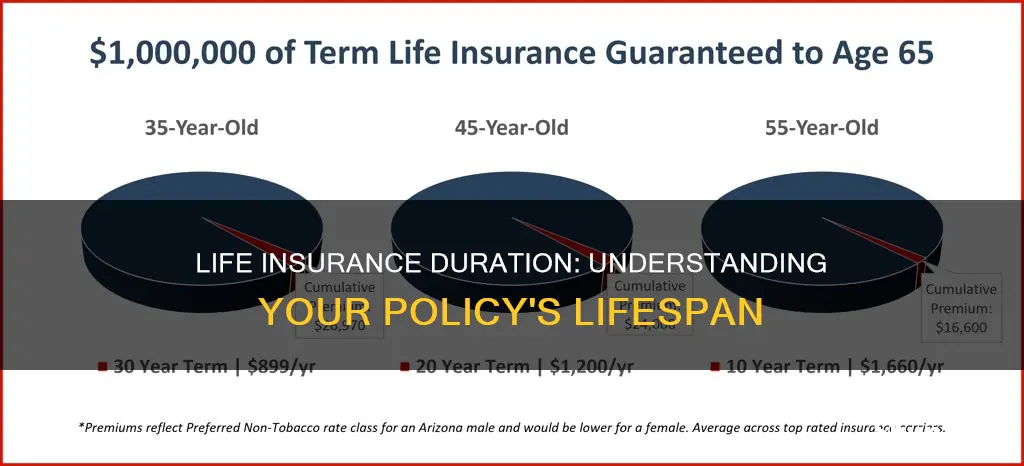

The length of life insurance coverage depends on various factors, including age, income, mortgage, debt, and dependents. Term life insurance, the most common type, offers coverage for a specific period, typically 10 to 30 years, while permanent life insurance provides lifelong protection. Term life insurance rates increase with age and health issues, making it essential to assess financial obligations when choosing a term length. Factors like mortgage, debt repayment, children's education, and retirement influence the duration of coverage.

| Characteristics | Values |

|---|---|

| Term life insurance policy length | 1, 5, 10, 15, 20, 25, 30, 40 years |

| Permanent life insurance policy length | Lifelong coverage |

| Annual renewable term life insurance | Good for short-term financial obligations |

| 5-year term life insurance | Good for small loans or college fees |

| 10-year term life insurance | Good for older adults without young children |

| 20-year term life insurance | Good for new parents or newlyweds |

| 30-year term life insurance | Good for large, long-term financial obligations like a mortgage |

What You'll Learn

Term life insurance: the basics

Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. The death benefit is the amount of money paid to beneficiaries after the insured dies and will only be paid out if the insured dies during this time period. This can be issued in a variety of ways, such as a lump-sum payment or as annuities.

Types of Term Life Insurance

There are several types of term life insurance policies. The best option depends on individual circumstances. Most companies offer terms ranging from 10 to 30 years, although a few offer 35- and 40-year terms.

Level Term or Level-Premium Policy

The most common type of term policy, level-premium insurance, has a fixed monthly payment for the life of the policy. The death benefit also remains fixed. As the costs of insurance increase over time, the level premium is comparatively higher than yearly renewable term life insurance.

Yearly Renewable Term (YRT) Policy

Yearly renewable term policies are one-year policies that can be renewed annually without providing evidence of insurability. However, the premiums increase each year as the insured person ages, and they can become unaffordable over time.

Decreasing Term Policy

These policies have a death benefit that declines annually according to a set schedule. The policyholder pays a fixed level premium for the duration of the policy. Decreasing term policies are often used in conjunction with a mortgage, with the policyholder matching the insurance payout to the declining principal of the home loan.

Pros and Cons of Term Life Insurance

Term life insurance is a relatively inexpensive way to provide a lump sum to dependents if something happens to the insured. It is ideal for people who want substantial coverage at a low cost. However, term life insurance has no cash value or investment options.

Who Should Consider Term Life Insurance?

Term life insurance is not suitable for everyone. It is often considered a useful tool for those with specific needs for a particular period, such as a child's education or a mortgage. It can also be a good option for young people starting a family who are concerned about future health issues affecting their eligibility for permanent life coverage. However, term life insurance may not be the best choice for those who can afford permanent life insurance and have dependents who would be financially burdened if they were to pass away.

Term life insurance policies typically last anywhere from five to 30 years. The policy might also end if the insured reaches a specific age, usually around 65. If the policy ends, it may be possible to renew it, depending on the insured's age.

Haven Life Insurance: Ticker Talk and More

You may want to see also

Permanent life insurance: the pros and cons

Permanent life insurance is a type of insurance policy that covers you for your entire life, provided that you pay the premiums. It also has a cash value component that grows over time and can be withdrawn or borrowed against. While permanent life insurance is more expensive than term life insurance, it can be a good option for those who want lifelong coverage and the opportunity to build cash value. Here are some of the pros and cons of permanent life insurance:

Pros:

- Lifelong coverage: Permanent life insurance policies typically last your entire life, providing coverage no matter when you die, as long as premiums are paid.

- Cash value: These policies have a cash value component that grows over time and can be used to pay premiums, take out a loan, or be withdrawn.

- Flexibility: Depending on the policy, you may be able to adjust premium payments and coverage amounts to fit your needs.

- Investment opportunities: The cash value of permanent life insurance can be invested, providing potential growth and diversification to your portfolio.

Cons:

- Cost: Permanent life insurance is significantly more expensive than term life insurance due to the lifelong coverage and investment opportunities.

- Complexity: Some permanent life insurance policies, such as universal and variable policies, require careful monitoring to ensure the cash value performs well and the policy stays in force.

