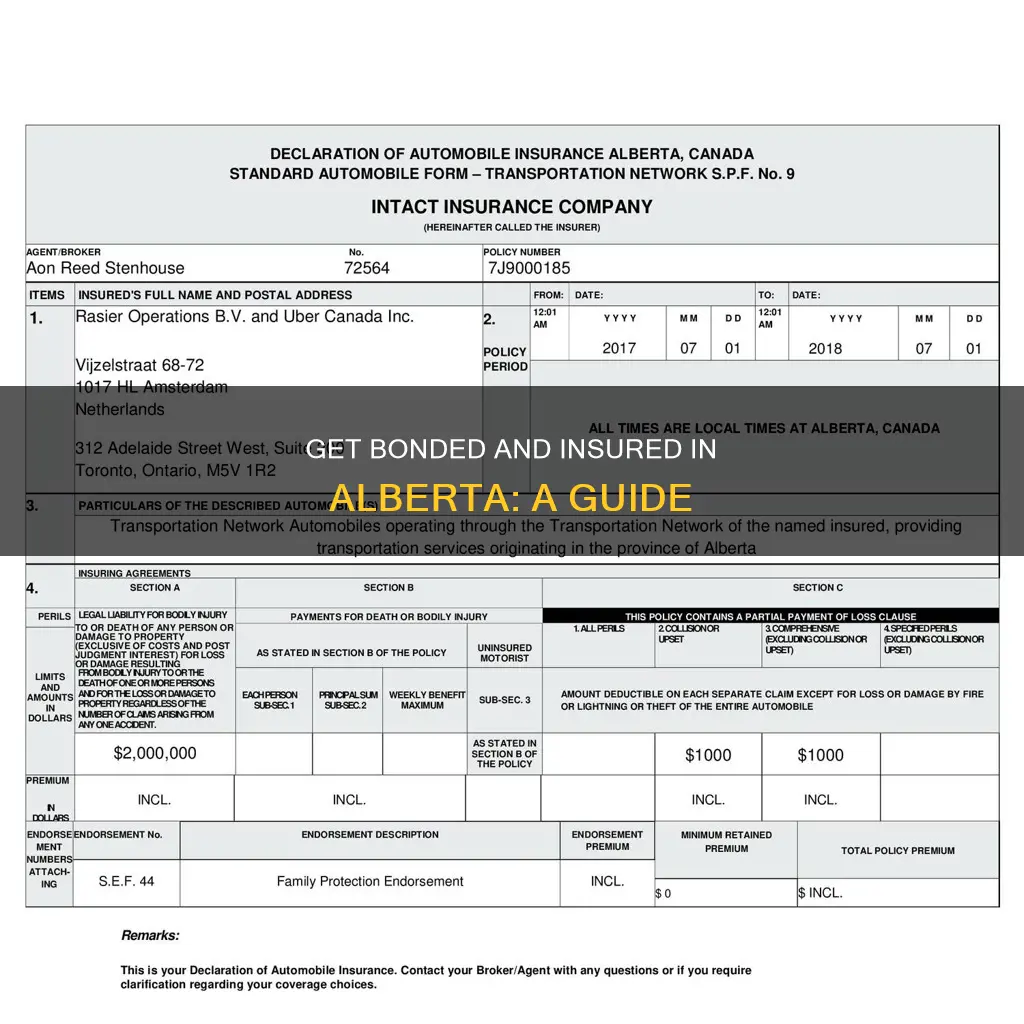

Getting bonded and insured in Alberta is a crucial step for businesses aiming to establish themselves in the province. Alberta's diverse economic sectors, including construction, mining, and importing and exporting, often require businesses to obtain surety bonds. While some bonds, like the General Surety Bond, are straightforward to obtain, others involve a more rigorous vetting process. This paragraph introduces the topic of how to become bonded and insured in Alberta, which is essential for businesses to demonstrate their credibility, protect themselves financially, and comply with legal requirements.

What You'll Learn

Understand the different types of bonds

There are several types of bonds available in Alberta, each serving a specific purpose and catering to different industries. Here is an overview of some common types of bonds:

Fidelity Bonds:

Fidelity bonds are a form of insurance that protects businesses from financial loss due to employee dishonesty or damage to a client's property. This type of bond is often purchased as part of an insurance package and provides coverage in the event of theft or incompetence by employees.

