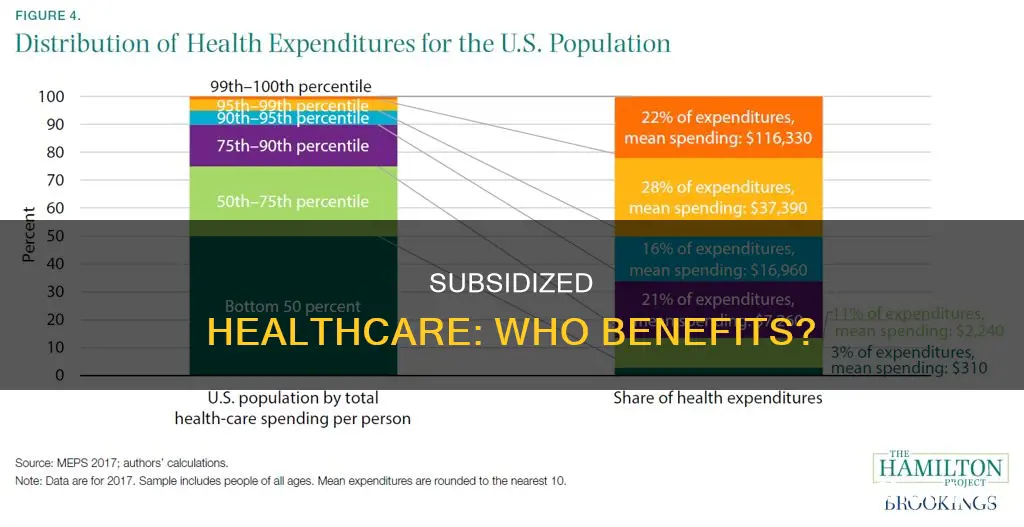

In 2023, federal subsidies for health insurance were estimated to be $1.8 trillion, or 7.0% of the gross domestic product (GDP). The Affordable Care Act (ACA) provides sliding-scale subsidies that lower premiums and out-of-pocket costs for eligible individuals. There are two types of financial assistance available: the premium tax credit and the cost-sharing reduction. As of early 2023, there were about 14.3 million people receiving premium subsidies.

| Characteristics | Values |

|---|---|

| Number of people enrolled in health plans through the exchanges/marketplaces nationwide | 15.7 million |

| Number of people receiving premium subsidies | 14.3 million |

| Federal subsidies for health insurance in 2023 | $1.8 trillion |

| Federal subsidies for health insurance in 2033 | $3.3 trillion |

| Percentage of people projected to have health insurance in any given month over the 2024-2033 period | 91.5% |

| Number of people estimated to be uninsured in 2023 | 24.3 million |

| Number of people estimated to be uninsured in 2033 | 29.6 million |

| Number of Americans living in non-expansion states who fall into the coverage gap | 1.9 million |

What You'll Learn

Medicaid and CHIP coverage

Medicaid and the Children's Health Insurance Program (CHIP) provide free or low-cost health coverage to low-income people, families and children, pregnant women, the elderly, and people with disabilities.

Medicaid is available in all US states and provides coverage for some low-income people, families and children, pregnant people, the elderly, and people with disabilities. Some states have expanded their Medicaid programs to cover all adults below a certain income level. However, coverage and costs may vary from state to state.

The Children's Health Insurance Program (CHIP) is available in all states and provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid but too little to afford private coverage. In some states, CHIP also covers pregnant women. CHIP benefits vary by state but include comprehensive coverage such as dental and vision care, inpatient and outpatient hospital care, and laboratory and X-ray services.

To qualify for Medicaid or CHIP, individuals must meet certain income requirements, which vary by state. In states that have expanded Medicaid coverage, the household income must be below 138% of the federal poverty level (FPL) to qualify. In states that have not expanded Medicaid, individuals with an income of at least 100% of the FPL can qualify for subsidies. The federal poverty level changes annually and is based on income and family size.

Individuals can apply for Medicaid or CHIP at any time during the year and can do so through the Health Insurance Marketplace or directly through their state Medicaid agency.

Unraveling the Web of Deceit: Understanding Insurance Deceits and Their Synonyms

You may want to see also

Premium tax credits

The Premium Tax Credit is a refundable tax credit that helps eligible individuals and families with low or moderate incomes afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of the Premium Tax Credit is based on a sliding scale, with lower-income earners receiving a larger credit to help cover the cost of their insurance. This credit can be used to lower your monthly insurance payment when you enroll in a plan through the Health Insurance Marketplace.

To be eligible for the Premium Tax Credit, you must meet the following requirements:

- Have a household income that falls within a certain range (between 100% and 400% of the federal poverty line).

- File a tax return that is not married filing separately (there are exceptions for certain victims of domestic abuse and spousal abandonment).

- Cannot be claimed as a dependent by another person.

- In the same month, you or a family member must enroll in coverage (excluding "catastrophic" coverage) through a Marketplace, be unable to get affordable coverage through an eligible employer-sponsored plan, and be ineligible for coverage through a government program like Medicaid, Medicare, CHIP, or TRICARE.

- Pay the share of premiums not covered by advance credit payments.

You can choose to have the Marketplace compute an estimated credit that is paid to your insurance company to lower your monthly premiums (advance payments of the Premium Tax Credit or APTC), or you can receive the entire credit when you file your tax return for the year. If you choose to receive advance payments, you will need to reconcile the amount paid in advance with the actual credit you compute when you file your tax return. In either case, you will need to complete and attach Form 8962, Premium Tax Credit (PTC), to your tax return.

The Premium Tax Credit is available in every state, and most exchange enrollees qualify for subsidies. As of early 2023, there were about 14.3 million people enrolled in health plans through the exchanges/marketplaces nationwide who were receiving premium subsidies.

