Life insurance is a valuable asset for people of all ages and backgrounds. To qualify for life insurance, applicants must submit to a review of their medical and lifestyle information. The application process involves filling out paperwork, taking a medical exam, and providing health histories for the applicant and their immediate family. The application will also ask for basic information such as name, address, occupation, and employer, as well as financial information, including annual income and net worth. The lower the risk presented to the insurer, the lower the premiums will be. While it is easier for young, healthy people to obtain life insurance at an affordable rate, there are many different types of policies, so it is possible to qualify for life insurance regardless of one's life stage.

| Characteristics | Values |

|---|---|

| Age | Younger people are more likely to get life insurance at an affordable rate. |

| Health | The healthier you are, the more likely you are to be approved for a policy at a better rate. |

| Habits | Smoking, drinking, drug use, and dangerous hobbies like skydiving can increase your premium. |

| Family health history | Certain diseases among family members can affect your life expectancy and, therefore, your premium. |

| Occupation | High-risk occupations, such as military service, can make it more difficult to get life insurance. |

| Financial situation | A criminal record, bankruptcy, or high debt can impact your ability to qualify for life insurance. |

| Driving record | Multiple moving violations can increase your premium. |

Medical history

When applying for life insurance, you will be required to provide your medical history. This is because insurance companies want to know how likely it is that you will die while you're covered. They will evaluate your risk of death and assign a cost to the policy accordingly. The younger and healthier you are, the lower the premiums will be.

During the medical exam, a paramedical will ask about your medical history, including any medical conditions, surgeries, and prescription medications. They will also ask about your family's medical history. Basic samples such as blood and urine may be collected to carry out tests for HIV and diabetes.

It is important to be completely honest about your medical history and current lifestyle. Lying on your life insurance application can lead to a denial of your application or a denial of benefits later on. Policies typically start with a life insurance ""contestability period" of one to two years, during which the insurance company can investigate and verify an applicant's claims if the insured dies. If the insurance company discovers any omissions or falsehoods, they may deny or reduce the beneficiary's death benefit.

Trusts: The Best Life Insurance Beneficiary Option?

You may want to see also

Family medical history

When applying for life insurance, you will be asked to provide details about your family's medical history. This is because certain medical conditions are genetic, and understanding your family history helps the insurer to understand your overall health and longevity. Insurers will be looking to identify whether there is a strong pattern of mortality, or in other words, whether multiple family members have experienced similar severe, genetic health issues, particularly at a young age.

Insurers will be particularly interested in your immediate family's health history, including your biological parents and siblings. They will want to know about any history of illness in your family that could be hereditary, such as certain types of cancer, neurological conditions, and other genetic conditions. For example, if your mother and sister have both had breast cancer, the insurer will want to learn more about your family's health history.

If you don't know your family's medical history, don't worry. You won't be penalised for this, and your family's medical history simply won't be included in your health profile. However, if you do know your family's medical history, it's important to be completely honest about it. Failing to disclose relevant information or lying on your application form could invalidate your policy.

While your family's medical history is a factor in determining the cost of your life insurance, it is not the most important factor. Your personal health profile and age are considered to be more significant.

Life Insurance: Injury Coverage and its Limits Explained

You may want to see also

Lifestyle choices

Smoking:

Smoking is a major lifestyle factor that can affect your life insurance qualification. Smokers are considered high-risk individuals due to the numerous health issues associated with smoking. Life insurance companies typically charge smokers higher premiums, sometimes even more than twice the rate of non-smokers. Even occasional smoking or vaping can result in higher premiums or classification as a smoker. It is important to be honest about your smoking habits, as lying on your application can lead to policy cancellation.

Dangerous hobbies and occupations:

Engaging in dangerous hobbies, such as racing cars, scuba diving, or rock climbing, can significantly increase your insurance premiums. Similarly, if you work in a high-risk occupation, such as a police officer or a miner, you may be subject to higher rates. Life insurance companies assess the risk associated with your hobbies and occupation, which can impact your qualification and premium amount.