Contract Bonds:

Contract bonds, also known as surety bonds, protect clients from non-completion of a contract. If a contractor fails to fulfil their contractual obligations, the bond would compensate the client financially, allowing them to hire another contractor to finish the work. It's important to note that the insurer may seek reimbursement from the original contractor after paying out the bond.

License and Permit Surety Bonds:

These bonds are required by various government entities in Canada, including federal, provincial, and municipal bodies. Before obtaining certain licenses or permits, businesses often need to post a bond as a guarantee that they will adhere to the associated terms and conditions. The bond amount varies depending on the province and the specific license or permit being sought. Examples include auctioneer's licenses, brewer's bonds, spirit license bonds, and tobacco license bonds.

Court Bonds:

Court bonds are a type of surety bond that is used to satisfy legal requirements. They are often needed during legal proceedings to ensure compliance with court orders or to provide financial assurance in cases involving disputes or claims.

Construction/Contract Bonds:

These bonds are specifically designed for construction projects and are used to guarantee the performance and completion of construction contracts. They protect clients from financial loss if the contractor fails to fulfil their obligations.

Commercial Bonds:

Commercial bonds are used to comply with governmental or local province statutes and legislations. They are often required for businesses operating in specific industries or sectors, ensuring that they meet the necessary regulatory requirements.

General Surety Bond (Alberta Only):

The Alberta government has implemented a general surety bond to ensure that businesses within certain industries comply with various license requirements. This bond is applicable to debt repayment agencies, point-based contractors, and high-cost credit providers.

Electrical Contractor Bond:

This bond is required by electrical contractors in addition to their industry-specific license. It ensures compliance with safety standards and provides protection for clients in the event of any issues or disputes.

Fuel Tax Bond:

Any business selling fuel in Canada is required to obtain a fuel tax bond. This bond guarantees that the business will pay the relevant fuel taxes and protects the province and clients from financial loss due to tax evasion.

Motor Vehicle Dealer Bonds:

Motor Vehicle Dealer Bonds are necessary for car dealerships to protect their customers from misrepresentation or fraud. These bonds are not required in all Canadian territories, so it's important to check the specific requirements in your province.

The above list provides a comprehensive overview of the different types of bonds available in Alberta, each serving a unique purpose and catering to specific industries. It's important to assess your business needs and consult with a reputable broker to determine the most suitable type of bond for your situation.

Updating Insurance Details: A Guide to Changing Primary Insurance in Therabill

You may want to see also

Find a bond provider

Your current insurance provider is a good place to start looking for a bond provider. There are also several local insurance agents you can check with. You can search online for "surety bonds Alberta" or "fidelity bonds Alberta" and you'll be able to choose from several options. Try narrowing your search to your specific industry, for example, "pet sitting bonding".

You can also find specialty surety bond companies. You can also contact a surety bond broker, such as Bond Connect, to help you find a suitable bond provider.

Navigating the Billing Maze: Strategies to Ensure Hospital Charges Hit Insurance First

You may want to see also

Compare bond companies

When comparing bond companies in Alberta, it's important to consider several factors to ensure you select a reputable and reliable provider. Here are some key aspects to keep in mind:

- Types of Bonds Offered: Different industries have specific bonding requirements. For instance, construction companies typically need bid bonds, performance bonds, and payment bonds. Ensure the bond company offers the specific type of bond you need for your industry.

- Experience and Expertise: Opt for a bond company with extensive experience in the Alberta market and a deep understanding of the unique risks and challenges faced by businesses in the province. This expertise will ensure they can guide you effectively through the bonding process.

- Reputation and Track Record: Look for a bond company with a strong reputation and a proven history of providing reliable and responsive service to its clients. Check reviews, testimonials, and client feedback to gauge their level of client satisfaction.

- Financial Stability: Choose a financially stable bond company that is capable of providing the necessary financial guarantees. Assess their financial strength and stability to ensure they can back your projects or contracts effectively.

- Customer Service and Support: Select a bond company that prioritizes customer service and is committed to helping you navigate the bonding process. They should be responsive, communicative, and dedicated to protecting your interests.

- Competitive Pricing: Compare the pricing and rates offered by different bond companies. While cost should not be the sole deciding factor, it is important to ensure you are getting good value for your money.

- Customization and Flexibility: Look for a bond company that can tailor their services to your specific needs. They should understand your business and industry to provide customized bonding solutions.

- Claims Handling: Inquire about the bond company's claims handling process. Choose a company with a smooth and efficient claims procedure, ensuring timely assistance when you need it.

