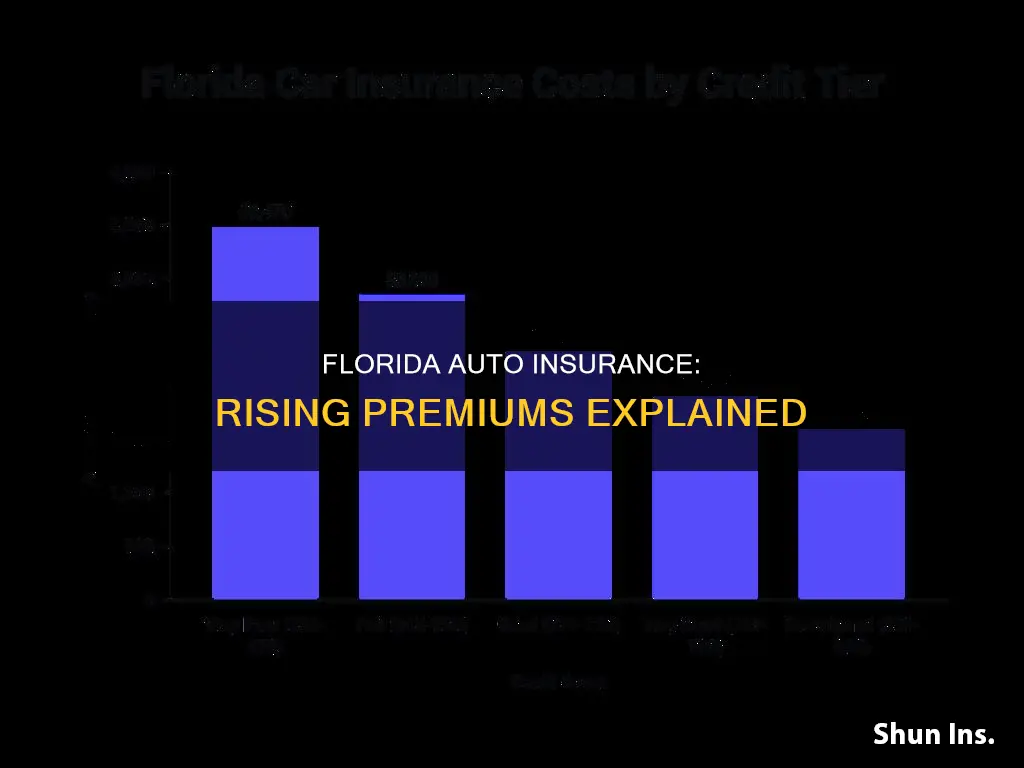

Florida auto insurance rates are notoriously high, with drivers facing a 24% increase in premiums compared to the previous year. This is a significant jump, especially when compared to the national average increase of 20%. There are several factors contributing to the steep rise in insurance costs in Florida. Firstly, the state's propensity for extreme weather events such as hurricanes, tornadoes, and flooding leads to more accidents and drives up the cost of repairs. Additionally, Florida has a high rate of litigated car accident claims, and the rising cost of auto parts and labor further increases the expense of repairing vehicles after accidents. The state also has a high proportion of uninsured drivers, which drives up the cost of insurance for all Floridians.

| Characteristics | Values |

|---|---|

| Average annual full coverage premium in Florida | $3,941-$4,326 |

| Average annual full coverage premium in the US | $2,118-$2,542 |

| Florida's rank in the US | 1st |

| Increase in Florida's car insurance rates compared to last year | 24%-25% |

| Increase in national average | 17%-20% |

| Average annual cost of car insurance in Florida | $2,412 |

| Average annual cost of car insurance in the US | $1,668 |

| Florida's rank in the US in terms of vehicle theft rates | 4th |

| Number of vehicles insured by USAA in Florida | Over 1 million |

| Number of vehicles insured by State Farm Mutual Automobile Insurance Co. in Florida | 2.9 million |

| Number of vehicles insured by Progressive in Florida | Over 3.3 million |

| Number of vehicles insured by Liberty Mutual in Florida | N/A |

| Number of vehicles insured by Geico General Insurance Co. in Florida | 2.5 million |

What You'll Learn

Florida's high proportion of uninsured drivers

Florida's auto insurance rates are the highest in the country. One of the main reasons for this is the state's high proportion of uninsured drivers. In 2022, about one in seven drivers in the US was uninsured, with Mississippi having the highest rate of uninsured drivers at 29.4%. In Florida, more than 20% of drivers don't have car insurance, which is one of the top five highest rates in the country.

The high number of uninsured drivers in Florida has a significant impact on the cost of car insurance for everyone in the state. When there are more uninsured drivers, the risk of being involved in an accident with someone who doesn't have insurance increases. This means that insured drivers often have to rely on their own insurance policies to cover the costs of accidents, even if they are not at fault.

