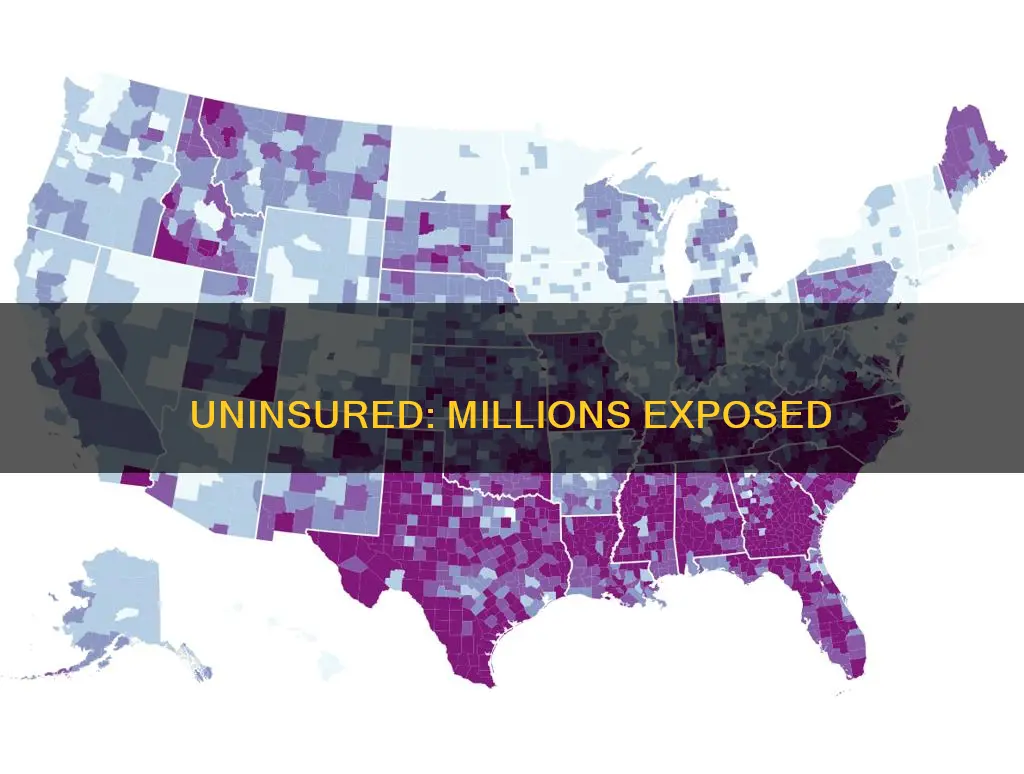

In 2020, 8.6% of people in the US, or 28 million, did not have health insurance. This number has been decreasing since 2010, when the Affordable Care Act (ACA) was enacted. The ACA, also known as Obamacare, expanded Medicaid and offers health insurance to people who lack job-based coverage through a mix of subsidized private plans. In 2022, the number of nonelderly uninsured individuals reached an all-time low of 8% or 25.6 million. The uninsured rate among children was 5.1% in 2022, less than half the rate among nonelderly adults (11.3%). Most of the nonelderly uninsured are adults in working low-income families, and people of colour.

What You'll Learn

High costs of insurance

There are many factors that contribute to the high costs of insurance. Here are some reasons why insurance, particularly car insurance, has become increasingly expensive:

Rising Repair Costs

The cost of repairing vehicles has been on the rise due to several factors. The increasing sophistication of technology in modern cars means that even a simple fender bender can now damage cameras, sensors, and other equipment used for safety features such as cruise control, parking assistance, and emergency braking. As a result, the average estimate for a drivable, front-end claim has increased significantly in recent years. Additionally, there is a shortage of vehicle parts, and labour costs have also gone up, further contributing to higher repair costs.

