Moving from DC to New York will likely result in changes to your insurance. If you are moving out of state, you will need to obtain a new insurance policy as every state has different coverage requirements and regulations. In addition, you will need to register your vehicle in New York and obtain New York insurance coverage. You cannot keep your DC insurance coverage or have out-of-state insurance for a vehicle registered in New York.

Your insurance rates may also be impacted by the move. Rates are based in part on the claims history of an area, so a move to a new location with fewer thefts, break-ins, and accidents could result in lower rates. Conversely, moving to a large metropolitan area with higher theft and vandalism rates could increase your insurance costs.

| Characteristics | Values |

|---|---|

| Car insurance | If your current provider does not sell insurance in New York, you will have to change insurance companies. |

| Your move will impact your car insurance rate. Rates are partially based on an area's claims history, so your rate may increase or decrease depending on the claims history of your new area. | |

| You will need a new car insurance policy, even if you can stay with the same insurer. | |

| You will have to register your vehicle in New York. | |

| Health insurance | You will need to start a new Marketplace application and enroll in a new plan in New York. |

What You'll Learn

Car insurance rates in New York

When moving from DC to New York, you will need to change your car insurance provider as rates differ between states. Your new car insurance rate will be influenced by several factors, including the claims history of your new area, your annual mileage, and commuting distance.

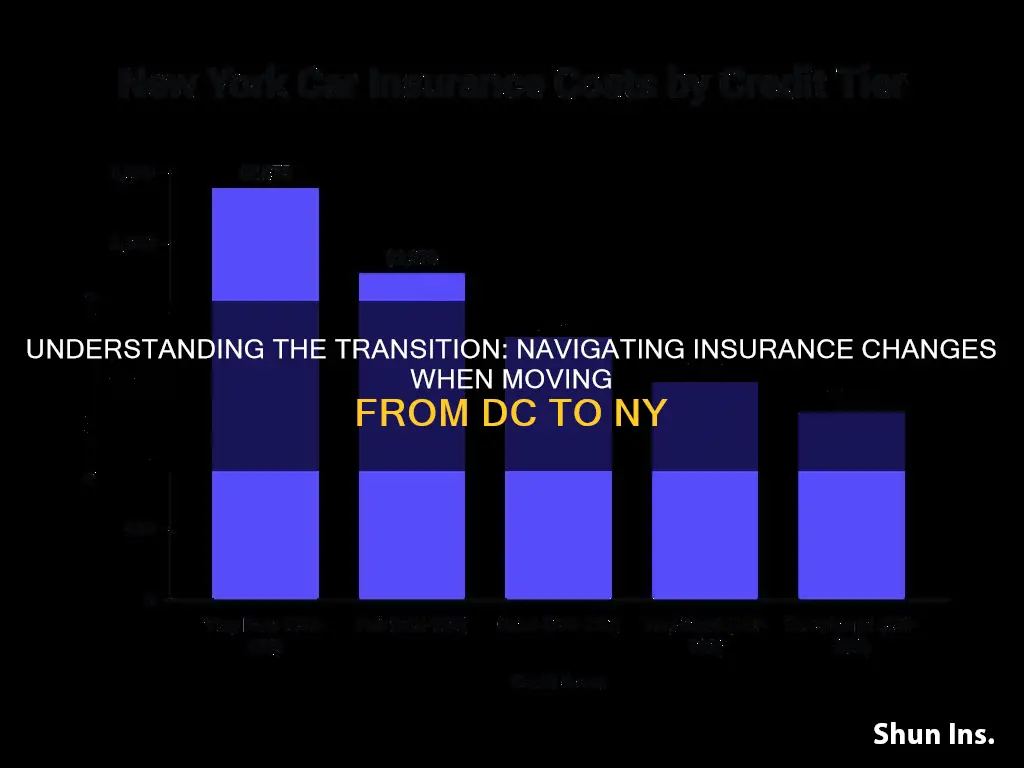

The average cost of car insurance in New York is $88 per month or $1,059 per year for minimum liability insurance. For full coverage, the average cost is $169 per month or $2,030 per year. However, these rates can vary depending on your age, gender, marital status, credit score, and driving record. For example, a 16-year-old driver in New York pays an average of $5,370 per year for car insurance, while a driver in their 50s pays only $1,347 per year.

When choosing a car insurance company in New York, it is important to compare quotes from multiple providers and consider factors such as coverage options, customer service, and convenience. Progressive is often cited as the cheapest car insurance company in New York, offering minimum coverage for $52 per month and full coverage for $94 per month. Other companies with competitive rates include Erie, GEICO, and NYCM.

Policybazaar's Term Insurance: A Safe Bet for Long-Term Financial Security?

You may want to see also

Health insurance options in New York

Health insurance is designed to protect you from substantial medical costs. The cost of health insurance in New York is higher than the national average, so it's important to find a plan that suits your needs and budget.

