The NAIC, or National Association of Insurance Commissioners, is responsible for setting the regulations and standards for the insurance industry in the United States. They assign a unique 5-digit NAIC number to each insurance company to identify them and credential their insurance services. This number is helpful when filing an insurance claim or registering a vehicle. You can find the NAIC number on your insurance card, insurance policy, or the NAIC website.

| Characteristics | Values |

|---|---|

| What is an NAIC number? | A 5-digit unique number used to identify insurance companies. |

| What does NAIC stand for? | National Association of Insurance Commissioners |

| Where can I find my NAIC number? | On your insurance card, insurance policy, or the NAIC website. |

| Why do I need an NAIC number? | To renew your vehicle registration, file an insurance claim, or identify your insurance company. |

What You'll Learn

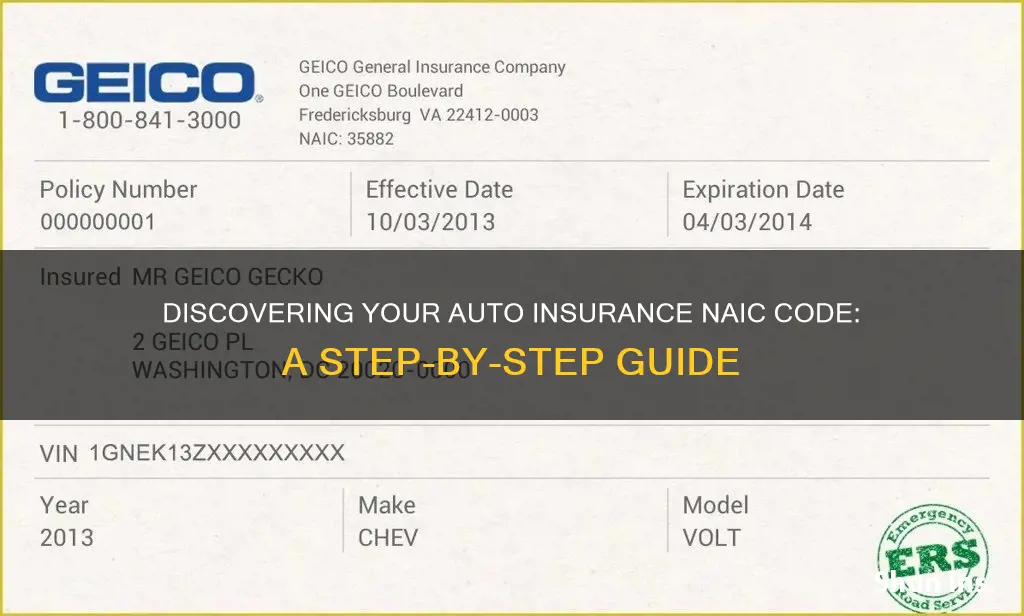

Finding the NAIC code on an insurance card

The NAIC (National Association of Insurance Commissioners) number is a unique 5-digit identification code assigned to every insurer to identify and credential their insurance company. This number is helpful in many cases, especially accidents and collision coverage. If you get into an accident and need to file for insurance, you will need to provide your insurer's NAIC number.

The NAIC number is usually printed on your insurance card, though it may not be labelled as such. If you find it challenging to find the NAIC number, try to look for the Company Number. If it is a 5-digit number, it is most likely the NAIC number.

Your insurance policy documentation will also include the NAIC number. The insurance policy will specify the NAIC number or the Company Number, so it is readily available at the time of the claim. However, this process might be more difficult as insurance policy documents are not usually carried around like an insurance card.

If you cannot find the NAIC number on your insurance card or policy documentation, or if you have misplaced your documents, you can log on to the NAIC website. You can use the consumer insurance search tool on the NAIC website to locate your insurer's company number.

Vehicle Insurance Binder: What's the Deal?

You may want to see also

Locating the NAIC number on the insurance policy

The NAIC number is a unique, five-digit identification code assigned to insurers by the National Association of Insurance Commissioners (NAIC). This number is used to identify the insurer and the policy they provide. It is essential when filing an insurance claim or registering a vehicle. The NAIC number can be found in several places, and there are a few quick tips to locate it:

Insurance Card

The NAIC number is typically printed on your insurance card. It may be labelled as the "Company Number" and is usually a five-digit numeral. If you have an insurance card, this is the first place to look.

Insurance Policy Documentation

The NAIC number is also specified in the insurance policy documentation. It is often included with the policy number and is the same number that appears on the insurance card. However, this method may be less convenient as insurance policy documents are not always easily accessible, unlike the insurance card.

NAIC Website

If you are unable to locate the NAIC number on your insurance card or policy documentation, or if you have misplaced these items, you can visit the NAIC website. The website provides a consumer insurance search tool that allows you to find your insurer's company number. By entering the company name, you can retrieve the corresponding NAIC number.

Contacting the Insurance Company

If you are still having difficulty finding the NAIC number, you can always contact your insurance company directly. They will be able to provide you with the correct NAIC number associated with your specific insurance product or policy. Remember that insurers may have multiple NAIC numbers, so it is essential to provide the correct one when filing a claim or registering a vehicle.

Verifying the Correct NAIC Number

It is important to ensure that you have the right NAIC number for your insurer and your specific policy. In some cases, insurers may have different subsidiaries or operate in multiple states, resulting in variations in their NAIC numbers. Always double-check the number to avoid any issues with claim processing or vehicle registration.

Auto Insurance: Break-Ins Covered?