- Reduced death benefit: If you borrow from the cash value and don't pay it back, the insurer will typically reduce the death benefit by the same amount.

- Limited need: For most people, term life insurance is sufficient, as financial obligations tend to decrease over time. Permanent life insurance may be unnecessary for those without significant financial obligations or the need for lifelong coverage.

Life Insurance and Sunsuper: What's the Deal?

You may want to see also

How to choose the right term length

When choosing the right term length for your life insurance, there are a few key factors to consider.

Firstly, think about your financial responsibilities, such as your mortgage. If you're a new homeowner, you may want to opt for a 30-year term, as that's how long many mortgages last. Even if you've taken out a shorter mortgage, choosing a longer term can give you flexibility if you refinance or your circumstances change.

Secondly, consider any co-signed loans you have. Whether it's a student loan for your child or a business loan with a partner, your life insurance policy should outlast those debts so that your co-signers can keep up with payments.

Thirdly, take into account your family situation and how long your children will be dependent on you. If you're a new parent, you'll need coverage for as long as your children are financially dependent, which could be anywhere from 20 to 30 years if you plan to support them past the age of 18 or help with their education.

Another factor to consider is your retirement age. Your life insurance policy should ideally last until your beneficiaries can support themselves without your financial input. For many people, this financial independence occurs at retirement age, when their children are out of college and their mortgage is paid off.

Finally, your age can impact the term lengths you qualify for. Older adults may not be eligible for the longest terms but can still get coverage for a significant number of years.

It's important to carefully consider your unique circumstances and financial goals when choosing a term length for your life insurance policy. Seeking advice from a financial advisor or licensed insurance professional can help you make an informed decision.

Life Insurance: Geico's Accelerated Rider Option Explained

You may want to see also

When to consider a longer term

There are several reasons why you may want to consider a longer-term life insurance policy. Here are some key factors to keep in mind:

- Financial obligations: If you have significant financial obligations, such as a mortgage, car loans, or other long-term debts, a longer-term policy can ensure that these debts are paid off without burdening your loved ones.

- Dependent support: If you have dependents who rely on your income, a longer-term policy can provide financial support until they are financially independent, including covering expenses such as education or other needs.

- Business planning: Life insurance can play a crucial role in business succession planning, covering key persons, or repaying business loans in the event of your death.

- Estate planning: Life insurance can be used for estate planning purposes, providing liquidity to pay estate taxes or creating an inheritance for your heirs.

- Income support: Life insurance can provide ongoing financial support to replace the lost income of the policyholder for their spouse or partner.

- Special needs dependents: If you have a dependent with special needs who will require lifelong financial support, a longer-term policy can ensure their needs are met even after you're gone.

- Peace of mind: Many people feel more at ease knowing that their family is financially protected for a longer period of time.

- Predictable costs: Longer-term policies offer financial stability as you will be paying level premiums throughout the life of the policy.

- Health changes: As you age, your health may worsen, and this can impact your ability to qualify for a new policy or renew your existing one. A longer-term policy can provide coverage during your healthier years, giving you peace of mind.

- Future financial obligations: If you anticipate taking on more financial obligations in the future, such as having children or starting a business, a longer-term policy can help you prepare for these expenses.

- Lower rates: Life insurance rates increase as you age. By purchasing a longer-term policy when you are younger, you can lock in lower rates for a more extended period.

Prudential's Drug Testing: Life Insurance Requirements and Protocols

You may want to see also

When to opt for a shorter term

The duration of your life insurance policy should be based on your unique financial situation and goals. While life insurance is intended to provide financial security for your loved ones after your death, there are several scenarios in which a shorter-term policy may be more suitable.

Firstly, if you're approaching retirement, your financial obligations will likely decrease, and you may only need a shorter term to cover the remaining years of your career. Similarly, if you have older children who are almost financially independent, a shorter term can provide coverage until they are fully self-sufficient.

Additionally, if you're close to paying off your debts, including a mortgage, opting for a shorter-term policy can be a wise decision to bridge that gap. This ensures that your loved ones are protected during this critical period without committing to a longer-term policy that may become unnecessary once your debts are settled.

Moreover, shorter-term life insurance policies offer advantages such as affordability and flexibility. Shorter terms are often less expensive because insurance companies determine that their risk is reduced over a shorter period. This flexibility allows you to re-evaluate your needs periodically and adjust your insurance accordingly.

However, it's important to consider the potential complexities of renewal with shorter-term policies. While a shorter term may seem ideal, health issues that arise during the policy period could impact your ability to renew or secure a new policy at the end of the term.

In summary, opting for a shorter term can be advantageous when your financial obligations are decreasing, such as when approaching retirement, when your children are becoming financially independent, or when you're close to paying off significant debts. However, it's crucial to carefully assess your circumstances and consider seeking advice from a financial advisor or licensed insurance professional to ensure the best decisions regarding your life insurance coverage.

Get a Life Insurance License in South Carolina Easily

You may want to see also

Frequently asked questions

Term life insurance policies typically last for a set period of time, ranging from 10 to 30 years. However, some insurers offer shorter or longer terms, with lengths of five, 15, 25, or 40 years also available.

When determining the length of your life insurance coverage, consider your financial obligations, such as your mortgage, debts, and the number of dependents you have. You should also think about your age, income, and retirement plans.

Yes, many term life insurance policies offer the option to renew for a limited number of years without requiring evidence of insurability. Additionally, some insurers allow you to convert your term policy into a permanent life insurance policy, which provides lifelong coverage.

Term life insurance provides coverage for a specific period, after which it expires. In contrast, permanent life insurance offers lifelong coverage as long as premiums are paid and does not expire.