Life insurance companies make money by charging premiums and investing a portion of those payments. They also profit from policies that lapse or expire without a claim being made. Commissions are another source of income for life insurance companies, as agents earn a percentage of the policy when it is sold and then receive further commissions when it is renewed. The life insurance industry is one of the most profitable industries in the world, with billions in profits reported annually.

What You'll Learn

Charging premiums

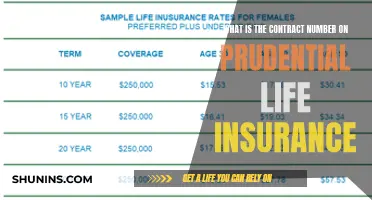

Actuaries play a crucial role in determining premium rates. They use advanced statistical and probability models to assess various risk factors such as age, health, and lifestyle. By setting premiums at an appropriate level, insurance companies can cover their liabilities and make a profit.

The premiums collected by insurance companies serve multiple purposes. Firstly, they fund the death benefit, ensuring that beneficiaries receive the promised payout upon the policyholder's death. Secondly, they cover the administrative costs associated with managing the policy. Finally, the premiums provide a source of profit for the insurance company.

It's important to note that insurance companies rely on a large number of customers paying premiums regularly. If too many customers were to pass away prematurely, the insurer would have to pay out more claims than expected, potentially resulting in financial losses. Therefore, insurance companies carefully assess risks during the application process and impose penalties for concealing relevant information.

In summary, charging premiums is a fundamental aspect of how life insurance companies make profits. By collecting regular payments from policyholders, insurance companies can fund the death benefit, cover administrative costs, and generate profits to sustain their business.

Life Insurance Policy: Locating Your Coverage

You may want to see also

Investing premiums

Life insurance companies make money by investing a portion of the premium payments they receive from policyholders. They invest in various financial instruments, such as stocks, bonds, real estate, and other types of investments. The interest gained from these investments enables them to pay out claims to beneficiaries upon the policyholder's death while remaining profitable.

The investment income from premium payments can be significant, even surpassing revenue from life insurance premiums. For example, in 2020, investment income contributed $186 billion to the life/annuity insurance industry's revenue, compared to $143.1 billion from life insurance premiums.

Permanent life insurance policies, such as whole life and universal life, have a cash value component that grows over time. A portion of each premium paid by the policyholder goes into this cash-value account, which is then invested by the insurer. The insurer sets aside enough cash to cover potential claims and keeps any interest gained, providing a source of profit.

The cash value funds are often invested through the insurer's ""general account," primarily in fixed-income securities like bonds. However, they may also be invested in stocks, real estate, or other types of investments. The earnings from these investments are shared between the insurance company and the policyholders, with the money earned by the general account determining the interest credited to the policyholders' cash-value accounts.

Variable life insurance policies differ in that the cash values are not invested in the general pool of cash reserves. Instead, they are invested in mutual fund subaccounts offered within each policy.

By investing premium payments, life insurance companies can generate substantial profits, ensuring their long-term financial stability and growth while fulfilling their obligations to policyholders.

Life Insurance and Suicide: What's Covered?

You may want to see also

Gaining from cash value investing

The premiums for permanent life insurance policies are significantly higher than those for term life insurance. This is because permanent life insurance premiums fund both the death benefit and the investment-like cash value feature. The cash value funds are pooled together and invested by the insurer, and some of the earnings are kept by the company. This investment stream provides an additional source of revenue for insurance companies, contributing to their overall profitability.

The interest and dividends generated from investing the cash value funds help cover operational costs, pay out claims, and generate profit. Insurance companies often invest in interest-bearing assets, such as Treasury bonds, high-grade corporate bonds, high-yield savings accounts, and certificates of deposit. Rising market interest rates can boost earnings, while falling rates may lead insurers to invest in riskier assets.

By investing the cash value funds, insurance companies can significantly increase their profits. They collect the premiums upfront and may not have to pay out a claim, allowing them to invest the money and generate additional income. This business model sets insurance companies apart from traditional businesses, as they do not have to invest heavily in product development and can put more money into their investment portfolios.

Life Insurance and Mortgages: What's the Connection?

You may want to see also

Benefiting from policy lapses and expirations

A life insurance policy lapse occurs when a policyholder stops paying the required premiums, resulting in the termination of the policy benefits. This situation can have significant consequences for the insured and their beneficiaries. When a policy lapses, the coverage it provides ceases, and the insured loses all the benefits associated with the policy.

- Loss of Coverage: When an individual's life insurance policy lapses, the most significant consequence is the loss of coverage. This means that if the insured person dies after the policy lapses, the insurance company will not pay out any death benefit, and the beneficiaries will not receive the intended financial support.