Health and medical history:

Your current health and medical history are crucial factors in determining your eligibility for life insurance. Pre-existing conditions, such as cancer, heart disease, or diabetes, can make it more challenging to qualify for life insurance and may result in higher premiums. It is important to manage serious health conditions and make positive lifestyle changes before applying for life insurance to improve your chances of qualification and secure more favorable rates.

Driving record:

Your driving record is also taken into consideration when evaluating your lifestyle choices. A history of moving violations, drunk driving, or multiple accidents can dramatically increase your life insurance premiums. However, improving your driving habits over time can lead to more favorable rates.

Age and gender:

While age and gender are not exactly lifestyle choices, they are worth mentioning as they fall under the broader category of factors that insurance companies consider when assessing your lifestyle. Age is a critical factor, as the younger you are, the lower your premiums will be. Life insurance becomes more expensive as you get older, and you may even reach an age where you no longer qualify for certain policies. Regarding gender, women generally pay lower premiums than men because they have a higher life expectancy.

Life Insurance and Medi-Cal: How Does Eligibility Work?

You may want to see also

Age

Most insurance companies have a maximum age at which they will issue a policy, with this maximum age tending to be around 65. The older you are, the more expensive your premiums will be, as the insurer potentially has fewer years to collect your premium payments and will have to pay out the policy sooner.

Additionally, age can also impact the type of policy you are eligible for. For example, term life insurance only covers a set period of time, while permanent life insurance provides coverage for your entire life. If you are older, you may find that term life insurance is not a suitable option, as the policy may expire before you pass away.

It is important to note that age is not the only factor considered by insurers. Your health, lifestyle choices, occupation, and financial situation will also play a role in determining your eligibility and premium costs.

In conclusion, while age is a significant factor in qualifying for life insurance, it is not the only consideration, and it is still possible to obtain coverage at any stage of life, albeit with potential adjustments to the type of policy and premium costs.

Life Insurance: Pyramid Scheme or Legit Business?

You may want to see also

Dangerous hobbies

To qualify for life insurance, you need to first apply. The application process involves filling out paperwork, taking a medical exam, and providing health histories for yourself and your immediate family. The younger and healthier you are, the lower your premiums will be.

During the application process, you will be asked about your lifestyle habits, including any risky hobbies. Some dangerous hobbies that can affect your life insurance include:

- Aviation sports: Paragliding, base jumping, and skydiving are considered high-risk due to the risk of airplane malfunction, parachute failure, collisions, and botched landings.

- Scuba diving: Equipment malfunctions, drowning, and decompression sickness contribute to the risk of this hobby. Frequent dives and diving alone can also increase your risk profile.

- Rock climbing: Climbing in rough terrains and at high altitudes increases the risk of falling and can affect your life insurance rates.

- Skiing: Backcountry and heli-skiing are considered high-risk due to the increased risk of accidents.

- Racing: Car and motorcycle racing are dangerous hobbies that can lead to higher life insurance rates. The level of experience, frequency of racing, and car structure are factors that insurers consider.

It is important to be honest about your dangerous hobbies when applying for life insurance. Failing to disclose them can result in denial of coverage or benefits. Additionally, certain high-risk hobbies may require additional coverage or riders to be included in your policy.

Life Insurance: Money Pit or Smart Investment?

You may want to see also

Frequently asked questions

Life insurance companies use a process called underwriting to determine your risk of dying. They will ask for information on your health, habits, and family history. They will also want to know if you have any pre-existing conditions, a high-risk occupation, or dangerous habits.

