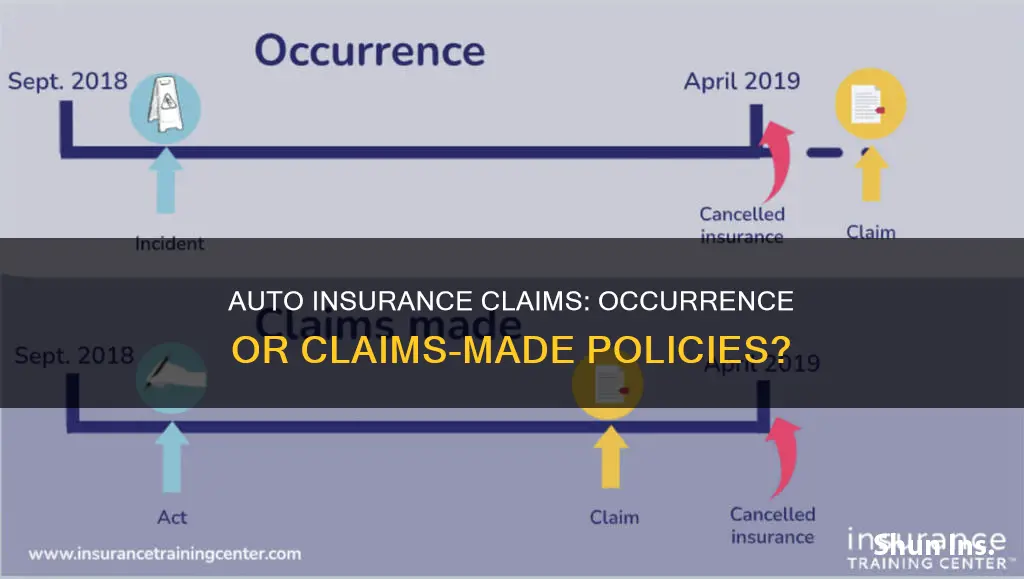

There are two types of auto insurance claims: claims-made and occurrence. The difference between the two lies in how their coverage is activated. Claims-made insurance covers incidents reported during the active policy period or during an extended reporting period, as long as they occur after the policy's retroactive start date. On the other hand, occurrence insurance covers losses that take place during a specific coverage period, regardless of when an incident is reported.

Auto Insurance Claims: Characteristics and Values

| Characteristics | Values |

|---|---|

| Coverage Activation | Claims-made: incident reported during the active policy period. Occurrence: incident occurred during the policy period. |

| Coverage Timing | Claims-made: requires both incident and claim to occur within the policy's timeframe. Occurrence: covers incidents during the policy period, regardless of when the claim is reported. |

| Retroactive Date | Claims-made: has a retroactive date, and incidents before this date may not be covered. Occurrence: no retroactive date. |

| Extended Reporting Period | Claims-made: may include tail coverage or ERP to extend the reporting period after policy cancellation. Occurrence: no need for tail coverage as claims can be reported anytime. |

| Cost | Claims-made: typically costs less than occurrence policies. Occurrence: more expensive due to indefinite claim reporting period. |

| Common Types | Claims-made: professional liability, errors and omissions, directors and officers insurance. Occurrence: general liability, commercial auto, and umbrella liability insurance. |

What You'll Learn

- Claims-made policies are cheaper but don't cover incidents before the retroactive date

- Occurrence policies cover incidents during the policy period, regardless of when the claim is filed

- Claims-made policies cover claims made and reported during the policy period

- Occurrence policies are typically more expensive than claims-made policies

- Claims-made policies are usually purchased by small businesses

Claims-made policies are cheaper but don't cover incidents before the retroactive date

When it comes to insurance, there are two main types of policies: claims-made and occurrence. While both have their advantages and disadvantages, understanding their differences is crucial in choosing the right coverage for your needs. Claims-made policies are a cost-effective option, often cheaper than occurrence policies, especially for new businesses or those with limited funds. However, it's important to be aware that claims-made policies do not cover incidents that occurred before the retroactive date.

A retroactive date is a defining feature of claims-made policies. It is the specific date when the policy's coverage begins and can be negotiated with the insurer. If an incident occurs before this date, it will not be covered by the claims-made policy. This is a crucial distinction from occurrence policies, which provide lifetime coverage for incidents during the policy period, regardless of when the claim is filed.

