Not having medical insurance can be a risky decision, as it increases the financial risk of medical bills and reduces access to healthcare. Two-thirds of people who were uninsured in 2023 have been without coverage for more than a year, and many go without insurance due to the cost of coverage or changes in employment. Uninsured adults are more likely to forgo needed care than their insured counterparts, and cost is a significant factor in why adults without coverage go without needed care in the past year.

| Characteristics | Values |

|---|---|

| Percentage of people without insurance in 2023 | 64% |

| Percentage of adults without insurance who did not see a doctor in the past 12 months | 46.6% |

| Percentage of adults with private insurance who did not see a doctor in the past 12 months | 15.6% |

| Percentage of adults with public coverage who did not see a doctor in the past 12 months | 14.2% |

| Percentage of adults without insurance who went without needed care in the past year | 22.6% |

| Percentage of adults with private insurance who went without needed care in the past year | 5.1% |

| Percentage of adults with public coverage who went without needed care in the past year | 7.7% |

| Average monthly cost of a Bronze plan on the ACA health insurance marketplace | $420 |

What You'll Learn

Lack of access to affordable health coverage

Uninsured adults are more likely to forgo needed care than their insured counterparts. In 2023, nearly half (46.6%) of uninsured adults ages 18 to 64 reported not seeing a doctor or health care professional in the past 12 months compared to 15.6% with private insurance and 14.2% with public coverage. Part of the reason for not accessing care among uninsured individuals is that many (42.8%) do not have a regular place to go when they are sick or need medical advice. But cost also plays a role. Over one in five (22.6%) adults without coverage said that they went without needed care in the past year because of cost compared to 5.1% of adults with private coverage and 7.7% of adults with public coverage.

If your insurance company still denies the claim, you can pursue an external review appeal. An independent third party performs this. It’s called “external" because your insurer will no longer have the final decision over whether or not to pay for a claim. It’s generally never a good idea to skip health insurance coverage due to the financial risk of ending up with whopping medical bills. Even the healthiest person can suddenly become gravely ill or be badly hurt in a car accident or other mishap. The average monthly cost of a Bronze plan on the ACA health insurance marketplace is $420 for a 40-year-old.

There are many different reasons why people might go without health insurance for a period, from the cost of coverage to changes in employment. There is currently no tax penalty assessed at the federal level for not having health insurance, but there are risks associated with being uninsured. It is in most people’s best interest to have insurance that can help cover healthcare costs such as doctor’s visits, prescription drugs, and potential visits to the emergency room, however, it’s not always accessible to everyone.

Providers and facilities must give you an estimate when you schedule care at least 3 business days in advance, or if you ask for one. If a bill from one of your providers is at least $400 more than the good faith estimate from that provider, you can dispute your bill. A good faith estimate is a list of expected charges before you get health care items or services (procedures, supporting care) from a provider or facility.

Navigating Dual Medical Insurance: Benefits and Considerations

You may want to see also

Cost of coverage

The lack of access to affordable health coverage is the main reason many people say they are uninsured. A majority of working-age adults in the U.S. obtain health insurance through an employer, however, not all workers are offered employer-sponsored coverage or, if offered, can afford their share of the premiums.

Over one in five (22.6%) adults without coverage said that they went without needed care in the past year because of cost compared to 5.1% of adults with private coverage and 7.7% of adults with public coverage. Even the healthiest person can suddenly become gravely ill or be badly hurt in a car accident or other mishap. The average monthly cost of a Bronze plan on the ACA health insurance marketplace is $420 for a 40-year-old.

If you don’t have insurance, or are choosing not to use it, you may choose not to use insurance if the service you need isn’t covered, or it’s less expensive if you pay out of pocket. In most cases, providers and facilities must give you an estimate when you schedule care at least 3 business days in advance, or if you ask for one. If a bill from one of your providers is at least $400 more than the good faith estimate from that provider, you can dispute your bill.

There is currently no tax penalty assessed at the federal level for not having health insurance, but there are risks associated with being uninsured. Uninsured adults are more likely to forgo needed care than their insured counterparts. In 2023, nearly half (46.6%) of uninsured adults ages 18 to 64 reported not seeing a doctor or health care professional in the past 12 months compared to 15.6% with private insurance and 14.2% with public coverage.

If your insurance company still denies the claim, you can pursue an external review appeal. An independent third party performs this. It’s called “external” because your insurer will no longer have the final decision over whether or not to pay for a claim. It’s generally never a good idea to skip health insurance coverage due to the financial risk of ending up with whopping medical bills.

Unraveling IVF Medication Coverage: Insurance Insights

You may want to see also

Changes in employment

If you are losing your job, you may also lose your health insurance. You may choose not to use insurance if the service you need isn’t covered, or it’s less expensive if you pay out of pocket. In most cases, providers and facilities must give you an estimate when you schedule care at least 3 business days in advance, or if you ask for one. If a bill from one of your providers is at least $400 more than the good faith estimate from that provider, you can dispute your bill.

