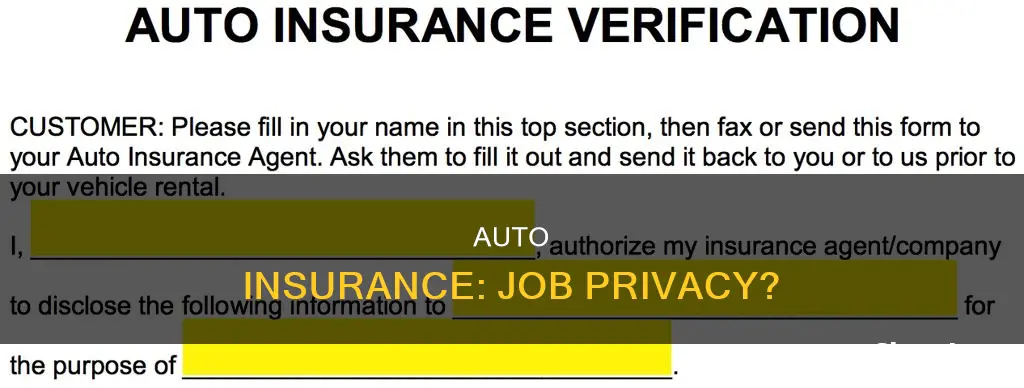

Whether your job can see if your auto insurance is active depends on several factors. If you drive your own vehicle or an employer-owned vehicle for work, your employer may ask for proof of insurance to ensure your policy is up-to-date and that you meet the minimum auto coverage requirements for your state. This is particularly relevant if you drive for work or use your personal vehicle for business-related purposes. In such cases, your employer may request proof of insurance on a bi-annual basis. Additionally, auto insurance companies can check your employment status, but they cannot deny you coverage if you are unemployed. Therefore, while your job may not be able to directly see if your auto insurance is active, they can influence your insurance rates and coverage options.

| Characteristics | Values |

|---|---|

| Can my job see if my auto insurance is active? | Yes, an employer can ask for proof of auto insurance to confirm that your policy is current and legitimate. |

| How can I check if my auto insurance is active? | You can check your policy online, or refer to a paper copy of your insurance policy or most recent renewal notice. You can also call your insurer and ask a representative to confirm whether your policy is still active. |

| What information do I need to verify my auto insurance? | You will need the Vehicle Identification Number (VIN), vehicle license plate number, or owner's driver's license number. |

What You'll Learn

Can my employer ask for proof of auto insurance?

Yes, an employer can ask for proof of your auto insurance, and they will likely do so if you drive your personal vehicle to work or for work-related purposes. This is to ensure that your policy is current and legitimate, and that you meet the minimum auto coverage requirements for your state.

Your employer may also ask for proof of insurance to protect themselves from liability or financial responsibility if you are involved in a crash during work hours. If you are in an accident while on the clock, your employer could be held liable for negligent acts you commit, and they may be responsible for paying the difference between what your insurance covers and your remaining accident-related losses.

If you drive a company-owned vehicle, your employer will likely have already added you to a commercial insurance policy. However, if you drive your own car for work, your employer will want to ensure that you have your own insurance policy.

You can provide physical proof of insurance with an ID card or a letter, or digital proof via an app. It is recommended to keep a copy of your proof of insurance in your glove compartment, bag, or on your phone, so that you can easily show it to your employer or anyone else who might need to see it.

It is important to note that some lawyers argue that requiring proof of insurance from employees who drive their personal vehicles for work may be considered subtle discrimination and may not always be enforceable.

Gap Insurance: Payout or Pitfall?

You may want to see also

What if I can't provide proof of insurance?

If you can't provide proof of insurance, you could face fines or even jail time, depending on the state. Generally, you can contest a ticket by mailing a copy of your proof of insurance or by attending the court hearing with proof that you were insured on the date the officer pulled you over. While the charges could be dismissed, you may have to pay a fine or court fees.

If you receive a ticket for not providing proof of insurance, make sure you respond to all correspondence. If you fail to do so, some states may revoke or suspend your license and registrations if you can't prove you're insured.

Many states use an electronic insurance verification system to identify uninsured drivers. Essentially, if they run verification on your information and discover your vehicle registration and insurance don't match, the violation may be reported to the DMV for administrative action. For example, in California, if your insurance documents don't match, you must contact your insurer right away to have the information corrected and resubmitted.

Keep in mind, failure to provide proof of insurance is a completely different offense than driving an uninsured vehicle. Driving without insurance is a far more serious offense, which can result in paying fines, having your driver's license suspended, paying license reinstatement fees, paying higher rates for auto insurance, or even jail time.

If you are pulled over by the police, it's acceptable to show an electronic copy of your proof of insurance in 49 states and Washington, D.C. New Mexico is the only state that does not recognize an electronic copy during a traffic stop.

Divorced Couples: Share Auto Insurance?

You may want to see also

How can I check if my insurance is active?

