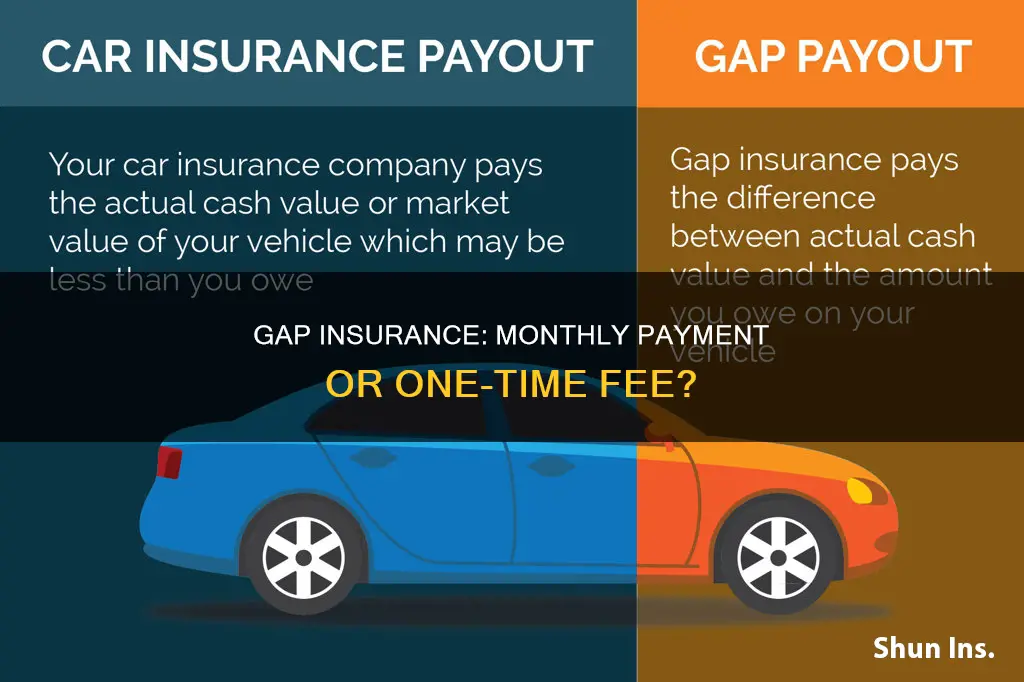

Gap insurance is an optional type of car insurance that covers the difference between the value of a car and the amount the driver owes on their auto loan or lease if the car is stolen or deemed a total loss. It is not a monthly payment but can be purchased from a dealership for a one-time cost of $400 to $700, or from a car insurance company for $20 to $40 per year.

| Characteristics | Values |

|---|---|

| Type of insurance | Optional |

| What it covers | The "gap" between what a car is worth and what the driver owes on their auto loan or lease |

| When to get it | When there is a significant difference between your car's value and what you owe on it |

| When not to get it | When your car loan is less than the current value of your car |

| Cost | $3-$40 per month when added to a car insurance policy; $400-$700 when purchased from a dealership |

What You'll Learn

- Gap insurance covers the difference between the depreciated value of the car and the loan amount owed if the car is involved in an accident

- It is an optional type of car insurance that can be purchased from car insurance companies

- It is worth it if you owe more on your car loan than the car is worth

- It is not required by state law

- It is not needed if you have already paid off most of the loan balance

Gap insurance covers the difference between the depreciated value of the car and the loan amount owed if the car is involved in an accident

Gap insurance, or guaranteed auto protection, is an optional type of car insurance that covers the difference between the depreciated value of a car and the loan amount owed if the car is involved in an accident, stolen, or deemed a total loss. This type of insurance is particularly useful for car owners who have not made a down payment and have chosen a long payoff period, as they may owe more than the car's current value.

When a car is involved in an accident, standard car insurance will only cover the current value of the car, which may be less than the outstanding loan amount. Gap insurance reimburses the difference between the depreciated value of the car and the remaining loan amount, ensuring that the car owner does not have to pay out of pocket to cover the shortfall. This type of insurance can provide financial protection and peace of mind for car owners who are concerned about the potential gap between their car's value and their loan amount.

It's important to note that gap insurance is not required by state law, but it may be required by lenders or lessors. Additionally, gap insurance is not necessary if you have already paid off most of the loan, made a significant down payment, or if the cost of the insurance is close to the potential gap. It is also worth mentioning that gap insurance does not cover engine failure, transmission failure, or other mechanical repairs.

The cost of gap insurance varies depending on the provider and the specific circumstances of the car and the loan. Dealerships typically charge a flat rate of $400 to $700 for gap insurance, while car insurance companies may offer it for as little as $20 to $40 per year. It is recommended to compare prices and consider the pros and cons of gap insurance before making a decision.

Insurance Tax Penalty Gaps

You may want to see also

It is an optional type of car insurance that can be purchased from car insurance companies

Gap insurance is an optional type of car insurance that can be purchased from car insurance companies. It is also available from dealerships and lenders, but it is more expensive to buy it this way as the cost is added to your auto loan or lease, and you pay interest on it.

Gap insurance covers the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is stolen or written off in an accident. This is why gap insurance is also known as guaranteed asset protection or guaranteed auto protection.