Claims-made policies only cover incidents that occur and are reported within the policy's timeframe. This means that both the incident and the claim must fall within the active policy period for coverage to apply. If a claim is made after the policy has expired, it will not be covered unless you have purchased additional coverage, such as tail coverage or an extended reporting period (ERP).

While claims-made policies may be more affordable upfront, they carry the risk of leaving you uncovered if an incident occurs before the retroactive date. This is especially important for businesses that have been operating for a while or have had previous insurance coverage. To ensure continuous coverage, some insurers offer prior acts coverage or nose coverage, which can fill in gaps in protection by setting a retroactive date that corresponds with the start of your business or an earlier policy.

In summary, while claims-made policies offer a more economical option, they do not provide coverage for incidents that took place before the retroactive date. This limitation underscores the importance of understanding your policy's specifics and considering your business's unique needs when choosing between claims-made and occurrence coverage.

Liberty Insurance and the 21st Birthday: Unraveling Auto Insurance Adjustments

You may want to see also

Occurrence policies cover incidents during the policy period, regardless of when the claim is filed

It's important to understand the difference between claims-made and occurrence policies when discussing auto insurance. This distinction determines whether your insurance covers incidents that occur during the policy period or when the claim is filed. Occurrence policies offer a more comprehensive and beneficial option for vehicle owners.

Occurrence policies, including most auto insurance policies, provide coverage for any incidents that happen during the policy period, regardless of when the claim is filed. This means that as long as the incident, such as a car accident, took place while the policy was active, the insurance company will cover the claim, even if it is filed months or even years later. This type of policy offers a wider safety net for policyholders, ensuring that unexpected or late-emerging issues are still covered. For example, if you are involved in a hit-and-run accident and cannot locate the at-fault driver, an occurrence policy allows you to file a claim and receive compensation even if you report the incident long after the policy has expired.

The key advantage of occurrence policies is their simplicity and peace of mind they offer. Policyholders don't need to worry about reporting incidents within a specific timeframe or keeping track of multiple policy periods if they have ongoing claims. This is especially beneficial in auto insurance, where claims can often involve complex legal processes and negotiations with other drivers' insurance companies. With an occurrence policy, you are protected as long as you maintain continuous coverage during the incident in question.

In contrast, claims-made policies only provide coverage if the incident occurs and the claim is filed during the active policy period. This type of policy is more common in professional liability insurance and requires careful attention to reporting timelines. Claims-made policies often include a retroactive date, which is the starting point of coverage for incidents, and a reporting period, during which any incidents must be reported. If a claim is filed after the reporting period has ended, it may no longer be covered, even if the incident occurred during the policy term.

Uncovering Auto Insurance Fraud: A Guide for Illinois Residents

You may want to see also

Claims-made policies cover claims made and reported during the policy period

There are two types of liability coverage: claims-made and occurrence. Claims-made policies cover claims made and reported during the policy period. This means that the incident must be reported within the policy's timeframe for the claim to be covered. Claims-made policies are often used to cover the risks associated with business operations, such as potential mistakes in financial statements or claims made by employees.

A claims-made policy is a popular option when there is a delay between when events occur and when claimants file claims. For example, malpractice insurance is triggered only when a covered claim arising from a covered wrongful act is "first made against the insured and first reported to the insurer" during the policy period. This is important because most mistakes made by lawyers are not discovered immediately, and most claims are not made until well after the actual mistake or error is made.

Claims-made policies have specific requirements for coverage to apply. The incident must occur after the policy's retroactive start date, and the claim must be reported during the active policy period or during an extended reporting period. The retroactive date is usually the policy's effective date or a past date agreed upon by the insured. If an incident occurs before the retroactive date, it won't be covered.

It's important to note that if a claims-made policy is canceled or a premium is not paid, any claim that comes through will not be covered, even if the incident occurred during the policy period. To avoid this, policyholders can purchase tail coverage or an extended reporting period (ERP) to extend the limits of their claims-made coverage.

In summary, claims-made policies provide coverage for incidents that occur and are reported within the policy's timeframe. They are commonly used in business operations and are advantageous when there is a delay in filing claims. To maintain coverage, it's essential to meet the policy's requirements and consider extending the reporting period if needed.

