There are several types of car insurance, but you may not need all of them. The type of insurance you need will depend on your state's requirements, whether you own your car, and other factors. Here's a look at the most common types of car insurance and when you might need them.

What You'll Learn

Liability insurance

When determining the amount of liability insurance coverage needed, it is crucial to consider the minimum requirements of your state and the value of your personal assets. If you have significant financial assets, you may want to consider a combined single-limit policy, which provides a single liability limit instead of separate limits for each category. Additionally, factors such as your driving record, age, location, driving frequency, and vehicle value can impact the cost of liability insurance.

Switching Auto Insurance: Is It Possible?

You may want to see also

Collision insurance

If you own your vehicle outright, collision insurance is optional. However, it may still be a worthwhile investment if you cannot afford to repair or replace your vehicle in the event of an accident. Collision insurance typically covers the cost of repairs or replacement, minus your deductible. If your car is totaled, collision insurance will pay the actual cash value of your vehicle, minus your deductible. Without collision insurance, you could be left with thousands of dollars in repair costs or a new vehicle.

When deciding whether to get collision insurance, consider the value of your vehicle. If your vehicle is brand new or still worth a significant amount, collision insurance can help cover expensive repairs or replacement costs. Additionally, if you cannot afford to pay for repairs or a replacement vehicle out of pocket, collision insurance can provide peace of mind. On the other hand, if your vehicle is older and has a low market value, collision insurance may not be worth the cost, as it will only pay out up to the current market value of your car, minus the deductible.

The cost of collision insurance varies depending on factors such as the vehicle type, driving history, and location. It is often sold alongside comprehensive insurance, which covers non-collision damage, such as theft, vandalism, or natural disasters. Together with liability insurance, these three types of coverage are typically referred to as "full coverage" insurance.

Go Auto Insurance: Good or Not?

You may want to see also

Comprehensive insurance

Comprehensive coverage does not have a limit. The maximum payout is based on the actual cash value of your vehicle, and you are responsible for paying your selected deductible. If your vehicle has a low cash value and a high deductible, comprehensive coverage may not be worthwhile. However, if your vehicle has a high cash value or you cannot afford repairs or a replacement, comprehensive coverage can provide peace of mind.

The Myth of No-Fault Auto Insurance in Michigan: Understanding the Reality

You may want to see also

Uninsured motorist insurance

There are several types of car insurance, and while some are mandatory, others are optional. Uninsured motorist insurance is one type of coverage that is required in some states and highly recommended in others.

In the US, nearly 13% of drivers don't have auto insurance, and in some states, the number of uninsured drivers is over 20%. Without uninsured motorist coverage, you could end up paying out of pocket for medical bills or vehicle repairs if you're in an accident with an uninsured or underinsured driver. Even if you have health insurance, it may not cover all the costs associated with an accident, such as lost wages or damage to your vehicle.

- Uninsured motorist bodily injury (UMBI) covers medical bills for you and your passengers if you're hit by an uninsured driver.

- Uninsured motorist property damage (UMPD) covers damage to your vehicle caused by an uninsured driver.

- Underinsured motorist bodily injury (UIMBI) covers medical bills for you and your passengers if you're hit by a driver whose insurance limits are too low.

- Underinsured motorist property damage (UIMPD) covers damage to your vehicle caused by a driver with insufficient insurance.

Uninsured motorist coverage is especially important if you're a victim of a hit-and-run accident, as you can file a claim against your own policy in such cases. While collision coverage can also protect you in these situations, it will only cover damages to your car, whereas UMPD can cover damages to both your car and other property.

In summary, uninsured motorist insurance provides valuable protection in the event of an accident with an uninsured or underinsured driver. It can help cover medical expenses and vehicle repairs, and it is a mandatory or recommended coverage in many states.

Mas Auto Insurance: The Evolution of Their Rating System

You may want to see also

Medical payments coverage

MedPay is particularly useful for those without health insurance, or for those who are unsure if they could afford medical bills resulting from a car accident. It is also beneficial if you want to avoid the financial burden of major medical expenses. The coverage limits of MedPay typically range from $1,000 to $10,000, depending on the state and insurer. It is generally recommended to carry coverage equal to your health insurance deductible so that MedPay can be used to cover any out-of-pocket medical expenses.