Uninsured motorist coverage is designed to protect drivers in the event of an accident with an uninsured driver. This coverage is available in two forms: uninsured motorist bodily injury (UMBI) and uninsured motorist property damage (UMPD). While nearly half of the states in the US require some form of uninsured motorist coverage, Florida does not. As a result, insured drivers in Florida may have to bear the full cost of repairs and medical bills if they are involved in an accident with an uninsured driver.

The issue of uninsured drivers in Florida is complex and challenging. While there are penalties for driving without insurance, including fines, license suspension, and even jail time, many drivers still choose to go without insurance. This could be due to a variety of reasons, such as financial constraints or the belief that they can avoid an accident. However, the high number of uninsured drivers continues to drive up the cost of car insurance for those who do have coverage.

Health Insurance: Auto Injury Coverage

You may want to see also

Extreme weather events

Florida's vulnerability to extreme weather events has contributed significantly to the surge in auto insurance rates. The state's exposure to hurricanes, coastal flooding, and powerful storms has led to substantial underwriting losses for insurers. As a result, insurance companies have been forced to impose rate hikes that surpass those in other regions.

The impact of extreme weather on auto insurance rates in Florida is twofold. Firstly, the increased frequency and severity of hurricanes and storms elevate the risk of vehicle damage, leading to more costly repairs due to the rising cost of auto parts. This is further exacerbated by supply chain issues, which have driven up the cost of materials required for vehicle repairs.

Secondly, the threat of extreme weather events has caused some insurers to exit the Florida market entirely. Major insurance providers, such as Allstate and State Farm, and Farmers Insurance, have stopped renewing policies or chosen to withdraw from the state due to the heightened risk of weather-related claims. This reduction in competition among insurers gives remaining companies more leeway to increase their rates.

The combination of increased claims and a diminished insurance provider pool has resulted in Florida drivers facing some of the highest auto insurance rates in the country. The average annual full coverage premium in Florida is $3,941, a staggering 55% higher than the national average.

To compensate for the heightened risk, insurers have passed on the increased costs to their customers, leading to the skyrocketing auto insurance rates seen in Florida. As a result, Florida residents are faced with the challenge of managing these elevated expenses, with some even opting to reduce their coverage or temporarily stop driving to cope with the financial burden.

Auto Owners Insurance in Florida: What You Need to Know

You may want to see also

Litigation costs

Florida's auto insurance costs have been on an upward trajectory, with drivers facing premiums that are more than twice the national average. A significant factor contributing to this trend is the state's litigious nature, which has led to escalating litigation costs for insurance companies.

Florida has gained a reputation for being a litigious state, particularly regarding insurance claims. While the state accounts for only 9% of all insurance claims in the US, it accounts for a staggering 79% of insurance litigation. This disparity has significantly contributed to the rising costs of auto insurance in Florida.

The state's history of insurance litigation has been influenced by several factors. One notable issue is the prevalence of fraudulent claims and setups, particularly within the Personal Injury Protection (PIP) system. Staged accidents and fake medical bills submitted by phony medical providers have resulted in increased costs for insurance companies, who then pass these costs on to their customers.

In response to the growing litigation costs, Florida regulators have implemented measures to reduce the financial burden on insurance companies. One such measure is the elimination of one-way attorney fees, where insurers are no longer required to pay the insured's legal fees if they lose in court. Additionally, the prohibition of Assignment of Benefits (AOB) aims to curb fraud by preventing opportunistic contractors from inflating claims or charging for unnecessary work.

Another factor contributing to litigation costs in Florida is the aggressive marketing and advertising techniques employed by plaintiff attorneys. Through billboards, television advertisements, and social media, these attorneys promise potential plaintiffs financial windfalls, encouraging more lawsuits and driving up litigation expenses.

The issue of litigation costs in Florida's auto insurance industry is further exacerbated by the involvement of third-party litigation funding (TPLF). This practice allows plaintiff attorneys to secure funding from hedge funds and other financiers in exchange for a percentage of any settlement or judgment. The lack of transparency around TPLF, with few states requiring disclosure, makes it challenging to hold plaintiff attorneys and their clients accountable to good faith standards.

In conclusion, the rising auto insurance costs in Florida are significantly influenced by the state's litigious nature and the associated costs incurred by insurance companies. While efforts have been made to reduce litigation and curb fraud, the impact of aggressive plaintiff attorneys and the involvement of TPLF contribute to a complex and costly legal landscape, ultimately affecting the premiums paid by Florida drivers.

Auto Insurance Abroad: Navigating US Coverage in Europe

You may want to see also

Rising cost of auto parts

Auto insurance rates in Florida have been on the rise, with consumers reporting significant increases in their premiums. One of the contributing factors to this trend is the rising cost of auto parts, which impacts the cost of repairs and insurance rates.

The rising cost of auto parts can be attributed to several factors, including supply chain issues, inflation, and technological advancements in vehicles. Firstly, supply chain disruptions caused by the pandemic have led to increased prices for auto parts. The pandemic-induced shortages of microchips, a crucial component in modern vehicles, have affected the supply of new vehicles and driven up prices.