Without gap insurance, drivers can be left paying off the remaining loan or lease balance on a vehicle that they can no longer drive. Gap insurance is worth considering if you have a small loan down payment, a long-term loan, or a car that depreciates quickly.

You can usually only add gap insurance to your policy if you still owe money on the vehicle or lease. Insurers' guidelines vary, but they may require your car to be no more than two to three years old and for you to be the original owner of the vehicle.

The cost of gap insurance varies depending on where you buy it. Dealerships and banks charge a lump sum of up to $700, whereas car insurance companies may charge as little as $3 per month, or $20 to $40 per year.

Pleasure vs Commute: Cheaper Insurance?

You may want to see also

It is worth it if you owe more on your car loan than the car is worth

Gap insurance is an optional, supplemental type of car insurance that covers the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is stolen or declared a total loss in an accident. It is worth considering if you owe more on your car loan than the car is worth.

Gap insurance is designed to protect drivers from potentially negative financial consequences in the event of their vehicle being stolen or written off. It is particularly useful for those who have made a small down payment on their vehicle, have a long-term loan (more than four years), or own a car that depreciates quickly in value.

It is important to note that gap insurance is not required by state law and few lenders or lessors require it. Additionally, it may not be worth purchasing gap insurance if you have already paid off most of the loan balance, made a significant down payment, or could afford to pay the gap yourself in the event of a total loss.

The cost of gap insurance varies depending on where it is purchased. Dealerships and banks typically charge a one-time fee of up to $700, while car insurance companies offer it for as little as $3 per month or $20-$40 per year. When bought from a dealership or lender, the cost of gap insurance is usually added to the total amount financed with the loan, resulting in additional interest charges. On the other hand, when purchased through an insurance company, the cost of gap insurance is included in regular premium payments.

In summary, gap insurance is worth considering if you owe more on your car loan than the car is worth. It provides financial protection in the event of a total loss, but it is not mandatory and may not be necessary if you can afford to cover the gap yourself or have a substantial amount of equity in your vehicle.

NCB Benefits: Vehicle Insurance Rewards

You may want to see also

It is not required by state law

While gap insurance is not required by state law, it is still a very useful form of coverage for car owners. Gap insurance, or guaranteed auto protection, covers the difference between the depreciated value of a car and the loan amount owed in the event of an accident, theft, or total loss. This is especially important for car owners who have put no money down and chosen a long payoff period since they may owe more than the car's current value.

Gap insurance is typically purchased from a car dealer, lender, or auto insurer. When bought from a dealership or lender, it is often rolled into the loan payments, which means the buyer pays interest on the cost of the insurance over the life of the loan. On the other hand, auto insurers usually charge a few dollars a month or around $20 a year for gap insurance.

It is worth noting that gap insurance is not necessary for all car owners. If you have already paid off most of your loan, made a significant down payment, or could afford to pay the difference between the amount owed and the car's value, then gap insurance may not be worth the additional cost. Additionally, gap insurance is only applicable if you have a car loan or lease. If you own your car outright, gap insurance is not needed.

Overall, while not legally required, gap insurance can provide valuable financial protection for car owners who find themselves owing more on their car loan than their car is worth. By purchasing gap insurance, individuals can ensure they are not left with a significant financial burden in the event of an accident or total loss.

Smart Ways to Save on Auto Insurance

You may want to see also

It is not needed if you have already paid off most of the loan balance

Gap insurance is an optional type of car insurance that covers the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is totaled or stolen. It is not a monthly payment but a one-time cost of between $400 and $700 when purchased from a dealership, or between $20 and $40 per year when added to a car insurance policy.

Gap insurance is not needed if you have already paid off most of the loan balance. This is because gap insurance is designed to cover the "gap" between the current value of the car and the remaining loan amount. If you have already paid off most of the loan, the "gap" is likely to be small, and you may be able to cover the difference yourself if your car is totaled or stolen.

In addition, if your loan balance is less than the car's value, you no longer have a gap to worry about, and gap insurance is not necessary. It is recommended to use online pricing guides such as Kelley Blue Book or National Automobile Dealers Association (NADA) guides to check how much your car is worth and compare it to your loan balance.

Furthermore, if you made a significant down payment on the car, you may not need gap insurance. A large down payment reduces the gap between the car's value and the loan amount, and you may not owe much even if your car is totaled or stolen.

Overall, gap insurance is designed to protect drivers from financial losses in the event of a total loss. However, if you have already paid off most of your loan, made a significant down payment, or your loan balance is less than the car's value, gap insurance may not be necessary for your specific situation.

Stolen Vehicles: Insurance Claim Process

You may want to see also

Frequently asked questions

Gap insurance, or guaranteed asset protection, is an optional type of car insurance that covers the difference between the amount owed on a car loan or lease and the car's current market value in the event of theft or a total loss.

Gap insurance costs around $3 per month when added to a car insurance policy. When purchased from a car dealership, a gap insurance policy will cost a total of $400 to $700.

Gap insurance is worth it if you owe more on your car loan or lease than your car is worth. It is also useful if you've made a small down payment, have a long-term loan, or have a car that depreciates quickly.