There are five different tier levels of health insurance in New York: Catastrophic, Bronze, Silver, Gold, and Platinum. Each level has a distinct monthly premium and out-of-pocket expenses.

Catastrophic

A Catastrophic plan is a high-deductible, low-cost option that covers you in a serious health crisis or emergency. To qualify, you must be under 30 or have an approved hardship exemption. Catastrophic plans are not eligible for premium tax credits.

Bronze

Bronze plans feature low monthly payments with higher deductibles. They are best for individuals or couples with few doctor visits who only need coverage for emergencies.

Silver

Silver plans have average monthly payments and lower deductibles than Bronze plans. They are ideal for individuals and smaller families with average healthcare needs. Silver plans also offer cost reductions for those who qualify.

Gold

Gold plans have higher monthly payments and lower deductibles than Silver plans. They are best for individuals or families with regular, ongoing healthcare needs. Gold plans cover most routine healthcare costs.

Platinum

Platinum plans offer the most comprehensive coverage with the highest premiums but the lowest out-of-pocket costs. They are perfect for those with extensive healthcare requirements.

Public Health Insurance Plans

Public health insurance plans are free or low-cost and include Medicaid, Child Health Plus, and the Essential Plan. These plans can be enrolled in at any time of the year and must be renewed annually.

Private Health Insurance Plans

Private health insurance plans, also known as Qualified Health Plans, are available on the New York health insurance marketplace, the NY State of Health Marketplace. These plans can be purchased directly from an insurance company, but financial assistance is not available if you buy outside the marketplace.

Other Options

If you do not qualify for public health insurance or cannot afford a private plan, there are other options:

- NYC Care: A healthcare program that provides low- and no-cost health services.

- Short-term insurance plans: Offer limited coverage at affordable prices and can start in a few days.

- Dental and Vision Insurance Plans: Cover routine dental and vision care and may reduce costs for contact lenses or glasses.

- Medicare Insurance Plans: Part A covers hospital expenses, while Part B provides outpatient care for a reasonable monthly premium.

Enrollment Periods

For private health insurance plans, New Yorkers can enroll or change their coverage during the open enrollment period from November 1 to January 31. A Special Enrollment Period may be granted if you experience a qualifying life event, such as having a baby or getting married.

For public health insurance plans, enrollment is available year-round.

Maximizing Insurance Billing: Strategies for Savvy Contractors

You may want to see also

Changing insurance coverage

When it comes to changing insurance coverage due to a move from Washington, DC, to New York, there are a few things you need to keep in mind, especially regarding car insurance and health insurance.

Car Insurance

Firstly, it's important to understand that car insurance rates are impacted by location. This is because rates are based in part on an area's claims history, including thefts, break-ins, and accidents. Additionally, factors such as weather patterns, the cost of medical bills and car repairs, and the frequency of lawsuits due to state tort or no-fault laws can influence rates. Therefore, your car insurance rate may increase or decrease depending on the specific area you're moving to in New York.

Secondly, you may need to change your car insurance company if your current provider does not offer insurance in New York. It is essential to check with your current provider to see if they offer coverage in your new state. If they do not, you will need to find a new insurance company. This is because car insurance policies are state-specific, and every state has different coverage requirements and regulations.

- Contact your current insurance company or agent to verify if they offer coverage in New York. If they do, ask for a quote for your new address.

- If your current provider does not offer coverage in New York, ask friends for recommendations or compare quotes from multiple companies in your new area.

- Learn about the specific insurance requirements in New York, as these may differ from DC. For example, New York may require underinsured/uninsured motorist coverage, personal injury protection, or medical payments coverage.

- Purchase a new auto insurance policy from your current provider or a new company, ensuring that it meets New York's requirements.

- Cancel your old policy. If you are staying with the same insurer, they should automatically cancel your old policy once the new one is issued.

- Update your address with your new insurance company to ensure your policy remains active and up-to-date.

- Register your vehicle in New York and surrender your DC vehicle registration and plates to the DC DMV.

It's important to note that you may have a limited timeframe, such as 30 to 90 days, to switch your insurance, driver's license, and registration after moving to a new state. Failing to make the switch within the deadline could result in fines.

Health Insurance

When moving to a new state, it is essential to understand that you cannot keep your current health insurance plan. You must report an out-of-state move immediately and enroll in a new plan in your new state to avoid a break in coverage and paying for coverage that doesn't apply in New York.

To enroll in a new health insurance plan:

- Log in to your Marketplace account.

- Select the year you want coverage and your new state. If your new state runs its own Marketplace, you will need to use its website to apply.

- Click "Apply or Renew" to start a new application.

- Compare the plans and prices available to you and pick a plan that suits your needs.