Natural Disasters and Severe Weather

Climate change and severe weather events, such as storms, wildfires, and flooding, have led to an increase in insurance claims. In 2023, U.S. insurance companies covered a record $60 billion in losses from strong winds, heavy rain, hail, and tornadoes. As a result, insurers have been raising prices, pulling back coverage, and even denying renewals, especially in high-risk states like Florida, Louisiana, and California.

Inflation and Supply Chain Issues

Inflation has made everything more expensive, including the cost of new and used vehicles. The pandemic disrupted supply chains, causing a shortage of vehicle parts, which drove up prices. Additionally, there is a labour shortage, and garages have had to increase wages to attract workers, further contributing to higher vehicle and insurance costs.

Individual Factors

Insurance companies base premiums on multiple rating factors, including individual driver profiles. For example, younger and less experienced drivers are considered high-risk and are charged higher rates. Other factors such as your ZIP code, credit history, driving record, and the make and model of your car can also affect your insurance premium.

Legal and System Abuse

In some states, policyholders and their attorneys may abuse the legal system by intentionally increasing the time and cost of claims settlements. This contributes to rising costs for all consumers. Additionally, insurance fraud, such as that seen in Florida in 2023, can also drive up insurance rates.

Company-Specific Reasons

Insurance companies set their own rates, and your current insurer may have hiked rates higher than others. Additionally, your experience with a previous insurance company can also affect your current rates. For example, if you filed multiple claims or failed to pay your premiums on time with a previous insurer, you may now be paying higher rates.

Other Factors

Other factors that can contribute to high insurance costs include:

- The choice of insurance company and coverage: Some companies may be more expensive than others, and opting for full coverage will cost more than minimum liability coverage.

- Driving record: At-fault accidents, traffic tickets, and DUIs will lead to higher insurance rates.

- Location: Insurance costs vary by state and even by ZIP code within a state. Factors such as population density, theft rates, vandalism, and severe weather events can affect insurance rates.

- Vehicle choice: The make and model of your car can affect your insurance rates. Luxury vehicles, for example, may be more expensive to insure due to higher repair costs and the risk of theft.

- Personal characteristics: Factors such as age, gender, marital status, education level, and occupation can influence insurance rates.

Understanding Insurance Billing for Lactation Services: A Guide for Healthcare Providers

You may want to see also

Lack of access to healthcare by demographics and gender

In 2020, 8.6% of people in the United States, or 28 million, did not have health insurance at any point during the year. The following year, the number of uninsured nonelderly individuals dropped to 25.6 million, a decrease of 3.3 million from 2019. Most of the nonelderly uninsured are adults in working low-income families, and people of colour. In 2022, Hispanic and White people comprised the largest shares of the nonelderly uninsured population at 40.0% and 37.7%, respectively.

In the United States, gender differences in health and healthcare use are a long-standing concern. Women tend to have fewer economic resources than men, and controlling for health needs did little to explain gender differences in preventive care and increased gender differences in the use of hospital services. Women were less likely to have hospital stays and had fewer physician visits than men with similar demographic and health profiles. However, the greater use of home healthcare among women was almost entirely explained by their greater health needs.

Differences in health service use and access by race/ethnicity and gender were also observed. Non-Hispanic whites had the greatest gains in health service use and access across two separate analyses using data from 2006 to 2014 and 2012 to 2014. While there was significant progress among Hispanic respondents from 2012 to 2014, no significant changes were found before and after healthcare reform, suggesting access may have worsened before improving for this group. Black women and men fared the worst with respect to changes in healthcare access.

Disparities in access to healthcare also exist in subgroup categories such as age, race, ethnicity, geographic location, and insurance status. For the most recent year, females had better access to care than males for 43% of access measures. People in poor households had worse access to care than people in high-income households for 79% of access measures. People with disabilities had worse access to care than people without disabilities for 42% of access measures.