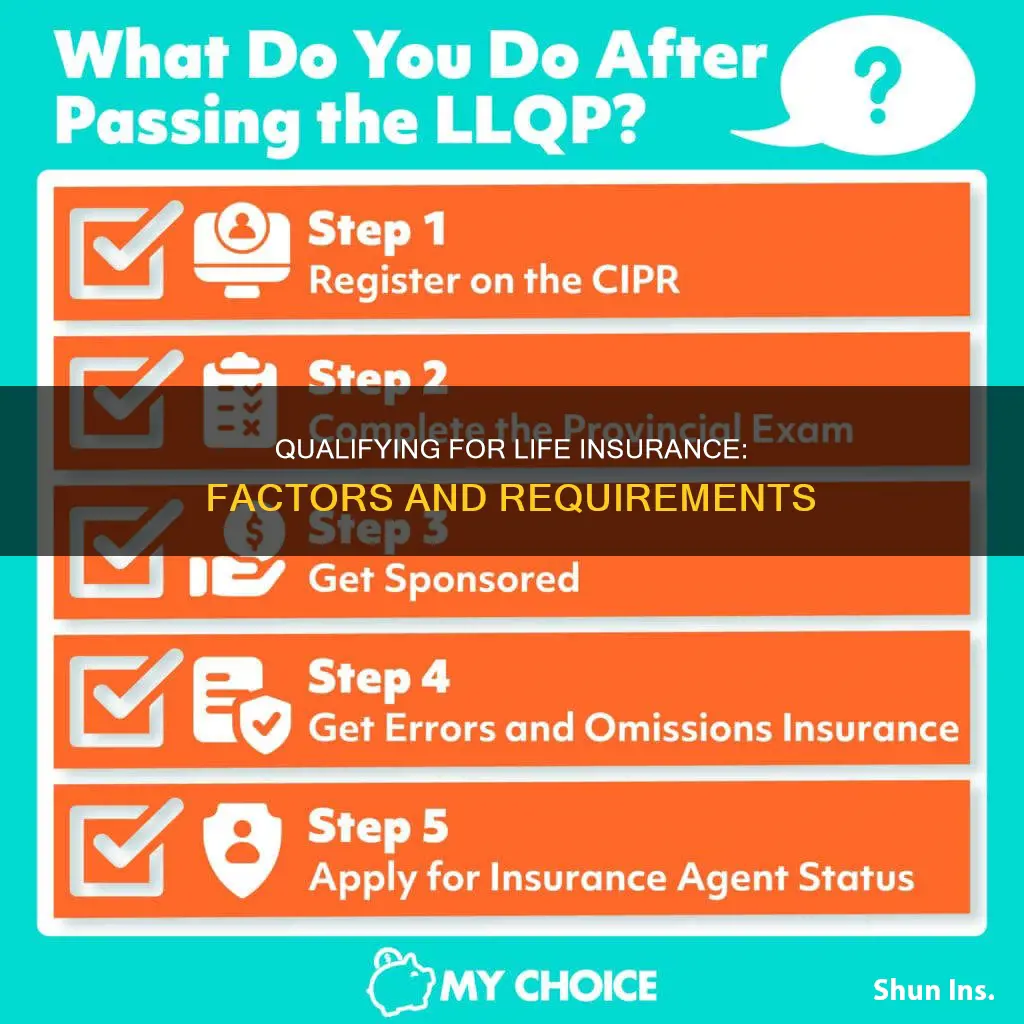

The application process involves filling out paperwork, taking a medical exam, and providing health histories for you and your immediate family. The application will ask for basic information such as your name, address, occupation, and employer, as well as lifestyle habits, health history, and financial information.

The first step is to fill out an application and answer all questions honestly. The second step is to undergo a physical exam, which may include a review of your medical history, family medical history, and habits. The third step is to pay the premium for your desired policy.

If you don't qualify for life insurance, it may be due to pre-existing conditions, a high-risk occupation, or dangerous habits. You may still be able to get life insurance by paying a higher premium, but there may be a limit on the amount of coverage you can get. It's important to shop around and compare rates from different companies.

To get the best rates, it's important to be in good health, don't smoke, and avoid high-risk hobbies such as skydiving. You can also reduce your premium by making lifestyle changes such as quitting smoking, losing weight, reducing alcohol intake, and improving your driving record.