Car insurance premiums can vary wildly depending on a number of factors. These include:

- Age: Males under 25 are considered a high-risk group for insurance purposes.

- Gender: Men are statistically more likely to have accidents than women, so their insurance premiums tend to be higher.

- Driving experience: Newer drivers are considered more of a risk and will pay higher premiums.

- Accident history: If you have been in an accident that was your fault, your insurance premium will increase.

- Location: If you live in an area with high crime or limited parking, your insurance will be more expensive.

- Type of vehicle: Older vehicles with fewer safety features are considered more dangerous and therefore more expensive to insure.

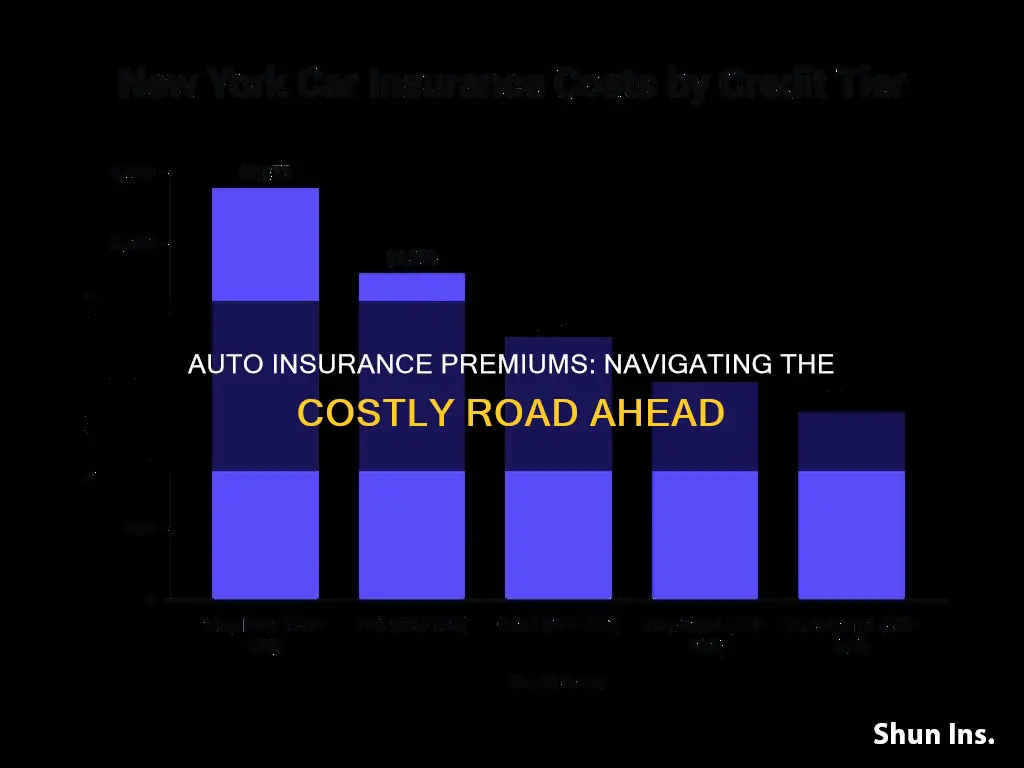

- Credit score: In some states, insurance companies take your credit score into account when determining your premium.

- Marital status: Being married can lower your insurance premium.

| Characteristics | Values |

|---|---|

| Age | Younger drivers, especially those under 25, are considered high risk and have to pay higher premiums. |

| Gender | Men are considered higher risk than women and have to pay higher premiums. |

| Marital Status | Married people are considered lower risk and have to pay lower premiums. |

| Driving History | Drivers with a history of accidents and/or claims have to pay higher premiums. |

| Type of Vehicle | The make, model, age, safety and safety features of a vehicle affect insurance rates. |

| Vehicle Ownership | Drivers who own their vehicles have to pay higher premiums. |

| Zip Code | The area in which a vehicle is kept affects insurance rates. |

| Mileage | The more a vehicle is driven, the higher the insurance rates. |

| Credit Score | A low credit score can lead to higher insurance rates. |

| Insurance History | Drivers with a history of insurance will get lower rates than first-time insurance buyers. |

| Insurance Provider | Different insurance providers offer different rates. |

What You'll Learn

Age and gender

For example, one 30-year-old male user reported paying $88.50 per month for full coverage on a 2005 Tacoma, while another 20-year-old male user was quoted $188.60 per month for full coverage on a 2015 Ford EcoBoost Mustang. Similarly, a 28-year-old male user reported paying $160 per month for full coverage on a 2018 Chevy Sonic, while a 23-year-old male user was quoted $400 per month for full coverage on a 2023 Corolla.

However, it is important to note that other factors also influence insurance rates, such as driving record, location, type of vehicle, and credit score (except in California, Hawaii, and Massachusetts). As a result, insurance rates can vary significantly from person to person, even within the same age group and gender.

Insurers: Less Money, More Problems?

You may want to see also

Driving history

In addition to driving history, insurance companies consider various other factors when determining insurance rates, such as age, gender, credit score, vehicle type, and location.

