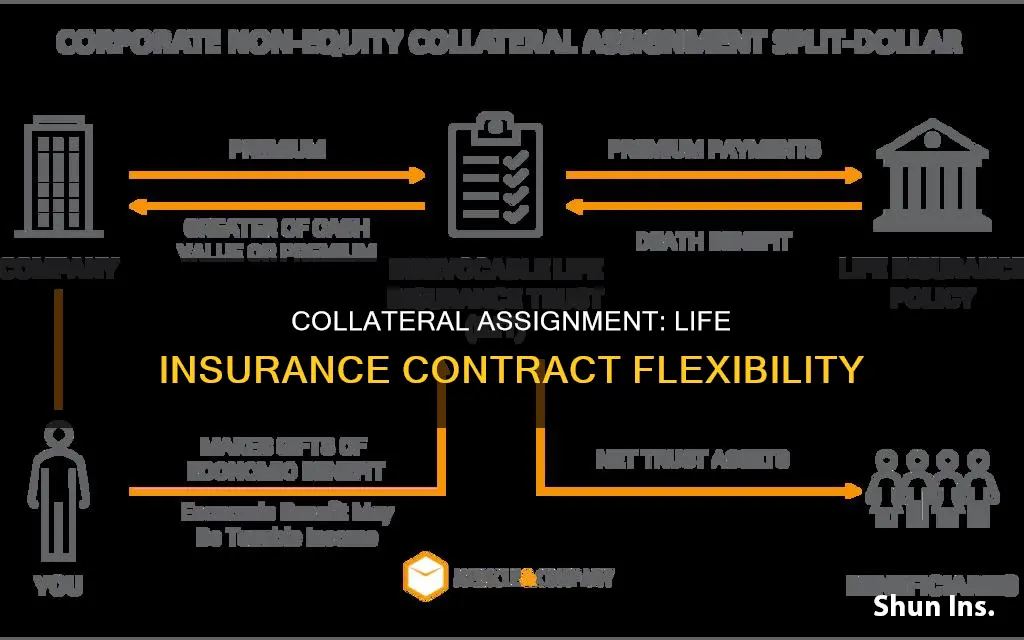

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. The death benefit of the policy is used as collateral for a loan, with the lender having a claim to some or all of it until the loan is repaid. This allows the lender to get paid what they are owed, and any remaining funds from the death benefit are then given to the policy's beneficiaries.

| Characteristics | Values |

|---|---|

| Definition | A collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. |

| Type of Insurance | Both term and permanent life insurance policies may be used as collateral. |

| Lender's Rights | The lender has a claim to some or all of the death benefit until the loan is repaid. |

| Beneficiaries | Any remaining death benefit after the lender is paid is distributed to beneficiaries. |

| Policy Owner | The borrower of a business loan using life insurance as collateral must be the policy owner, who may or may not be the insured. |

| Policy Status | The policy must remain current for the life of the loan, with the policy owner continuing to pay all premiums. |

| Collateral Assignment Form | A collateral assignment form must be completed by the assignor, assignee, and insurance company. |

| Lender as Assignee | The lender is named as the assignee of the policy, entitling them to a stake in its benefits until the loan is repaid. |

| Beneficiary Designation | The policy owner names beneficiaries who will receive the remaining death benefit after the loan is repaid. |

| Premium Payments | The policy owner is responsible for making timely premium payments to avoid violating the loan contract. |

| Loan Interest Rate | Collateral assignment may result in a lower interest rate on the loan due to reduced financial risk for the lender. |

| Policy Control | The collateral assignment may restrict the policy owner's ability to make changes or access the cash value until the loan is repaid. |

What You'll Learn

- What is a collateral assignment of life insurance?

- How does a collateral assignment of life insurance work?

- What types of life insurance are eligible for collateral assignment?

- What are the steps required to apply for collateral assignment?

- What are the pros and cons of using life insurance as collateral?

What is a collateral assignment of life insurance?

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. The lender becomes the temporary beneficiary of the policy's death benefit until the loan is repaid. This means that if the borrower dies before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of the life insurance policy. Any remaining funds from the death benefit would then be disbursed to the policy's designated beneficiary or beneficiaries.

The collateral assignment of life insurance is commonly used for business loans, but it can also be used for other types of loans, such as auto or home loans. Lenders may require the borrower to get a life insurance policy to be used for collateral assignment. The borrower must be the owner of the policy but does not have to be the insured, and the policy must remain current for the life of the loan, with the owner continuing to pay all premiums.

The advantage of using a collateral assignment is that it allows the borrower to access needed funding without putting their personal assets, such as their home or car, at risk. It can also be a good option for borrowers with a low credit score, as the lender can rely on the policy's death benefit to pay off the loan if necessary. However, there are also disadvantages to using a collateral assignment of life insurance, including the reduced death benefit for beneficiaries and the potential impact on the policy's cash value.

To set up a collateral assignment of life insurance, the borrower must first find a lender who is willing to accept life insurance as collateral. The borrower then needs to apply for a life insurance policy that meets the lender's requirements and fill out a collateral assignment form, which is provided by the insurance company. The form must be signed by all parties involved, including the borrower, the lender, and the insurance company. Once the form has been submitted and the loan has been approved, the borrower can access the funds.

