Keeping your auto insurance information safe and secure is important, especially if you need to file a claim or prove that you have insurance. In most states in the US, drivers are legally required to have automobile liability insurance and to carry proof of insurance when driving. This proof can be in the form of an insurance ID card or other documents from your insurance company. It's a good idea to keep your insurance card in your vehicle, either in your wallet, glove compartment, or center console, or as a digital file on your smartphone. You should keep your insurance documents for as long as your policy is active and until any open claims are resolved. If you have a business auto insurance policy, it is recommended to keep your statements for up to seven years in case of an IRS tax audit. It's also important to properly dispose of old insurance documents to prevent identity theft.

| Characteristics | Values |

|---|---|

| How long to keep auto insurance documents | Keep auto insurance documents for as long as the policy is active and until all open claims are resolved. |

| How long to keep old insurance policies | Keep old insurance policies for at least one year after they expire. |

| How long to keep insurance bills | Keep insurance bills for at least one year after payment to verify transaction details and coverage periods. |

| How to dispose of old insurance documents | Shred documents using a cross-cut shredder. |

| When to keep insurance statements for tax purposes | Keep insurance statements for seven years if deducting auto insurance premiums from income to reduce taxes. |

| Where to keep car insurance documents | Store car insurance documents in a safe and secure place, such as a filing cabinet or a digital folder with password protection. |

What You'll Learn

Keep your insurance card in your vehicle at all times

Keeping your insurance card in your vehicle at all times is essential for complying with state laws and avoiding penalties. Here are some reasons why it is crucial to keep your insurance card in your vehicle:

Complying with State Laws

In most states, drivers are legally required to carry proof of insurance when driving. State laws mandate that drivers must have proof of insurance in their vehicles. Failing to provide proof of insurance when requested by a police officer or during an accident can result in fines, driving penalties, or even jail time. Therefore, keeping your insurance card in your vehicle ensures that you comply with these laws and avoid any legal consequences.

Providing Proof of Insurance

Your insurance card acts as proof of insurance and is essential in various situations. For instance, when registering a vehicle, the Department of Motor Vehicles (DMV) typically requires a copy of your insurance card and electronic confirmation of your coverage. Additionally, if your vehicle's registration is suspended due to lapsed insurance, you will need to provide a new insurance card to reinstate the registration. Having your insurance card readily available in your vehicle helps streamline these processes.

Ease of Access in Emergencies

In the event of an accident or a traffic stop, law enforcement officers may request proof of insurance. By keeping your insurance card in your vehicle, you can easily provide this documentation without having to search for it elsewhere. This is especially important if your vehicle is towed or impounded, as the proof of insurance is typically kept with the vehicle. Additionally, if your vehicle is stolen, having the insurance card with the vehicle's information can assist the police in their investigations.