- Pay your first month's premium to complete your enrollment.

- Update your profile with your new address to ensure your information is accurate and up-to-date.

By following these steps, you can ensure that you have the necessary insurance coverage in your new state of residence.

Unlocking ABA Therapy Reimbursement: Navigating the Insurance Billing Maze

You may want to see also

Cancelling insurance coverage

When moving from DC to New York, you will need to cancel your existing insurance coverage and purchase a new policy that aligns with New York's insurance laws. Here are some important steps and considerations for cancelling your insurance coverage:

- Contact your current insurance provider: Get in touch with your insurance company or agent to initiate the cancellation process. Ask about their specific requirements, such as a cancellation fee, a signed cancellation notice, or a written request.

- Understand the timeline: Be mindful of the timeline for cancelling your current policy. In some cases, you may need to provide a certain number of days' notice (e.g., 30 days) before the intended cancellation date.

- Secure new insurance first: Before cancelling your existing coverage, ensure you have a new policy in place to avoid a lapse in coverage. This is crucial because driving without insurance is illegal in most states and can result in fines and increased future insurance rates.

- Confirm the cancellation: Request a policy cancellation notice or confirmation from your current insurer. This ensures that you have written documentation that your policy has been formally cancelled.

- Handle any refunds or remaining payments: If you have prepaid your current policy, you may be entitled to a refund for the remaining period. Ask your insurance company about their refund policy and any applicable cancellation fees.

- Update your address: Notify your insurance company of your new address in New York. This is especially important if you are staying with the same insurer, as they will need to update their records and adjust your rate based on your new location.

- Understand special circumstances: If you are cancelling insurance for a vehicle you plan to sell, it is recommended to wait until the new owner takes possession and the title is transferred. Additionally, if you are moving out of state, you may need to surrender your vehicle registration and plates to the DMV before cancelling your old policy.

- Consider alternative options: Depending on your situation, you may have the option to suspend your insurance coverage temporarily instead of cancelling it. This may be applicable if you are going on an extended vacation or deploying for military service.

- Be aware of health insurance considerations: If you have employer-sponsored health insurance, you can typically only cancel during open enrollment or if you experience a qualifying life event, such as relocating outside of the plan's coverage area. Contact your company's HR department for guidance.

Remember to review your current insurance policy carefully to understand any specific requirements, fees, or notice periods. Additionally, when moving to New York, research the state's insurance laws and requirements to ensure your new policy complies with all necessary regulations.

Maximizing Reimbursement: Navigating Insurance Billing for EMDR Therapy

You may want to see also

Special enrollment periods

A Special Enrollment Period (SEP) is a time outside the yearly Open Enrollment Period when you can sign up for health insurance. You qualify for an SEP if you've experienced certain life events, including a change in residence.

Changes in Residence

You may qualify for an SEP if you move to a new home in a new ZIP code or county, or to the U.S. from a foreign country or U.S. territory. You may also qualify if you move to or from the place you attend school (if you're a student), the place you live and work (if you're a seasonal worker), or a shelter or other transitional housing.

Moving only for medical treatment or going on vacation does not qualify you for an SEP.

Qualifying Health Coverage

You must have had qualifying health coverage for one or more days during the 60 days before your move. You don't need to provide proof if you're moving from a foreign country or U.S. territory.

Time Limit

Your SEP will be in effect for 60 days from the date of your move, and you can enroll in a new plan on or off-exchange.

Qualifying Life Events

In addition to a change in residence, other qualifying life events include:

- Losing health coverage

- Getting married

- Having a baby

- Adopting a child

- Gaining citizenship

- Leaving incarceration

Special Cases

If you are moving to New York State from Washington D.C., there are some additional considerations. In Washington D.C., you can qualify for an SEP if you are uninsured and need coverage due to the COVID-19 pandemic. In New York, individuals and families can enroll in a private health plan after January 31, 2016, if they have had a Qualifying Life Event.

Navigating Insurance Billing: What to Do When Your Doctor's Office Refuses to Bill Your Insurer

You may want to see also

Frequently asked questions

Yes, you will need to change your insurance policy when moving out of state. Your current provider may not sell insurance in New York, so you will need to check with them and possibly find a new provider.

Your move will likely impact your insurance rate. Rates are partially based on the claims history of an area, so your rate may increase or decrease depending on the number of thefts, break-ins, and accidents in your new area. Your rate may also be affected by your annual mileage and commuting distance.

You will need to contact your insurance company and notify them of your new address and move date as soon as possible. You will also need to learn about the insurance requirements in New York and purchase a new policy.

Once you have purchased a new policy, contact your old insurance company and cancel your previous policy. If you are staying with the same insurance company, they should automatically cancel your old policy once they issue your new one.

If you do not change your insurance policy, your insurance coverage may lapse and your registration and driver's license may be suspended.