An insurance adjuster, or claims adjuster, is responsible for investigating insurance claims by inspecting property damage, personal injury, or healthcare claims to determine how much money an insurance company should pay out for a loss. There are several types of adjusters, including company (staff) adjusters, independent adjusters, and public adjusters. Company adjusters work for a specific insurance company, independent adjusters work for an adjuster firm that can represent multiple insurers, and public adjusters are independent contractors that represent the interests of the policyholder.

To become a licensed insurance adjuster, individuals must pass a state licensing exam and meet certain prelicensing requirements, which vary by state. Some states require prelicensing education, while others require work experience.

| Characteristics | Values |

|---|---|

| Who is an insurance adjuster? | A professional responsible for assessing and determining the extent of damage or loss covered by an insurance policy. |

| Who hires an insurance adjuster? | The insurance company or the policyholder. |

| Types of insurance adjusters | Company (staff) adjuster, independent adjuster, and public adjuster. |

| Who is a company (staff) adjuster? | A salaried employee of a specific insurance company who investigates, evaluates, and settles claims for that insurer only. |

| Who is an independent adjuster? | An employee of an adjuster firm that can represent more than one insurer and settles claims for the insurer's customers only. |

| Who is a public adjuster? | An independent contractor representing the financial interests of the policyholder or named insured, who pays the adjuster for their services. |

| Who does an independent adjuster represent? | The insurance company. |

| Who does a public adjuster represent? | The policyholder. |

| What does a home insurance adjuster do? | Assess the damage claimed in the insurance report, inspect the property, evaluate the damage, and calculate the appropriate compensation or settlement. |

| What is the cost of hiring a home insurance adjuster? | In most cases, a home adjuster works for the insurance company and is paid by the carrier. If you hire a public adjuster, they typically take a percentage (around 10-15%) of the claim. |

What You'll Learn

Home insurance adjusters

A home insurance adjuster, also known as a property claims adjuster, is responsible for investigating insurance claims. They are usually contracted or employed by insurance providers. Their role involves inspecting the property, evaluating the damage, and calculating the appropriate compensation or settlement that the insurance company should offer.

There are two types of home insurance adjusters: independent adjusters and public adjusters. Independent adjusters are contracted by an insurance company to assess and investigate claims. They are expected to remain impartial and recommend a settlement. Public adjusters, on the other hand, are hired by policyholders and advocate for their interests in the claims process. They assess the damage, recommend a settlement, and negotiate on behalf of the policyholder with the insurance company.

When a home insurance adjuster visits your home, they will inspect the damaged areas, take pictures, and make notes about the observable damage. They may also examine collateral property to determine the extent of the damage. They will ask questions about how and when the damage occurred and make assessments of the structural integrity of your home to determine if any damage occurred before the incident in question. The process typically lasts about an hour or two. After the visit, the adjuster will file a report with their findings and recommendations.

Before the adjuster's visit, it is essential to document the damage by recording the time and date of the incident and taking photos or videos. You should also collect relevant documents such as witness statements, repair estimates, and receipts for any damaged items. It is recommended to be present during the adjuster's visit to answer questions and ensure nothing is overlooked.

If you disagree with the insurance carrier's offer or if your claim is rejected, you can dispute the claim by speaking with the insurance company's customer service and requesting a written explanation of their assessment. At this point, you may consider hiring a public adjuster or a lawyer to negotiate on your behalf and help you receive a more favourable settlement.

Auto Insurance Rates: Most Expensive States

You may want to see also

Independent adjusters

An independent adjuster is any person, firm, association, or corporation that acts on behalf of an insurer when investigating and adjusting claims arising under insurance contracts issued by that insurer. They are considered independent because they are often not employed directly by the company, but by a third party that specialises in homeowners or other types of insurance claims.

Insurance Claims: Recovered Vehicle

You may want to see also

Public adjusters

A public adjuster is a type of insurance adjuster who acts on behalf of the insured (the policyholder) in negotiating a settlement for a claim for loss or damage to their property. Public adjusters are independent contractors who are hired and paid by the policyholder, and they represent the financial interests of the insured. They do not represent the insurance company.

To become a public adjuster, an individual must meet certain prelicensing requirements, including completing a prelicensing education course. They must also pass a licensing exam and submit various documents, including Certificates of Character and a bond.

Mileage Tracking: A Standard Practice Across Auto Insurers?

