A vehicle's primary location is a critical factor in determining auto insurance rates. Car insurance companies rely on location as a primary rating factor, taking into account the number of accidents in the area, the crime rate, and the average value of vehicles in the vicinity. This information helps them assess the risk associated with insuring a vehicle in a particular area. Without a fixed address, insurance companies may deem an individual as high-risk and uninsurable. The primary location of a vehicle significantly influences the cost of insurance, with rates varying by hundreds of dollars between different ZIP codes.

| Characteristics | Values |

|---|---|

| Importance of Vehicle Primary Location | Insurance companies use the primary location of a vehicle to calculate the level of risk and price policies accordingly. |

| The primary location of a vehicle is a major rating factor for insurance companies, allowing them to assess the risks posed by the area in which the car is driven, including density, number of traffic incidents, and weather conditions. | |

| Who Should be Listed on an Auto Insurance Policy | All licensed drivers in a household should be listed on the auto insurance policy, regardless of whether they regularly drive a specific car. |

| Insurance providers base rates and premiums on driving records, location, vehicle usage, and vehicle make and model. | |

| Primary Driver | The primary driver is the person who most frequently uses the car and is also known as the assigned or rated driver. |

| Insurance companies assign a primary driver to each car, and their driving record and risk profile are used to calculate the insurance rate for that vehicle. |

What You'll Learn

- The primary location of a vehicle is a major rating factor for insurance companies

- The primary location of a vehicle helps insurance companies assess the risk of the area

- Insurance companies use previous claims and population data to price policies

- Without a fixed address, insurance companies may deem a vehicle uninsurable

- The primary location of a vehicle can affect the type of insurance policy required

The primary location of a vehicle is a major rating factor for insurance companies

For example, if a vehicle is located in an area with a high number of traffic incidents, the insurance company may deem the vehicle to be at a higher risk of being involved in an accident. Similarly, if a vehicle is located in an area with a high crime rate, the insurance company may consider the vehicle to be at a higher risk of being stolen or vandalized.

The primary location of a vehicle can also impact the cost of insurance. For instance, if a vehicle is located in an area with a high population density, the insurance company may charge a higher premium to account for the increased risk of accidents or theft. On the other hand, if a vehicle is located in a rural area with low traffic density, the insurance company may offer a lower premium as the risk of accidents or theft is perceived to be lower.

In addition to the primary location, insurance companies also consider other factors such as the vehicle's usage, the driver's age, and their driving record. For example, if a vehicle is used primarily for commuting to work, it may be considered a higher risk than a vehicle used only for occasional pleasure driving. Similarly, a teenage driver or a driver with a history of accidents may be considered higher-risk and result in higher insurance rates.

Overall, the primary location of a vehicle plays a crucial role in determining insurance rates as it helps insurance companies assess the potential risks associated with the area in which the vehicle is driven. By taking into account various factors related to the vehicle's location, insurance companies can calculate premiums that reflect the likelihood of claims being made.

Gap Insurance Claims: Report to NC Commissioner?

You may want to see also

The primary location of a vehicle helps insurance companies assess the risk of the area

The primary location of a vehicle is a key factor in determining auto insurance rates. Insurance companies use location to assess the risk associated with the area in which the vehicle is primarily driven and stored. This includes analyzing factors such as population density, traffic incidents, crime rates, and weather conditions. By understanding the risks posed by the primary location, insurance companies can price policies accordingly, ensuring they adequately cover potential claims.

For example, a vehicle located in an area with a high population density and frequent traffic incidents may be deemed riskier to insure than one in a rural setting with fewer accidents. Similarly, areas with higher crime rates may result in higher insurance rates due to an increased risk of theft or vandalism. Weather conditions also play a role, as locations prone to extreme weather events, such as hurricanes or blizzards, could lead to more frequent and severe claims.

Insurance companies rely on data from previous claims and population information within specific geographic areas, often down to the ZIP code or postal code level. This data helps them understand the risks associated with different locations and price policies accordingly. For instance, two applicants with the same vehicle and driving history but different ZIP codes may experience a significant difference in insurance rates due to the underlying risk factors of their respective areas.