You may want to see also

Using the NAIC website to find the code

The NAIC website is a useful resource for finding the NAIC code for auto insurance. NAIC stands for the National Association of Insurance Commissioners, which is responsible for setting regulations and standards for the insurance industry in the United States. The NAIC number is a unique, five-digit identification code assigned to each insurer to help identify them and credential their insurance company. This number is extremely useful in accidents and collision coverage, as it helps streamline the claims process.

To find the NAIC code on the NAIC website, follow these steps:

- Navigate to the NAIC website: The website address is www.naic.org. Once you arrive at the website, you will find a wealth of information and resources related to the insurance industry.

- Locate the consumer insurance search tool: The website should have a dedicated search tool for consumers to look up insurance-related information. This tool will allow you to search for insurance companies and access relevant information.

- Enter the insurance company's name: In the search tool, type in the name of the insurance company for which you need the NAIC code. Make sure to spell the company name correctly to get accurate results.

- Review the search results: After performing the search, you should see a list of companies that match your query. Carefully review the list to find the correct insurance company. As mentioned earlier, insurance companies may have multiple subsidiaries with different names, so ensure you select the right one.

- Find the NAIC code: Once you have located the correct insurance company in the search results, look for the NAIC code associated with that company. It should be a five-digit number. This code will be essential for various insurance-related processes, such as filing claims or registering a vehicle.

- Verify the NAIC code: Double-check that the NAIC code you have found is correct and up-to-date. NAIC codes may change or be updated from time to time, so it is important to verify that you have the most current information.

- Note the NAIC code for future reference: Write down or save the NAIC code in a safe place. You may need to provide this code when dealing with insurance-related matters, such as filing a claim or interacting with the Department of Motor Vehicles (DMV).

By following these steps, you can easily find the NAIC code for your auto insurance company using the NAIC website. This code will empower you to navigate insurance-related processes more efficiently and effectively. Remember to keep the NAIC code handy, as it plays a crucial role in streamlining insurance claims and ensuring compliance with state regulations.

U.S. Auto Insurance: Cheaper Premiums After Turning 25

You may want to see also

Understanding the purpose of the NAIC number

The NAIC number, an abbreviation for the National Association of Insurance Commissioners, is a unique 5-digit identification code assigned to every insurer to help identify them and credential their insurance company. The NAIC is responsible for setting the regulations and standards for the insurance industry in the United States.

The NAIC number is essential for several reasons. Firstly, it helps identify your insurer and the specific policy you have with them. When filing an insurance claim for your home, travel, or automobile, providing your insurer's NAIC number is mandatory. Your claim will be considered incomplete without it. Secondly, the NAIC number is often required at the Department of Motor Vehicles (DMV) for tasks such as registering a vehicle or completing other paperwork.

Additionally, the NAIC number allows you to access information about your insurer. By using the NAIC number, you can look up reports, closed complaints, cases of fraud, and financial data related to the insurance company. This information can be crucial if you have concerns about the practices and conduct of your insurer. The NAIC number also helps verify if an insurer is authorised to operate in your state.

NAIC numbers can usually be found on your insurance card or policy documents. They are often labelled as the "Company Number". If you are unable to locate the NAIC number on these documents, you can visit the NAIC website, which provides a consumer insurance search tool to find the company number of your insurer.

Vehicle Insurance: Mexico's Mandatory Law

You may want to see also

When to use the NAIC number

The NAIC number is a unique five-digit identification code assigned to insurers by the National Association of Insurance Commissioners (NAIC). It is used to identify the insurer and the specific policy held by the customer. This number is essential when filing an insurance claim or report with a state's Department of Motor Vehicles (DMV). Here are some scenarios where you would need to use the NAIC number:

When Filing an Insurance Claim:

If you are involved in an accident and need to file an insurance claim for your vehicle, home, or travel, you will need to provide the NAIC number for your specific policy. This number helps identify your insurer and streamline the claims process. It is also useful when dealing with collision coverage, as mentioned earlier.

Vehicle Registration and Renewal:

When registering or renewing the registration of your vehicle, the NAIC number is typically required. This number confirms that your insurance provider is licensed to offer vehicle insurance in your state. It is an essential part of the paperwork required by the DMV.

Checking Insurer's Credentials:

The NAIC number allows you to look up information about your insurer. You can check their legal history, financial data, complaints filed against them, and the states they are licensed to operate in. This information helps ensure you are dealing with a credible and legitimate insurance company.

Filing a Report with the DMV:

If you need to file a report or complete any other paperwork with your state's DMV, having your insurer's NAIC number is crucial. This number helps the DMV identify your insurer and ensures your paperwork is processed smoothly.

Switching Insurance Providers:

When switching insurance providers, the NAIC number can be useful. You can use it to compare different insurance companies, their rates, and the types of policies they offer. This information allows you to make an informed decision when choosing a new insurance provider.

Remember, you can find the NAIC number on your insurance card, insurance policy documentation, or by searching for it on the NAIC website. It is a crucial piece of information to have on hand when dealing with any insurance-related matters.

Vehicle Tagging: Insurance Requirements

You may want to see also

Frequently asked questions

NAIC stands for the National Association of Insurance Commissioners. The NAIC assigns a unique 5-digit identification code to every insurer to help identify them and credential their insurance company.

Your NAIC number should be on your insurance card. If you are unable to find it, look for the Company Number, which is usually a 5-digit number and is likely to be your NAIC number.

If you are unable to locate the NAIC number on your insurance card, you can check your insurance policy documentation. If you still can't find it, you can log on to the NAIC website and use their consumer insurance search tool to find your insurer's company number.

You need an NAIC number to identify your insurer and the policy you have. It is also required when filing an insurance claim or registering a vehicle at the DMV.

The NAIC number is used to access information about an insurance company. It can be used to identify the number of complaints filed against a company, their legal and financial history, and which states they are licensed to operate in.