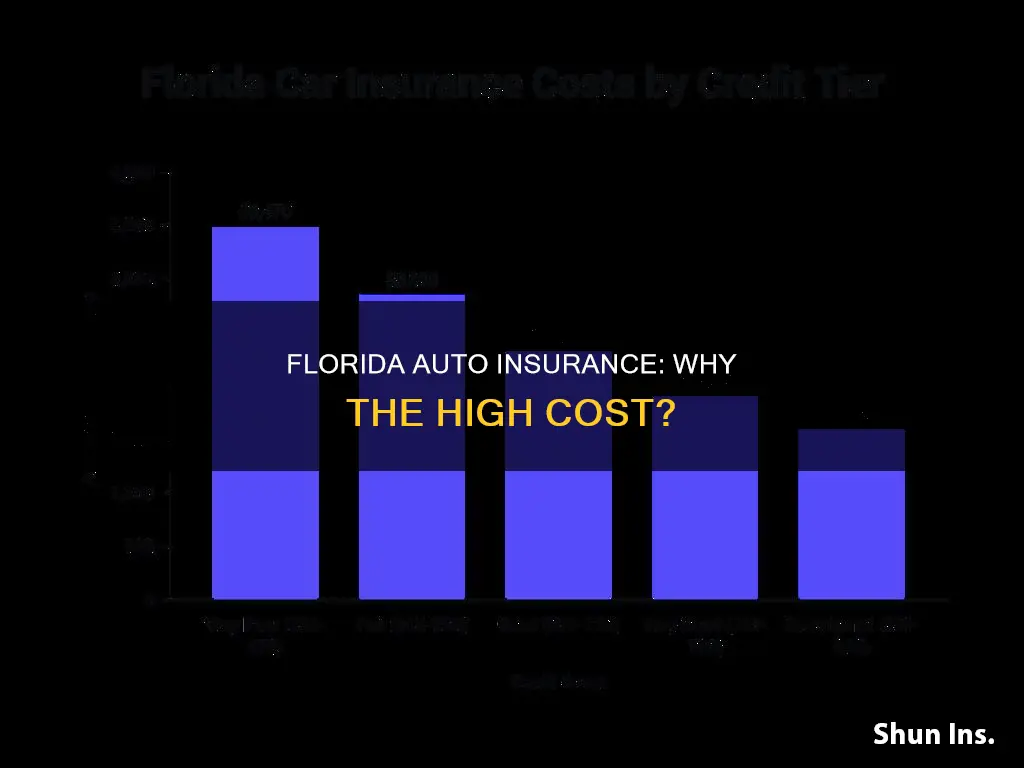

Florida has some of the most expensive car insurance rates in the US. The average annual full-coverage premium in Florida was $3,941 in January 2024, 55% higher than the national average. There are several reasons for this, including the high number of uninsured drivers, extreme weather, an increased number of accidents, and higher vehicle prices.

What You'll Learn

Florida has the highest percentage of uninsured drivers in the US

Florida's high rate of uninsured drivers is due in part to the state's high insurance costs. As the cost of insurance continues to rise, more drivers take the risk of driving without it. This creates a cycle that further increases insurance costs for insured drivers.

The high number of uninsured drivers in Florida has several consequences. Firstly, it contributes to the state's high insurance costs. Secondly, it increases the risk of accidents, as uninsured drivers may be more likely to engage in risky driving behaviours. Finally, it can lead to financial hardship for both uninsured and insured drivers. Uninsured drivers may struggle to cover the costs of an accident, while insured drivers may face higher premiums and out-of-pocket expenses if they are involved in an accident with an uninsured driver.

To mitigate the impact of uninsured drivers, insured drivers in Florida can consider purchasing uninsured motorist coverage. This type of insurance provides protection in the event of an accident with an uninsured driver. Additionally, insured drivers can also explore other options to lower their insurance costs, such as comparing rates from multiple insurance companies and taking advantage of discounts offered by insurance providers.

