Servicemembers' Group Life Insurance (SGLI) is a Department of Veterans Affairs program that provides low-cost group life insurance to eligible military members. SGLI offers coverage of up to $500,000, which remains in effect for 120 days after discharge from the military. After this period, individuals can convert their SGLI to Veterans' Group Life Insurance (VGLI), allowing them to maintain their life insurance coverage as long as they continue paying the required premiums.

| Characteristics | Values |

|---|---|

| Maximum Coverage | $500,000 |

| Coverage Cost | 6 cents per $1,000 of coverage |

| Traumatic Injury Protection (TSGLI) Cost | $1 per month |

| Total Monthly Premium for Maximum Coverage | $31 |

| Coverage After Leaving the Military | 120 days |

| Conversion to Veterans' Group Life Insurance (VGLI) After Leaving the Military | Within 1 year and 120 days |

What You'll Learn

Servicemembers' Group Life Insurance (SGLI) costs

Servicemembers' Group Life Insurance (SGLI) is a Department of Veterans Affairs program that provides low-cost group life insurance to eligible military members. If you meet the eligibility criteria, you will be automatically insured under SGLI for a maximum of $500,000, unless you choose otherwise. The maximum coverage was raised from $400,000 to $500,000 in March 2023.

SGLI costs 6 cents per $1,000 of coverage. This means that for the maximum coverage of $500,000, the monthly premium is $30. All SGLI participants must also pay a $1 monthly charge for Traumatic Injury Protection (TSGLI), bringing the total monthly premium to $31 for $500,000 worth of coverage. The TSGLI coverage provides protection against loss due to traumatic injuries and is designed to provide financial assistance to members so their loved ones can be with them during their recovery. The coverage ranges from $25,000 to $100,000 depending on the nature of the injury.

The monthly premium for SGLI coverage will be automatically deducted from your base pay. You can choose your level of coverage or even refuse coverage completely. You can also choose your beneficiaries (the people who will receive the money from your life insurance policy if you die) and change them as needed.

If you decide to leave the military, your SGLI coverage will remain in effect for 120 days after your discharge. After leaving the military, you have the option to convert your SGLI to Veterans' Group Life Insurance (VGLI), a similar program. You can apply for VGLI within 1 year and 120 days from your date of discharge, for up to the amount of coverage you had through SGLI. Alternatively, you can convert your SGLI coverage to a permanent, individual insurance policy within 120 days of your discharge without proof of good health.

How to Sell the Beneficiary of Your Life Insurance Policy

You may want to see also

Eligibility criteria for SGLI

Servicemembers' Group Life Insurance (SGLI) offers low-cost term coverage to eligible service members. If you meet certain criteria, you will be automatically signed up for SGLI.

You may be eligible for full-time SGLI coverage if you meet at least one of the following requirements:

- You're an active-duty member of the Army, Navy, Air Force, Space Force, Marines, or Coast Guard.

- You're a commissioned member of the National Oceanic and Atmospheric Administration (NOAA) or the U.S. Public Health Service (USPHS).

- You're a cadet or midshipman of the U.S. military academies.

- You're a member, cadet, or midshipman of the Reserve Officers Training Corps (ROTC) engaged in authorized training and practice cruises.

- You're a member of the Ready Reserve or National Guard, assigned to a unit, and scheduled to perform at least 12 periods of inactive training per year.

- You're a volunteer in an Individual Ready Reserve (IRR) mobilization category.

If you're in non-pay status with the Ready Reserve or National Guard, you may be eligible for full-time SGLI coverage if you meet both of the following requirements:

- You're scheduled for 12 periods of inactive training for the year.

- You're drilling for points rather than pay.

Note that if you're in non-pay status, you must pay your premiums directly.

Accessing and managing SGLI

If you qualify for SGLI, you will be automatically signed up through your service branch. Check your unit's personnel office for more information.

You can choose your level of coverage or even refuse coverage completely. You can also choose your beneficiaries (the people you pick to get the money from your life insurance policy if you die) and change them as needed.

To make changes to your benefits, submit your changes online through the SGLI Online Enrollment System (SOES).

