Michigan has historically had the highest auto insurance benefits and costs in the country. In 2019, Governor Whitmer signed a bipartisan no-fault auto insurance reform bill to lower insurance rates for Michigan drivers. The new law, which came into effect in July 2020, allows drivers to choose from six PIP coverage limits, including an option to opt out of PIP medical coverage entirely. This has resulted in significant savings for Michigan drivers, with insurance companies required to reduce PIP statewide average medical premiums for eight years. However, the savings for consumers have been disappointing, with insurance companies reporting record profits.

| Characteristics | Values |

|---|---|

| Average cost of auto insurance in Michigan | $5,471 per year |

| Average cost of auto insurance in Michigan for a policy meeting state minimums | $3,688 per year |

| Michigan's rank among states for auto insurance costs | Most expensive |

| Percentage increase in auto insurance rates in Michigan from 2015 to 2020 | 51% |

| Percentage of savings on auto insurance in Michigan after No-Fault reform | Disappointing |

| Average savings on auto insurance in Michigan | Up to $1,771 per year |

| Percentage of savings on auto insurance in Michigan for drivers who opted for less PIP coverage | 44% to 100% |

| Average savings on auto insurance in Michigan for drivers who opted for less PIP coverage | $1,000 |

| Number of auto insurance subsidiaries in Michigan that the rate reduction estimates are based on | 8 |

| Percentage of Michigan drivers without car insurance | 20% |

| Michigan's rank among states for the number of uninsured drivers | 2nd highest |

| Percentage of drivers in Michigan without auto insurance | 26% |

| Average savings on auto insurance in Michigan for drivers with Medicare Parts A and B | Up to $1,200 per car |

What You'll Learn

Personal Injury Protection (PIP) Choice

Personal Injury Protection (PIP) is also known as "no-fault insurance". It is a component of an automobile insurance plan that covers the healthcare expenses associated with a car accident. PIP covers medical expenses for both injured policyholders and passengers, even if some don't have health insurance. PIP policies have a minimum coverage amount and a per-person maximum coverage limit.

PIP is available primarily in no-fault states. In a no-fault state, if a policyholder is injured in a car crash, their policy pays for their medical care, regardless of who caused the accident. Policyholders with PIP coverage can receive benefits even if the other driver doesn’t have insurance. PIP pays for medical expenses for people in the policyholder's vehicle, no matter who causes the accident.

PIP coverage, in addition to making medical care affordable, often provides payments for lost income, child care, and funeral expenses related to the accident. Some no-fault states offer medical payments coverage, but it typically has low limits and does not pay for these other costs.

PIP is required in 15 states and Puerto Rico. Minimum coverage requirements are set by the state governments and can vary. Maximums are set by insurance companies and can also vary, but they are usually no more than $25,000.

In Michigan, Governor Whitmer signed a new auto no-fault law to lower costs for drivers, maintain the highest coverage options in the country, and strengthen consumer protections. The new law allows drivers to choose a PIP coverage level that suits their needs and budget. Michigan is the only state where unlimited PIP medical coverage continues to be an option. Under certain circumstances, drivers may choose to opt out of PIP medical coverage entirely or exclude specific household members. If drivers choose to opt out of PIP medical, the entire PIP medical portion of their premium will be eliminated, but excluded members will have no PIP medical coverage under the policy.

The new law also requires insurance companies to reduce statewide average PIP medical premiums for eight years. Beginning after July 1, 2020, insurance companies must implement the following overall statewide PIP medical coverage premium reductions:

- An average 45% or greater reduction per vehicle for the $50,000 PIP option

- An average 35% or greater reduction per vehicle for the $250,000 PIP option

- An average 20% or greater reduction per vehicle for the $500,000 PIP option

- An average 10% or greater reduction per vehicle for the unlimited PIP option

Contacting Gap Insurance: Quick and Easy

You may want to see also

Rate Reduction

The new auto insurance law in Michigan mandates that each insurance company reduces its PIP statewide average medical premiums. The reduction will vary depending on the PIP coverage option chosen by the driver. For instance, for the $50,000 PIP option, there should be an average reduction of 45% or more per vehicle, while for the $250,000 PIP option, there should be an average reduction of 35% or more per vehicle.

The mandatory rate reductions, however, do not guarantee that individual drivers will see a 10% reduction in their premiums. Instead, insurance companies are only required to make enough adjustments across all their policies to achieve an overall average reduction.