You may want to see also

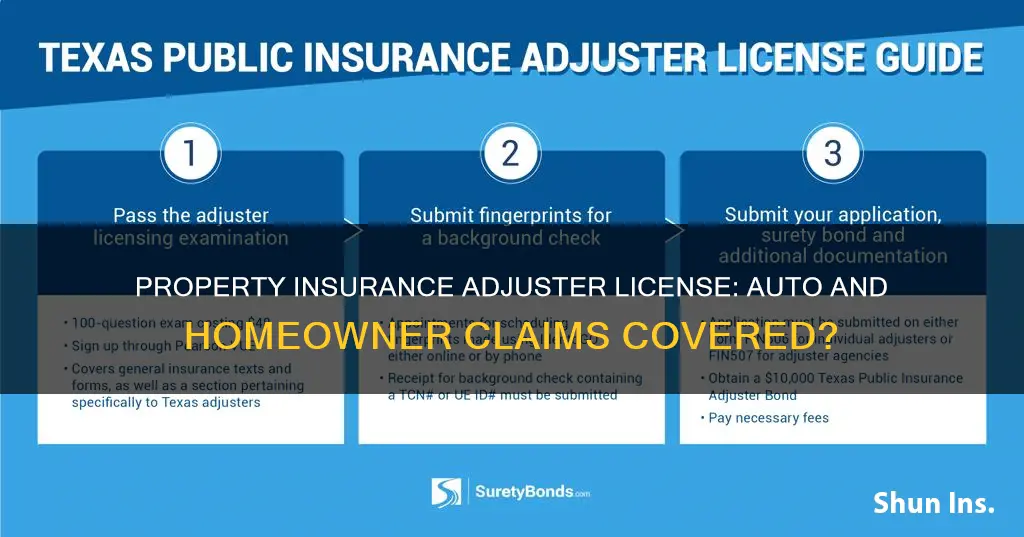

Adjuster licensing requirements

The requirements to become an insurance adjuster vary across different US states. Some states require a license, while others don't. The former are called "licensing states", and the latter "non-licensing states".

Licensing States

In licensing states, individuals must typically complete a few steps to obtain a license. This usually involves taking a state licensing exam, which can be facilitated by taking either pre-licensing classes or exam prep courses. Pre-licensing classes are typically 40-hour courses that include the exam, while exam prep courses prepare individuals for the exam, which is then taken at a testing facility.

After completing the relevant course, individuals can apply to the state. This process can take a few days to a few months. The cost of the license varies depending on the state, ranging from less than $100 to several hundred dollars.

It is important to choose the right type of license, such as an "All Lines Adjuster License", which allows individuals to handle any type of claim.

Non-Licensing States

In non-licensing states, individuals can skip the exams and start working in their home state without a license. However, if they want to work in another state, they will need a catastrophic insurance adjuster license for that specific state.

To work in multiple states, individuals can take advantage of reciprocity agreements between states. This means that if an individual has passed the exam for one state, other reciprocal states may waive the requirement to take another exam. Florida, Indiana, and Texas are often recommended as designated home states due to their high number of reciprocal states.

Specific State Requirements

Some states have unique requirements. For example, New York is known for having a challenging exam and a costly application process, but it is in high demand as it is not reciprocal with any other states.

Additionally, some states have special all-lines adjuster licenses that cover all kinds of claims, while others have separate licenses for different types of insurance.

General Requirements

To become a licensed insurance adjuster, individuals must demonstrate entry-level knowledge of the industry. This includes understanding insurance concepts, contracts, law, and adjusting practices, as well as familiarity with state-specific laws and regulations that apply to insurance adjusters.

Application Process

The application process for an insurance adjuster license typically involves submitting personal and background information, as well as paying various fees. Some states also require fingerprints as part of the application.

Continuing Education

Once licensed, individuals may need to meet continuing education requirements to maintain their license. The number of required hours varies by state, but most require 24 hours biennially, including ethics.

Who Pays When You're At Fault?

You may want to see also

Adjuster licensing fees

The fees for obtaining an adjuster license vary from state to state. In Texas, the process of getting licensed as an adjuster can take anywhere from a few weeks to a few months and costs a minimum of $429. This includes a pre-exam course ($279), fingerprinting and background check ($47), and the application fee ($50, plus a small processing fee). Additionally, each exam attempt costs $43.

In New York, there is a non-refundable fee of $100 for a license issued for more than a year and $50 for a license issued for a year or less.

In Alabama, the fees are as follows: Exam Prep ($75), Licensing Fee ($115), Fingerprinting ($49.20), and Renewal CE ($85).

Other states have different fee structures, with some charging for exam prep, licensing, fingerprinting, and renewal continuing education (CE), while others may have additional or slightly different requirements and associated costs. It's important to check the specific requirements and fees for the state in which you intend to obtain an adjuster license.

Capital One Auto Finance: Uncovering the Gap Insurance Mystery

You may want to see also

Frequently asked questions

A property insurance adjuster, or claims adjuster, is responsible for investigating insurance claims by inspecting property damage, personal injury, or healthcare claims to determine how much money an insurance company should pay out for a loss.

There are three types of property insurance adjusters: company (staff) adjusters, independent adjusters, and public adjusters. Company adjusters are salaried employees of a specific insurance company and investigate, evaluate, and settle claims for that insurer only. Independent adjusters are employed by an adjuster firm that can represent more than one insurer and settles claims for the insurer's customers. Public adjusters are independent contractors representing the financial interests of the policyholder, who pays the adjuster for their services.

Independent adjusters are contracted by an insurance company to assess and investigate claims, providing third-party objectivity and greater perceived fairness to those filing a claim. Public adjusters, on the other hand, are hired by policyholders and advocate for their interests in the claims process. They assess damage, recommend settlements, and can negotiate on behalf of the policyholder with the insurance company.