Excluding Teens from USAA Auto Insurance: What You Need to Know

You may want to see also

Occurrence policies are typically more expensive than claims-made policies

When it comes to auto insurance, there are two main types of policies available: claims-made policies and occurrence policies. While both types of policies have their advantages and disadvantages, occurrence policies are typically more expensive than claims-made policies. This is because occurrence policies provide lifetime coverage for any incidents that occur during the policy period, regardless of when the claim is reported.

Occurrence policies offer more comprehensive coverage compared to claims-made policies. With an occurrence policy, you are protected for any incidents that occur during the policy period, even if you switch insurance providers or cancel your policy altogether. This means that if an accident happens while the policy is in place, but a claim is not made until after the policy expires, you are still covered. For example, if you get into a car accident while your policy is active but don't notice the damage to your vehicle until after your policy has expired, you can still file a claim and receive coverage under an occurrence policy.

In contrast, claims-made policies only cover incidents that are reported during the active policy period. If an incident occurs but the insurance policy expires or is cancelled before a claim is made, no coverage will be awarded. Claims-made policies often have a retroactive date, which means that claims arising from incidents before this date may not be covered. Additionally, if a policy is cancelled or a premium is not paid, any subsequent claims will not be covered, even if the incident occurred during the policy period.

The higher cost of occurrence policies is due to the fact that there is no time limit on the claims reporting period. This means that insurance companies take on more risk by offering occurrence policies, as they may have to pay out for claims many years after the policy has expired. As a result, occurrence policies typically come with higher premiums to offset this risk.

Ultimately, the decision between choosing a claims-made or occurrence policy depends on the specific needs and risk level of the policyholder. For those who are just starting out or have limited assets, a lower-cost claims-made policy may be more suitable. On the other hand, larger firms with more disposable cash and more assets at risk may prefer the added protection of an occurrence policy, despite the higher cost.

Get Auto Insurance: A Step-by-Step Guide

You may want to see also

Claims-made policies are usually purchased by small businesses

When it comes to business insurance, owners can choose between two main types of liability coverage: claims-made and occurrence policies. Claims-made policies are typically more popular among small businesses due to their lower cost and flexibility in coverage. Here's a more detailed explanation:

Cost-Effectiveness

Claims-made policies are generally more affordable than occurrence policies, especially during the initial years of coverage. This cost-effectiveness is a significant advantage for small businesses, which often have tighter budgets and may be more price-sensitive when it comes to insurance.

Tailored Coverage

Claims-made policies offer tailored coverage for small businesses. They are triggered by a claim being filed during the policy period, providing protection for incidents that occur after a specified retroactive date. This allows small businesses to customise their coverage according to their unique needs, ensuring they only pay for the protection they require.

Flexibility

Claims-made policies are also flexible, as they can be switched between different insurance providers without losing coverage for past incidents. This flexibility is advantageous for small businesses that may experience growth or changes in their operations and want the option to adjust their insurance coverage accordingly.

Simplicity

Claims-made policies are straightforward and easy to understand. They provide coverage for incidents that occur and are reported within the policy's timeframe. This simplicity makes it easier for small business owners to manage their insurance and ensure they are adequately protected.

Professional Liability

Claims-made policies are particularly relevant for small businesses offering professional services. Errors and omissions (E&O) insurance, also known as professional liability insurance, is typically written on a claims-made basis. This type of insurance covers claims arising from mistakes or negligence in providing professional services, which is essential for small businesses in industries like consulting, accounting, or legal services.

In summary, claims-made policies are often the preferred choice for small businesses due to their cost-effectiveness, flexibility, and ability to provide tailored coverage. Small businesses can benefit from the affordability and customisation that claims-made policies offer, ensuring they have the necessary protection without breaking their budget.

Canceling Geico Auto Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

A claims-made policy covers incidents that are reported during the active policy period or during an extended reporting period, and that occur after a policy's retroactive start date. An occurrence policy covers losses that take place during a specific coverage period, regardless of when an incident is reported.

A retroactive date is the specific date a policy's coverage begins. This is generally the policy's effective date or a past date agreed on by the insured. If an incident occurs before the retroactive date, it won't be covered.

Also known as tail coverage, an extended reporting period is a provision on a policy that extends the amount of time you can report a claim after a policy's cancellation.

No, you don't need tail coverage if you have an occurrence policy because you will get coverage for a claim if the incident occurred during the policy period, even if you are reporting claims after your policy's expiration date.

There is no advantage to having one over the other. Claims-made coverage usually costs less, but occurrence coverage offers more peace of mind as you get a new aggregate limit each time you renew your policy.