Private health insurance is a contract between an individual and a private health insurance company that mandates the insurer to pay some or all of the individual's medical expenses as long as they pay their premium. Private health insurance is typically paid for through a monthly premium, which varies based on factors such as the level of coverage, the member's age, tobacco use, and location. In some cases, employers may offer private health insurance as part of an employee benefits package, with both the employer and employee sharing the cost of the premium. Private health insurance is the most common way Americans get coverage, with the U.S. Census Bureau estimating that 66% of Americans have a private health plan compared to 36% with public plans.

| Characteristics | Values |

|---|---|

| Type | Individual, Family, Group, Medicare Advantage, Short-Term, Catastrophic, Supplemental, Dental and Vision, Long-Term Care, Travel, Specific Disease or Illness, High-Deductible Health Plans |

| Coverage | Doctor's visits, hospital stays, prescription medications, diagnostic tests, and other medical services |

| Payment | Monthly premium, shared between employer and employee in some cases |

| Cost Influencers | Level of coverage, member's age, tobacco use, location, number of individuals covered |

What You'll Learn

Monthly premiums

Private health insurance plans are typically paid for through a monthly premium, which varies depending on factors such as the level of coverage, the member's age, tobacco use, and location. The monthly premium is the price paid in exchange for coverage by the insurer's plan.

For private health insurance obtained through an employer, the employer often covers a significant portion of the premium costs. Usually, these are pre-tax dollars, which can reduce taxes for those covered by the plan. In these cases, both the employer and employee share the cost of the premium.

For those who purchase private health insurance on the marketplace, they may be eligible for premium tax credit subsidies and other cost-sharing reductions, which can substantially lower their healthcare costs.

The cost to purchase private health insurance varies widely, and insurance companies set their premiums. In addition to the premium, there are usually out-of-pocket costs for care, including the plan deductible, copays, and coinsurance.

Hospitals' Private Insurer Contracts: How Do They Work?

You may want to see also

Employer-sponsored coverage

Types of Coverage

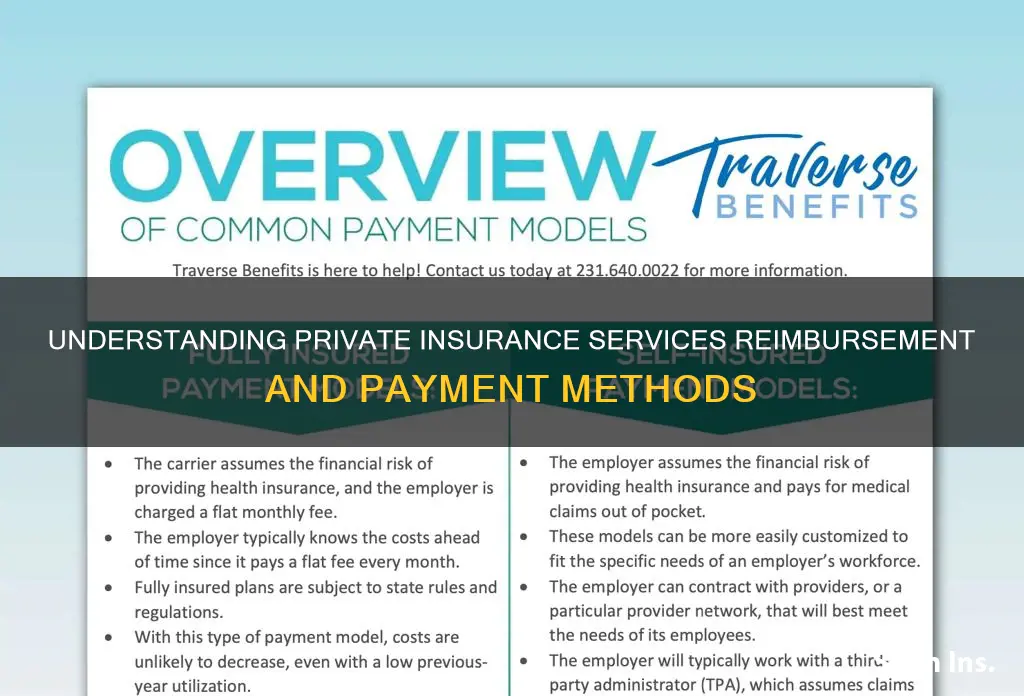

Employers can offer a range of health insurance options, including group insurance, Health Reimbursement Accounts (HRAs), supplemental plans, flexible spending accounts, and COBRA. Group health insurance is a common benefit, offered to a group of people, usually employees, and is designed to be more affordable than individual plans due to group purchasing power.

Costs

The average employer-sponsored health plan had a total monthly premium of $703 for a single employee and $1,997 for family coverage in 2023. Typically, the employer pays the majority of the cost, but employees will usually pay a portion of the premiums through payroll deduction.

Requirements

The Affordable Care Act, signed into law in 2010, includes an employer mandate that requires businesses with at least 50 full-time employees to offer affordable, minimum-value insurance to full-time workers (30+ hours per week). If they do not, they may face a tax penalty.

Coverage Options

Employers can purchase small-group or large-group coverage, depending on the number of employees. They can also choose to self-insure, which means paying employees' medical claims out of pocket rather than purchasing coverage from an insurance company. Self-insured plans often still contract with an insurance company to administer the coverage.

Alternatively, employers can offer an ICHRA (Individual Coverage Health Reimbursement Arrangement), where they reimburse employees for some or all of the costs of obtaining individual market coverage.

