those who agree to higher deductibles.

When you have a deductible, it means that you are responsible for covering the first portion of any claim, up to the specified amount. For example, if your policy has a $500 deductible and you file a claim for $3,000 in damages, you would pay the first $500, and the insurance company would cover the remaining $2,500. This arrangement encourages policyholders to be more cautious and potentially reduce the number of small claims, as they would need to pay the full deductible each time.

The deductible amount can vary widely depending on the type of insurance and your personal preferences. For instance, in health insurance, deductibles can range from a few hundred to several thousand dollars. In auto insurance, deductibles might be in the hundreds or thousands, depending on the coverage and the vehicle's value. Understanding your specific deductible is essential to managing your insurance effectively.

Knowing your deductible is important for several reasons. Firstly, it helps you budget for potential expenses. By being aware of the deductible, you can plan and save accordingly, ensuring that you can afford to pay the initial amount when a claim is filed. Secondly, it allows you to make informed decisions when choosing a policy. If you're considering multiple insurance providers, comparing deductibles can help you select a plan that aligns with your financial situation and risk tolerance.

In summary, a deductible is a fundamental aspect of insurance coverage, and understanding its implications is vital. It influences the cost of your premium and the amount you pay out of pocket when making a claim. By grasping the concept of deductibles, you can navigate the insurance process with more confidence and make informed choices to protect your financial well-being. Remember, knowing your deductible is the first step towards managing your insurance effectively and ensuring you're adequately covered when you need it most.

Billing Insurance for Shingrix: A Guide for Healthcare Providers

You may want to see also

Review Policy Documents: Deductibles are listed in your insurance policy, often in the summary or coverage details

When it comes to understanding your insurance deductible, one of the most straightforward ways is to review the policy documents. Insurance companies provide detailed information about their policies, and deductibles are a crucial part of this. These documents are designed to be accessible to policyholders and should contain all the necessary information about your coverage.

The policy document typically includes a summary of the insurance plan, which often highlights the key features and benefits. Within this summary, you will usually find a section dedicated to the coverage details. This section is where you can locate the information about your deductible. Deductibles are the amount of money you are responsible for paying out of pocket before the insurance coverage kicks in. It is a fixed amount that you agree to pay when making a claim.

In the coverage details section, look for a table or a list that outlines the various coverage options and their corresponding deductibles. This table will provide a clear picture of what you need to pay and when the insurance company will start covering the costs. The deductible amount is often listed next to the specific coverage type, making it easy to identify. For example, you might see something like "Auto Insurance: $500 deductible for comprehensive claims."

If you are unable to find the deductible information in the summary or coverage details, it is advisable to look for a separate document called the 'Policy Declaration Page' or 'Coverage Summary.' This document provides a concise overview of your insurance policy and is often included as an attachment or a separate page in the policy package. It is a quick reference guide that highlights the key terms and conditions, including the deductible amount.

Reviewing these policy documents is essential as it empowers you to make informed decisions and understand your financial responsibilities. Knowing your deductible ensures that you are prepared when making a claim and can help you manage your finances effectively. It is a critical aspect of insurance that policyholders should be aware of to ensure a smooth and efficient claims process.

Foreign Insurer: What Qualifies?

You may want to see also

Contact Insurance Provider: Reach out to your insurance company for specific deductible information

If you're unsure about your insurance deductible, the most direct way to find out is by contacting your insurance provider. Insurance companies are responsible for providing policyholders with clear and accurate information about their coverage, including deductibles. Here's a step-by-step guide on how to proceed:

First, gather your insurance documents. These typically include your policy statement, which outlines the terms and conditions of your insurance plan. Look for a section that mentions 'deductible' or 'deductibles' and provides specific amounts or a range of values. If you can't find this information in your documents, it's time to reach out to your insurance company.

Contacting your insurance provider is a straightforward process. You can usually find their customer service number on your policy documents or on their official website. When you call, be prepared to provide your personal details, such as your name, policy number, and contact information. Clearly state that you are inquiring about your insurance deductible and ask for the specific amount or any relevant details. Insurance companies often have dedicated teams to assist with policy-related inquiries, so you'll likely speak to someone who can provide the information you need.

If you prefer written communication, you can also send an email or letter to your insurance provider's customer service department. Include your policy details and specifically request the deductible information. This method might take a little longer to receive a response, but it is still an effective way to get the answers you're looking for.

Remember, insurance companies have a duty to ensure their policyholders are well-informed about their coverage. They should be able to provide you with the necessary details regarding your deductible. If you encounter any difficulties or have further questions, don't hesitate to ask for clarification or speak to a supervisor if needed. Knowing your deductible is crucial for managing your insurance claims and understanding your financial responsibilities.

Understanding Your Insurance Protection Class: A Guide to Knowing Your Coverage

You may want to see also

Understand Coverage Types: Different insurance types (health, auto, etc.) have varying deductible structures

Understanding the different types of insurance and their respective coverage structures is crucial when it comes to comprehending your insurance deductible. Deductibles can vary significantly across various insurance categories, such as health, auto, and homeowners insurance. Each type of insurance has its own unique deductible system, which directly impacts the amount you'll need to pay out of pocket before your insurance coverage kicks in.

