Adding a vehicle to your USAA insurance policy is a straightforward process that can be done online, over the phone, or through the mobile app. This process is necessary to ensure your new vehicle is covered in case of an accident, theft, or damage. To add a vehicle, you will need to provide basic information such as the Vehicle Identification Number (VIN), year, make, model, and state of registration. You will also need to indicate if the car is leased or financed and select your desired coverage limits. USAA will then provide you with a quote for adding the vehicle, and if accepted, the car will be officially added to your policy. It is important to review your policy regularly and understand how any changes may impact your coverage and premium.

| Characteristics | Values |

|---|---|

| How to add a car to a USAA insurance policy | Online, by phone, or through the mobile app |

| Information required | Vehicle Identification Number (VIN), year, make, model, body type, whether the car is leased or financed, lender information, physical damage coverage limits |

| Proof of insurance | Digital or physical copy of the insurance card |

| Additional considerations | Re-evaluate coverage limits and deductibles, consider extra coverage and discounts |

What You'll Learn

Adding a new car to your USAA insurance policy

Overview of Adding a Car to USAA Insurance:

Provide basic vehicle information: You will need to provide details such as the Vehicle Identification Number (VIN), year, make, model, and body type of the car. USAA will use this information to generate a quote.

Get a Quote and Accept:

USAA will provide a quote for adding the new vehicle, including any changes to your premium. The rates are based on the car's attributes, your policy limits, and other factors. If you accept the quote, the car will be officially added to your policy. You can choose the effective date for the coverage to start, ensuring there are no lapses in coverage.

Update Payment Details:

Your premium may change after adding a car. USAA will adjust your monthly payments or send you a bill for any additional premium due. Review and update your payment details to prevent any interruptions in coverage.

Obtain Proof of Insurance:

Once the car is added to your policy, you will receive proof of insurance reflecting the newly added vehicle. Keep this document in your glove box or save it on your phone.

Consider Extra Coverage and Discounts:

Adding a car is an opportunity to re-evaluate your coverage limits and deductibles. USAA can recommend options to ensure the new vehicle is adequately protected. Consider usage-based coverage through USAA's SafePilot program and take advantage of any applicable discounts, such as multi-vehicle or good student discounts.

Adding a Car Online:

