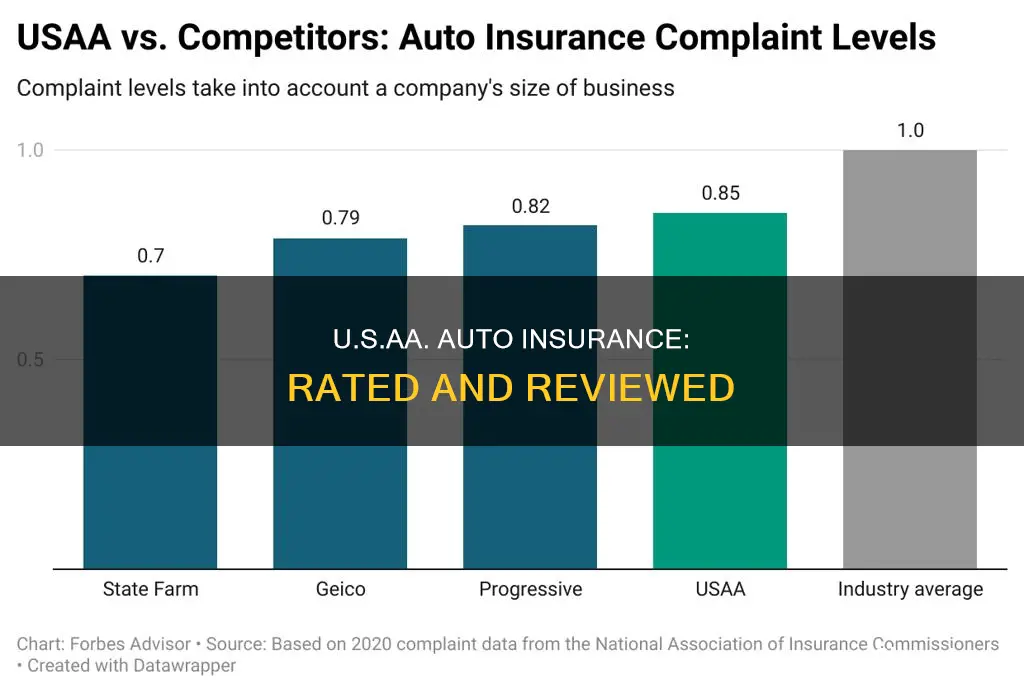

USAA is rated No. 1 in the US News Best Car Insurance Companies rating. It stands out for its customer service, claims handling, number of available discounts, and its appeal to senior drivers. USAA also has the lowest average annual rate overall and is the cheapest among companies in the analysis for drivers with a speeding ticket or accident on their record. However, USAA is only available to current and former members of the military and their families.

| Characteristics | Values |

|---|---|

| USAA Car Insurance Cost | $807 per year ($67 per month) for a minimum-coverage policy |

| USAA Car Insurance Cost Compared to National Average | $720 per year |

| USAA Full Coverage Insurance Cost | $2,802 per year |

| USAA Car Insurance Cost Increase After an Accident | 44% |

| USAA Car Insurance Cost Increase After a Speeding Ticket | 9% |

| USAA Customer Service Rating | 82% of customers said they were completely satisfied with the new-policy process |

| USAA Claims Handling Rating | 74% of USAA drivers stated they were highly satisfied with the final claim resolution |

| USAA Customer Loyalty Rating | 62% of respondents said they were very likely to recommend USAA insurance |

| USAA Average Auto Insurance Rate | $875 |

| USAA Average Auto Insurance Rate Compared to National Average | $1,321 |

What You'll Learn

USAA's customer service

USAA is rated No. 1 for customer service, claims handling, and discounts. In a survey, 60% of respondents said they were completely satisfied with the customer service provided, and 64% said they were completely satisfied with the ease of contacting USAA’s customer service. Over 65% of survey respondents were completely satisfied with the ease of filing a claim, while 67% were completely satisfied with how their claim was resolved. When it came to getting updates about their claims, 61% responded that they were completely satisfied.

USAA also has a customer service phone number: 1-800-531-USAA (8722).

However, some customers have complained about the company's insurance rates, especially in certain states. Some customers have also complained about the company's savings account interest rates and credit card reward points.

AAA vs USAA: Unlocking the Auto Insurance Advantage

You may want to see also

USAA's claims handling

USAA is rated No. 1 for claims handling, according to U.S. News. More than 65% of survey respondents were completely satisfied with the ease of filing a claim, while 67% were completely satisfied with how their claim was resolved. When it came to getting updates about their claims, 61% responded that they were completely satisfied.

