Auto insurance has been around for over a century, with the first auto insurance policy in the US being sold in 1898 by the Travelers Insurance Company. The history of auto insurance is closely tied to the evolution of automobiles and the increasing number of car accidents. As cars became faster and more widely used, the need for financial protection in the event of collisions arose. The first mandatory auto insurance laws were enacted in the 1920s, with Massachusetts being the first state to mandate auto insurance in 1925. Over time, more states followed suit, and by the 1970s, auto insurance had become mandatory in most states. Today, auto insurance is required in nearly every state, with varying minimum coverage requirements and penalties for non-compliance.

| Characteristics | Values |

|---|---|

| When was car insurance first sold in the US? | 1897 or 1898 |

| Who sold the first car insurance policy in the US? | Travelers |

| Who was the first car insurance policy sold to? | Gilbert J. Loomis of Dayton, Ohio, or Dr. Truman Martin of Buffalo, New York |

| How much did the first car insurance policy cost? | $1,000 or $12.25 |

| When was the first comprehensive insurance policy sold? | 1902 |

| Which state was the first to pass compulsory automobile insurance legislation? | Massachusetts |

| Which state was the second to pass compulsory automobile insurance legislation? | North Carolina |

| When did the majority of states have laws requiring drivers to buy a minimum amount of liability coverage? | By the 1970s |

| Which states do not require drivers to have a minimum amount of car insurance? | Virginia, New Hampshire, and Mississippi |

What You'll Learn

The first auto insurance policy was sold in 1897 or 1898

The first auto insurance policy was sold in the United States in 1897 or 1898. According to the U.S. Census Bureau, the first car insurance policy was sold by Travelers in 1898 to Dr. Truman Martin of Buffalo, New York. Dr. Martin purchased $5,000 in liability coverage for $12.25, which would be the equivalent of more than $347.89 today. On the other hand, the Ohio Historical Society claims that Travelers sold a $1,000 liability car insurance policy to Gilbert J. Loomis of Dayton, Ohio, in 1897.

Gilbert J. Loomis was a mechanic and early auto pioneer who built the vehicle he insured. He remained a Travelers policyholder for over 60 years. The cost of his original policy was $7.50 for $1,000 in liability coverage. Dr. Truman Martin, a physician, wanted to use his car to visit patients and was concerned about his potential liability should he have an accident.

Early automobile insurance policies from Travelers were adaptations of "teams" liability policies written on horses and horse-drawn vehicles. The word "auto" was substituted for "team." It wasn't until 1905 that Travelers began selling liability policies with "automobile" printed on them. Premiums at the time were based on the vehicle's horsepower.

The development and growth of auto insurance reflect the emergence of the automobile as the primary mode of transportation in American society. From the first policy, with a premium of $7.50, Travelers Property Casualty now has 1.5 million auto policies in force, with total premiums of nearly $2 billion. Auto insurance is currently estimated to be a $100 billion-plus industry in the United States.

Mississippi Valley Credit Union: GAP Insurance Offerings

You may want to see also

The first comprehensive insurance policy was sold in 1902

The first comprehensive auto insurance policy was sold in 1902, a few years after the first liability car insurance policy was sold in the United States in 1897 or 1898.

The first comprehensive insurance policy was introduced with the creation of fire and theft auto insurance. This type of insurance was designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damage.

In the event of a collision, the insurance company will pay for the damage to the covered vehicle and any other property damaged as a result of the accident. If the insured driver causes bodily harm to a third party and is deemed responsible for the injuries, the insurance company will also cover court costs and damages that the insured driver may be liable for.

Comprehensive insurance is typically more expensive than liability-only insurance, as it provides more extensive coverage. It is important to note that while comprehensive insurance covers a wide range of incidents, it does not cover every possible scenario. For example, mechanical breakdowns, flat tires, and running out of gas are typically not covered under comprehensive insurance.

The introduction of comprehensive auto insurance was a significant development in the history of automobile insurance, providing drivers with more comprehensive protection in the event of accidents or other incidents.

Insuring Friends: Auto Insurance Add-Ons

You may want to see also

The UK was the first country to introduce compulsory car insurance

The Road Traffic Act 1930 was amended in 1988 to include a requirement for insurance against property damage. This law, set out in the Road Traffic Act 1988, is still in force today. It states that motorists must be insured against liability for injuries to others (including passengers) and for damage to other persons' property resulting from the use of a vehicle on a public road or in other public places. The UK government can penalise those who fail to comply with this law.

Before the introduction of compulsory car insurance in the UK, injured victims would rarely receive compensation following a crash, and drivers often faced considerable costs for damage to their car and property. The new law ensured that, in the event of an accident, an insurance company would be able to step in and pay the necessary costs. Those affected by the accident could be compensated without bankrupting the driver.

Since the introduction of compulsory car insurance in the UK, the way that uninsured vehicles are identified has changed. Until 2014, car owners in the UK were required to display a valid tax disc on their vehicle, which also showed that the vehicle was insured. Now, the Motor Insurance Database (MID) is used to keep track of the insurance status of vehicles in the UK. Police can access this database and use automatic number plate recognition (ANPR) technology to check whether a vehicle is insured.

Auto Insurance: Retroactive Coverage?

You may want to see also

The majority of US states had laws requiring drivers to buy insurance by the 1970s

The history of auto insurance in the US dates back to the late 19th century when the invention of the automobile led to a rise in collisions. In 1897, Gilbert J. Loomis took out the first automobile insurance policy in Dayton, Ohio. However, it wasn't until the 1920s that auto insurance started to become more mainstream, with Massachusetts becoming the first state to require drivers to have liability insurance in 1927.