Legality of Switching Insurance Brokers

You may want to see also

The impact of the Affordable Care Act

The Affordable Care Act (ACA) has had a significant impact on health insurance coverage and access in the United States. Here are some key ways in which the ACA has influenced the landscape of healthcare in the country:

Reducing the Number of Uninsured Individuals

The ACA has successfully reduced the number of uninsured Americans, bringing this figure down to historically low levels. Specifically, the ACA has extended coverage to more than 31 million people as of early 2021. The law has also contributed to a downward trend in the number of nonelderly uninsured individuals, with a decrease of nearly 1.9 million people from 2021 to 2022. This reduction in the uninsured population is particularly notable among nonelderly adults and racial and ethnic minority groups.

Expanding Medicaid Eligibility

The ACA allowed states to expand Medicaid eligibility to individuals and families with incomes up to 138% of the Federal Poverty Level. As of March 2022, 38 states and Washington, D.C., had adopted Medicaid expansion, connecting more people to coverage and improving health outcomes, especially for women of color and families.

Protecting Individuals with Pre-existing Conditions

The ACA prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions. This protection applies to more than 133 million people with conditions such as cancer, asthma, or diabetes.

Improving Access to Care

The increase in insurance coverage due to the ACA has resulted in improved access to healthcare services, particularly for low-income individuals and people of color. Enrollment through ACA marketplaces and Medicaid expansion has played a significant role in enhancing access, with premium assistance also helping to make coverage more affordable.

Enhancing Financial Protection

The ACA's provisions, including Medicaid expansion and marketplace subsidies, have reduced out-of-pocket healthcare costs for enrolled individuals. This financial protection is especially beneficial for those with lower incomes, who may otherwise struggle to afford necessary medical care.

Advancing Health Equity

The ACA has advanced health equity by improving access to care and reducing disparities among underserved populations. For example, the law has provided coverage to approximately 4 million Latinos and 3 million Black Americans since its enactment in 2010. Additionally, the ACA established the Offices of Minority Health within six agencies at the Department of Health and Human Services, elevating the focus on health equity.

Strengthening Mental Health and Substance Use Support

The ACA established the Substance Abuse and Mental Health Services Administration (SAMHSA) Office of Behavioral Health Equity, which works to reduce disparities in mental and substance use disorders. The law also mandated coverage of mental health and substance use disorder treatment services as essential health benefits, benefiting approximately 30.4 million enrollees.

Investing in Community Health Centers

The ACA provided significant funding to bolster and expand community health centers, investing $11 billion to support nearly 1,400 HRSA-funded health centers. These centers provide comprehensive and preventive healthcare services to approximately 29 million people across the country.

Promoting Prevention and Public Health

The ACA made preventive services more accessible and affordable by requiring plans to cover certain preventive health services without cost-sharing. This includes services such as immunizations, cancer screenings, and wellness visits. The law also established the Prevention and Public Health Trust Fund, providing $15 billion to finance community investments that improve public health.

Creating State Health Insurance Exchanges

The ACA established state health insurance exchanges, simplifying the process of purchasing health insurance. These exchanges offer a one-stop shop for individuals and businesses to compare and select qualified health plans, providing information, enrollment assistance, and subsidy eligibility calculations.

Lowering Costs for the Federal Government

While the ACA's coverage expansions and subsidies have increased federal spending, the overall cost to the federal government has been lower than initially projected. This is due to lower growth in healthcare costs, reduced premiums in marketplaces, and lower enrollment in these marketplaces.

Navigating Mid-Year Insurance Changes: A Comprehensive Guide

You may want to see also

The impact of Trump's presidency

During his 2016 campaign, President Donald Trump promised "insurance for everybody" and pledged to “take care of everybody” and lower costs. However, the impact of his presidency on health insurance coverage fell far short of these promises.

Between 2016 and 2019, the number of uninsured Americans rose by about 2.3 million, including 726,000 children. This increase in the number of uninsured people has been attributed to Trump administration policies aimed at attacking the Affordable Care Act (ACA).