Occupations: Impacting Life Insurance Rates and Policy Coverage

You may want to see also

How does a collateral assignment of life insurance work?

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. The lender becomes the temporary beneficiary of the policy's death benefit until the loan is repaid. The borrower must be the owner of the policy, but they do not have to be the insured person. The policy must remain current for the life of the loan, with the owner continuing to pay all premiums.

The collateral assignment process works like a standard loan. The insurance policy is used as "collateral" for the loan, and the lender becomes the temporary beneficiary of the policy's death benefit. The lender does not have the authority to make changes to the policy, resell it, or take any of its cash value. They can only draw on the death benefit if the policyholder defaults.

To apply for a collateral assignment of life insurance, you need to follow these steps:

- Understand the requirements: Find out if your lender accepts collateral assignments of existing permanent or term life insurance policies. Confirm that your current policy's death benefit amount meets their requirements. If they require a new policy, shop around for life insurance that meets their collateral assignment criteria.

- Apply for life insurance: If you need a new policy, apply with the insurer. Once approved, double-check that the policy meets your lender's loan requirements.

- Complete the collateral assignment form: Once your first life insurance premium is paid, obtain a collateral assignment form from your insurer and provide your lender's contact information. This form will designate them as the collateral assignee until your loan is repaid. Both you (the assignor) and the lender (the assignee) must sign this form.

- Proceed with your loan application: After your lender confirms they are the collateral assignee, proceed with your loan application.

It is important to note that you should continue to make timely premium payments on your life insurance policy during the loan. Failing to do so could violate your loan contract and trigger consequences such as an increased interest rate or a demand for full repayment of the loan.

Life Insurance: Choking Hazards and Policy Risks

You may want to see also

What types of life insurance are eligible for collateral assignment?

Any type of life insurance policy is acceptable for collateral assignment, provided that the insurance company allows assignment for the policy. However, some lenders may not accept term life insurance policies as collateral because they do not accumulate cash value.

Term life insurance can be used as collateral, but the policy must have a term length that is at least as long as the term of the loan.

Subcategories of permanent life insurance, such as whole life, universal life, and variable life, may also be used. A permanent policy with cash value may be especially appealing to a lender, as they could access the cash reserves if necessary.

Insurers' Investment Risk: Whole Life Insurance Explained

You may want to see also

What are the steps required to apply for collateral assignment?

The steps required to apply for a collateral assignment of life insurance are:

- Understand the requirements: Find out if your lender accepts collateral assignment of an existing permanent or term life insurance policy. If they do, confirm that your current policy's death benefit amount is sufficient as collateral for the loan. If your lender requires you to take out a new life insurance policy, you may need to shop around for a policy with a death benefit amount that meets their requirements.

- Apply for life insurance: If you need to buy a new life insurance policy, apply with the insurer. Once approved, double-check with your lender that the policy meets their loan requirements.

- Complete the collateral assignment form: Once your first life insurance premium is paid, obtain a collateral assignment form from your insurer and complete it. On the form, provide your lender's contact information so they can be added as the death benefit collateral assignee until your loan is repaid. The form also requires signatures from both you (the assignor) and your lender (the assignee).

- Proceed with your loan application: Once your lender has confirmed that they are the collateral assignee for your life insurance policy, you can proceed with your loan application.

It is important to note that you should not cancel your life insurance policy during the course of your loan, and you must make your insurance payments on time to avoid a policy lapse. Otherwise, you could violate your loan contract, giving your lender the right to raise your loan's interest rate or demand full repayment of your outstanding loan balance.

Life Insurance and M&T Bank: What You Need to Know

You may want to see also

What are the pros and cons of using life insurance as collateral?

Using life insurance as collateral can be a great way to access funds without putting other assets at risk. It can also be a good option if you have a low credit score, as lenders are more likely to offer favourable terms. Here are some of the pros and cons of using life insurance as collateral.

Pros

- It may be an affordable option, especially if your life insurance premiums are less than the payments for an unsecured loan with a higher interest rate.

- You won't need to put up personal property, such as your home, as collateral.

- Lenders generally view life insurance as a good choice for collateral, so you may find lenders eager to work with you.

- Loans secured with collateral often have lower interest rates than unsecured loans.

- If you have a life insurance policy with sufficient cash value, it may be easier to secure a loan against it than to obtain an unsecured loan.

- You can quickly access loan funds using life insurance as collateral, as the application and approval process is often shorter.

- Using life insurance as collateral can allow you to preserve your other investments.

- Depending on the terms of the policy and loan agreement, you may have flexible repayment options.

Cons

- The amount your beneficiaries would receive will be reduced if you die before the loan is paid off, as the lender has first rights to the death benefits.

- If you are older or in poor health, you may struggle to purchase life insurance.

- If you are using a permanent form of life insurance as collateral, your ability to use the policy's cash value may be impacted during the life of the loan. If the loan balance and interest payments exceed the cash value, the policy's value may be eroded over time.

- You may lose control of your policy.

- There may be limited use of the cash value of the policy.

Canceling Primerica Life Insurance: A Step-by-Step Guide

You may want to see also