Car insurance in Sarasota, Florida, is more expensive than the national average, with drivers paying around $176 per month compared to the national average of $146. However, Sarasota residents pay around $26 less per month than the rest of Florida. The average cost of car insurance in Sarasota is $167 per month for liability coverage and $241 per month for full coverage. State Farm is the cheapest full-coverage insurer in Sarasota, with rates starting at $64 per month.

What You'll Learn

- Sarasota's average monthly insurance rate is $176.41, compared to the national average of $146.47

- State Farm is Sarasota's cheapest insurance company, with an average monthly rate of $115.89

- Sarasota's insurance rates are influenced by factors such as age, gender, and driving history

- Sarasota's insurance rates are higher than the national average due to the state's frequent weather-related risks and high number of uninsured drivers

- Sarasota's car insurance rates are cheaper than those of other cities in Florida, such as Tampa and Miami

Sarasota's average monthly insurance rate is $176.41, compared to the national average of $146.47

Sarasota's average monthly insurance rate is $176.41, which is higher than the national average of $146.47. Sarasota residents pay around $17 more per month than the rest of the country. However, compared to the rest of Florida, Sarasota's insurance rates are around $26 cheaper per month.

The cost of car insurance in Sarasota depends on several factors, including age, gender, vehicle make and model, driving record, and credit score. For example, 18-24-year-olds pay a lot more than those who are at retirement age. Additionally, women tend to pay slightly less than men. Drivers with clean records will also pay lower rates than those with accidents or violations on their records.

The type of vehicle driven also affects insurance rates. In Sarasota, SUVs tend to be the cheapest to insure, followed by trucks, vans, and cars. Newer vehicles are generally more expensive to insure than older ones.

When it comes to insurance companies, State Farm, Liberty Mutual, Mercury Insurance, and 21st Century are some of the most affordable options in Sarasota. State Farm, in particular, offers competitive rates for various driver profiles, including teens, young adults, adults, and seniors.

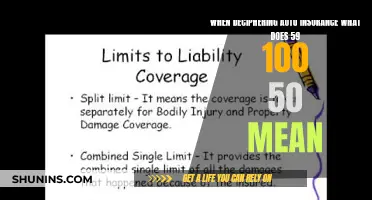

Auto Insurance Deductible: Understanding the 500 Plan

You may want to see also

State Farm is Sarasota's cheapest insurance company, with an average monthly rate of $115.89

Car insurance rates in Sarasota, Florida, vary depending on factors such as age, driving history, and the insurance company. On average, drivers in Sarasota pay around $176.41 per month, compared to the national average of $146.47. However, according to SmartFinancial, State Farm is Sarasota's cheapest insurance company, with an average monthly rate of $115.89.

State Farm offers a range of insurance options, including auto, fire, life, health, commercial, and financial services accounts. They provide coverage for various vehicles, including luxury sports cars and travel trailers. State Farm also offers home and property insurance, including condo insurance and renters insurance, in addition to auto insurance.

It is important to note that insurance rates are not static and may change over time. Additionally, rates can vary based on individual factors, so it is always a good idea to compare quotes from multiple insurance companies to find the best rate for your specific situation.

Auto Insurance and Theft: What You Need to Know

You may want to see also

Sarasota's insurance rates are influenced by factors such as age, gender, and driving history

Sarasota's insurance rates are influenced by a variety of factors, including age, gender, and driving history.

Age is a significant factor in determining insurance rates, with younger drivers often paying higher premiums than older, more experienced drivers. Insurance rates tend to decrease as drivers age, reflecting their increased experience and reduced risk of accidents. However, rates may creep back up for older drivers due to factors such as vision or hearing loss and slowed response time.

Gender also plays a role in insurance rates, with men generally facing higher premiums than women due to a greater propensity for risky driving behaviour. However, the difference in premiums between genders narrows as drivers age.

Driving history is another crucial factor that influences insurance rates in Sarasota. Drivers with clean records benefit from lower rates, while those with accidents, speeding tickets, or other violations on their record pay significantly more. Insurance companies typically look at an individual's driving history over the past three to five years when determining rates.

Other factors that contribute to Sarasota's insurance rates include the vehicle's make and model, marital status, housing situation, and credit score. Additionally, local factors such as off-street parking access, local laws, parking situations, and crime rates can impact insurance rates in Sarasota.

Expedia's Auto Insurance: Worth the Detour?

You may want to see also

Sarasota's insurance rates are higher than the national average due to the state's frequent weather-related risks and high number of uninsured drivers

Florida is one of the most expensive states for car insurance, and Sarasota is no exception. The average cost of car insurance in Sarasota is $167 per month for liability coverage and $241 per month for full coverage. However, Sarasota's rates are slightly lower than the statewide average of $256. The city's relatively low accident rate may contribute to this.

State Farm and GEICO are two of the cheapest car insurance companies in Sarasota, offering liability rates starting at $55 and $57 per month, respectively. Sarasota residents can also take advantage of various strategies to lower their rates, such as increasing their deductible, taking advantage of discounts, bundling policies, and driving an older vehicle.

Loyalty Discounts: Do They Apply to Auto Insurance?

You may want to see also

Sarasota's car insurance rates are cheaper than those of other cities in Florida, such as Tampa and Miami

There are several factors that contribute to Sarasota's lower car insurance rates. One reason may be the city's relatively low crime rate, which can impact insurance rates. Additionally, Sarasota has a lower population density than cities like Tampa and Miami, resulting in less congested roads and a lower risk of accidents.

It's important to note that car insurance rates can vary within Sarasota as well. For example, the cost of insurance in downtown Sarasota may be higher than in the surrounding areas due to higher traffic and a greater risk of accidents. Additionally, factors such as age, gender, vehicle type, and driving record can also impact insurance rates.

While Sarasota's car insurance rates are generally lower than those of other Florida cities, it's always a good idea to shop around and compare quotes from multiple insurance companies to ensure you're getting the best rate. By comparing rates and taking advantage of discounts, Sarasota residents can further lower their car insurance costs.

Insuring a New Vehicle: What to Expect

You may want to see also

Frequently asked questions

Sarasota drivers pay around $97 a month for their car insurance. This is about $26 cheaper than the rest of Florida, but $17 more expensive than the US national average.

Car insurance rates are determined by factors such as age, gender, vehicle make and model, driving record, and credit score. Sarasota is also susceptible to severe weather events, which can damage vehicles and increase the number of insurance claims.

State Farm is the cheapest car insurance company in Sarasota, with rates as low as $55 per month for liability-only coverage.

The average cost of car insurance in Florida is $3,430 for full coverage and $1,048 for minimum coverage.

Florida is a no-fault state, which means drivers are required to carry personal injury protection (PIP) coverage and property damage liability coverage. The minimum coverage required is $10,000 for both.