The primary location of a vehicle also impacts insurance rates because it indicates whether the vehicle is used for personal or business purposes. A vehicle registered to a business address or frequently used to transport equipment or products is likely to require a commercial auto policy, which may have different coverage needs and risks than a personal vehicle.

Furthermore, the primary location can help determine if a vehicle is used for commuting or pleasure. Commuter vehicles, which are typically driven more miles and during busier times of the day, are considered riskier and may have higher insurance rates. On the other hand, pleasure vehicles, which are driven less frequently and for leisure purposes, often qualify for lower insurance rates due to reduced mileage and a lower likelihood of accidents.

Free Auto Insurance: The Ultimate Guide

You may want to see also

Insurance companies use previous claims and population data to price policies

The primary location of a vehicle is a significant factor in determining auto insurance rates. Insurance companies rely on location as a major rating factor, assessing the number of accidents in the area, the crime rate, and the average cost of vehicles in the vicinity. This information helps them gauge the risks posed by the area in which the car is driven most frequently and price policies accordingly.

Additionally, insurance companies consider the average cost of vehicles in a particular location. For example, in areas with a higher proportion of luxury or high-value vehicles, insurance rates may increase to account for the potential cost of repairs or replacements. This information is crucial in determining the level of risk associated with insuring vehicles in specific locations.

The absence of a fixed address can pose challenges in obtaining car insurance. Without a permanent location for the vehicle, insurance companies struggle to predict the risks they may be exposed to. As a result, individuals without permanent addresses may be deemed uninsurable or face higher insurance rates. This situation particularly affects those who are homeless or living in their vehicles, as insurance companies perceive a higher level of risk associated with these circumstances.

To overcome this challenge, individuals without permanent addresses can use the address of a friend or family member where the vehicle will be parked as their listed address for insurance purposes. However, it is crucial to ensure that the vehicle is consistently parked at the listed location when not in use. Providing inaccurate or misleading information about the primary location of the vehicle can lead to coverage denial or cancellation by the insurance company.

Insurance Coverage: Auto Claims and Benefits

You may want to see also

Without a fixed address, insurance companies may deem a vehicle uninsurable

A vehicle's primary location is very important when it comes to auto insurance. Car insurance companies rely on location as a primary rating factor, assessing the number of accidents in the area, the crime rate, and the average cost of vehicles in the immediate area. This allows them to gauge the risks posed by the area in which the vehicle is driven most often. Without a fixed address, insurance companies may deem a vehicle uninsurable.

Insurance companies need to assess risk when pricing policies. They do this by looking at previous claims and population information for a particular ZIP code. Without a fixed location for a vehicle, it is difficult for an insurance company to predict the kind of risk it will be exposed to. This makes it challenging to obtain car insurance coverage without a permanent address.

However, it is not impossible to get car insurance without a permanent address. If you are temporarily without an address because you are waiting to move into a new home, most insurance companies will allow you to use your new address to start a policy before you actually move in. If you are living with a friend temporarily, you can get an insurance policy for their address, as this is where the vehicle will be parked. If you are homeless or living in your vehicle, you can keep your vehicle at a friend's house and use that address for your quote, but it is critical that you park the vehicle at this location when it is not in use.

When applying for car insurance without a permanent address, it is important to be honest about your circumstances. Insurance companies will not hesitate to reject an application if they discover any information, including address information, has been falsified.

Police and Auto Insurance: Who Talks?