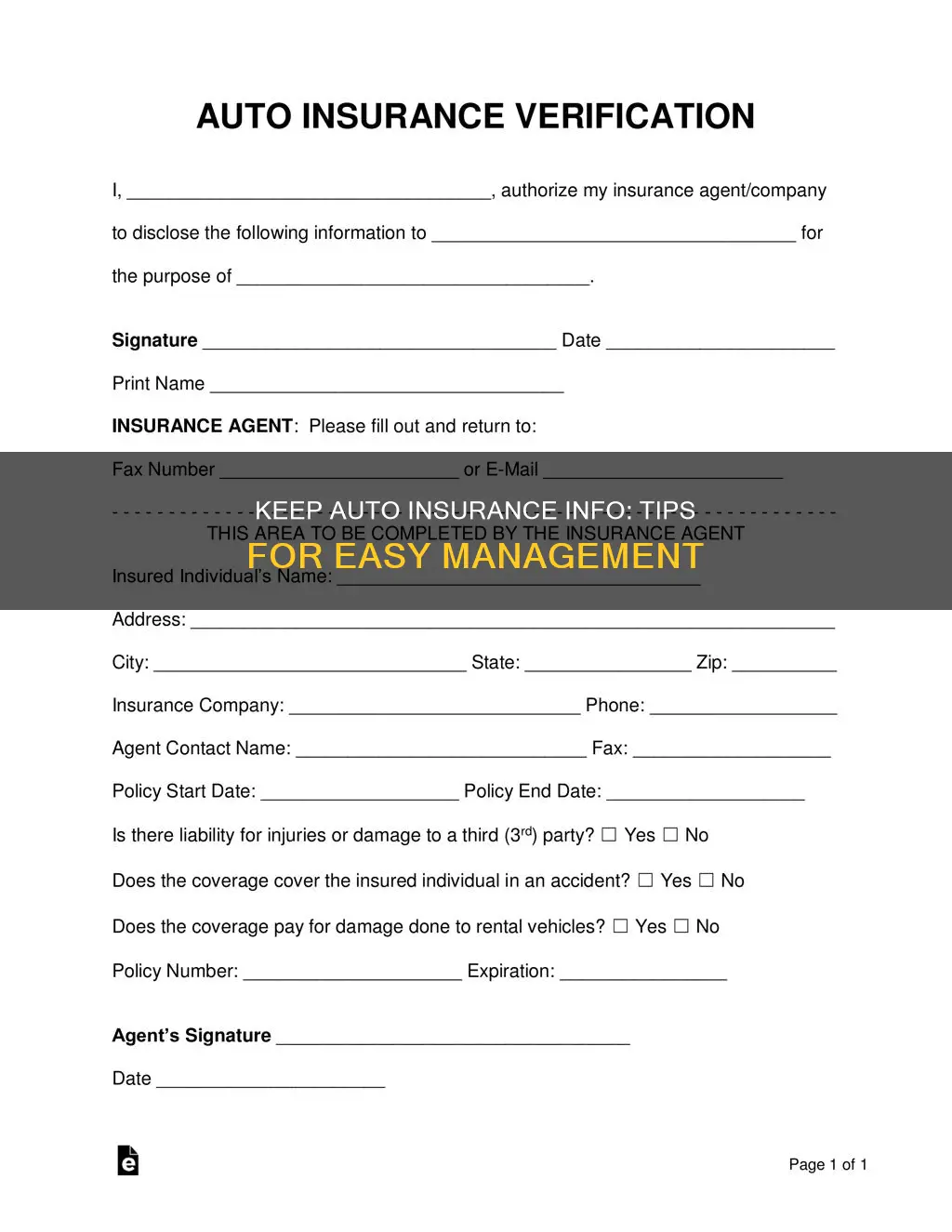

Quick Verification of Insurance Details

Your insurance card contains vital information about your policy and vehicle. It includes your name, address, coverage effective and expiration dates, vehicle details (year, make, model, and Vehicle Identification Number), and your insurance company's details. Having this information readily available in your vehicle allows for quick verification of your insurance status and policy details. This is particularly useful when speaking with insurance agents or law enforcement officers, as they can easily access the relevant information.

Avoiding Inconvenience

Not having your insurance card in your vehicle can lead to unnecessary inconvenience. If you need to provide proof of insurance and don't have the card with you, you may have to contact your insurance company to request a replacement or access your online account to retrieve the information. This can be time-consuming and cumbersome, especially if you're in a hurry or an emergency situation.

Claiming Auto Accident Injury Insurance: Your Guide to Success

You may want to see also

Store insurance documents in a safe place

Keeping your insurance documents in a safe place is essential for several reasons. Firstly, it ensures that you have easy access to them when needed, such as during an insurance claim or tax audit. Secondly, storing them securely helps protect your personal information and prevents identity theft. Here are some detailed instructions on how to store your insurance documents safely:

- Choose a secure location: Select a safe place to store your insurance documents, such as a locked file cabinet, a desk drawer, or a fireproof home safe bolted to the floor or wall. This will protect your documents from theft, fire, or other natural disasters.

- Keep essential documents: Retain all insurance-related documents, such as your insurance ID card, policy declarations page, monthly billing statements, and documents pertaining to any claims. These records should be kept for the duration of your policy and any open claims.

- Consider digital storage: In addition to physical copies, consider scanning and storing digital copies of your insurance documents. You can save them on a secure hard drive, in an encrypted cloud storage service, or on a flash drive. This provides an extra layer of protection and allows you to access your documents remotely.

- Use a safe deposit box: Renting a safe deposit box at a bank is an excellent option for storing important documents. These boxes are typically fireproof and waterproof, offering protection from natural disasters. However, note that you won't be able to access the box outside of banking hours, so it's best to store documents you don't need in an emergency.

- Inform your loved ones: If your insurance documents are intended for your loved ones, such as life insurance policies, inform them about the location of these documents. Let them know where to find the physical copies and how to access digital copies if needed.

- Regularly review and update: It's important to review your insurance documents periodically, such as once a year, to ensure they are up to date. This is especially important if there are any changes to your policy or beneficiaries.

Auto Rentals and Liability Insurance: What's the Deal in California?

You may want to see also

Keep insurance documents for at least a year after the policy expires

Keeping your insurance documents for at least a year after your policy expires is a sound practice for several reasons. Firstly, it ensures that you have the necessary documentation if any claims or disputes arise during that time. While most car insurance policies last for six months to a year, keeping the documents for an additional year provides a buffer in case of any unforeseen circumstances.