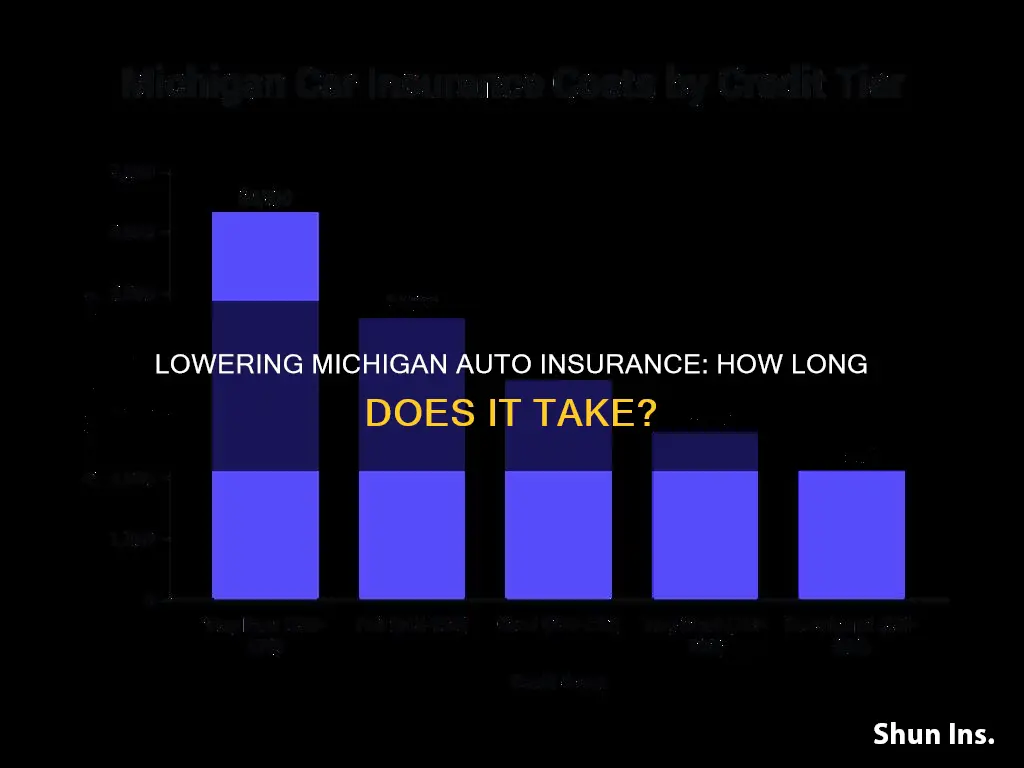

The new law also prohibits auto insurance companies from using certain non-driving factors, such as credit score, marital status, gender, occupation, and zip codes, when setting insurance rates. Despite this, insurance companies can still use territorial rating to determine insurance costs, so where you live will continue to impact your premiums.

Additionally, the Michigan Catastrophic Claims Association (MCCA) fees that drivers pay as part of their premiums have been reduced. The MCCA fee used to be $220, but it has dropped to $86 for drivers who opt for full PIP coverage, and drivers who select lower PIP limits won't have to pay any MCCA fee at all.

The new law also limits the amount that hospitals and healthcare providers can charge insurers for medical care covered by no-fault auto insurance. This provision aims to address the increased costs that these providers have been charging auto insurance companies, which has been a contributing factor to high insurance premiums.

Choosing Auto Insurance: A Nerd Wallet Guide to Getting the Right Coverage

You may want to see also

Fee Schedule

The new auto insurance law in Michigan has been a boon for insurance companies, which have reported record profits. However, consumers have been left disappointed by the lack of significant savings. The new law includes a fee schedule that establishes a cost control measure between auto insurance companies and healthcare providers to make Personal Injury Protection (PIP) medical coverage more affordable for consumers. This fee schedule is designed to control the costs that medical providers can charge auto insurers for their services, similar to provisions used by other types of insurance such as health insurance.

The fee schedule will not affect the services to which accident victims are entitled. It will, however, make PIP medical coverage premiums more affordable for policyholders. This is especially important given that Michigan has the second-highest number of uninsured drivers in the country, with almost 26% of drivers lacking auto insurance.

The new law allows drivers to choose from six PIP coverage limits, with some options carrying stipulations. The PIP coverage options are:

- Unlimited coverage per person per accident: This option is available to all drivers and was the same coverage that all drivers in Michigan were required to carry prior to the reforms.

- Up to $500,000 in coverage per person per accident: This option is available to all drivers.

- Up to $250,000 in coverage per person per accident: This option is available to all drivers. However, policyholders can choose to exclude some or all drivers on their policy if they have a health insurance policy that covers auto injuries with a deductible lower than $6,000.