Checking your insurance status can be done in several ways. Here are some methods to help you verify if your insurance is active:

Check Your Insurance Card

This is often the quickest way to verify if you have active insurance. Insurance cards typically include essential details such as the insurance company's name, policy number, effective dates, and a customer service phone number. If you don't have your physical card, you can try to find it digitally by checking your email or online accounts.

Contact Your Insurance Provider

If you don't have access to your insurance card or the information on it, you can contact your insurance provider directly. They can confirm your coverage details, including the effective dates and any conditions or limitations. You can find their contact information on their website or through a quick online search.

Review Your Online Account

Many insurance companies offer online portals or accounts for their customers. Log in to your account on their website or through their mobile app, if available. There, you should be able to view your policy details, including effective dates and coverage limits. You may also find digital copies of your insurance card and other relevant documents.

Check with Government Resources

If you have government-provided insurance or live in an area with government-managed insurance programs, you can verify your insurance status through official channels. For example, in the United States, you can check your coverage through websites like HealthCare.gov or Medicare.gov. These sites allow you to log in and review your plan details, including effective dates and coverage options.

Speak to a Licensed Agent or Broker

If you are unsure where to start or need more personalised assistance, consider contacting a licensed insurance agent or broker. They can help you understand your coverage, verify its active status, and answer any questions you may have about your policy. Licensed agents are typically available by phone or online chat.

Remember, it is essential to know your insurance status to make informed decisions about your healthcare, vehicle, or any other insured aspects of your life. By taking a few simple steps, you can ensure that you have the coverage you need when you need it.

Is Your Gap Flood Insurance Capitalized?

You may want to see also

What happens if my insurance isn't active?

If your insurance isn't active, you may face serious consequences, especially if you're involved in an accident. Driving without valid insurance is illegal in most places and can result in fines, penalties, and even criminal charges. Here are some things that can happen if your insurance isn't active:

Legal Consequences

In many places, driving without valid insurance is illegal and can result in fines, tickets, or other penalties. If you're caught driving without insurance, you may be issued a ticket and fined by law enforcement. In some jurisdictions, driving without insurance may even result in the suspension or revocation of your driver's license.

Increased Financial Liability

If you're in an accident and don't have active insurance, you will be personally responsible for all the associated costs. This can include repairs to your vehicle, medical expenses for any injuries, and liability claims from other parties involved. Without insurance coverage, you will have to pay for these expenses out of pocket, which can be financially devastating.

Difficulty Obtaining Future Insurance

Having a lapse in insurance coverage can make it more challenging and expensive to obtain insurance in the future. Insurance companies may view you as a higher-risk driver and charge higher premiums or deny coverage altogether. A history of continuous insurance coverage is generally viewed favourably by insurers when determining rates and eligibility.

Impact on Credit Score

In some cases, a lapse in insurance coverage can negatively affect your credit score. Insurance companies may report policy cancellations or non-renewals to credit bureaus, which can lower your credit score and impact your ability to obtain loans or favourable interest rates.

Employment-Related Consequences

If you use your personal vehicle for work-related purposes, your employer may require you to maintain valid insurance. Driving without insurance may violate company policies and result in disciplinary action, up to and including termination of employment. Additionally, if you're in an accident while on the job, your employer may be held liable if you don't have the appropriate insurance coverage.

Restricted Vehicle Registration and Licensing

In some jurisdictions, maintaining valid insurance is a requirement for registering your vehicle and obtaining license plates. If your insurance lapses, you may be unable to renew your registration or obtain new license plates until you can provide proof of insurance.

To avoid these consequences, it is crucial to maintain active and valid insurance coverage for your vehicle. Staying insured protects you financially, legally, and can provide peace of mind while on the road.

Root Auto Insurance: Trustworthy?

You may want to see also

What information do I need to verify another driver's insurance?

If you've been in a collision, it's essential to get the correct auto insurance information from the other driver. Here is what you need to verify another driver's insurance:

- The driver's name, as it appears on the policy.

- The driver's insurance company.

- The insurance policy number.

- The driver's license number.

- The vehicle's license plate number.

- The make, colour, and model of the vehicle.

The simplest way to get this information is to ask the other driver. However, if the other driver refuses to provide their insurance information or flees the scene, you can try the following methods:

- File an accident report with the police, who may be able to track down the insurance information.

- Contact your local Department of Motor Vehicles (DMV) and provide them with the police report and other relevant documents.

- Speak with your insurance company, especially if the other driver is at fault and cannot be contacted.

It's important to note that you must be able to provide your own proof of insurance at all times when driving. Keeping a copy of your insurance in your glove compartment, bag, or on your phone can be helpful in case of an accident.

Salvage Vehicle: Insurance Reporting

You may want to see also

Frequently asked questions

Yes, your employer is allowed to ask for proof of auto insurance, especially if you drive your personal vehicle to work or for business-related purposes.

You can provide proof of auto insurance by showing your insurance card or policy documents.

If you can't provide proof of auto insurance, you may face penalties such as a fine or a ticket. It is important to always keep your proof of insurance with you when driving.

No, your job cannot see if your auto insurance is active without your providing proof of insurance. However, they may ask you to provide proof of insurance on a bi-annual basis to ensure your policy is up-to-date.