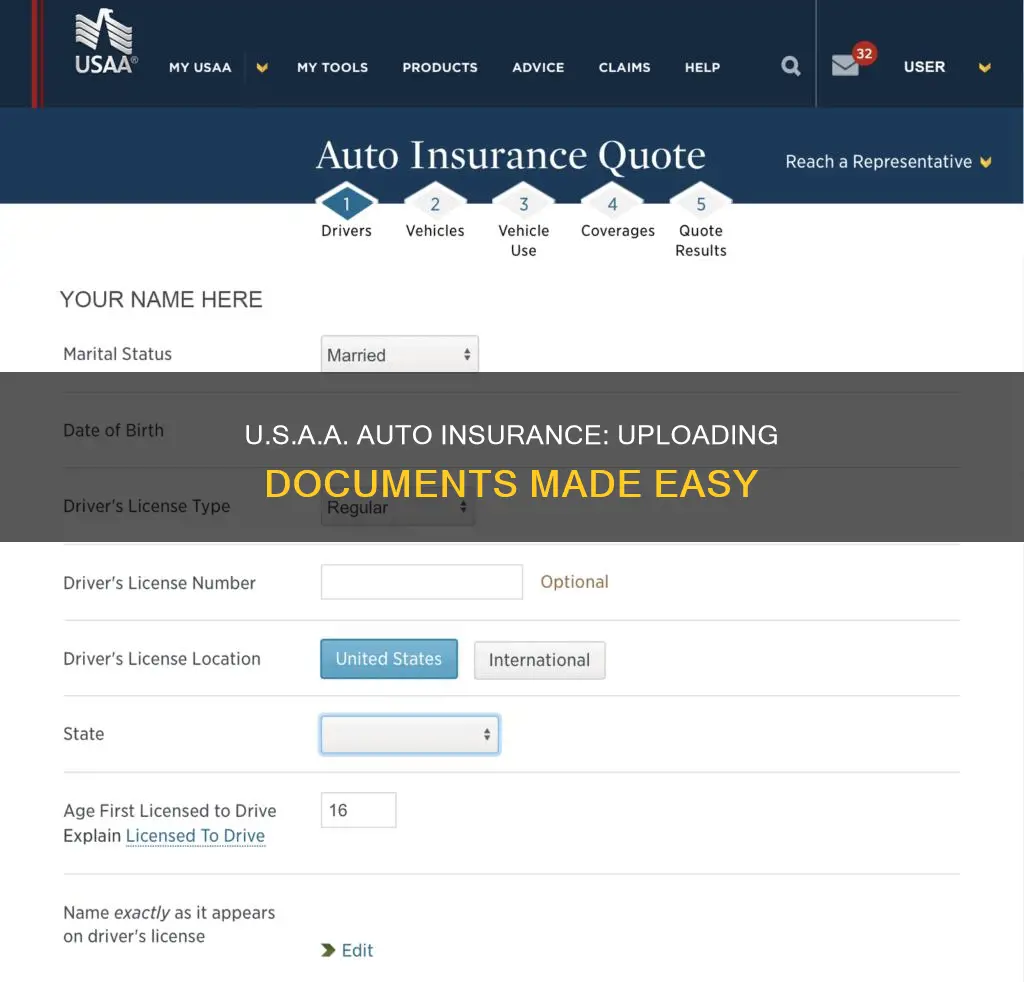

Log into your USAA account and go to your Auto Insurance policy page. Look for the "Add Vehicle" button and click on it. Enter the vehicle details, including the VIN, body type, lease or finance information, and select your desired coverage limits. Review the premium quote, choose the effective date, accept the terms and conditions, and pick your payment option. Once submitted, you'll receive immediate proof of insurance for the new vehicle.

Using the USAA Mobile App:

Open the USAA app and log into your account. Go to your Auto policy and look for the "Add Vehicle" option. Enter the VIN or manually enter the vehicle details. Select lease or finance information, choose your coverage limits, and review the premium quote and effective date. Accept the terms, pick your payment option, and your proof of insurance will be generated instantly in the app.

Contacting USAA:

You can also work with a USAA agent over the phone by calling their customer service line at 800-531-8722. Provide them with your member ID, VIN, vehicle details, lease or finance information, and select your coverage limits. The agent will provide a premium quote and explain how the additional vehicle impacts your policy. Choose the effective date, pick your payment method, and ask the agent to send your updated insurance documents.

Important Tips:

- Add the car right away to avoid any gaps in coverage.

- Double-check that all information, including VIN, vehicle, and driver details, is accurate in your updated documents.

- Review your liability limits, deductibles, and discounts to ensure they meet your current needs.

- Contact USAA if you sell or remove a vehicle from your policy, as your premium will need to be adjusted.

By following these steps and tips, you can easily add a new car to your USAA insurance policy and ensure that your vehicle is properly covered.

U.S. Auto Insurance Availability: USAA's Oregon Offering

You may want to see also

Obtaining proof of insurance from USAA

The United Services Automobile Association (USAA) is an insurance provider for people and families who serve, or have served, in the United States Armed Forces. If you are one of their 13 million members, you will need to carry proof of your insurance. This is essential in 48 states that require drivers to purchase liability insurance.

USAA will issue you an insurance declaration page, insurance identification (auto ID) card, and, if requested, a binder letter. All of these documents include key policy dates, insurer details, your policy number, and vehicle identification information. The auto ID card is what you need to carry with you when driving, in case you need to show it to law enforcement or the DMV.

- Through the website: Log in to your account and access the "My Documents" section. Here, you will find temporary insurance cards and the declarations page in the "Insurance Folder." This will be valid for 30 days from the start of your policy.

- Request a replacement auto ID card: Through the website, go to "My Account Summary" and select "Get Proof of Auto Insurance (Auto ID Cards)" and "Proof of Insurance Cards." Here, you can select your vehicle and choose to receive your card by mail or email.

- USAA Mobile App: You can access your digital auto ID card through the USAA mobile app. This option is available in most states, except those that do not accept digital proof of insurance, such as New Mexico.

- Contact USAA: If you are unable to access your proof of insurance through the website or mobile app, you can call or email USAA for assistance. They may be able to send you a binder letter or a copy of your policy.

It is important to note that if you have recently purchased a policy, USAA provides temporary coverage for a limited time, such as 30 days or up to two weeks, depending on the situation. During this period, you can use the temporary insurance cards and declarations page available through your online account.

Auto Insurance: Job Privacy?

You may want to see also

Understanding the impact of changes on your premium

When you make changes to your USAA auto insurance policy, such as adding a new vehicle, it's important to understand how these changes can impact your premium. Here are some key factors that can influence your premium:

- Vehicle Attributes: The age, make, model, and value of your car play a significant role in determining your premium. Newer and more expensive vehicles typically result in higher insurance rates.

- Coverage Limits: The liability, collision, and comprehensive coverage levels you choose for the added vehicle will affect your premium. Higher coverage limits usually lead to higher premiums.

- Driver Assignment: The main driver assigned to the additional vehicle can impact the rate based on their demographics and driving record.

- Discounts: The new vehicle may qualify for certain discounts, such as multi-vehicle or anti-theft device discounts, which can help lower your overall premium.

- Increased Exposure: Adding another vehicle to your policy means USAA is covering a higher overall value, which often results in a higher premium due to increased risk exposure.