- Up to $50,000 in coverage per person per accident: This option is only available to drivers enrolled in Medicaid who meet additional eligibility requirements.

- Opt-out with no PIP coverage: This option is only available to drivers who have Medicare Parts A and B and who meet additional eligibility requirements.

- No PIP medical coverage: To select this option, both of the following conditions must be met: the applicant or named insured has coverage under both Medicare Parts A and B, and any spouse and all resident relatives have qualified health coverage or are covered under another auto policy with PIP medical coverage.

The fee schedule will also affect the amount of medical fees charged to auto insurers. Michigan's new law limits the amount that hospitals, doctors, and other healthcare providers can charge insurers for medical care covered by no-fault auto insurance. This provision aims to address the increased costs that these providers have charged auto insurance companies under the current system, which has contributed to high auto insurance costs in the state.

Gap Insurance: Monthly Payment or One-Time Fee?

You may want to see also

High rate of uninsured drivers

Michigan has a problem with uninsured drivers, with an estimated one million drivers on the state's roads without insurance. This is a particular issue in cities such as Detroit, where over half of all drivers are believed to be uninsured.

The percentage of uninsured drivers in Michigan has fluctuated in recent years. In 2019, the state had an uninsured motorist rate of 25.5%, the second-highest in the country. However, between 2020 and 2022, Michigan saw the largest decline in uninsured motorists in the nation, with a 6.2% drop. This decrease has been attributed to the state's 2019 auto insurance reform law, which introduced several consumer protections, including new low-cost options and rate reductions, an amnesty period for uninsured drivers, and the elimination of certain non-driving factors from the rating process. Despite this progress, Michigan still has a higher rate of uninsured motorists than the national average, with an estimated 20% of Michiganders driving without insurance.

The consequences of being an uninsured motorist in Michigan can be severe. If caught driving without insurance, individuals may face penalties such as fines, license suspension, vehicle impoundment, and even jail time. Additionally, uninsured drivers involved in accidents may be held liable for the other driver's vehicle damage or medical bills.

To protect oneself financially from accidents involving uninsured motorists, it is recommended to add uninsured motorist coverage to one's auto insurance policy. This coverage will provide compensation for personal injury, property damage, and other expenses incurred due to an accident with an uninsured driver. It is also advisable to practice safe driving habits to reduce the risk of accidents and, consequently, the likelihood of dealing with an uninsured motorist.

Encompass Gap Insurance: What's Covered?

You may want to see also

High rate of insurance fraud

Michigan auto insurance is notoriously expensive, with drivers paying 85% more than the national median insurance rate. One of the reasons for this is the high rate of insurance fraud in the state.

Michigan insurance companies suffer from a high rate of insurance fraud every year. Reports show that about 10% of no-fault insurance claims in Michigan are fraudulent. This includes claims requesting that the insurer pay injured victims' family members for patient care or cover unnecessary medical bills.

Insurance fraud can take many forms. For example, an individual may lie about their accident history when applying for insurance or file a claim for damage that occurred before the policy took effect. Another common form of insurance fraud is when an individual exaggerates the extent of their injuries to get a larger settlement from the insurance company.

To combat insurance fraud, Michigan has established a Fraud Investigation Unit to investigate criminal and fraudulent activity related to insurance and financial markets. Suspected fraud can be reported to the Department of Insurance and Financial Services (DIFS) by phone, email, or through their website. Automotive insurance fraud is a serious crime in Michigan, punishable by up to four years in jail and fines of up to $50,000.

The high rate of insurance fraud in Michigan contributes to the overall high cost of auto insurance in the state. Insurance companies raise rates to cover the losses they encounter due to bogus claims, making auto insurance less affordable for honest drivers.

Accessing AAA Auto Insurance: The Mobile Guide

You may want to see also

Frequently asked questions

The new auto insurance law in Michigan came into effect on July 1, 2020.

The new law mandates a reduction in Personal Injury Protection (PIP) premiums, with the exact amount depending on the coverage level chosen. The reduction is expected to be between 10% and 45% per vehicle.

Auto insurance rates in Michigan are influenced by various factors, including the consumer price index, the cost of repairing a car, and the price of medical care.

There are several ways to save on auto insurance in Michigan, such as shopping around for rates, bundling policies, asking about discounts, using comparison tools, increasing your deductible, and considering pay-as-you-drive coverage.

The new law established consumer protections, including the elimination of certain non-driving factors in setting insurance rates, the creation of a Fraud Investigation Unit, enhanced transparency for the Michigan Catastrophic Claims Association (MCCA), and increased fines for insurance companies.