Additional Coverage

Employers often provide additional supplemental coverage, such as dental insurance, vision insurance, life insurance, and short- and long-term disability coverage.

Enrollment Periods

Employees typically enroll in employer-sponsored coverage during specified periods, such as when they first join the company or during annual open enrollment.

Tax Benefits

Both employers and employees may benefit from tax savings related to group health insurance premiums. Premium payments are deducted from employees' paychecks before taxes, reducing their taxable income.

Flood Insurance: Private Insurers' Inability and Government's Role

You may want to see also

Individual and family plans

Private health insurance is a contract between an individual or family and a private health insurance company. The insurer agrees to pay some or all of the individual or family's medical expenses as long as they pay their premium. This is different from public health insurance, which is provided by the government and includes programs such as Medicare, Medicaid, and the Children's Health Insurance Program (CHIP).

Private health insurance can be obtained in several ways. It is commonly provided through an employer as part of an employee benefits package, with both the employer and employee sharing the cost of the premium. In this case, the premium is typically paid monthly, with the employer covering a significant portion.

Alternatively, individuals and families can purchase private health insurance directly from a private insurance company or through the Health Insurance Marketplace (also known as the Affordable Care Act (ACA) marketplace). The Marketplace was created in 2014 by the ACA and allows individuals and families to compare and shop for health insurance plans, as well as enrol in them. The Marketplace offers plans from various companies, including Kaiser Permanente, Blue Cross Blue Shield, and UnitedHealthcare. It is important to note that plans purchased directly from the insurance company may not comply with ACA regulations and may not provide all the essential health benefits found in ACA plans.

The cost of private health insurance varies depending on factors such as the level of coverage, the member's age, tobacco use, and location. Additionally, there are usually member out-of-pocket costs, including the plan deductible, copays, and coinsurance.

For individuals and families, private health insurance typically offers a range of benefits, including coverage for doctor's visits, hospital stays, prescription medications, diagnostic tests, and other medical services. It often provides advantages over public health insurance, such as more plans to choose from, access to a broader network of care providers, and fewer limitations on certain medical services.

Private Club Insurance: What Members Need to Know

You may want to see also

Cost-sharing reductions

Who is eligible for cost-sharing reductions?

When an enrollee who is eligible for CSR applies for a Silver plan, they are enrolled in a Silver plan that has cost-sharing reductions automatically built into the plan design. So the lower out-of-pocket cap and higher AV are automatic, as long as the person picks a Silver plan.

If you qualify for savings on out-of-pocket costs and enrol in a Silver plan, you will have:

- A lower deductible: This means the insurance plan starts to pay its share of your medical costs sooner.

- Lower copayments or coinsurance: These are the payments you make each time you get care, like $30 for a doctor visit.

- A lower "out-of-pocket maximum": This means the total amount you'd have to pay in a year if you used a lot of care, like if you got seriously sick or had an accident, would be lower.

Note that CSRs work somewhat differently for American Indians and Alaskan Natives, who can receive CSRs with Bronze, Silver, Gold, or Platinum plans. For Native Americans, these CSR benefits extend to households earning up to 300% of the poverty level, and they eliminate cost-sharing, as opposed to just reducing it.

FHA and Private Flood Insurance: What's Allowed?

You may want to see also

Out-of-pocket costs

There are several types of out-of-pocket costs, and they can significantly impact your overall health insurance options and choices. Here are some common examples:

- Non-covered services: Health insurance plans differ, and some services may not be covered by your specific plan. For instance, cosmetic surgery, non-prescription drugs, dental and vision coverage often fall into this category.

- Coinsurance: This dictates how much your insurance will pay and how much you will have to pay out-of-pocket after meeting your deductible. For example, your insurance might cover only 80% of a procedure, leaving you to pay the remaining 20%.

- Copayments: These are set amounts you pay for specific healthcare services, such as doctor visits or prescription drugs.

- Deductibles: The amount you pay out-of-pocket before your insurance starts covering costs.

- Premiums: The regular payments you make to keep your health insurance active.

It is important to note that insurance providers may not always reimburse out-of-pocket expenses, and these costs can be unpredictable. Additionally, out-of-pocket costs can vary based on whether you are treated in a hospital or outside of it, the type of treatment, and whether your treatment is covered by services like Medicare.

When choosing a health insurance plan, it is essential to compare the estimated total yearly costs, including premiums, deductibles, copayments, and coinsurance. This will help you make an informed decision that fits your budget and healthcare needs.

Single Payer Insurance: Private Insurance's End?

You may want to see also

Frequently asked questions

Private health insurance is coverage provided by a private company, rather than the government. It is currently used by a little over half of the US population.

Private health insurance is typically paid for through a monthly premium, which varies depending on factors such as the level of coverage, the member's age, tobacco use, and location.

The cost of private health insurance is influenced by the chosen plan, the insurer, the number of individuals covered, and the region in which it is purchased. For individual purchasers, age and tobacco status also factor into the cost.

Yes, if you purchase insurance through a government-run marketplace/exchange, you may be eligible for Affordable Care Act subsidies such as premium tax credits or cost-sharing reductions. Employers also often cover a significant portion of the premium costs for their employees.

Private health insurance plans usually have specific enrolment periods, the most common being the annual Open Enrollment Period (OEP) in the fall. During the OEP, you can apply for new coverage, renew existing coverage, or make changes to your plan.