- Industry Specialization: Depending on your industry, consider selecting a bond company that specializes in serving your sector. For example, if you are in the construction industry, opt for a company with expertise in construction surety bonds.

- Broker Relationships: Some bond companies work with brokers who can provide additional guidance and ensure compliance with Alberta's bonding regulations. Consider whether you would benefit from working with a broker and factor this into your decision.

Remember to do your due diligence when comparing bond companies. Research their reputation, financial stability, and ability to meet your specific bonding requirements. By considering these factors, you can make an informed decision and select a bond company that best aligns with your business needs in Alberta.

Switching Lanes: Navigating the Account Change Process with Progressive Insurance

You may want to see also

Apply for a bond

To apply for a bond, you must first ensure that you need a surety bond and that you qualify for one. A surety bond is a type of agreement often used between contractors and their clients. It consists of three parties: the principal (the contractor), the obligee (the contractor's client), and the surety, which is the company that underwrites the bond agreement.

To qualify for a surety bond, your business's financial stability will be inspected. This includes your assets, cash flow, and credit history. Your company's integrity will also be assessed by contacting your business associates, such as suppliers and customers. Additionally, the surety will evaluate your company's longevity and capacity to ensure you do not contract more work than you can handle.

Once you have confirmed that you need and qualify for a surety bond, you can follow these steps to apply:

- Choose a surety bond company that specializes in your industry or contract size. Compare their credit ratings, turnaround times, and rates.

- Get a quote from the bond company, usually for free or a small fee.

- Apply for the bond using the bonding company's form, providing information about your business and specifying the amount of bonding needed.

- Sign a credit release agreement.

- Upon approval, sign the indemnity agreement, which governs what the surety is and isn't liable for. You will typically pay your premium at this stage.

- Sign the bond agreement and send it to your client (the obligee) for approval. Work can begin once the agreement is approved.

It is important to note that the bonding process may vary slightly depending on the type of bond and the requirements of the specific surety bond company.

Understanding Insurance Billing with Quest Diagnostics: A Guide to Navigating the Process

You may want to see also

Sign the indemnity agreement

To become bonded and insured in Alberta, Canada, you must follow several steps, including finding a bond provider, filling out an application, and signing an indemnity agreement. This paragraph will focus specifically on the importance of signing the indemnity agreement and what it entails.

An indemnity agreement is a crucial aspect of obtaining bonding insurance, as it outlines the rights and obligations of both parties in the event of a claim. This agreement serves to protect your business from potential losses caused by theft or incompetence. For example, if you operate a pet-sitting business and an employee's actions result in damage to a client's property, your bonding insurance would cover the cost of the damage through the indemnity agreement.

When signing the indemnity agreement, it is essential to carefully review the terms and ensure you understand the procedures for filing and processing a claim. The agreement should specify the acts or damages that the bonding insurance will cover, as well as any exclusions or limitations. Additionally, be mindful of the period of indemnity, which refers to the specific length of time for which the payment is valid.

Indemnity agreements typically work in one or both of the following ways:

- Protecting the insured party from any liability arising from third-party claims.

- Preventing the indemnitor (the insurer) from making any claim against the insured party.

By signing the indemnity agreement, you are transferring the risk of financial loss from your business to the bonding company, providing your business with essential protection and peace of mind.

It is worth noting that indemnity agreements are complex business contracts, and it is always recommended to seek legal advice to ensure you fully understand the terms and conditions of the agreement before signing.

Unraveling the Meaning of 'CV' in Insurance Jargon

You may want to see also

Frequently asked questions

Being bonded means purchasing a surety bond, which acts as a guarantee from a bonding company that a business will fulfil its contractual obligations. Being insured means purchasing an insurance policy that protects against loss.

Being bonded and insured gives customers confidence that the business is reputable and trustworthy. It also protects the business against potential losses caused by theft or incompetence.

First, ensure that you need a surety bond and that you qualify for one. Then, select a reputable surety bond broker and fill out a bond application. After that, sign the indemnity agreement, then sign the bond agreement and send it to your client.

You can start by contacting your current insurer to see if they can provide the insurance you need. If not, you can reach out to other insurance agents or search online. Once you've found a provider, you'll need to fill out an application form and pay the premium.

The cost of being bonded and insured will depend on various factors, such as the type of bond or insurance, the amount of coverage, the number of employees, and the business's financial position.