Haven Life Insurance: Quick Phone Support for Queries

You may want to see also

Converting SGLI to Veterans' Group Life Insurance (VGLI)

Servicemembers' Group Life Insurance (SGLI) offers low-cost term coverage to eligible service members. If you are a service member who meets certain criteria, you will be automatically signed up for SGLI.

When you leave the military, you have the option to convert your SGLI coverage to a permanent, individual insurance policy (like whole life) within 120 days from your date of discharge without proof of good health. You can also apply for Veterans' Group Life Insurance (VGLI) within 1 year and 120 days from your date of discharge for up to the amount of coverage you had through SGLI.

To be eligible for VGLI, you must meet at least one of the following requirements:

- You had SGLI while you were in the military and you're within 1 year and 120 days of being released from an active-duty period of 31 or more days.

- You're within 1 year and 120 days of retiring or being released from the Ready Reserve or National Guard.

- You're within 1 year and 120 days of assignment to the Individual Ready Reserve (IRR) of a branch of service, or to the Inactive National Guard (ING). This includes members of the United States Public Health Service Inactive Reserve Corps (IRC).

- You're within 1 year and 120 days of being put on the Temporary Disability Retirement List (TDRL).

- You had part-time Servicemembers' Group Life Insurance (SGLI) as a member of the National Guard or Reserve, and you suffered an injury or disability that disqualified you for standard premium insurance rates.

If you sign up for VGLI within 240 days of leaving the military, you won't need to prove you're in good health. If you sign up after the 240-day period, you'll need to submit evidence that you're in good health.

You can apply for VGLI in one of two ways:

- Apply through the Office of Servicemembers' Group Life Insurance (OSGLI), using the Prudential website.

- Apply by mail or fax. Fill out the Application for Veterans' Group Life Insurance (SGLV 8714).

Who Can Be a Life Insurance Beneficiary?

You may want to see also

Applying for VGLI

Servicemembers' Group Life Insurance (SGLI) offers low-cost term coverage to eligible service members. If you're a service member who meets certain criteria, you will be automatically signed up.

When you leave the military, you can apply for Veterans' Group Life Insurance (VGLI) within 1 year and 120 days from your date of discharge for up to the amount of coverage you had through SGLI.

You can apply for VGLI in one of two ways:

- Apply through the Office of Servicemembers' Group Life Insurance (OSGLI), using the Prudential website. Apply online through OSGLI.

- Apply by mail or fax. Fill out the Application for Veterans' Group Life Insurance (SGLV 8714).

If you sign up within 240 days of leaving the military, you won’t need to prove you’re in good health. If you sign up after the 240-day period, you’ll need to submit evidence that you’re in good health.