Secondly, retaining insurance documents for a year after policy expiration allows for proper verification of payment and a review of coverage details. This is especially important if you need to account for payments during tax time. For example, if you deduct your car insurance premiums from your income to reduce your taxes, keeping your insurance statements for a year can help you provide the necessary proof of payments.

Additionally, keeping insurance documents for a year after policy expiration can aid in resolving any disputes with the insurance company. Having the relevant documentation will help you prove that you have been paying your premiums faithfully and enable you to easily reference your coverage details.

Furthermore, retaining insurance documents for this duration is particularly crucial if you have an unresolved claim. Keeping all related paperwork, including policy documents, receipts, and bills, will ensure that you have the necessary information to support your claim until it is resolved.

Finally, keeping insurance documents for a year after policy expiration is a recommended practice for maintaining proper records. This allows you to have access to important information if needed, even after the policy has expired.

Vehicle or Person: Who's Insured?

You may want to see also

Keep insurance documents for seven years for tax purposes

Keeping insurance documents for at least seven years is generally a good idea for tax purposes, especially if your insurance policy is related to a business or if you are self-employed. The Internal Revenue Service (IRS) can audit tax returns filed within the last three years, but they may go back six years in cases of unreported income that exceeds 25% of the gross income shown on the tax return. In some cases, the IRS may go back seven years or more, especially if there is a claim for a loss from worthless securities or bad debt deduction. Therefore, keeping insurance documents for seven years ensures that you have the necessary records in case of an audit.

The length of time you should keep insurance documents depends on the type of policy and any related claims. It is generally recommended to keep insurance documents for as long as the policy is in effect and until all open claims are resolved. Most car insurance policies last six months to one year, so you can discard the documents once the policy ends if there are no open claims. However, if you have an open claim, keep the policy documents, receipts, and bills until the claim is resolved, even if the policy expires.

For homeowners insurance, policies typically renew annually, so it is recommended to keep the documentation for at least a year until the new policy starts. For renters insurance, the policy periods can vary from a few months to a year. Again, if there is an outstanding claim when the policy ends or renews, keep the related documents until the claim is resolved.

It is also important to keep insurance documents related to property and investments while you own the asset. This includes real estate deeds, mortgage documents, closing papers, receipts for home improvements, vehicle titles and purchase or lease documents, and receipts, warranty certificates, and operating instructions for household items.

To ensure the safety and accessibility of your insurance documents, it is recommended to keep both digital and hard copies. Hard copies should be stored in a climate-controlled, secure space, such as a waterproof and fire-resistant safe. For digital copies, consider using both cloud-based and drive-based storage methods for added protection.

Does Towing a Boat Affect Your Auto Insurance?

You may want to see also

Keep digital and hard copies of insurance records

Keeping digital and hard copies of your insurance records is a good idea for several reasons. For one, it ensures that you have a backup in case one copy is lost or becomes inaccessible. Additionally, having physical copies can be useful when you need to quickly access important information, such as in the event of an accident or when requested by a police officer.

- Keep a digital copy of your insurance ID card on your smartphone. This card acts as proof of insurance and is often required when you are involved in an accident or pulled over by the police.

- Store important insurance documents in a safe and accessible place, such as a file cabinet or desk drawer. This includes the declarations page of your auto insurance policy, which provides a snapshot of your coverage types, limits, and exclusions.

- Keep digital or hard copies of receipts from repairs and pictures from accidents, as these can be essential when making an insurance claim.

- If your policy pertains to a business, speak with a tax professional about how long to keep your monthly billing statements. Typically, it is recommended to keep these statements until your payment has been processed or the policy period has ended, but business-related statements may need to be retained for tax purposes.

- Make use of cloud-based storage solutions, such as Dropbox or iCloud, to securely store digital copies of your insurance records.

- For physical copies, consider investing in a waterproof and fireproof safe to protect your documents from potential damage or loss.

- When it comes time to dispose of old insurance records, be sure to shred them using a cross-cut shredder to prevent identity theft.

Smart Ways to Save on Auto Insurance

You may want to see also

Frequently asked questions

You should keep your auto insurance documents for as long as your policy is active and until all open claims are resolved.

Old insurance cards should be securely shredded before disposal to prevent identity theft or fraud.

Yes, it is recommended to keep old auto insurance documents for at least one year after the policy expires in case you need to access important information.

Your auto insurance card should be kept in your vehicle at all times as proof of insurance coverage, in a secure location such as the glove compartment.

If you lose your insurance card, you can download a digital copy from your insurance company's app or website, or contact your agent to send you an updated copy.