USAA's auto accident claims can be submitted online through their web claims system or by contacting the company. A claims representative will be assigned to your case automatically. Simple claims can be completed without a telephone call. You can tell USAA what happened, upload photos of the accident or damages to your vehicle, review your coverage, determine how you want to proceed, set an inspection and get a rental car if applicable.

USAA recommends you file a claim if someone got hurt as a result of the accident, you caused minimal or serious damage to someone else's vehicle or property, or you caused damage to a municipality's property, such as a guardrail, telephone pole or street sign.

You may not want to file a claim if you caused minimal damage to your own vehicle or property, and the damage is less than your deductible, or you don't plan on fixing your vehicle.

USAA also offers home insurance claims. You can file a claim online or via the USAA Mobile App, or by calling them. Once you file your claim, you should hear from an adjuster within 48 business hours.

The Hidden Cost of Auto Accidents: Does Insurance Cover Diminished Value?

You may want to see also

USAA's insurance costs

USAA offers a range of discounts and incentives that can lower insurance costs even further. These include discounts for multi-vehicle policies, multi-policy bundles, safe driving, membership, loyalty, and more. USAA also offers lower rates for specific groups, such as teen drivers, young adults, adults, seniors, and drivers with poor credit or a clean record.

The cost of USAA insurance depends on various factors, including the driver's history, age, state, and coverage limits. For example, full coverage insurance from USAA costs an average of $2,802 per year, while minimum coverage costs an average of $807 per year.

Discontinuing MetLife Auto Insurance: Any Penalties?

You may want to see also

USAA's insurance discounts

USAA offers a variety of discounts to its members, which can help keep insurance rates low. The availability of certain discounts may vary by state, but USAA offers 14 auto insurance discounts in total. Here are some of the most notable USAA insurance discounts:

Safe Driver Discount

USAA offers a discount for those with a clean driving record for at least five years. This discount is also known as the Premier Driver Discount.

Defensive Driving Discount

Taking an approved defensive driving course can help you save on your insurance premium.

Driver Training Discount

USAA offers a discount for drivers under 21 who take a basic driver training course.

Good Student Discount

College students and teenagers who are enrolled full-time and maintain at least a "B" average or a 3.0 GPA can qualify for this discount.

New Vehicle Discount

If your vehicle is less than three years old, you may be eligible for a discount.

Multi-Vehicle Discount

You can get a discount if you insure more than one car on the same policy.

Annual Mileage Discount

Drivers aged 29 or older can get a discount based on the number of miles driven each year.

Family Discount

Former dependents under the age of 25 with a clean driving record can get up to a 10% discount if they had coverage on their parents' policy for at least three years.

Military Installation Discount

If you store your vehicle on a military base, you can get up to a 15% discount on comprehensive and collision coverage.

Stored-Vehicle Discount

If you're deployed and store your vehicle for at least 30 consecutive days, you can receive up to a 60% discount on your premiums.

Length of Membership Discount

Long-time USAA customers can get a discount for their loyalty.

Multi-Policy Discount

You can save by buying multiple types of insurance from USAA, such as bundling home and auto insurance.

SafePilot Discount

By allowing USAA to track your driving habits through the SafePilot app, you can save up to 30% on your insurance premium.

Full Coverage Auto Insurance: State Farm Explained

You may want to see also

USAA's insurance availability

USAA insurance is available in all 50 states and Washington, D.C. However, it is only available to current and former members of the military and their families.

USAA's insurance rates are based on factors such as a driver's history on the road, age, state, and coverage limits. The company offers several discounts, including multi-vehicle and multi-policy discounts.

Insurance Rates: Zip Code Discrimination

You may want to see also

Frequently asked questions

USAA is a great insurance company for military members and their families, and it ranked fourth overall in our nationwide study of over 100 providers. The provider typically ranks highly in customer satisfaction across several J.D. Power studies. It also has some of the lowest full-coverage car insurance rates among major providers in the country.

USAA's rates are among the lowest of all insurance companies in our research, combined with the highest customer satisfaction ratings. USAA is the cheapest insurer in our Cheapest Car Insurance Companies ranking, while Progressive ranks sixth place out of nine insurers. In our Best Car Insurance Companies ranking, USAA claims the top spot and Progressive lands in seventh place.

Although military service members can benefit from discounts, a wide variety of qualifying drivers could be very pleased with the insurer’s low rates and service that earns high satisfaction ratings.

USAA provides insureds with various coverages, including homeowners insurance, renters insurance, small business insurance, life and health insurance. USAA is #1 in our 2024 ranking of Best Home and Auto Insurance Bundles. USAA also offers more specialized or add-on coverages such as mobile phone protection, pet insurance, aviation insurance, and collectibles insurance.