It is important to note that MedPay does not cover wage reimbursement if your injuries force you to miss work. Additionally, it does not cover injury expenses if you cause harm to other drivers.

Auto Insurance: Unaffordable for Many

You may want to see also

Frequently asked questions

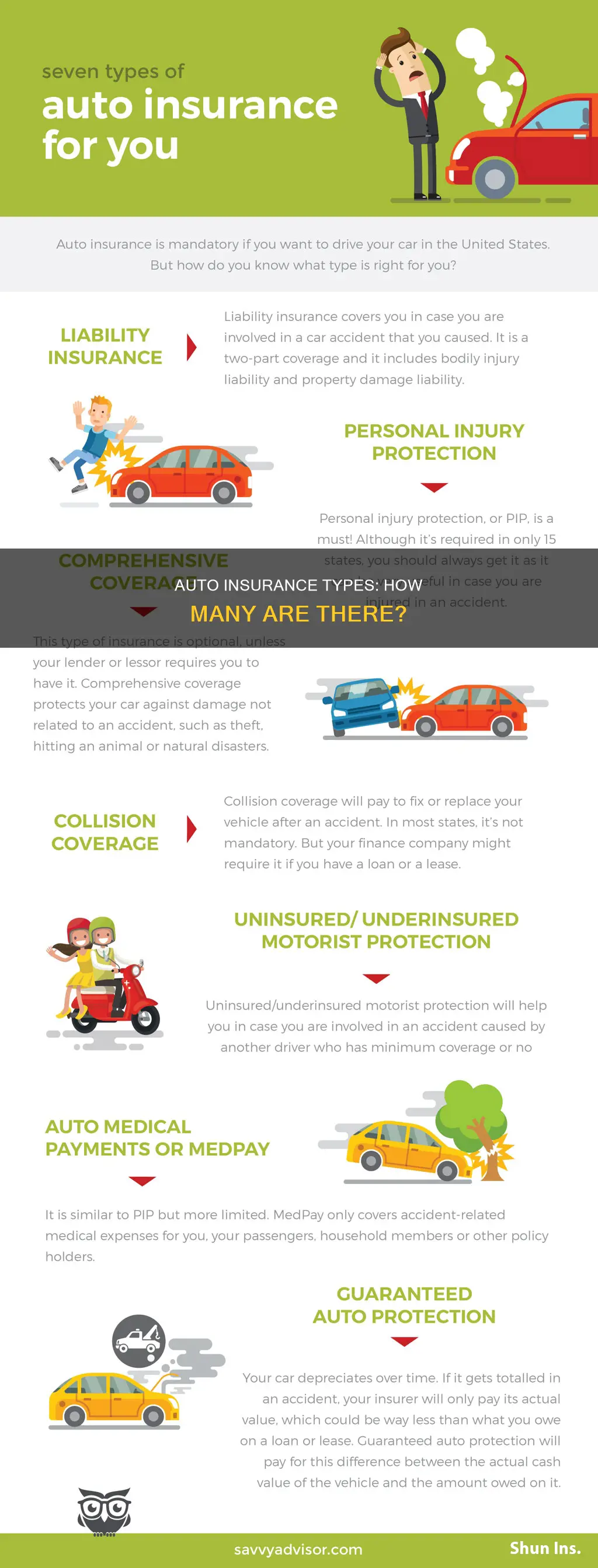

There are six types of auto insurance: liability, collision, comprehensive, personal injury protection, uninsured/underinsured motorist, and medical payments.

Liability insurance covers the other driver's injuries or property damage if you are found liable for an accident, up to the limits of your policy. It is required in most states.

Collision insurance covers the cost to repair or replace your car after any accident, regardless of fault. Comprehensive insurance covers damage to your car caused by something other than an accident, such as vandalism or a natural disaster. Collision and comprehensive insurance are optional in every state but may be required in certain situations, such as if you leased or financed your vehicle.

Personal injury protection (PIP) covers your medical expenses and, in some cases, lost wages, household expenses, and funeral costs after an accident, regardless of who was at fault. It is required in some states.