There are many different reasons why people might go without health insurance for a period, from the cost of coverage to changes in employment. Lack of access to affordable health coverage is the main reason many people say they are uninsured. Uninsured adults are more likely to forgo needed care than their insured counterparts. In 2023, nearly half (46.6%) of uninsured adults ages 18 to 64 reported not seeing a doctor or health care professional in the past 12 months compared to 15.6% with private insurance and 14.2% with public coverage. Part of the reason for not accessing care among uninsured individuals is that many (42.8%) do not have a regular place to go when they are sick or need medical advice. But cost also plays a role. Over one in five (22.6%) adults without coverage said that they went without needed care in the past year because of cost compared to 5.1% of adults with private coverage and 7.7% of adults with public coverage.

Even the healthiest person can suddenly become gravely ill or be badly hurt in a car accident or other mishap. There are risks associated with being uninsured. It is in most people’s best interest to have insurance that can help cover healthcare costs such as doctor’s visits, prescription drugs, and potential visits to the emergency room, however, it’s not always accessible to everyone. If your insurance company still denies the claim, you can pursue an external review appeal. An independent third party performs this. It’s called “external” because your insurer will no longer have the final decision over whether or not to pay for a claim. It’s generally never a good idea to skip health insurance coverage due to the financial risk of ending up with whopping medical bills. The average monthly cost of a Bronze plan on the ACA health insurance marketplace is $420 for a 40-year-old.

Maximize Your Life Insurance: Strategies to Shield from Medicaid

You may want to see also

No regular place to go when sick

If you have no medical insurance, you may not have a regular place to go when you are sick or need medical advice. This is because uninsured adults are more likely to forgo needed care than their insured counterparts. In 2023, nearly half (46.6%) of uninsured adults ages 18 to 64 reported not seeing a doctor or health care professional in the past 12 months compared to 15.6% with private insurance and 14.2% with public coverage.

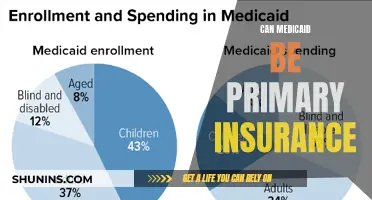

Lack of access to affordable health coverage is the main reason many people say they are uninsured. A majority of working-age adults in the U.S. obtain health insurance through an employer; however, not all workers are offered employer-sponsored coverage or, if offered, can afford their share of the premiums. Medicaid covers many low-income individuals, especially children, but Medicaid eligibility for adults remains limited in most states that have not adopted the ACA expansion.

If you don't have insurance, you may choose not to use it if the service you need isn't covered, or it’s less expensive if you pay out of pocket. In most cases, providers and facilities must give you an estimate when you schedule care at least 3 business days in advance, or if you ask for one. If a bill from one of your providers is at least $400 more than the good faith estimate from that provider, you can dispute your bill.

Even the healthiest person can suddenly become gravely ill or be badly hurt in a car accident or other mishap. It’s generally never a good idea to skip health insurance coverage due to the financial risk of ending up with whopping medical bills. The average monthly cost of a Bronze plan on the ACA health insurance marketplace is $420 for a 40-year-old.

There are many different reasons why people might go without health insurance for a period, from the cost of coverage to changes in employment. While there is currently no tax penalty assessed at the federal level for not having health insurance, there are risks associated with being uninsured. It is in most people’s best interest to have insurance that can help cover healthcare costs such as doctor’s visits, prescription drugs, and potential visits to the emergency room.

Epo: Unlocking Medical Insurance Benefits: What It Really Means

You may want to see also

Financial risk of medical bills

Not having health insurance can lead to financial risk due to medical bills. Even the healthiest person can suddenly become gravely ill or be badly hurt in a car accident or other mishap. There are many different reasons why people might go without health insurance for a period, from the cost of coverage to changes in employment. Uninsured adults are more likely to forgo needed care than their insured counterparts. In 2023, nearly half (46.6%) of uninsured adults ages 18 to 64 reported not seeing a doctor or health care professional in the past 12 months compared to 15.6% with private insurance and 14.2% with public coverage. Over one in five (22.6%) adults without coverage said that they went without needed care in the past year because of cost compared to 5.1% of adults with private coverage and 7.7% of adults with public coverage. If a bill from one of your providers is at least $400 more than the good faith estimate from that provider, you can dispute your bill. A good faith estimate is a list of expected charges before you get health care items or services (procedures, supporting care) from a provider or facility. If your insurance company still denies the claim, you can pursue an external review appeal. An independent third party performs this. It’s called “external” because your insurer will no longer have the final decision over whether or not to pay for a claim.

Viagra Coverage: Navigating Insurance for Erectile Dysfunction Treatment

You may want to see also

Frequently asked questions

There is no specific time limit on how long you can go without medical insurance. However, it is generally not recommended to go without health insurance due to the financial risk of ending up with whopping medical bills. The average monthly cost of a Bronze plan on the ACA health insurance marketplace is $420 for a 40-year-old.

There is currently no tax penalty assessed at the federal level for not having health insurance. However, there are risks associated with being uninsured. Uninsured adults are more likely to forgo needed care than their insured counterparts. In 2023, nearly half (46.6%) of uninsured adults ages 18 to 64 reported not seeing a doctor or health care professional in the past 12 months.

There are many different reasons why people might go without health insurance for a period, from the cost of coverage to changes in employment. A majority of working-age adults in the U.S. obtain health insurance through an employer. However, not all workers are offered employer-sponsored coverage or, if offered, can afford their share of the premiums.