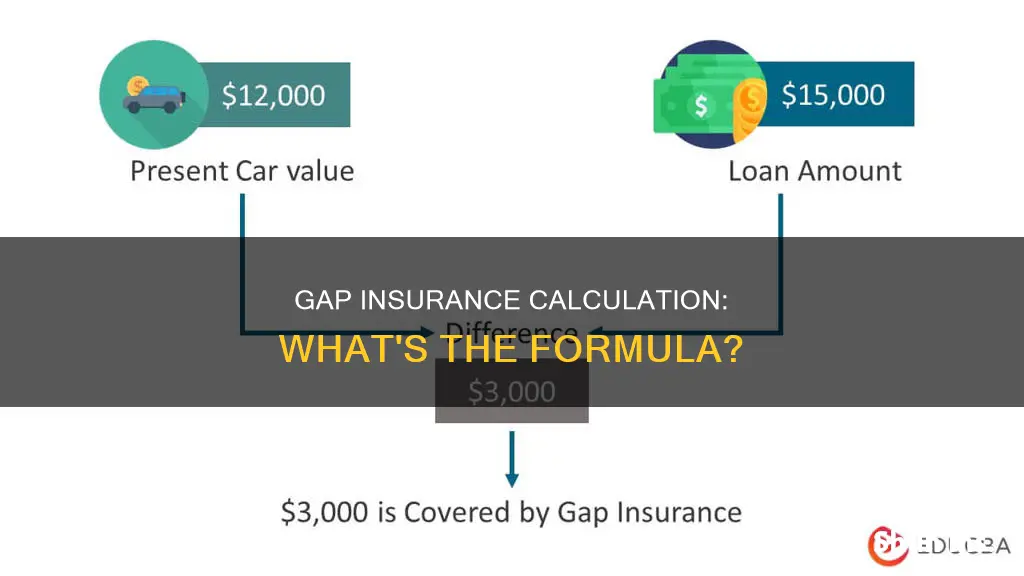

Gap insurance is calculated by taking the current value of your vehicle and subtracting it from the remaining balance of your loan. This calculation is used to determine the difference between what you owe on your car and its actual cash value in the event of a total loss. For example, if you owe $20,000 on your car loan and your car is currently valued at $15,000, gap insurance would cover the $5,000 difference. It's important to note that gap insurance is optional and may not be necessary if the amount you owe on your car is less than its value.

| Characteristics | Values |

|---|---|

| What is covered by gap insurance? | The difference between the amount owed on a car loan or lease and the car's actual cash value in the event of theft or a total loss. |

| When is gap insurance relevant? | When a car is stolen or involved in a crash that renders it unrecoverable or irreparable. |

| When is gap insurance payable by the loan provider? | When the loan amount is greater than the value of the car at the time of the accident. |

| How is gap insurance calculated? | By subtracting the current market value of the car from the loan amount owed to the loan provider. |

| When should gap insurance be discontinued? | After the initial years of buying a car, when the debt to the loan provider is less than the car's actual value. |

| When is gap insurance worth it? | When you owe more on your car loan than the car is worth, e.g. when you've made a small down payment, have a long-term loan, or the car depreciates in value quickly. |

What You'll Learn

Calculating the cost of gap insurance

Gap insurance, or Guaranteed Asset Protection, is an optional insurance coverage that pays for the difference between what you owe on your car and the amount you receive from your insurance company after a total loss. It is applicable only if you have a lease or loan on your vehicle.

The cost of gap insurance depends on several factors, including the make and model of your vehicle, its current market value, and how fast it depreciates. Generally, gap insurance costs between $50 and $250 per year to add to an insurance policy, but it can be as low as $35 or as high as $208 per year.

Vehicle Value and Depreciation Rate

The higher the value of your vehicle, the higher the cost of gap insurance. Additionally, vehicles that depreciate quickly will require higher gap insurance costs. For example, a $100,000 Range Rover may cost $150 or more per year for gap coverage due to its high cost and rapid depreciation rate. In contrast, a $40,000 Toyota with minimal depreciation may cost $50 or less per year for gap coverage.

Place of Purchase

You can purchase gap insurance from your insurance company or the auto dealership where you bought your car. Buying gap insurance from your insurance company is generally more cost-effective, as dealerships tend to charge higher prices and may include interest on the cost of gap insurance if it is rolled into your auto loan.

Length of Coverage

Gap insurance is typically only necessary during the first two to three years of financing a vehicle, as this is when the auto loan is most likely to be "upside down," meaning you owe more than the car is worth. After this period, you may no longer need gap insurance, as the difference between what you owe and the car's value should decrease over time.

