American Family Insurance and Farmers Insurance Group are two of the most popular insurance providers in the United States. Both companies offer auto, commercial, home, life, motorcycle, RV, and umbrella insurance. However, American Family also offers additional insurance products, including condo, farm, health, and renters insurance. When it comes to cost, American Family is generally cheaper than Farmers, with lower average monthly rates and annual premiums for different age groups. American Family also offers a wider range of discounts, while Farmers stands out for its various discount options and larger market share. Both companies have solid financial standings and are known for their excellent customer service.

Customer satisfaction

American Family scored 14 percentile points ahead of Farmers in customer satisfaction surveys, indicating their commitment to delivering exceptional service and products. The company's focus on building personal relationships with customers has resonated well, and they are renowned for their industry-leading service and exceptional claims experience.

American Family also offers a wide range of discounts, including claims-free pricing, generational discounts, and good student discounts, making their policies even more attractive and affordable for customers. Their MyAmFam app is highly rated for its ease of use and convenience in managing insurance policies.

Farmers Insurance, on the other hand, stands out for its various discounts and extensive coverage options. They have been recognised for their highly-rated customer service and have a strong presence with nationwide availability. Farmers also provides valuable add-ons, such as their Roadside Assistance program, which offers essential services like towing, locksmith assistance, and fuel delivery for a reasonable price.

Both American Family and Farmers Insurance excel in different aspects of customer satisfaction. While American Family takes the lead in overall satisfaction and discount options, Farmers shines with its broad coverage choices and valuable add-ons, ensuring that customers can find the right fit for their specific needs.

The Impact of Driver's Ed on Insurance Rates: A Farmer's Perspective

You may want to see also

Discounts

American Family Insurance Discounts:

- Bundling Discounts: Customers who bundle their auto and home insurance policies can save up to 23% on both policies. Those who bundle their auto and renters insurance can save up to 5%.

- Multi-Product Discount: Save by purchasing multiple types of insurance, such as auto, home, renters, life, etc.

- Multi-Vehicle Discount: Insuring more than one vehicle on the same policy can lead to reduced premiums.

- Loyalty Discount: Long-time customers are rewarded with a discount based on their tenure with American Family.

- Safe Driving Discounts: These include the KnowYourDrive discount, which offers up to a 20% discount for allowing the company to track your driving habits, as well as discounts for good driving records, factory-installed safety equipment, and completing defensive driving courses.

- Young Driver Discounts: Families with teen drivers can benefit from various discounts, such as the Teen Safe Driver program, good student discounts, and volunteer work discounts.

- Billing Discounts: Customers can save by enrolling in automatic funds transfer, paying their premium in full, or choosing paperless billing.

- Other Discounts: American Family also offers discounts for renovated homes, generational discounts, low mileage, and more.

Farmers Insurance Discounts:

- Bundling Discounts: Farmers offers a variety of bundling options, including home and auto, auto and renters, and multiple lines of insurance, which can lead to significant savings.

- Multi-Line Discount: Save by purchasing multiple types of insurance, such as auto, home, life, umbrella, small business, etc.

- Multi-Car Discount: Insuring more than one vehicle on the same policy can result in a discount.

- Safe Driver Discounts: Farmers offers a safe driver discount, as well as discounts for completing a defensive driving course, having no bodily injury points, and maintaining safe driving habits.

- Young Driver Discounts: Farmers has discounts for distant students, good students, youthful drivers, and drivers who are on their own policy.

- Vehicle Discounts: Discounts are available for alternative fuel vehicles, anti-lock brakes, anti-theft devices, passive restraints, homing devices, VIN etching, and daytime running lights.

- Other Discounts: Farmers also offers discounts for affinity groups, military personnel, good payers, homeowners, and more.

Both American Family and Farmers Insurance provide numerous opportunities for customers to save money through discounts. It's important to note that discount availability and eligibility may vary by state and policy terms, so it's always a good idea to check with the insurance company directly to see which discounts you qualify for.

The Six-Month Insurance Premium Shift: What Farmers Need to Know

You may want to see also

Types of insurance

When it comes to types of insurance, Farmers beats American Family. Both companies offer auto, commercial, home, life, motorcycle, RV, and umbrella insurance. However, Farmers offers additional types of insurance, including mobile/manufactured homes, earthquake and flood policies. American Family also offers condo, farm, health, and renters insurance.