Challenging Auto Insurance Non-Renewal: Your Options Explained

You may want to see also

It's a no-fault state

Florida is a no-fault state, which means that drivers are required to carry personal injury protection (PIP) insurance. This is a mandatory endorsement to auto policies in the state of Florida and takes priority in paying the insured after an accident, regardless of fault. The minimum coverage is $10,000, which will pay 80% of medical bills, 60% of lost wages, and 100% of replacement service costs. PIP also provides a $5,000 death benefit and covers 80% of all reasonable and necessary medical expenses. This includes emergency transportation, hospitalization, surgical procedures, nursing services, dental work, and more.

The no-fault system is intended to provide faster and more efficient compensation for accident victims. However, it has been criticized for leading to an increase in fraudulent insurance claims and inflated medical expenses. Despite these criticisms, the no-fault system has its benefits. Accident victims can receive compensation for their injuries and lost wages more quickly and efficiently than in a traditional tort system. It also reduces the number of lawsuits and legal disputes resulting from car accidents.

In addition to being a no-fault state, there are several other factors that contribute to Florida's high insurance costs. Florida has the highest number of uninsured motorists nationwide at 26.7%. The state also has a substantial number of high-risk drivers, including the elderly, tourists, and students. Florida is also known for its unpredictable weather, such as intense storms and hurricanes, which can cause property damage. Florida is the third-busiest state, which leads to busy roadways and an increased likelihood of accidents. All of these factors contribute to the high cost of auto insurance in Florida.

Navigating Auto Insurance: Strategies to Avoid Costly Premiums

You may want to see also

There are high levels of insurance fraud

Florida is known for its high levels of insurance fraud, which is a contributing factor to the state's expensive auto insurance. The state has a high rate of Personal Injury Protection (PIP) fraud, with Miami ranking third in the country after New York and Tampa. This type of fraud occurs when individuals lie or exaggerate claims to receive higher insurance payouts.

Insurance fraud can take many forms, from soft fraud to hard fraud. Soft fraud typically involves exaggerating a claim or omitting critical details on an insurance application. For example, a driver might claim that a dent in their bumper was caused by a hit-and-run when it actually happened while backing into a mailbox. Hard fraud, on the other hand, involves more serious and intentional offences, such as faking an accident or abandoning a vehicle and reporting it as stolen to receive insurance money.

Florida has a dedicated Bureau of Insurance Fraud that investigates various types of insurance fraud, including vehicle insurance fraud. The bureau is organised into two districts and five regions, with a total of 134 sworn officers and 32 civilian support staff members. Despite these efforts, insurance fraud continues to be a significant issue in Florida, impacting both residents and insurers.

The high levels of insurance fraud in Florida have contributed to increased insurance premiums for homeowners and drivers. The average cost of car insurance in Florida is significantly higher than the national average, and insurance companies have imposed steep increases in auto insurance renewal rates.

Insurance fraud has also led to higher litigation costs and payouts, further driving up insurance prices. Law firms have filed thousands of lawsuits based on fraudulent claims, resulting in large settlements paid out by insurance companies. As a result, insurance providers have raised premiums to cover these increasing costs.

The state has implemented insurance reforms to address the issue of insurance fraud and stabilise the market. These reforms aim to protect policyholders and insurance companies from fraudulent claims and improve transparency in pricing and communication between insurers and contractors.

Amica Auto Insurance: Moving Truck Rentals Covered?

You may want to see also

Florida is prone to severe weather events

The Atlantic hurricane season lasts from June 1 to November 30, with August and September typically seeing the most activity. However, storms can occur throughout the season and even beyond these months. Florida has experienced many hurricanes over the years, including the recent Hurricane Ian in September 2022, which destroyed over 100,000 vehicles. Hurricane Dorian also threatened Florida's shores, causing one resident to park his car in his kitchen for safety.

In addition to hurricanes, Florida experiences other severe weather events. The state has the highest number of thunderstorms in the US, occurring 75-105 days each year. These storms can produce lightning, tornadoes, hail, strong winds, and heavy rain that can lead to flooding. Florida also experiences urban flooding, with localized instances of flooding along urban corridors and saturated grounds. Thunderstorms and lightning are common, with Florida recording an average of 1.4 million cloud-to-ground lightning strikes annually. This has resulted in the state often having the highest number of lightning-related injuries and deaths in the country.