Lender or Lessor Requirements

In some cases, your lender or lessor may require you to carry gap insurance, especially if you have a long-term loan or have made a small down payment. This is to protect them from financial loss in the event of a total loss.

Comparison Shopping

It is always a good idea to compare quotes from multiple insurers to get the best rate for gap insurance. Additionally, consider comparing the cost of adding gap insurance to your existing auto insurance policy versus purchasing it separately from a specialty gap insurance carrier.

Stand-Alone vs. Add-On Coverage

Purchasing stand-alone gap insurance, or coverage from a third-party provider, is usually more expensive than adding it to your existing auto insurance policy. This is because stand-alone coverage often comes with higher fees, and you may also be charged interest on the coverage if it is included in your loan payments.

Your Driving Record

If you have a good driving record, you may be able to get a discount on your gap insurance premiums. Insurers may view you as a lower-risk driver, which can result in lower costs for your coverage.

In conclusion, the cost of gap insurance is influenced by a combination of factors, including your vehicle's value, depreciation rate, place of purchase, length of coverage, lender or lessor requirements, comparison shopping, type of coverage, and driving record. By understanding these factors, you can make informed decisions about the cost and benefits of gap insurance for your specific situation.

Commercial Vehicle Insurance: Expense or Essential?

You may want to see also

When to buy gap insurance

Gap insurance is an optional form of coverage that is not required by state law. However, it may be required by lenders or lessors. It is designed to cover the difference between the amount owed on a car loan or lease and the vehicle's actual cash value in the event of theft or a total loss. This type of insurance is particularly useful for those who have a low down payment, a long-term loan, or a car that depreciates quickly.

- Low Down Payment and Large Auto Loan: If you make a small down payment, there will be a bigger gap between what you owe and the car's depreciated value. In this case, gap insurance can help protect you from owing more than the car's value.

- Leasing a Vehicle: Auto leases often have lower monthly payments because the lessee pays less principal each month. Many leases include gap coverage automatically, but it's important to check the terms of your lease agreement.

- Quick Depreciation: Some cars, such as sports cars or electric vehicles, depreciate much faster than others. Sources like Edmunds or Kelley Blue Book can help you compare the expected depreciation of different makes and models. If you own a car that depreciates quickly, gap insurance can help ensure you don't owe more than its decreasing value.

- Rolling Over Other Products into Auto Financing: When you finance extended service agreements, dealer-installed options, or debt from previous auto financing, you increase your overall financial obligation without necessarily increasing the value of your car. In this case, gap insurance can help cover the potential gap between what you owe and the car's value.

- High Mileage: Driving more than 15,000 miles per year can accelerate your car's depreciation. Gap insurance can provide coverage if you expect to put a lot of miles on your vehicle.

- Long-Term Loan: Long-term loans almost guarantee that the car buyer will have negative equity for some period. With the average car loan term being 72 months, the longer it takes to pay off the loan, the more likely you are to owe more than the car's depreciating value.

It's important to note that gap insurance is not necessary if you don't have a car loan or lease. Additionally, if you've already paid off a significant portion of your loan, made a substantial down payment, or could afford to pay the gap yourself in the event of a total loss, then gap insurance may not be worth the additional cost.

Insurance Data: Vehicle Identification Accuracy

You may want to see also

How to get a refund for gap insurance

Gap insurance, or guaranteed asset protection, is an optional add-on to your standard car insurance that covers the difference between the amount you owe on your car loan and the car's actual cash value if it is stolen or deemed a total loss. You can typically buy gap insurance from car insurance companies, banks, credit unions, or car dealerships.

Understand when you can get a refund: There are typically three situations when you can cancel your gap insurance and get a refund:

- Paying off your loan: If you pay off your car loan early, you are eligible for a partial refund for the gap coverage that you haven't used yet.

- Switching insurance companies: If you switch to a different insurance company, you can cancel your original policy and get a refund for the unused coverage.

- Selling or trading your car: If you sell or trade your car, you can get a refund on the amount of gap coverage you didn't use.

- Know when you cannot get a refund: There is one main situation when you cannot get a gap insurance refund. If your insured car is declared a total loss and your gap policy pays out the difference between the car's value and your loan balance, you won't be eligible for a refund for the remaining months of coverage.

- Contact your insurance provider: Start the refund process by contacting your insurance provider and informing them that you want to cancel your gap insurance and request a refund for the remaining coverage. Remember to do this only after your car loan is paid off, or your car is legally sold or traded.