- Reinstatement Challenges: While many insurance companies offer an option to reinstate a lapsed policy, it often comes with certain conditions and requirements. The policyholder may have to provide evidence of their continued insurability, such as proof of no significant changes in health. They will also have to pay all overdue premium payments, possibly with additional interest or penalties.

- Increased Premiums: If a lapsed policy is reinstated or the policyholder purchases a new policy, they will likely face higher premiums. Insurance rates generally increase with age, and any new health issues or risks identified during the reinstatement process can result in even higher rates.

- Loss of Policy Benefits: Some insurance policies include additional riders or benefits, such as an accidental death benefit or a waiver of premium rider. A lapse in the policy can lead to the loss of these valuable add-ons, reducing the overall benefits for the insured.

- Surrender Charges: For policies with a cash value component, if the policy lapses or the policyholder chooses to surrender it, there may be surrender charges applied. This results in the policyholder receiving less than the total accumulated cash value, reducing the overall profitability of the policy for the insured.

- Tax Implications: Lapsed policies with a cash value component can have tax consequences for the policyholder, especially if they have taken loans or made withdrawals from the policy. This can further reduce the net benefit and profitability of the policy for the insured.

- Higher Premiums for Reinstatement: When a policy is reinstated after a lapse, insurance companies often charge higher premiums to account for the increased risk and administrative costs associated with the lapse. This benefits the insurance company by generating additional revenue from the reinstated policy.

- New Underwriting Requirements: In some cases, insurance companies may require a new underwriting process for reinstating a lapsed policy. This allows them to reassess the insured's risk profile and adjust premiums accordingly, potentially increasing their profitability on the policy.

- Grace Period Interest: During the grace period, which is typically around 30 days, policyholders are often required to pay interest on the missed premium payments. This benefits the insurance company by providing additional revenue, even if the policy is ultimately not reinstated.

- Lapses Reduce Payouts: When policyholders lapse or surrender their policies, the insurance company retains the premiums paid up to that point. This reduces the overall payouts made by the insurance company, positively impacting their profitability.

In summary, insurance companies can benefit from policy lapses and expirations by retaining premiums, reducing payouts, and generating additional revenue through reinstatement fees, higher premiums, and interest charges. While policyholders may face challenges and losses due to lapses, insurance companies can often turn these situations into profitable opportunities.

Life Insurance: A Warm Welcome or Cold Comfort?

You may want to see also

High commission rates

Life insurance companies make money through premium payments, investing those premiums, and benefiting from lapsed policies. One of the main ways life insurance companies make money is by charging premiums. These premiums are carefully calculated by insurers to cover the policy's death benefit and administrative costs, as well as provide profits for the company. The high commission rates on these premiums are a significant source of income for life insurance companies.

Life insurance agents are typically paid through commissions and must find customer leads independently. The commission rates on life insurance policies are notably high compared to other types of insurance sales, such as health insurance. For example, a life insurance agent can earn anywhere from 30% to 90% of the premium in the first year and then 5% to 10% of premiums paid in subsequent years. These high commission rates provide a strong incentive for agents to sell life insurance policies.

The high commission rates in the life insurance industry can be attributed to the large size of the policies and the significant annual premiums associated with them. The high cost of whole life insurance, for instance, leads to higher commissions for agents. Whole life insurance is a type of permanent life insurance that combines coverage with a cash value component, resulting in higher premiums. The cash value in these policies grows over time, and the policyholder can borrow against it.

While the commission rates for life insurance agents are attractive, the job comes with its challenges. Finding qualified customers can be difficult, and the product itself is often hard to sell due to its focus on mortality. Life insurance sales typically require a significant amount of time and perseverance to build a professional network and acquire clients. Despite these challenges, the high commission rates in the life insurance industry contribute significantly to the profitability of life insurance companies.

Life Insurance Usage: Assisted Living Eligibility and Conditions

You may want to see also

Frequently asked questions

Life insurance companies make money by charging premiums, investing those premiums, gaining interest from cash value investments, and benefiting from lapsed policies.

When a policy lapses or expires without a claim being made, the company retains all the collected premiums without having to pay out a death benefit.

Insurance companies invest premiums in various financial instruments, such as stocks, bonds, and real estate. The returns on these investments enable them to pay out claims while remaining profitable.

Life insurance agents are typically paid on commission. The U.S. Bureau of Labor Statistics reports that insurance sales agents can earn anywhere from $34,000 to $134,000 per year, with a median salary of over $59,000 per year.