Additionally, inflation has played a significant role in the rising cost of auto parts. According to the U.S. Bureau of Labor Statistics, prices for motor vehicle parts and equipment showed an average inflation rate of 1.87% per year between 1977 and 2024. This has resulted in a substantial increase in the cost of auto parts over time. For example, car parts that cost $500 in 1977 would amount to $1,196.41 in 2024, reflecting a 139.28% increase.

Moreover, the increasing sophistication of vehicle technology has contributed to the rising cost of auto parts. Modern vehicles are equipped with advanced features such as rearview cameras, traffic sensors, and advanced driver-assistance systems. While these technologies enhance safety and performance, they also drive up the cost of replacement parts and repairs. The need for specialized technicians to repair and calibrate these high-tech components further adds to the overall expense.

The impact of these factors is evident in the insurance premiums paid by Florida drivers. As the cost of auto parts increases, the expense of repairing vehicles rises, leading to higher insurance rates. This trend is not unique to Florida but is reflected in the overall increase in car insurance rates across the nation.

To mitigate the financial burden, consumers are advised to shop around for the lowest insurance rates and consider their coverage needs carefully. Comparing rates from different insurers and reviewing coverage options can help drivers find the most suitable policy at a more affordable price. Additionally, taking advantage of discounts, such as good student driver discounts, and enrolling in in-vehicle monitoring programs can help reduce premiums.

Switching Auto Insurance: The Art of a Smooth Transition

You may want to see also

High crash and fatality rates

Florida's auto insurance rates are the highest in the country, with drivers paying more than twice the national average. A range of factors contribute to this, one of the most significant being the high crash and fatality rates in the state.

Florida's roads are notoriously dangerous, with a high number of motor vehicle crashes and resulting deaths. In 2022, there were a total of 42,514 motor vehicle crash deaths in the United States, with fatality rates varying across states. While Florida-specific data is not available, the state's high population and large number of vehicles on the road contribute to increased crash risks.

The state's traffic laws, emergency care capabilities, weather conditions, and topography also play a role in the high crash and fatality rates. For example, Florida's laws and traffic enforcement practices may not be as stringent as in other states, contributing to a higher rate of crashes and fatalities. Additionally, the state's flat and expansive road network may result in higher speed limits, which can increase the severity of crashes.

The high crash and fatality rates in Florida have a direct impact on insurance rates. Insurance companies take into account the risk of accidents and the potential cost of claims when setting premiums. With a higher number of crashes and fatalities, insurance companies will likely charge higher premiums to offset the expected payouts for claims.

Furthermore, Florida's no-fault auto insurance system, implemented in 1971, has been criticised for encouraging fraud and abuse. Under this system, drivers are required to carry Personal Injury Protection (PIP) insurance, which covers their own injuries regardless of who is at fault in an accident. However, this system has led to a rise in fraudulent claims and staged accidents, driving up the cost of insurance for all Floridians.

In conclusion, Florida's high crash and fatality rates are a significant factor in the increasing auto insurance premiums in the state. The combination of dangerous roads, lenient traffic laws, and a flawed insurance system contributes to the high cost of auto insurance in Florida. Addressing these issues through stricter safety measures, improved traffic regulations, and insurance system reforms is crucial to reducing the financial burden on Florida drivers.

Auto Insurance: Understanding the Legal Requirements

You may want to see also

Frequently asked questions

There are several reasons why auto insurance rates in Florida are on the rise. Firstly, Florida is prone to extreme weather events like hurricanes, tornadoes, and flooding, which lead to more accidents and higher repair costs. Secondly, the state has a high rate of litigated car accident claims, which increases costs for insurers. Thirdly, auto parts and labor have become more expensive, making it pricier to fix vehicles after accidents. Additionally, Florida has a high proportion of uninsured drivers, and medical treatment costs for accident victims have also risen. Finally, there is a high occurrence of insurance fraud in the state, with staged accidents and windshield replacement scams being common.

To reduce the financial burden of rising auto insurance rates, consider the following strategies:

- Enroll in automatic payments through your bank account to avoid extra service fees charged by insurance companies.

- Improve your credit score, as insurers often use this to determine rates.

- Encourage teen drivers in your household to maintain good grades to qualify for discounts.

- Shop around for cheaper insurance policies, but be mindful of the level of coverage you need.

- Raise your deductible amount to reduce the burden on your insurer, resulting in lower premiums.

Maintaining a clean driving record is crucial for accessing lower insurance rates. Safe driver discounts offered by insurers can range from 10% to 25% in reduced premiums. Conversely, speeding tickets and other driving violations can lead to higher insurance rates.

Several factors, including your age, gender, address, and vehicle type, can influence your auto insurance rates. Younger and male drivers are often considered higher-risk and therefore pay higher premiums. The model, price, and age of your vehicle also matter, as some cars are more expensive to repair than others.