One such policy was the cessation of federal support for enrollment navigators and assisters. Funding for ACA outreach and advertising was reduced by 90% between 2017 and 2020, making it more difficult for Americans to obtain comprehensive insurance coverage. The administration also discontinued cost-sharing reduction payments to insurers for silver marketplace plans in 2017, leading some insurers to reduce plan offerings, leave markets, or raise prices.

In addition, the Trump administration's public charge rule discouraged immigrants and their family members from seeking coverage and care for which they were eligible. The expansion of junk, short-term health insurance plans, which are not required to comply with the ACA's consumer protection rules, also contributed to the rise in uninsured individuals.

The impact of these policies was felt disproportionately by certain groups. For example, among the 41 states with increases in their numbers of uninsured residents, the largest increases were in Texas and Florida. The number of uninsured nonelderly individuals also dropped in some states, including New York, which saw a decline of 176,000.

The consequences of these coverage losses were severe. It is estimated that the loss of health coverage led to at least 3,399 deaths and possibly as many as 25,180. The pandemic further exacerbated the problem, as Americans continued to lose jobs and job-based health insurance.

Despite these concerning trends, the Trump administration continued to actively push forward with a health care lawsuit that could invalidate the entire ACA, endangering coverage for millions more.

Walgreens Flu Shot Services: Understanding Insurance Coverage and Billing

You may want to see also

The difference between universal healthcare and the US system

Universal healthcare refers to a system where every individual has health coverage. This can be achieved through a government-run health coverage system, a private health insurance system, or a combination of both.

The US system is a mix of public and private health coverage. Citizens or businesses can obtain health insurance from private companies, while individuals may also qualify for public, government-subsidized health insurance.

Differences Between the Two Systems:

Coverage:

One of the main differences between universal healthcare and the US system is the extent of coverage. While universal healthcare aims to provide coverage for all citizens, the US system has millions of people who are uninsured, with an estimated 27.2 million people (8.3%) uninsured in 2021, decreasing to 25.6 million (9.6%) in 2022.

Funding:

Another key difference lies in the funding mechanisms. Universal healthcare systems are typically funded by the government through taxes, with some countries having additional private insurance options. In contrast, the US system relies heavily on private health insurance, with private coverage being more prevalent than public coverage.

Administration:

Universal healthcare systems are generally administered by a single entity, often the government, which pays for and provides health services to the entire population. On the other hand, the US system involves multiple payers and administrators, including private insurance companies, government programs like Medicare and Medicaid, and employer-sponsored plans.

Access:

Universal healthcare systems aim to provide equitable access to health services for all citizens, regardless of socio-economic status, employment status, or ability to pay. In contrast, the US system has been criticized for having limited public coverage, particularly for adults, and high costs that act as barriers to accessing healthcare.

While both universal healthcare and the US system aim to provide health coverage to their populations, they differ in terms of coverage, funding, administration, and access. Universal healthcare strives for comprehensive coverage through government funding and administration, while the US system relies on a mix of public and private coverage with multiple payers and administrators.

Specialty Doctors: Insurance Coverage Explained

You may want to see also

Frequently asked questions

As of 2022, around 25.6 million non-elderly people in the US were uninsured, which is around 8-9.6% of the population.

The number of uninsured people has been decreasing since 2010, when the Affordable Care Act (ACA) was introduced. However, there was an increase in the number of uninsured people between 2016 and 2020.

Adults are more likely to be uninsured than children, and people of colour are more likely to be uninsured than white people. Most uninsured people are from low-income families, and there are higher rates of uninsured individuals in the South and West of the US.

The high cost of insurance is the main reason, with 64% of uninsured adults in 2022 citing this as the reason for lacking coverage. Many people also don't have access to insurance through their job, and some are ineligible for financial assistance.

Uninsured people often face unaffordable medical bills and are more likely to delay or go without necessary treatment due to costs. They are also more likely to face negative health outcomes and increased stress and anxiety.