Life Events: Insurance Enrollment Explained

You may want to see also

Cost-sharing reductions

Silver plans are considered mid-range, with moderate monthly premiums and moderate costs when receiving care. If eligible for cost-sharing reductions, individuals will pay less out of pocket each time they use medical services. This includes a lower deductible, lower copayments or coinsurance, and a lower "out-of-pocket maximum". The deductible is the amount an individual must pay for medical care themselves before the insurance company starts contributing. Copayments are payments made each time an individual receives care, such as $30 for a doctor's visit. The "out-of-pocket maximum" is the total amount an individual would have to pay in a year if they received a lot of care, for example, if they got seriously sick or were involved in an accident.

Individuals and families with incomes up to 250% of the poverty line are eligible for cost-sharing reductions if they are eligible for a premium tax credit and purchase a Silver plan through the Affordable Care Act (ACA) marketplace in their state. People with lower incomes receive the most assistance.

The ACA includes government subsidies to help people pay their health insurance costs. One of these is the premium tax credit, which helps pay monthly health insurance premiums. As of early 2023, there were about 15.7 million people enrolled in health plans through the exchanges/marketplaces nationwide, and about 14.3 million of them were receiving premium subsidies. The other type of ACA subsidy is the cost-sharing reduction. Despite the Trump administration eliminating funding for cost-sharing reductions in 2017, insurers simply added the cost of these subsidies to premiums, which were largely offset by larger premium subsidies, making coverage more affordable for many enrollees.

Accidental Death Benefit: Understanding the Extra Layer of Protection in Term Insurance

You may want to see also

Eligibility based on income

Eligibility for subsidized healthcare insurance is largely based on income. In the United States, HealthCare.gov offers a tool to check if you might save on Marketplace premiums or qualify for Medicaid or the Children's Health Insurance Program (CHIP), based on your income. The Affordable Care Act (ACA) includes government subsidies to help people pay their health insurance costs.

The Federal Poverty Level (FPL) is used to determine eligibility for subsidized healthcare insurance. The FPL varies by family size. For Marketplace coverage in 2024, the poverty level used is $14,580 for a single adult and $30,000 for a family of four. Federal poverty levels are higher for Alaska and Hawaii.

In states that have expanded Medicaid coverage, your household income must be below 138% of the FPL to qualify. In all states, your household income must be between 100% and 400% FPL to qualify for a premium tax credit that can lower your insurance costs. If your income is at or below 150% FPL, you may qualify to enroll in or change Marketplace coverage through a Special Enrollment Period.

If your income is above 400% FPL, you may still qualify for savings on a Marketplace health insurance plan. However, if your income is below the poverty level, you may not be eligible for a subsidy. In some states that have not expanded Medicaid, this results in a coverage gap for low-income residents. They are not eligible for Medicaid or premium subsidies because their income is below the poverty level.

The amount of the subsidy is also based on income. Individuals and families with incomes between 100% and 400% of the poverty level will pay between 0% and 8.5% of their incomes for a mid-level plan premium (the "benchmark silver plan"). Anything above that is paid by the government.

There are tools and calculators available to help estimate eligibility and costs, such as the Health Insurance Marketplace Calculator provided by KFF. This calculator takes into account factors such as income, age, and family size to provide estimates of eligibility and costs for health insurance premiums and subsidies.

Eligibility based on citizenship

Eligibility for subsidized healthcare insurance in the United States is based on several factors, including income level, family size, and citizenship status. To understand eligibility based on citizenship, it is important to look at the Affordable Care Act (ACA) and the requirements for receiving financial assistance through health insurance marketplaces or exchanges.

The ACA provides subsidies in the form of premium tax credits and cost-sharing reductions to help eligible individuals and families with the cost of health insurance. To receive these subsidies, individuals must enroll in a plan offered through a health insurance marketplace. These marketplaces are typically run by individual states, and most states have expanded Medicaid coverage under the ACA.

When it comes to eligibility based on citizenship, the requirements are as follows:

- US citizenship: Individuals must have US citizenship or proof of legal residency to be eligible for the premium tax credit. Lawfully present immigrants with a household income below 100% of the Federal Poverty Level (FPL) may also be eligible for tax subsidies if they meet other eligibility requirements.

- Tax filing status: If an individual is married, they must file taxes jointly to be eligible for the premium tax credit.

- Income level: Household income is a critical factor in determining eligibility. For the premium tax credit, household income must be at least equal to the FPL, which is determined based on the previous year's poverty guidelines. In states with expanded Medicaid, the income threshold is typically 138% of the FPL, while in non-expansion states, it can be as low as 100% of the FPL.

- Other coverage options: To be eligible for the premium tax credit, individuals must not have access to affordable coverage through an employer (including a family member's employer) or be eligible for coverage through Medicare, Medicaid, or the Children's Health Insurance Program (CHIP).

It is important to note that eligibility requirements may vary slightly from state to state, especially in states that have not adopted the Medicaid expansion under the ACA. Additionally, the eligibility criteria and income thresholds may be updated periodically, so it is essential to refer to the official government websites and guidelines for the most current information.

Understanding Insurance Billing for Lactation Services: A Guide for Healthcare Providers

You may want to see also

Frequently asked questions

24.3 million people, or 7.2% of the population, are estimated to be uninsured in 2023.

Roughly 60% of these people, or 15.2 million, are estimated to be eligible for subsidized coverage.

The federal government's cost of health insurance subsidies in 2023 is estimated to be $1.8 trillion, or 7.0% of the gross domestic product (GDP).

The main factor is income. Individuals who make up to $47,000 and families of four that make up to $97,000 may qualify for a subsidy.