When assessing driving records, insurance companies typically look back at the previous three to five years of a driver's history. However, this timeframe can vary depending on state regulations and the insurance company. Some companies may look back as few as three years, while others may go back as far as ten years.

The specific information included in a driving record can vary by state but generally includes personal information, driver's license status and number, accident history, traffic violations, and convictions related to motor vehicle violations.

Maintaining a clean driving record is crucial for obtaining affordable auto insurance. Safe driving practices, adhering to traffic rules, and regularly checking one's driving record for accuracy can help individuals achieve this.

Additionally, insurance companies may also review an individual's Claims Loss Underwriting Exchange report, which details the frequency of insurance claims on their vehicle and home, further influencing their insurance rates.

Outdated Insurance: Driving Risks and Consequences

You may want to see also

Type of car

The type of car you drive can have a significant impact on the cost of your auto insurance. Insuring a newer, more expensive car will generally be more costly than an older, less valuable vehicle. The make and model of your car can also affect your insurance rates, with some cars being more expensive to insure due to higher repair costs or a higher risk of theft.

The safety features of your car can also play a role in determining your insurance rates. Cars with advanced safety features, such as collision avoidance systems and airbags, may qualify for discounts or lower premiums. On the other hand, if your car is older and lacks modern safety features, you may end up paying more for insurance.

Additionally, the age of your car can be a factor. Older cars may have higher insurance rates due to increased maintenance costs and the potential for more frequent repairs. However, some insurers offer discounts for vehicles with low mileage or those that are garaged.

It's worth noting that insurance rates can vary significantly depending on your location and other factors such as your age, gender, driving record, and credit score. It's always a good idea to shop around and compare quotes from multiple insurance providers to find the best rate for your specific situation.

Safe Auto Insurance: Teen Rates Explained

You may want to see also

Location

The location of the policyholder is a significant factor in determining the cost of auto insurance. Insurance rates can vary widely depending on the state and city in which the insured resides. For example, in the United States, car insurance rates in California are notoriously high, with some users reporting monthly premiums of up to $500. In contrast, a user from Wisconsin reported paying only $65 per month for full coverage on a 2011 Audi. Location can also affect the cost of insurance within a state; for instance, insurance in Los Angeles, California, is generally more expensive than in other parts of the state.

Insurance rates can also be influenced by the local crime rate, accident rate, and population density of the area in which the insured lives. For example, insurance in urban areas tends to be more expensive than in rural areas due to the higher risk of accidents and vehicle theft. Additionally, insurance companies may charge higher rates in areas with a high density of luxury or high-performance vehicles, as these cars are more expensive to repair or replace in the event of an accident.

Furthermore, insurance rates can be influenced by state-specific regulations. For instance, several users have mentioned that insurance in California is particularly expensive due to Proposition 103, which sets strict regulations on insurance companies in the state. On the other hand, some states have lower insurance rates due to favourable regulations or a more competitive insurance market.

It is worth noting that insurance rates are also affected by a variety of other factors, including the policyholder's age, gender, driving record, type of vehicle, and level of coverage. However, location plays a significant role in determining insurance rates and can have a substantial impact on the overall cost of auto insurance.

Car Rental Insurance: What You Need to Know

You may want to see also

Credit score

While the impact of credit scores on insurance rates varies across states, it is a significant factor in most states. Poor credit can lead to substantially higher insurance rates, with drivers with poor credit paying up to $144 more per month for full coverage compared to those with good credit. Additionally, insurance companies may view credit scores differently, resulting in variations in insurance rates between companies.

It is worth noting that some states, such as California, Hawaii, Massachusetts, and Michigan, prohibit insurance companies from using credit scores to determine insurance rates. In these states, rates are primarily based on driving records, location, and other factors.

To improve credit-based insurance scores, individuals can take similar actions as they would to improve their credit scores, including maintaining a good payment history, keeping credit card balances low, and using a mix of revolving and installment credit.

It is also important to mention that getting insurance quotes does not hurt an individual's credit score, as insurance companies typically perform a soft inquiry when providing quotes. However, hard inquiries, such as those resulting from applying for new loans or credit cards, may temporarily impact credit scores.

Auto and Cycle: How Car Insurance Impacts Motorcycle Coverage

You may want to see also

Frequently asked questions

The average cost of auto insurance in the US is $223 per month or $2,681 per year for full coverage. For minimum coverage, the average cost is $72 per month or $869 per year.

Teen drivers typically pay the highest rates for auto insurance, with 16 to 19-year-olds paying an average of $5,669 per year or $472 per month for full coverage.

Auto insurance rates tend to decrease as drivers get older, with rates typically lowest for drivers in their 40s and 50s. Rates may increase slightly for drivers over the age of 65.

Auto insurance rates vary significantly by state and even by ZIP code. The most expensive state for auto insurance is Michigan, with an average cost of $3,643 per year or $304 per month for full coverage. The cheapest state is Maine, with an average cost of $1,175 per year or $97 per month for full coverage.

Auto insurance rates are typically higher for drivers with a history of accidents, speeding tickets, or other violations. For example, a single speeding ticket can increase your auto insurance rates by an average of $325 per year.