Over the next few decades, more states followed suit and passed compulsory insurance laws. By the 1970s, the majority of US states had laws in place requiring drivers to purchase auto insurance. This shift towards compulsory insurance was driven by a growing recognition of the damage that cars could cause and the potential legal liability for drivers.

While most states require drivers to carry at least a minimum level of liability insurance, there are a few exceptions. For example, Virginia, New Hampshire, and Mississippi do not require vehicle owners to carry auto insurance, although there may be alternative financial requirements for uninsured drivers in these states.

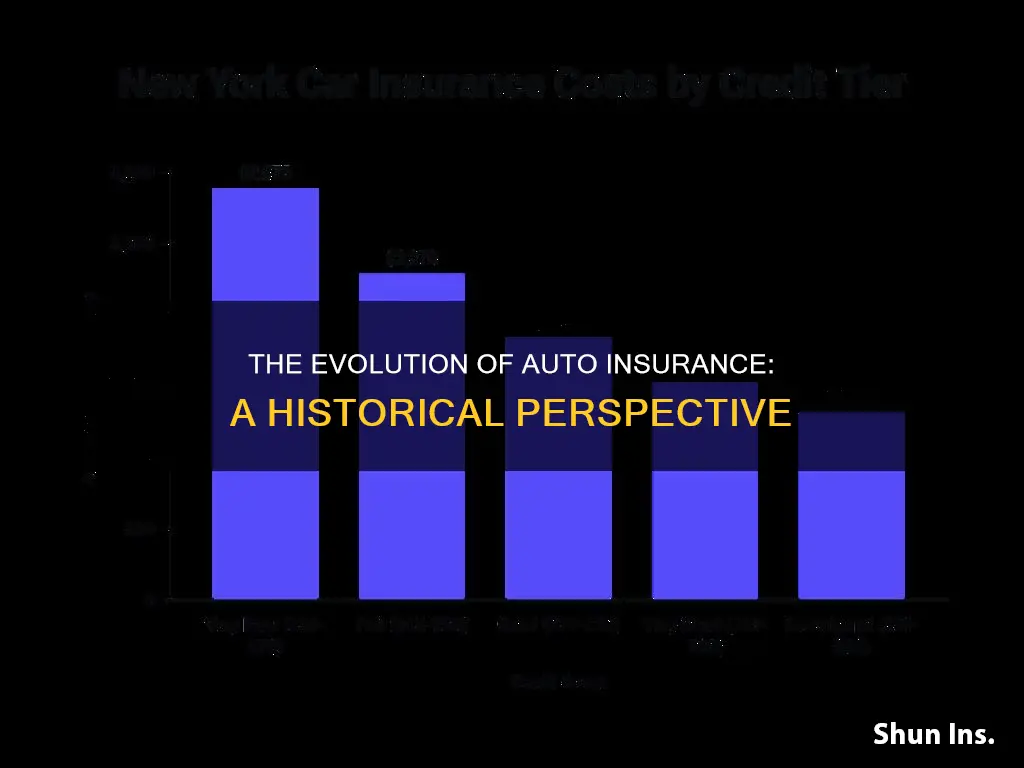

The specific requirements and coverage levels vary from state to state, and insurance companies use a range of factors to determine the cost of insurance premiums, including the type of vehicle, the driver's age, gender, marital status, and driving history.

Women Pay Less for Car Insurance

You may want to see also

Auto insurance is compulsory in Canada

Auto insurance has been around for over a century, with the first liability car insurance policy sold in the US in 1897 or 1898. The world's oldest insurance company still in existence is the RSA Group, founded in London in 1710.

In Canada, auto insurance is compulsory for all drivers, with the industry closely monitored by the provincial government. Each province has its own regulations regarding auto insurance, with some provinces allowing lawsuits for pain and suffering and economic loss beyond insurance benefits, but with set limits on these payments.

In British Columbia, Manitoba, and Saskatchewan, auto insurance is provided through government-owned corporations or insurers. In Quebec, the government administers insurance covering minimum limits for bodily injury, while property damage coverage is provided by private insurers.

Across Canada, auto insurance is mandatory, and drivers must carry proof of insurance in their vehicles at all times. This is usually in the form of an insurance card, which must be presented to a police officer upon request. Failure to do so can result in fines and the suspension of one's driver's license.

The provincial government determines the factors that insurers can and cannot use when setting auto insurance rates, such as age and gender. Insurers must have their rating rules and systems for classifying risk approved by regulators and must get government approval to change their rates.

In Canada, auto insurance is not just a recommendation but a legal requirement, with strict penalties for those who do not comply.

Spouse's Auto Insurance: Your Responsibility?

You may want to see also

Frequently asked questions

Auto insurance has been around in the US since the late 19th century. The first auto insurance policy was sold in 1897 or 1898.

Auto insurance became mandatory in the US in the 1920s. Massachusetts was the first state to pass compulsory auto insurance legislation in 1925. By the 1970s, the majority of states had laws requiring drivers to buy a minimum amount of liability coverage.

The oldest auto insurance company in the world is the RSA Group, originally known as the Sun Fire Office, founded in London in 1710.

The Travelers Companies, which sold the first auto insurance policy in the US, is the oldest auto insurance company in the country.