- Provide the necessary documentation: Gather and submit any documentation or forms that your insurance provider requires for the cancellation process. This may include proof that your vehicle was sold, traded, or paid off, and verification of your car's current mileage.

- Understand the refund amount: The amount of your refund will depend on how you pay your insurance bill. If you pay monthly, you may not get a refund, as you've only paid for the coverage received so far. If you pay your insurance in a lump sum, the refund amount will depend on how far into your coverage you were when you cancelled your policy.

- Be prepared for timing: Once you cancel your policy and request a refund, it typically takes between four to six weeks to receive the money.

It's important to note that gap insurance refunds may vary depending on the insurance provider and their specific policies. Be sure to carefully review your insurance contract and reach out to your provider for clarification if needed.

Ontario's Cheapest Vehicle to Insure

You may want to see also

When gap insurance is worth it

Gap insurance is worth it in several scenarios. Firstly, if you owe more on your car loan than the car is currently worth, gap insurance can help bridge this financial gap. This situation often arises when you have a long finance period, a low resale value car, or a small down payment. Gap insurance is also worth considering if your lease or loan agreement requires it. Some auto leases and loans mandate gap insurance as a protective measure, and it may already be included in the price of your lease.

Additionally, if you plan to put a lot of miles on your car, which will quickly impact its value, gap insurance can be beneficial. It is also a good option if you have a long-term car loan of 60 months or more, as this increases the likelihood of your car being worth less than what you owe. Furthermore, if you have negative equity or are upside down on your loan, gap insurance can provide valuable protection. This situation occurs when the amount you still owe on your car loan exceeds its actual cash value, which can happen due to rapid depreciation or a low down payment.

While gap insurance offers financial security, it may not be necessary in all cases. If you owe less than your car's value or can afford to pay the difference between the amount owed and the car's value in case of an incident, you may not need gap insurance. It's important to carefully consider your circumstances, loan terms, and vehicle value before deciding whether to opt for gap insurance.

MOT and Insurance: Are You Legal to Drive?

You may want to see also

Where to buy gap insurance

When buying a new car, you can purchase gap insurance from the dealer or your auto insurance company. It is usually optional if you're financing a purchase, but it might be mandatory if you're leasing a vehicle.

Buying gap insurance from a dealer

When you buy or lease a car, the dealer will likely ask if you want to purchase gap insurance when you discuss your financing options. Buying gap insurance from a dealer can be more expensive if the cost of the coverage is bundled into your loan amount, which means you'd be paying interest on your gap coverage.

Buying gap insurance from an insurer

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance from an insurance company may be less expensive, and you won't pay interest on your coverage. If you already have car insurance, you can check with your current insurer to determine how much it would cost to add gap coverage to your existing policy. Note that you need comprehensive and collision coverage to add gap coverage to a car insurance policy.

- Progressive Insurance Company: They offer loan/lease payoff coverage, which is similar to gap coverage. The payout is limited to no more than 25% of the vehicle's value, though the limit varies by state.

- Associated Credit Union of Texas: You can add gap coverage to your auto loan or opt for it during the loan application process. Refunds are available if the coverage is cancelled within the first 60 days.

- Allstate: Allstate provides gap insurance and typically suggests this coverage for those who have paid less than 20% upfront for their vehicle, have auto loans extending 60 months or more, or are leasing their vehicle.

- Greater Texas Credit Union: This credit union offers affordable gap insurance to its members, available up to 18 months from the start of the auto loan.

- USAA: USAA offers gap insurance among its range of budget-friendly insurance options for military members, veterans, and their families.

- Texas DPS Credit Union: Their Gap Plus option includes standard gap coverage and deductible assistance if your vehicle isn't totaled. It also offers a $1,000 discount on your next loan with the credit union.

- State Farm: They offer gap insurance as part of their coverage.

- Travelers: They offer gap insurance.

Insurance Revoked: DMV Notified?

You may want to see also

Frequently asked questions

Gap insurance is calculated by subtracting the current market value of your vehicle from the amount you owe on your loan or lease. This difference represents the "gap" that needs coverage.

The cost of gap insurance depends on factors such as the value of your vehicle, the loan terms, and the insurance provider. It typically costs between $50 and $250 per year to add to an insurance policy.

You can buy gap insurance from your auto insurance company, the car dealership, or a specialty gap insurance carrier.

Gap insurance is recommended if you have a new vehicle, a long-term loan, or a small down payment. It's also a good idea if you owe more on your car than its actual cash value.