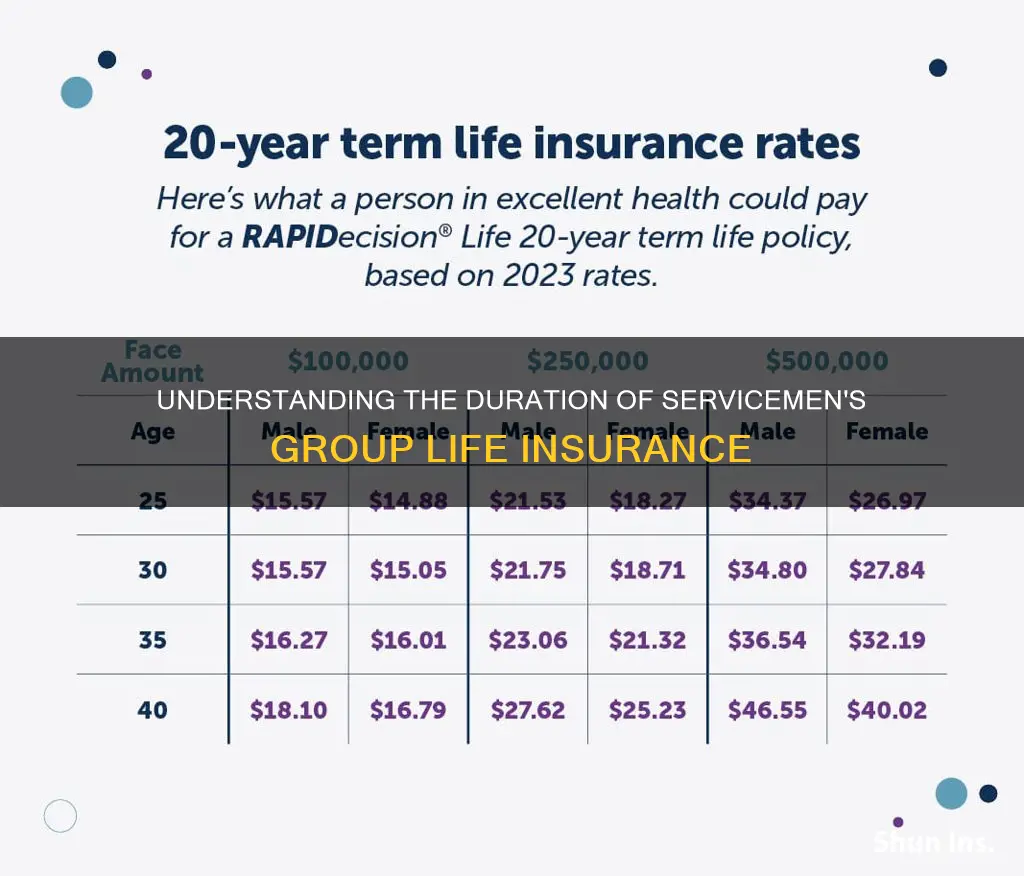

VGLI premium rates are based on your age and the amount of insurance coverage you want. You can get between $10,000 and $500,000 in term life insurance benefits. The amount you’ll get will be based on how much SGLI coverage you had when you left the military.

If you have questions about Servicemembers' or Veterans' Group Life Insurance, you can call the Office of Servicemembers' Group Life Insurance (OSGLI) at 800-419-1473, or email the Prudential Insurance Company.

Self-Insuring Life Insurance: A Viable Option for Employers?

You may want to see also

VGLI premium rates

Servicemembers' Group Life Insurance (SGLI) offers low-cost term coverage to eligible active-duty service members. When a service member leaves the military, they can apply for Veterans' Group Life Insurance (VGLI) within 1 year and 120 days from their date of discharge.

The VGLI premium rates for policies with effective/renewal dates before 10/01/02 can be found on the Veterans Affairs website. These rates vary based on the age of the insured, with separate charts for different age groups (0-34, 35-44, 45-54, 55-64, 65-74, and 75 and over).

The current basic SGLI premium rate is 6 cents per $1,000 of insurance coverage, which includes an additional $1 per month for Traumatic Injury Protection coverage (TSGLI). The monthly premium rate varies depending on the coverage amount, as outlined in the following table:

| Coverage Amount (in $) | Monthly Premium Rate (in $) | TSGLI Premium (in $) | Total Monthly Premium Deduction (in $) |

| --- | --- | --- | --- |

| 500,000 | 30.00 | 1.00 | 31.00 |

| 450,000 | 27.00 | 1.00 | 28.00 |

| 400,000 | 24.00 | 1.00 | 25.00 |

| 350,000 | 21.00 | 1.00 | 22.00 |

| 300,000 | 18.00 | 1.00 | 19.00 |

| 250,000 | 15.00 | 1.00 | 16.00 |

| 200,000 | 12.00 | 1.00 | 13.00 |

| 150,000 | 9.00 | 1.00 | 10.00 |

| 100,000 | 6.00 | 1.00 | 7.00 |

| 50,000 | 3.00 | 1.00 | 4.00 |

IDBI Federal Life Insurance: A Smart Choice?

You may want to see also

Frequently asked questions

Servicemembers' Group Life Insurance (SGLI) lasts 120 days after your discharge from the military.

After the 120 days, you can convert your SGLI to VGLI (Veterans' Group Life Insurance), a similar program.

You can apply for VGLI through the Office of Servicemembers' Group Life Insurance (OSGLI) using the Prudential website or by mail or fax.

VGLI lasts as long as you continue to pay the premiums.