For instance, in health insurance, deductibles are a common feature in many plans. When you have a health insurance policy with a deductible, you typically pay a set amount annually before the insurance company starts covering your medical expenses. This deductible amount can vary widely, ranging from a few hundred to several thousand dollars, depending on the plan you choose. Knowing your health insurance deductible is essential as it determines how much you'll pay for covered services until the deductible is met.

In contrast, auto insurance deductibles work differently. When you file a claim for an auto insurance policy, you'll often be asked to choose a deductible amount. This deductible is the portion of the repair or replacement cost that you agree to pay yourself before the insurance coverage applies. Higher deductibles usually result in lower premium costs, but they also mean you'll pay more out of pocket when making a claim. Understanding the relationship between deductibles and premiums is key to making informed decisions about your auto insurance coverage.

Homeowners or renters insurance also has its own deductible structure. In the event of a covered loss, you'll need to pay the deductible amount before the insurance company starts reimbursing you for the damage. The size of the deductible can vary, and it's important to choose a level that you can comfortably afford while still providing adequate coverage.

To ensure you have a clear understanding of your insurance deductibles, it's advisable to review your policy documents carefully. These documents will outline the specific deductible amounts for each type of coverage you have. Additionally, insurance providers often offer resources and tools to help policyholders understand their deductibles and the overall coverage structure. By educating yourself about these details, you can make more informed choices when managing your insurance policies.

Healthplans Insurance: Harvard Pilgrim Equivalent?

You may want to see also

Estimate Potential Costs: Deductibles impact out-of-pocket expenses; understanding them helps in financial planning

Understanding your insurance deductible is crucial for managing your financial obligations and making informed decisions about your healthcare or coverage. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. It directly impacts your out-of-pocket expenses and can significantly affect your overall healthcare costs. By estimating potential costs, you can better prepare for any unexpected medical expenses and ensure you have the necessary financial resources to cover them.

To estimate your potential costs, start by reviewing your insurance policy. Insurance companies provide detailed information about their coverage options and associated deductibles. Look for sections that outline the different coverage tiers and the corresponding deductibles. For example, a health insurance policy might offer various plans with different monthly premiums and deductibles. Understanding these options will help you choose a plan that aligns with your expected healthcare needs and financial situation.

Once you have identified the deductible amount, consider your past medical expenses and healthcare trends. Analyze your medical records and bills from the past year or two to estimate potential costs. Look for patterns in your healthcare utilization, such as frequent doctor visits, specialist consultations, or specific medical procedures. By understanding your typical healthcare spending, you can make more accurate estimates of future costs. For instance, if you tend to visit the emergency room frequently, a higher deductible might be more manageable, as you are likely to incur significant out-of-pocket expenses in that area.

Additionally, consider the potential impact of deductibles on your overall financial planning. Deductibles can influence your savings, investments, and retirement planning. A higher deductible may result in lower monthly premiums but could lead to higher out-of-pocket costs if you require extensive medical treatment. On the other hand, a lower deductible might provide more immediate financial relief but could increase your overall insurance costs. By evaluating your financial goals and risk tolerance, you can decide on a deductible that aligns with your long-term financial strategy.

In summary, estimating potential costs and understanding your insurance deductible is essential for effective financial planning. It allows you to anticipate out-of-pocket expenses, make informed choices about insurance coverage, and ensure you have the necessary funds to cover unexpected medical costs. By reviewing your policy, analyzing past expenses, and considering your financial goals, you can navigate the complexities of insurance deductibles with confidence and make the best decisions for your healthcare and financial well-being.

Get Bonded and Insured in Alberta: A Guide

You may want to see also

Frequently asked questions

Your insurance deductible is the amount you agree to pay out of pocket for covered expenses before your insurance policy kicks in and starts covering the costs. To find this information, you can review your insurance policy documents, which should outline the deductible amount for each type of coverage. If you're unsure, contact your insurance provider directly, as they can provide you with the specific deductible amount for your policy.

Yes, you can often find this information in your policy documents, which might be available online through your insurance provider's website or app. Look for sections related to your health insurance, auto insurance, or any other relevant coverage you have. If you can't locate the information, the policy documents will typically provide contact details for the insurance company, allowing you to reach out and request the details.

In such cases, you'll need to review each policy separately. Each insurance policy will have its own deductible amount, and it's essential to understand the terms of each policy to know what you're responsible for paying. You can organize your policies and create a summary to keep track of the different deductibles and their corresponding coverage.

Changing your deductible often requires a policy update, and this process varies depending on the insurance company and type of policy. Typically, you can adjust your deductible during the annual open enrollment period or when you renew your policy. However, increasing your deductible might result in lower premiums, while decreasing it could lead to higher premiums. It's a trade-off, and you should consider your financial situation and risk tolerance when making such decisions.