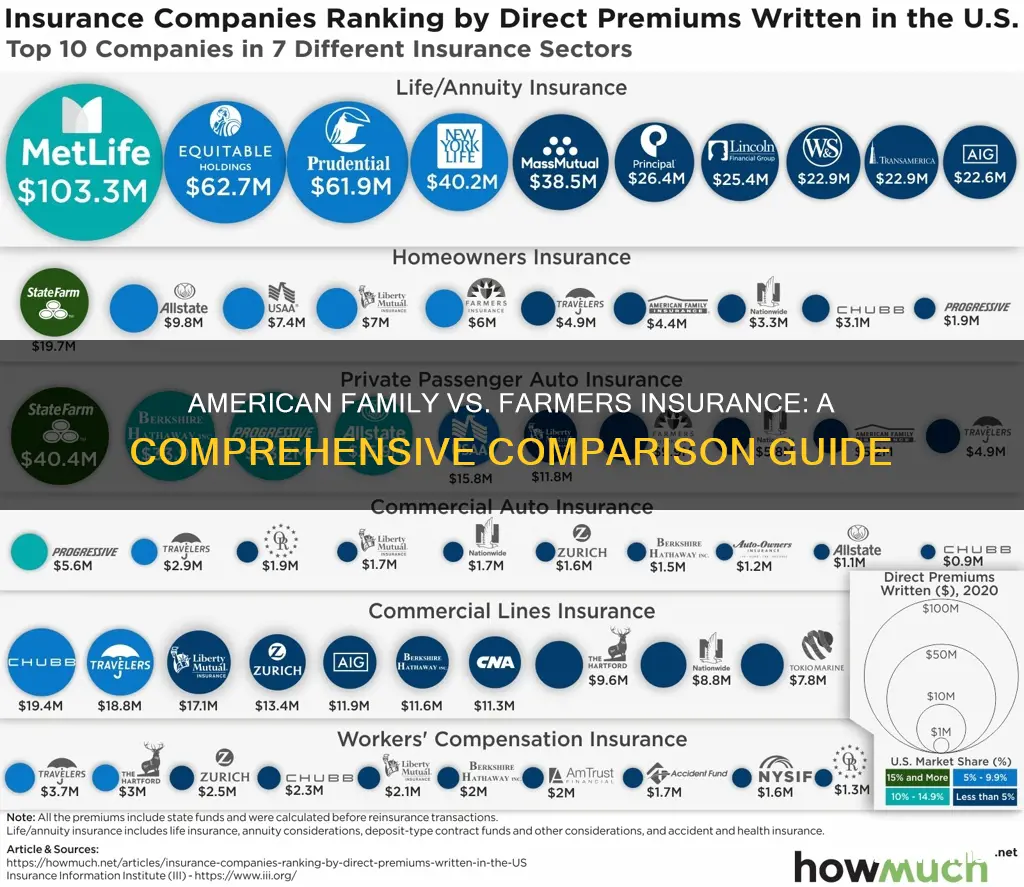

Both companies are among the nation's top auto insurance companies, but Farmers is a larger insurer by market share, meaning it has more resources. Farmers also has higher premiums than American Family. For example, a minimum-coverage policy for a good driver in Illinois costs an average of $3,204 per year from Farmers and $1,290 per year from American Family.

In terms of customer satisfaction, American Family scored 14 percentile points ahead of Farmers. American Family is also cheaper than Farmers for different age groups, including teens, young adults, the average driver, and seniors.

Cattle Conundrum: Unraveling Insurance Options for Farmers

You may want to see also

Cost

When it comes to cost, American Family is the cheaper option compared to Farmers Insurance. WalletHub's data shows that a minimum-coverage policy for a good driver in Illinois costs an average of $3,204 per year from Farmers and $1,290 per year from American Family. This is a significant difference in pricing between the two companies.

On average, Farmers charges approximately $262.63 per month, while American Family comes in at around $213.55 per month. The cheapest state average for Farmers is Ohio at $147.70 per month, while the most expensive is Michigan at $371.78 per month. For American Family, the cheapest state average is Ohio at $95.35 per month, and the most expensive is Illinois at $331.26 per month.

American Family also offers cheaper rates for teen drivers. Their average annual rates are $2,708 less than Farmers'. American Family is also a better choice for drivers with a ticket on their record, as Farmers penalizes drivers with a ticket by nearly 13% more than American Family.

In terms of credit scores, if you have extremely bad credit, American Family is the more cost-effective option. They offer cheaper premiums than Farmers for prospective clients with credit scores of 579 or less.

Both companies offer discounts, but American Family has better discounts overall, making it a more attractive option if price is a concern. American Family offers a wide range of discounts, including claims-free pricing, generational discounts, and good student discounts. Farmers also has unique discounts that American Family doesn't, such as transfer, teen driver, and pay-in-full discounts.

Overall, American Family beats Farmers when it comes to cost. They offer cheaper rates across various categories, including age groups, driving records, and credit scores.

The Digital Farm: Exploring the Need for Cyber Insurance in Agriculture

You may want to see also

Geographical coverage

On the other hand, Farmers Insurance offers its products and services across the United States, with coverage available in around 42 states. However, it is important to note that Farmers Insurance no longer writes new policies in Florida as of July 2023.

Both companies provide nationwide availability, but Farmers Insurance has a more extensive reach compared to American Family Insurance. This broader geographical coverage may be advantageous for customers who frequently travel or move between states, as it ensures continuous coverage across a wider range of locations.

Farmers Insurance Coverage in the Pacific Northwest: Exploring Policies in Washington and Idaho

You may want to see also

Frequently asked questions

American Family scored 14 percentile points ahead of Farmers in customer satisfaction. WalletHub gave American Family 4.3 out of 5 stars, while Farmers received 3 out of 5 stars.

On average, Farmers charges approximately $262.63 per month, while American Family charges around $213.55 per month.

American Family offers condo, farm, health, and renters insurance, which Farmers does not.