You may want to see also

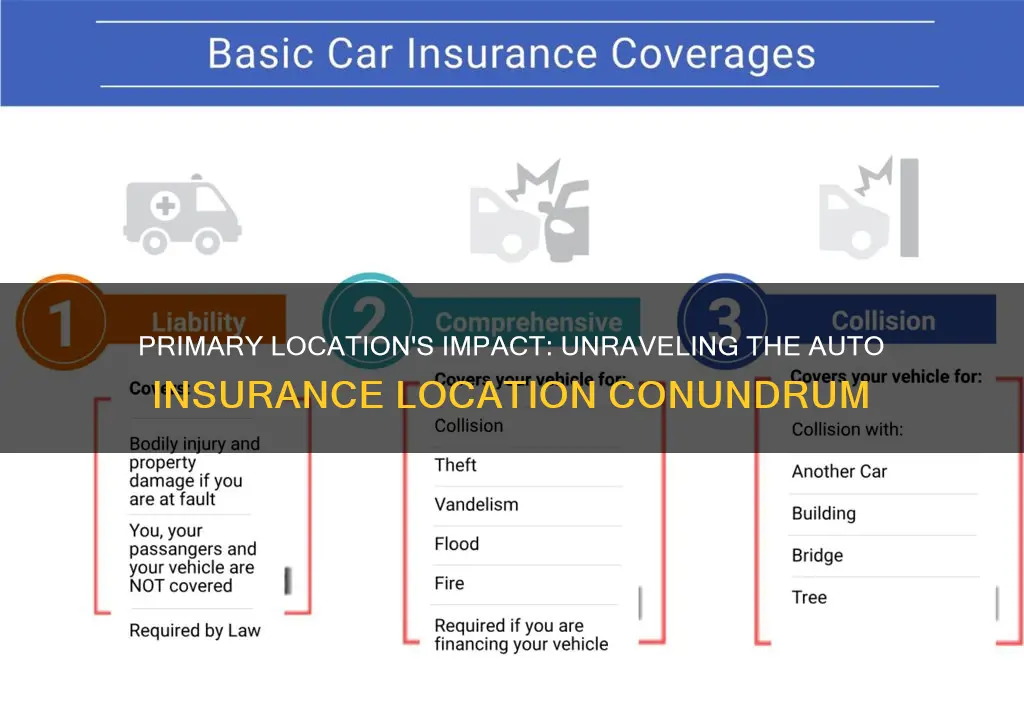

The primary location of a vehicle can affect the type of insurance policy required

The primary location of a vehicle is an important factor in determining the type of insurance policy required. This is because the location of the vehicle is a major rating factor for insurance companies, allowing them to assess the risks associated with the area in which the car is driven and parked. Factors such as the density of the area, the number of traffic incidents, and weather conditions can influence the insurance policy and rates.

When obtaining car insurance, insurance companies will consider the vehicle's primary location to gauge the potential risks. They will look at data such as previous claims and population information for the specific ZIP code or area. This information helps them calculate the likelihood of claims being made and the potential costs involved. For example, an area with a higher population density and frequent traffic incidents may result in higher insurance rates due to the increased risk of accidents or theft.

The primary location also plays a role in determining the purpose of the vehicle, such as personal or business use. If the vehicle is used for commuting to work or school, the insurance company will take this into account when setting the policy and rates. The frequency of use and annual mileage can impact the insurance rates, as vehicles used daily for commuting are typically driven more miles and are exposed to higher risks.

Additionally, the primary location can affect the type of coverage needed. For instance, if the vehicle is kept in an area prone to natural disasters or extreme weather conditions, the insurance policy may need to include comprehensive coverage to protect against potential damage. The location can also impact the cost of coverage, as certain areas may have higher repair or labour costs, which are reflected in the insurance rates.

It is important to note that insurance companies may have different weightings for various factors, so it is beneficial to shop around and compare policies from different providers. By providing accurate information about the primary location and usage of the vehicle, individuals can ensure they obtain the appropriate insurance coverage for their needs.

The Complex Art of Auto Insurance Rate Determination

You may want to see also

Frequently asked questions

Insurance companies use your primary location to calculate your level of risk and price your policy accordingly. They will look at the density, number of traffic incidents, and weather conditions of the area in which you drive most often.

If you don't have a fixed address, insurance companies may deem you uninsurable. They will be unable to predict the kind of risk they will be exposed to without a fixed location for the vehicle.

Insurance companies will use previous claims and population information for your ZIP code to price your policy. Even if the only unique factor between two auto insurance applicants is their ZIP code, there can be a difference of up to $300 in car insurance rates.