The unpredictable and severe weather in Florida is a significant factor in the state's high auto insurance rates. The frequent storms and hurricanes cause extensive property damage, including vehicles, leading to increased insurance claims and costs. Florida's weather conditions contribute to higher premiums for residents, making auto insurance in the state more expensive compared to other parts of the country.

Auto Insurance: Government Work Coverage

You may want to see also

The cost of auto repairs is increasing

Florida's auto insurance rates are increasing due to a multitude of factors, including the high number of uninsured drivers, the substantial number of high-risk drivers, frequent severe weather events, and an increase in the cost of auto repairs.

Heavier and More Complex Vehicles

Cars today are heavier and more powerful than they were in the past. In 2022, cars were 33% heavier than in 1985 and about twice as powerful. This means that collisions at higher speeds can result in more severe crashes and higher repair costs. Additionally, safety technology improvements have reduced the number of low-speed crashes, which tend to be less severe and lower in cost.

Increased Technology in Cars

The computerization of cars has added more equipment that can break down or be damaged in an accident. Advanced driver-assistance systems, such as auto emergency braking and lane-keeping assist, have become common in modern vehicles. These technologies rely on electronic sensors located in bumpers, fenders, and grilles, which are vulnerable to damage in wrecks. Repairing or replacing these sensors can be costly and time-consuming, as precision is crucial for proper functioning.

Supply Chain Issues and Parts Shortages

The pandemic-induced supply chain disruptions have also contributed to the increase in repair costs. Shortages of certain components, such as microchips, have made it tougher and more expensive to replace parts during repairs. This issue is further compounded by the increasing complexity of vehicles, which require more advanced and costly parts.

Rising Labor Costs

The auto repair industry is facing a shortage of talented technicians, leading to rising labor costs. The COVID-19 pandemic exacerbated this longstanding issue, as many technicians left the industry during the pandemic due to reduced demand for repairs. As a result, labor rates for repairs have increased, with the average hourly rate in the US rising from under $50 in 2019 to close to $60 at the end of 2023.

Inflation and Economic Shifts

Inflationary pressures and economic shifts have also played a role in increasing repair costs. Higher inflation has impacted the prices of new and used cars, replacement parts, and labor. Additionally, the shift towards more automated and electric vehicles has put further strain on the auto industry, requiring more chips and advanced components.

The combination of these factors has resulted in a significant increase in the cost of auto repairs, which, in turn, has contributed to the rising auto insurance rates in Florida and nationwide.

Get Auto Insurance Information: Quick and Easy Steps

You may want to see also

Frequently asked questions

There are several reasons why auto insurance in Florida is more expensive than in other states. Firstly, Florida has the highest percentage of uninsured drivers in the country, which increases the cost for insured drivers. Secondly, Florida is prone to severe weather events such as hurricanes, storms, and flooding, which result in a higher number of claims and more expensive premiums. Thirdly, there is a high rate of auto theft and claims fraud in the state. Other factors include the high cost of auto repairs, an increase in the number of accidents, and the impact of inflation on vehicle prices and repair costs.

Florida's status as a no-fault state is a significant contributor to high insurance costs. Additionally, the state has a high number of high-risk drivers, including tourists, students, and elderly residents. Florida's busy roadways also increase the likelihood of accidents, and the state's high vehicle theft rate further drives up insurance costs.

According to the Insurance Information Institute, as of January 2024, the average annual full-coverage premium in Florida was $3,941, which is 55% higher than the national average of $2,542. Florida has consistently ranked among the top three states with the highest car insurance rates in the country.

The average annual full-coverage rate in Florida is $2,917, or $243 per month, according to a report by Insurify. This is 44% higher than the national average. However, the cost can vary depending on factors such as age, location, and driving record.

While the overall trend in Florida is of increasing auto insurance rates, there are some ways to reduce premiums. These include raising your deductible, enrolling in a telematics or safe driving program, taking advantage of discounts for good students and military personnel, and comparing rates from multiple insurance companies.