- Policy Minimums: If the addition of a new vehicle takes you above a certain threshold for the number of insured vehicles, USAA may require you to move up to a higher policy minimum, which can increase your premium.

- Vehicle Eligibility Criteria: USAA has specific guidelines for vehicle eligibility. If your new car doesn't meet these requirements, it could affect your premium.

- Driving Record: Your driving history is a crucial factor in determining your premium. If the new vehicle has different safety features or performance characteristics, it may impact your rates.

- Location: Your premium can be influenced by your location, as certain areas may be considered higher risk by the insurance company due to factors such as accident rates or extreme weather events.

- Market Trends: Auto insurance rates can be impacted by inflation, supply chain costs, and industry trends. These factors may result in rate increases across the board, regardless of your specific circumstances.

It's important to note that the impact of changes on your premium may vary, and you should consult with a USAA representative to understand how your specific modifications will affect your policy. Additionally, USAA offers various discounts and optional add-ons that can help offset potential premium increases and provide you with additional coverage options.

Understanding Auto Insurance Coverage: Navigating the Complexities of Protection

You may want to see also

Adding a driver to your USAA car insurance policy

Contact USAA

Reach out to USAA via phone or online. Their representatives will guide you through the process and provide any necessary information. You can call them at 1-800-531-8722.

Provide Driver Information

Be prepared to provide the new driver's full name, date of birth, and driver's license information. USAA may also require additional documentation or verification, so it's a good idea to have those ready. This can include the driver's address and driving history.

Review Coverage and Premium

Adding a driver can impact your policy's coverage and premium. Discuss any changes or adjustments with USAA representatives, who can guide you through the potential implications. Factors such as the driver's age, driving history, and risk level can influence your premium.

Update Payment Details

Ensure your payment details are up to date. Adding a driver may affect your premium, so updating your payment information is crucial to avoid any interruptions in coverage.

Confirm and Receive Updated Policy

Once you've completed the above steps and provided all the necessary information, USAA will confirm the addition of the driver. You will receive an updated policy document reflecting this change. Keep this document safe, as it serves as proof of your updated insurance coverage.

It's important to note that USAA car insurance policies are tailored to meet the unique needs of military personnel and their families. This means that their coverage and benefits take into account the challenges and demands of military life, offering features like worldwide coverage for military members.

Additionally, USAA offers various benefits and discounts, including accident forgiveness, roadside assistance, rental car coverage, and savings for safe driving. Remember to review your policy regularly and stay informed about any changes to your coverage and premium.

Property Insurance Adjuster License: Auto and Homeowner Claims Covered?

You may want to see also

Removing a driver from your USAA car insurance policy

Step 1: Contact USAA

Reach out to USAA via phone or online to initiate the driver removal process. Their representatives will guide you through the process and provide any necessary information.

Step 2: Provide Driver Information

Be prepared to provide the driver's full name and driver's license information. USAA may also require additional documentation or verification, such as proof of address change or a new insurance policy.

Step 3: Review Coverage and Premium

Removing a driver from your policy may result in changes to your coverage and premium. A USAA representative can assist in understanding the impact of removing a driver and help you make any necessary adjustments.

Step 4: Update Payment Details

Ensure that your payment details are up to date, as removing a driver may affect your premium payments. Updating your payment information will prevent any interruptions in coverage.

Step 5: Confirm and Receive Updated Policy

Once you've completed the above steps and provided all the required information, USAA will confirm the removal of the driver. You will receive an updated policy document reflecting these changes.

It's important to note that USAA car insurance policies are designed for military personnel and their families, offering unique benefits such as worldwide coverage for military members. The company also provides various discounts and add-ons, including accident forgiveness and rental car coverage.

When removing a driver, be aware of the potential impact on your insurance premium. Removing a high-risk driver may decrease your premium, while removing a low-risk driver could result in an increase. USAA representatives can provide specific details about these changes.

U-Turn: USAA's High-Risk Auto Insurance Options

You may want to see also

Frequently asked questions

You can add a car to your USAA auto insurance policy by calling USAA's customer service line at 800-531-8722, or by using the USAA website or mobile app. You'll need to provide basic information about the car, such as the VIN, year, make, model, and whether it is leased or financed.

When adding a car to your USAA auto insurance policy, you will need to provide the Vehicle Identification Number (VIN), body type (car, truck, SUV, etc.), year, make, and model. If the car is leased or financed, you will also need to provide information about the lender.

Yes, you can add a vehicle to your USAA auto insurance policy at any time. It is important to add the car as soon as possible to avoid any lapses in coverage.

Once you have added a car to your USAA auto insurance policy, your premium may change. USAA will adjust your monthly payments or send you a bill for any additional premium due. You will also receive updated insurance documents and proof of insurance for the newly added car.